Accounting functions and tasks play a vital role in business decision-making. Accounting is also a critical aspect of staying sustainable in the long run. For example, bookkeeping helps you maintain proper records of your financial activities so you can determine your firm’s financial capacity to handle new projects.

Over time, the business landscape continues to change because of technological developments, regulatory changes, market expansion, and so on. As a result, businesses like yours may have to deal with many accounting challenges.

Today, we’ll look into some of the challenges that plague the accounting profession and field, and explore the potential strategies for overcoming them.

Let’s get started.

1. Compliance with changing local accounting regulations

Navigating constantly changing accounting regulations is one of the biggest problems businesses and accountants may face today. Governments and each country’s regulatory boards frequently update financial reporting guidelines and tax laws to keep up with economic shifts and ensure transparency.

For example, the United States Internal Revenue Service (IRS) has made changes to tax laws in recent years. The Tax Cuts and Jobs Act (TCJA) of 2017, for instance, impacted how individual and corporate tax rates, deductions, and credits were calculated.

Only recently, the US Financial Accounting Standards Board also voted to change the rules onwhen company partnerships can be kept off the books.

As a business, even when adapting to these regulatory changes in the accounting industry is tough, it’s still important to comply. Failure to do so may lead to legal issues, which could eventually lead to financial loss for your business. How do you ensure a less chaotic transition when faced with regulatory changes?

- Review your financial reporting process. Identify areas or tasks that need to be modified to meet the new regulations.

- Gather data from your previous reports if the new regulations will be applied retroactively to your firm’s financial activities and history, for instance.

- If you use specific accounting software or technology, update it based on new standards.

- Ensure your employees’ skills are aligned with the changes.

Of course, you wouldn’t want these changes to take you by surprise. So, it pays to be informed from the get-go. If you’re just looking to start a business in Oregon, for instance, you may want to take your research beyond seeking Oregon filing services for LLCs. Stay informed about accounting regulations from the start by subscribing to industry publications, attending conferences, and following the work of accounting standards boards in your area of operation.

2. Software integration challenges

The rapid integration of technology in various aspects of business operations has helped in terms of efficiency and productivity. However, the use of advanced accounting software, data analytics tools, and cloud-based systems can be a double-edged sword. While technology can help streamline accounting workflows, it also introduces new complexities and accounting challenges in terms of compatibility and adaptability.

With various digital accounting tools out there, finding one that meets your company’s needs may be challenging. You may have to look through many reviews or even try out multiple tools before you find one that helps you perform accounting tasks with ease. When you do, there’s also the challenge of integrating new technology into your existing process. For instance, you may want to adopt advanced bookkeeping software without losing your previous data.

Technological integrations, particularly for new developments, would typically come with the need to train accountants. This is because the lack of adequate training may lead to poor utilization of the software’s capabilities— which defeats the purpose of improving your accounting processes in the first place.

Research also reveals that the rise of new technology like blockchain, big data, and artificial intelligence may require accountants to acquire new skills. This learning curve may not be welcome by accounting departments. Provide ongoing support for your staff as they adapt to your new technology. You can also encourage them with incentives like pay raises. Or, publicly recognize them for their participation in your training programs.

Additionally, investing in advanced accounting technology can be expensive, especially for small businesses with limited financial resources. In this case, it’s crucial to evaluate the cost and long-term benefits of various software options before making a choice.

3. Data security and privacy related to accounting

Accounting data contains sensitive information — for example, account numbers, bank statements, and other personal or private information— that may be prone to cyber-attacks. A single security breach can lead to accounting challenges like financial losses or compromised customer information. According to IBM, the average cost of a data breach in the US is $6.44 million. That’s why cybersecurity matters should be addressed early on.

Data breaches may lead to a lack of trust in your organization, especially in cases where your client’s information was exposed. It may also result in adverse legal consequences.

Some of the data security risks you want to look out for include:

- Phishing attacks: This may involve sending emails with malicious or harmful links in the disguise of your software provider. Clicking these links may cause your system to be infected by malware.

- Malware infections: Malware is a harmful software that is designed to harm a computer system. Malware can be installed on a system by clicking a malicious link or downloading an infected file. The aim is to steal your data, damage files, or take over your system.

