Ah, tax season—that magical time of year when coffee consumption spikes and we’re buried in receipts and spreadsheets. As a business owner, you know the drill: you arm yourself with calculators, financial statements, and a steely determination to conquer your tax return. But let’s be honest, mistakes do happen. Maybe it’s a misplaced decimal point, an optimistic expense classification, or that one elusive receipt that decided to take a vacation.

But don’t worry, you can fix the errors and amend your tax return, even if you’ve already filed it. In my practice, I’ve seen it all, and today I’ll share with you the expertise of income tax return mistakes, how to correct and, most importantly, how to avoid them in the first place.

I’ll talk you through the IRS’s reactions, break down potential penalties, and even share a few tales from the trenches. Plus, I’ll be throwing in some proactive strategies to help you minimize the risk of future tax mishaps.

Grab a cup of coffee (you’ll need it), and let’s dive into the world of tax return errors – with a bit of humor to keep our sanity intact!

Contents

- Most common mistakes on tax returns according to the IRS

- Do you need to contact the IRS if you made a mistake in your tax return?

- What if the IRS finds your mistake before you do?

- How to correct a mistake on your income tax return?

- What happens after filing the amended tax return?

- How to avoid making errors in your taxes?

Most common mistakes on tax returns according to the IRS

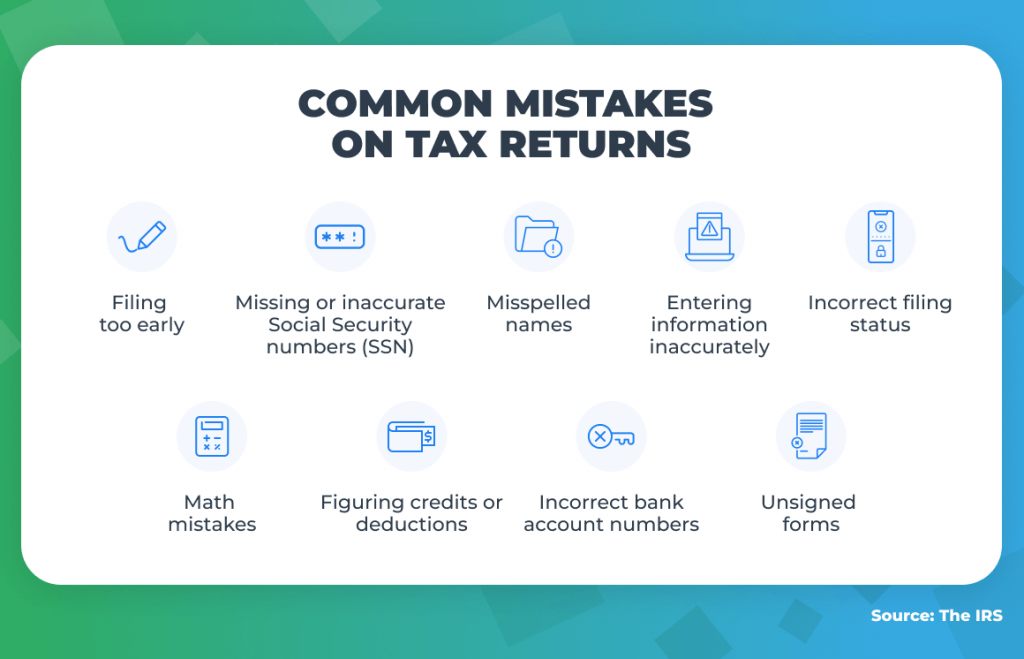

The IRS gets millions of tax forms every year, and a surprising number of them come with mistakes. But these aren’t always the big, scary errors you might expect—sometimes it’s as simple as forgetting to sign the filing form or mistaking last year’s date for this year’s.

The vast majority of mistakes relate to simply not being careful when putting in the correct information. A letter or a number here and there, it’s pretty much what it is. Below you’ll find common mistakes taxpayers make when filing their tax returns, as highlighted by the IRS.

These are mistakes that can occur while filling out tax forms. However, issues often arise much earlier, during your daily bookkeeping tasks throughout the year. Let’s dive into how this happens.

1. Misclassification of revenue and expenses

How you classify your business operation matters a lot to tax filing. And it isn’t so much about forgetting to record it, it’s more about not assigning it to the correct account.

Here are some types of misclassification that I often see in my practice.

Personal vs. business expenses

Business owners, especially sole proprietors, often blur the lines between personal and business expenses. I know it’s easy to slip up when your business feels like an extension of yourself, but mixing the two can lead to messy finances and potential tax trouble.

Capital vs. operational expenses

Capital expenses (long-term investments like equipment or property) and operational expenses (day-to-day costs like utilities or rent) must be correctly categorized. Why? Because how and when you deduct them differs, affecting your taxable income.

