In the rapidly evolving landscape of ecommerce and online transactions, businesses are increasingly reliant on efficient and secure payment processing solutions. One name that stands out in this realm is Stripe – a technology company that has revolutionized the way businesses handle payments. From startups to enterprises, Stripe provides a comprehensive suite of tools and services that simplify the payment process, enhance security, and facilitate global transactions.

In this article, we delve deep into the workings of Stripe, its benefits for businesses, its technical components, and its role in shaping the modern digital economy.

What is Stripe?

At its core, Stripe is an online payment processing platform founded in 2010 and headquartered in San Francisco. What sets Stripe apart is its commitment to simplicity and innovation. Stripe’s suite of services encompasses payment gateways, API integrations, checkout solutions, billing management, and subscription handling. The platform has earned its reputation as a leading fintech company, serving a vast and diverse user base ranging from small online businesses to tech giants. With a global presence, Stripe has cemented itself as a critical player in the financial technology space.

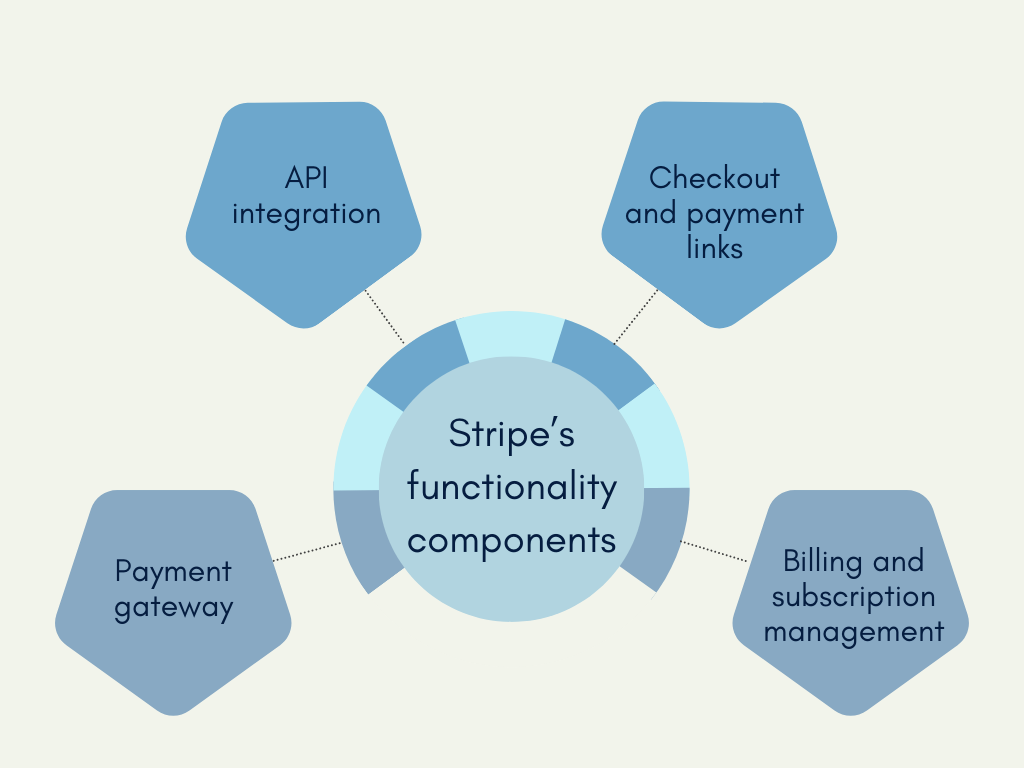

Key components of Stripe’s functionality

Let’s go real quick through the major components of Stripe functionality

Payment gateway

Stripe acts as a secure intermediary, handling transactions between customers, businesses, and financial institutions. Its payment gateway streamlines the process by securely capturing payment information, encrypting it, and transmitting it to the relevant parties. This seamless transmission of data ensures that sensitive financial information remains protected throughout the payment journey.

API integration

Stripe’s Application Programming Interface (API) is the backbone of its flexibility and adaptability. Businesses can integrate Stripe into their websites and applications, tailoring the payment process to match their branding and user experience. The API documentation provides developers with clear instructions on how to implement Stripe, allowing for custom solutions that suit various business models.

Checkout and payment links

For businesses without extensive technical resources, Stripe’s checkout feature offers a user-friendly solution. This feature provides a pre-built payment page that can be embedded directly into a website. Additionally, payment links allow businesses to generate quick URLs for one-time payments, making the process seamless for customers.

Billing and subscription management

Stripe’s tools for managing recurring billing and subscriptions have transformed the subscription-based business model. Entrepreneurs and enterprises alike can set up subscription tiers, free trials, and pricing changes with ease. This functionality not only benefits businesses by automating revenue collection but also enhances the customer experience through hassle-free subscription management.

