Handling ecommerce accounting across Shopify, PayPal, and QuickBooks often gets complicated, especially as your business grows and transactions start flowing through multiple channels. But here’s the good news: you can sync all three platforms at once without using multiple tools or manually importing data.

With an integration solution like Synder, you can connect Shopify and PayPal to QuickBooks Online in one automated workflow. This keeps your books clean, your sales data accurate, and your financial reporting ready for audits and tax season.

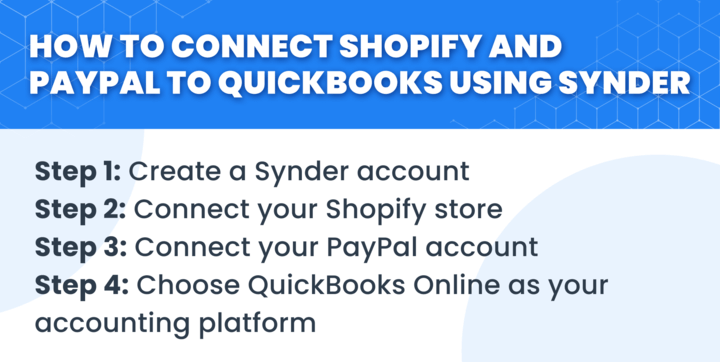

How to connect Shopify and PayPal to QuickBooks using Synder

Here’s how to set up a seamless, three-way sync in Synder:

Step 1: Create a Synder account.

Start by signing up for a Synder account if you haven’t already. You’ll get access to a free trial to explore features before committing.

Step 2: Connect your Shopify store.

Select Shopify on the connection step following the prompts to authorize access and grant the necessary permissions. This will enable real-time data sync for your Shopify sales, fees, taxes, and more.

For more information, study our detailed Shopify integration guide.

Step 3: Connect your PayPal account.

Repeat the same process for PayPal, and connect your account. Synder will automatically pull in all payment data, including PayPal transactions from your Shopify store.

Learn more about PayPal integration.

Step 4: Choose QuickBooks Online as your accounting platform.

Select QuickBooks Online as your accounting system. This ensures all synced data from Shopify and PayPal will flow directly into your QuickBooks Online account.

Explore possible QuickBooks integrations.

Once your platforms are connected, you can fine-tune your setup to ensure everything runs smoothly and your data flows accurately into QuickBooks. Here’s what you can do next:

- Map your accounts in QuickBooks

Customize how Synder records your data by matching sales, fees, shipping, and taxes to the correct accounts in your QuickBooks Chart of Accounts. This ensures accurate financial reporting from day one. - Enable Smart Rules (optional but powerful)

Automate tasks like expense categorization, product tagging, or flagging specific transactions using Smart Rules. These help tailor your reporting and reduce manual adjustments. - Turn on auto-sync

With everything mapped, activate auto-sync. Synder will begin importing transactions from Shopify and PayPal into QuickBooks either as daily summaries or individual entries, depending on your preferences. - Reconcile with bank deposits

Use Synder to create precise, audit-ready records by capturing all the necessary transaction details from Shopify and PayPal. With everything correctly recorded in QuickBooks, you can move forward with a smooth and accurate reconciliation process. - Monitor and adjust anytime

Synder’s dashboard provides full visibility into your sync activity. You can pause syncing, adjust mappings, or resync transactions whenever needed to keep things running smoothly.

Why Synder?

When working with Shopify, PayPal, and QuickBooks, it helps to have a system that keeps things organized. Synder brings these platforms together in one place, your QuickBooks, making everyday accounting a bit easier.

- One tool, multiple platforms: Sync Shopify and PayPal, as well as 30+ other platforms, in the same workflow without switching tools.

- Accurate reconciliation: Align sales, fees, taxes, and deposits to bank statements.

- Smart automation: Reduce manual work with smart rules and auto-sync.

- Real-time visibility: Track every transaction and avoid errors.

- Historical data import: Pull past transactions to fill in the gaps.

- Easy rollback: Undo syncs and correct mistakes in seconds.

Interested? Use Synder’s 15-day free trial to explore how it can benefit your accounting, or book a 1-1 demo for a chat with a specialist.

FAQ

1. How can I prevent duplicate transactions when syncing both Shopify and PayPal to QuickBooks?

Synder detects and filters out duplicates by tracking unique transaction IDs across platforms. Just avoid syncing both platforms directly into QuickBooks without a middleware tool like Synder. If needed, you can roll back and fix any syncs in a few clicks.

2. Why are some Shopify orders paid via PayPal not appearing in QuickBooks?

This usually happens when PayPal is not connected or auto-sync is turned off. Ensure both platforms are active in Synder and check your sync settings.

3. How do I reconcile multicurrency PayPal transactions from Shopify in QuickBooks?

Synder supports multicurrency syncing. It converts currencies based on PayPal exchange rates and posts them accurately into your QuickBooks accounts, supporting compliant reconciliation.

4. Can I connect multiple PayPal accounts to QuickBooks Online?

Yes. Synder allows you to connect multiple PayPal accounts and manage them from one dashboard, routing each to the correct income and fee accounts in QuickBooks.

5. How are PayPal fees recorded in QuickBooks when syncing with Shopify?

Synder separates and maps PayPal processing fees to an expense account, so you always see your gross and net revenue accurately in QuickBooks.