Also, with cloud-based accounting systems, you’d want to be concerned about hackers who may target your information. Apart from hackers, accounting challenges may also come in the form of internal attacks from conniving employees who may compromise confidential information for financial gain.

To prevent potential security and privacy risks, invest in robust security and internal control measures like using strong passwords for accessing your digital platforms. Also, invest in strong antivirus software and enable two-factor authentication as an extra layer of security.

Additionally, ensure that your systems undergo regular vulnerability scans to identify weaknesses and potential threats. Then, tackle them before they become a problem. Provide comprehensive cybersecurity training to employees.

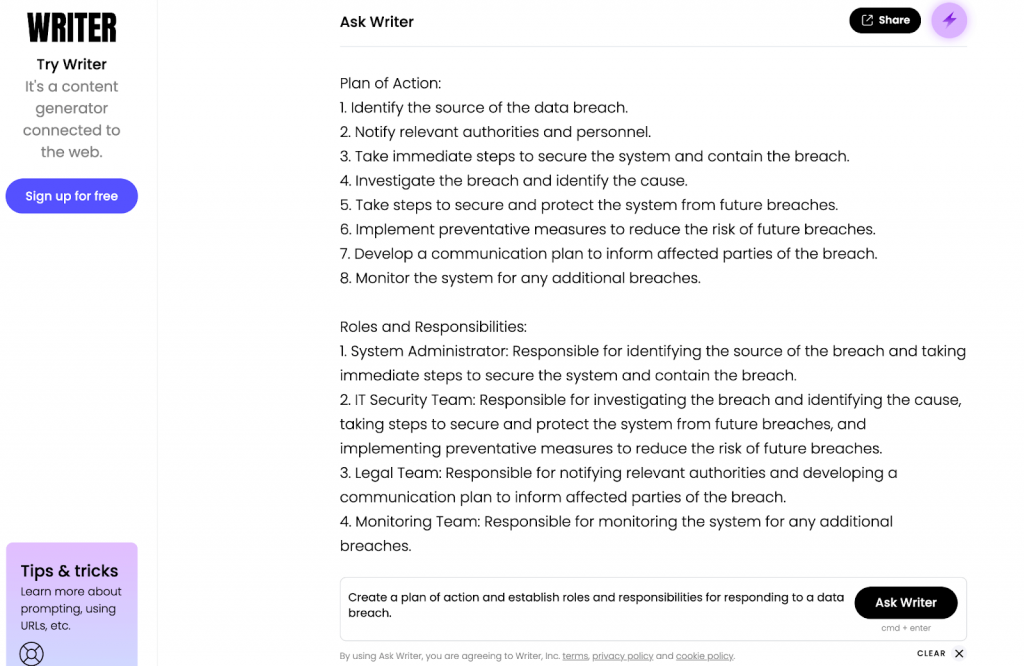

Create an incident response plan which tells your employees what to do in the event of a data breach. You can easily use a generative AI tool like Writer to create this document.

With this plan, you’ll equip your employees with the information they need to prevent or reduce the impact of a security breach on accounting data.

4. Managing cash flow challenges

Maintaining a healthy cash flow is vital to the survival of your business. Inconsistent cash flow can lead to accounting challenges like operational disruptions, cash shortages, and in some cases, bankruptcy.

Some factors that contribute to the cash flow challenge include:

- Increased operating expenses

- Delayed customer payments

- Unexpected business expenses

- Inaccurate bookkeeping practices

As a business owner, proper cash flow management enables you to address accounting challenges and meet financial obligations like paying creditors, employees, and suppliers.

The first step to better cash flow management is to run a cash flow analysis. You want a clear picture of how you’re earning and spending money. A cash flow analysis will also help you identify accounting issues like miscalculations or improper revenue recognition and deal with them speedily. Look out for unnecessary expenses and cut them.

Additionally, have the proper payment terms with your customers. Send early invoices and follow up to ensure timely payments. You can do this through frequent email notifications or calls. Of course, you’d want to verify email addresses or phone numbers first to ensure customers are receiving your notifications.

Also, create a contingency plan so you can handle unexpected expenses without causing a dangerous imbalance in your cash flow. Finally, invest in good accounting software so that bookkeeping and other accounting errors can be avoided or minimized.