Benefits of Stripe for businesses

Ease of use

Stripe’s intuitive interface and well-documented APIs simplify the process of integrating payment processing into websites and applications. The platform’s user-friendly dashboard provides real-time insights into transactions, refunds, and disputes, allowing businesses to manage their financial operations with ease.

Security

Security is paramount in the world of online payments, and Stripe takes it seriously. The platform is certified as a PCI DSS Level 1 Service Provider, the highest level of security certification in the payment industry. Stripe encrypts and tokenizes sensitive data, protecting it from unauthorized access. The incorporation of machine learning algorithms aids in fraud prevention, providing businesses with an additional layer of security.

Global reach

One of Stripe’s standout features is its ability to facilitate payments from around the world. Businesses can accept payments in multiple currencies, allowing them to tap into international markets without hassle. This global reach is essential for ecommerce platforms and service providers aiming to cater to diverse audiences.

Developer-focused approach

Stripe’s developer-centric approach is a major selling point. The platform offers a range of SDKs and APIs that allow developers to fine-tune payment processing according to the specific needs of their businesses. This level of customization empowers businesses to provide a seamless payment experience for their customers.

Scalability

As businesses grow, their payment processing needs evolve. Stripe’s infrastructure is designed to handle increased transaction volumes without compromising performance. This scalability is crucial for startups that anticipate rapid expansion, as well as established enterprises seeking to maintain efficient payment operations.

Payment processing with Stripe

Authorization and capture

Stripe employs a two-step process for payment processing: authorization and capture. When a customer initiates a transaction, Stripe verifies the validity of the payment method and places a temporary hold on the funds. Once the payment is confirmed, the funds are captured, and the transaction is completed. This process ensures that businesses receive secure and valid payments.

Disputes and Chargebacks

In cases of disputes or chargebacks, Stripe acts as a mediator between businesses and customers. The platform provides clear documentation of transactions, which can be used as evidence in resolving disputes. Stripe’s involvement in chargeback resolution helps businesses maintain positive customer relationships while adhering to regulatory guidelines.

Fees and pricing

Stripe’s pricing structure is transparent and designed to accommodate businesses of all sizes. Transaction fees are based on the type of transaction, whether it’s a standard payment, international payment, or subscription fee. While there are fees associated with certain services, such as currency conversion and failed payments, Stripe’s predictable pricing model allows businesses to manage their financial operations effectively.

Stripe most typical use cases

Ecommerce businesses

For online stores and marketplaces, Stripe’s suite of services is a game-changer. Businesses can seamlessly integrate Stripe into their platforms, offering customers a convenient and secure payment experience. The ability to accept payments in various currencies enhances the global reach of ecommerce businesses.

Subscription services

Stripe’s subscription management tools have transformed the way subscription-based businesses operate. Platforms offering software-as-a-service (SaaS), content subscriptions, and box subscriptions can easily set up and manage recurring billing cycles. This functionality not only ensures consistent revenue streams but also enhances customer retention.

On-Demand services

Platforms providing on-demand services, such as ride-sharing and food delivery, rely on Stripe’s efficient payment processing. These platforms require quick and secure transactions to maintain customer satisfaction. Stripe’s integration options enable such businesses to offer a seamless payment experience, supporting their rapid service delivery.

Challenges and limitations

Account stability and payouts

While Stripe’s risk assessment processes enhance security, businesses might occasionally face account holds or payout delays. These measures are in place to prevent fraudulent activities and protect both businesses and customers. However, businesses can mitigate this challenge by maintaining transparent operations and adhering to Stripe’s guidelines.

Technical complexity

For businesses seeking advanced customization, technical complexity could be a concern. Integrating Stripe’s APIs requires a certain level of technical expertise. However, Stripe’s thorough documentation and developer resources provide businesses with the guidance they need to overcome this challenge successfully.

Integration and implementation

Getting started

Creating a Stripe account is the first step toward unlocking its benefits. Businesses can sign up on the Stripe website, providing essential details to initiate the digital onboarding process. The account setup involves verifying business information and configuring the desired payment methods.

Integration steps

Integrating Stripe into a website or application involves several key steps. First, businesses choose the appropriate integration method, whether it’s a customized API integration, checkout page implementation, or payment link generation. Then, they follow the documentation provided by Stripe to implement the chosen integration method. This process may involve coding and testing to ensure a seamless payment experience.

Conclusion

In an era where online transactions are the backbone of the global economy, having a reliable and secure payment processing solution is essential for businesses of all sizes. Stripe has emerged as a leader in this space by providing a comprehensive suite of tools that cater to businesses’ diverse needs. From secure payment gateways and customizable API integrations to subscription management and global payment acceptance, Stripe offers a range of solutions that streamline the payment process and enhance customer experiences. As technology continues to advance, Stripe remains at the forefront, shaping the way businesses handle payments in the digital age. By understanding its components, benefits, and challenges, businesses can harness the power of Stripe to propel their growth and success in the modern business landscape.

Want to learn more about Stripe? Check out our article about What is a Stripe payment.