Money from loans vs. revenue from sales

When you get a loan, you get money in your account but that’s a liability toward a bank and should be classified accordingly. If you mistakenly record it as sales revenue, you’ll artificially inflate your taxable income, and underplay your actual liabilities.

2. Misreporting income

Misreporting income is a common, yet serious mistake. Your income greatly affects tax calculations, so any discrepancies are a big red flag for the IRS.

These errors often happen when not all sources of income make it onto the tax return—whether it’s cash, checks, credit card payments, or any other way you get paid for your products or services.

| Did you know? The IRS uses a sophisticated document-matching program—the Automated Underreporter (AUR) system—where forms filed by your customers and information provided by banks, brokerage firms, and other financial institutions are cross-referenced with the income reported on your tax return. |

But it’s not just about forgetting to include all your income sources that can lead to issues. Sometimes, the problem lies in how you categorize that income or in claiming deductions that don’t really apply to your business situation.

3. Record-keeping mistakes

As you can see, many of these issues stem from poor record-keeping. Whether it’s forgetting to log a transaction or entering it incorrectly, these mistakes can lead to problems when it’s time to file taxes.

Even if you carefully fill out your tax forms, basing them on incomplete or incorrect information can still land you in trouble with the IRS. It’s not just about doing the paperwork—it’s about making sure the data you’re working with is accurate.

These records are necessary to support the items of income, deductions, and credits reported on your tax return. Without them, you may have difficulty proving the accuracy of your tax filings if audited.

| How long should you keep the records? For tax purposes, the IRS advises that you generally need to keep records for at least 3 years from the date you file your return. However, certain situations require longer retention. |

4. Overlooked tax deductions and credits

Mistakes don’t always lead to penalties. I see many business owners miss out on valuable tax deductions and credits simply because they aren’t aware of them.

| Deduction or credit? A deduction reduces your taxable income, meaning you pay taxes on a smaller amount of your income. A credit directly reduces the amount of tax you owe, often dollar-for-dollar. In short, deductions lower your taxable income, while credits lower your tax bill directly. |

Here are some tax credits and deductions that I often see businesses miss.

Commonly overlooked tax credits:

- Research and Development (R&D) Tax Credit: Available for businesses investing in innovation and product development.

- Work Opportunity Tax Credit (WOTC): For businesses that hire individuals from certain targeted groups.

- Small Business Health Care Tax Credit: For small businesses providing health insurance to employees.

Commonly overlooked deductions:

- Home office deduction: For businesses that use part of their home exclusively for work.

- Section 179 deduction: Allows immediate expensing of equipment and software purchases.

- Start-up costs: Deductions up to $5,000 of the costs associated with starting a new business.

- Vehicle expenses: Deductions for business use of vehicles, which can include mileage or actual expenses like fuel and maintenance.

These missed opportunities generally result in paying more in taxes than necessary, rather than facing penalties. However, consistently making errors or omitting information can raise flags about your tax returns, leading to audits or reviews.

Now that we’ve covered common tax mistakes, let’s talk about what to do if you’ve made one.

Do you need to contact the IRS if you made a mistake in your tax return?

No, generally, there’s no need to contact the IRS before filing an amended return. The amended return itself will serve as notification of the correction.

Bear in mind that the IRS may take several months to process an amended return. You can check the status of your amended return using the IRS’s “Where’s My Amended Return?” tool online.

What if the IRS finds your mistake before you do?

If you received a notice from the IRS asking for clarification or additional information about your original return, you need to respond promptly to any inquiries from their side. This is what I usually tell my clients ahead of such a situation:

- Understand the notice: IRS notices come with specific codes and explanations. Understand what they’re asking for before responding.

- Provide accurate information: When providing additional information or clarification, ensure it’s accurate and complete. Half-truths with the IRS are a no-go.

- Seek professional help: If you’re unsure how to respond or if the situation is complex, getting help from a tax professional is a wise move.

How to correct a mistake on your income tax return?

So, you’ve made a mistake. It happens! But don’t stress out—correcting it is totally doable with the right steps. Let me walk you through how to fix errors on your tax return, so you can set things straight and move forward with confidence.

Step 1. Assess the mistake

First and foremost, determine the nature and extent of the mistake.

Is it an error in reporting income, an overlooked deduction, or a misclassification of an expense?

Understanding the error will guide your next steps. At this stage, it’s good to utilize available IRS tools to estimate any additional taxes, interest, or penalties that you think you might be facing.

Not all mistakes necessitate an amended return. Minor math errors are usually corrected by the IRS during processing. However, significant errors, especially those that impact your tax liability, typically require filing an amended return. This takes us to the next point: getting proper tax advice.