5. Inventory management

Inventory management is another one on the list of accounting challenges you should look for — especially if you’re involved in a manufacturing, distribution, or retail business.

Typically, your inventory represents current assets since it comprises items you intend to sell within a specific period. In your income statement, your inventory adds up to determine the cost of goods sold (COGS). So, where does the challenge lie?

In cases where physical inventory counts have to be taken before records are kept, differences between actual stock and recorded stock can lead to inaccurate financial reports. This can also affect the calculation of your business profitability. Therefore, you need to adopt reliable inventory tracking systems like Radio Frequency Identification (RFID) Technology or barcodes.

Cost allocation is another potential challenge. Relevant costs like direct material costs, labor costs, and overhead expenses should be accurately ascribed to inventory items. Otherwise, you may undervalue or overstate the cost of an item.This will affect how your products are priced and whether you eventually make a profit or not.

Additionally, businesses may also find it difficult to value goods bought on credit or paid for in advance, when the prices of these goods increase. This may happen as a result of fluctuations in demand, production, or procurement costs. So, constantly track the prices of goods so that accountants can adjust the inventory valuation method accordingly.

6. Talent acquisition and retention of accountants

Skilled accounting and finance professionals are essential to ensure accuracy in tasks like financial reporting and strategic business planning. However, the growing demand for top-notch accounting talent makes talent acquisition methods and retention a daunting task.. As a result, you may want to create more appeal by offering competitive benefits and professional development opportunities.

Be intentional about creating a positive work culture as this will help you retain skilled accountants. Before sourcing talent, assess your business so you can identify the specific skill sets needed to help you achieve your overall business objectives. This way, you’ll get the appropriate return on your recruitment expenses.

Apart from accounting professionals, account for your overall talent acquisition and retention efforts. For example, how do you account for salaries? How do you determine hourly rates? In the grand scheme of things, your records should help you measure the value you get in exchange for your investment in hiring processes.

7. Forecasting and financial planning

Forecasting allows you to predict the future financial performance of your business. It also allows you to identify potential risks and make strategic business decisions. However, market uncertainties and other external factors make forecasting more complex. It also increases the possibility of making errors and inaccurate predictions.

Thankfully, modern accounting tools have integrated forecasting software that can help you achieve more precision. So, it’s easier to analyze data and observe accounting trends for better predictions.

You should also note that accurate forecasting and financial planning involve collaborating teams across the business, such as sales, marketing, and operations. This way, you’ll have valuable insights that contribute to more strategic and efficient plans.

8. Dealing with international accounting standards

The International Accounting Standards Board (IASB) is responsible for creating and regulating a specific set of practices which we refer to as the International Accounting Standards (IAS) — now replaced by the International Financial Reporting Standards (IFRS).

Typically, the IFRS recommends methods for dealing with accounting tasks like defining transaction types, financial reporting, record-keeping and maintaining transactional data, to mention a few.

So, if you wish to operate your business on a global scale, it’s important to pay attention to the IFRS and how it may affect you. This is especially relevant when managing transactions through platforms like an Amazon account. Otherwise, it may be tough to escape legal or even technical accounting issues that could arise when these standards are neglected, especially when the countries in which you’ll be operating follow the IFRS.

How can you ensure international accounting standards are adequately followed? Establish a strong accounting framework that considers all the IFRS recommendations. Your employees should also be trained on IFRS standards. You should also use an independent audit to ensure that your financial statements adhere to international reporting standards.

Putting all these in place will help you maintain a culture of compliance as you aim to follow international accounting standards.

Closing thoughts

The business environment is faced with numerous opportunities and challenges. These include marketing, operational and accounting challenges.

This post has addressed some of the notable accounting challenges businesses face today. They include compliance with changing regulations, adapting to technology integrations, and dealing with security breaches. Managing cash flow and inventory also presents problems for businesses.

Additionally, accounting for the cost of talent acquisition and retention can be a tough nut to crack. Forecasting and making financial plans and complying with international accounting standards also present remarkable issues for businesses.

With these potential challenges in mind, you can create systems that’ll help you navigate the potential accounting issues in the changing business landscape. Good luck!