Step 2. Get support from a tax expert

Prior to taking any action, it’s wise to consult with a tax professional or accountant. They can offer expert advice on the severity of the mistake and the best course of action, ensuring that any amendments are properly executed and in compliance with tax laws.

For complex tax situations, working with a Certified Public Accountant (CPA) can be a great choice. CPAs are authorized to represent you before the IRS for audits, appeals, and other issues.

If you’re dealing with an audit or need to respond to IRS inquiries, a CPA can handle the communication, offering expert advice, clear explanations, and strong advocacy on your behalf. This takes the pressure off you and ensures your interests are well-protected.

Step 3. Choose the correct amended return form

You should file an amended return if there are changes in your income, deductions, credits, filing status, or other significant mistakes.

There are a few amended tax return forms: Form 1040X, Form 1120X, an amended Form 1120S, and an amended Form 1065. But what amended form you need to file depends on the type of your business entity.

Step 4. File the amended return form

After identifying errors, you need to fill out the appropriate amended form, making sure to clearly state and explain the changes you’re making.

Don’t forget to attach any necessary documentation, like updated financial statements, corrected 1099 forms, or receipts for business expenses. Finally, submit your amended return as soon as possible to avoid any extra interest or penalties.

What happens after filing the amended tax return?

Once your amended return has been filed, a new timeline starts. While patience is a virtue, being proactive also pays off during this time. Here, I’d like to show you what you can expect or do while you wait.

How the IRS can react

The IRS, while not exactly the friendliest neighbor on the block, doesn’t always show up with pitchforks and torches when you make a mistake on your tax return. For the majority of businesses, once they amend their tax forms, all goes back to normal.

But in some cases, the situation might look rather different, so let’s see what you can expect.

Worst case scenario: The IRS imposes penalties

The IRS has a lovely assortment of penalties they can dish out, but the severity usually depends on the nature of the mistake.

❌ Underpayment penalty: If you underreport your income and therefore, underpay your taxes, the IRS might charge you a penalty on the amount owed.

❌ Accuracy-related penalties: These can be applied if the IRS deems that you were negligent or disregarded rules and regulations.

❌ Late filing and payment penalties: If your mistake leads to late filing or payments, there are additional penalties – because, apparently, being late in the IRS’s world is almost as bad as being wrong.

❌ Fraud penalties: These are the heavy hitters. If the IRS suspects any foul play or intentional wrongdoing, they can impose severe penalties, which could include criminal charges, including even jail time. The maximum sentence for tax evasion is 5 years in prison (26 U.S. Code § 7201).

How to mitigate potential penalties?

If you find yourself facing penalties due to a mistake on your tax return, there are several strategies you can employ to potentially mitigate them. These options hinge on the specifics of your situation, such as the nature of the error and your tax history. Here are some approaches to consider:

- Reasonable cause argument: If the error was due to a reasonable cause (like relying on incorrect advice from a tax advisor), you might be able to argue against penalties.

- Penalty abatement request: In some cases, you can request an abatement or reduction of penalties, especially if you have a history of compliance.

- Payment plans: If you owe additional taxes, consider setting up a payment plan with the IRS to avoid lump-sum payments.

Best case scenario: The IRS may send you a tax refund

Not all tax mistakes end badly, there are also those stories where you end up with a tax refund. If you made a mistake on your tax return related to a credit or deduction and that mistake resulted in you overpaying your taxes, you could be eligible for a refund once the mistake is corrected.

How to avoid making errors in your taxes?

An ounce of prevention is worth a pound of cure. And there are a few things you can do to avoid, or at least diminish the chances of making mistakes in the first place:

- Use bookkeeping software tailored to your business needs.

- Store paper receipts securely and digitize them.

- E-file your income tax returns.

- Consult a tax professional when in doubt.

| Did you know? While about 21% of paper returns have errors, less than 1% of e-filed returns do. |

What’s more, the processing time for e-filing is 21 days, or less, while paper filing takes between 6-8 weeks. So that’s another reason to use an e-filing system.

Closing thoughts

And there you have it – your navigator through the choppy waters of tax return errors. Remember, making a mistake on your tax return isn’t the end of the world, even if it feels like you’ve accidentally invited the IRS to your birthday party.

The key takeaway: even if you make an error on your already filed return, you can correct it with the IRS.

But let’s not forget the most crucial piece of advice: prevention is better than cure. Staying organized, keeping abreast of tax law changes, and seeking professional advice can transform your tax experience from a frantic scramble to a confident stride. And if you ever feel overwhelmed, Tentho is here to guide you through every step, every form, and every confusing IRS guideline. Reach out to us, and let’s make your tax journey less about stress and more about success.