Picture never having to chase a late payment again. In the subscription-driven economy, recurring payments are changing how businesses and their customers interact. For customers, convenience—providing billing information once and enjoying automated, hassle-free payments—translates into loyalty and uninterrupted service. Square provides efficient tools for recurring payments, hence ensuring zero bumps—both for the business and the customer—in payments. Let’s dive into details!

Key takeaways:

- Recurring payments ensure predictable cash flow and reduce administrative costs because of the automation of billing processes, helping a business focus on growth rather than chasing late payments.

- Automation of recurring payments facilitates an element of convenience for customers by letting them submit their billing information just once.

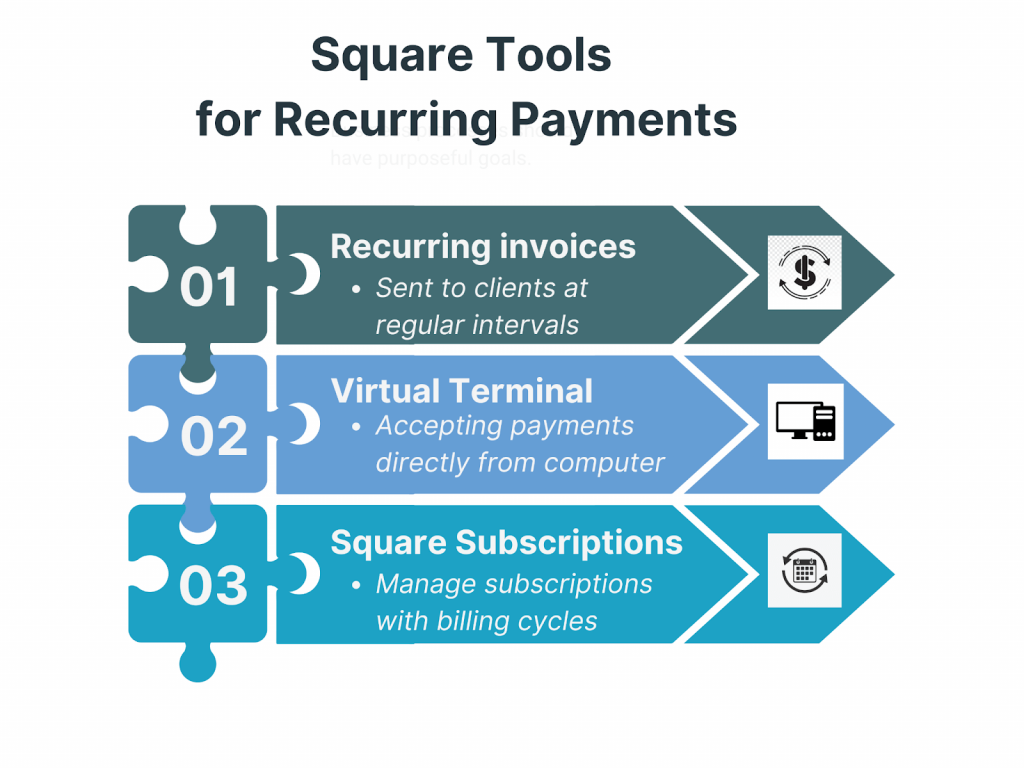

- Square allows its users to seamlessly set up and manage recurring payments with tools like recurring invoices, Virtual Terminal, and Square Subscriptions.

Contents:

1. What are recurring payments and their benefits for businesses?

2. Square tools for recurring payments

3. How to set up recurring payments on Square

4. Square fees on recurring payments

5. Easy accounting for Square payments

What are recurring payments and their benefits for businesses?

We’ll kick things off with the basics. As you probably know, recurring payments are automated recurring transactions scheduled at a specific time frame, either daily, weekly, monthly, or yearly. Customers are automatically charged for the continuing services or subscriptions.

Actually, recurring payments give businesses quite a few tangible benefits. Using them provides predictable cash flow, reduces administrative costs, and ensures better customer retention. It also improves operational efficiency, is scalable, and provides better financial management with competitive advantage by ensuring timely payments and reducing manual billing efforts.

Ready to find out how Square makes this a reality? Let’s see how it all works.

Square tools for recurring payments

As you can see, Square has a number of tools that help businesses implement recurring payments in the most seamless and efficient manner when it comes to billing.

1. Recurring invoices

Take your invoicing process to the next level with recurring invoices and a completely automated workflow. These invoices are sent automatically to clients at intervals that you set: daily, weekly, monthly, or yearly. With card information securely saved to facilitate automatic payment, transactions are processed on time, every time, guaranteeing you never miss a payment.

Suppose you have a gym with members who pay a subscription fee on a monthly basis. You could use Square’s recurring invoices to automatically bill them each month. Once a member’s credit card information is in the system, it’ll charge them every month, send them a receipt, and provide you with steady cash flow—all without your input. This not only streamlines your billing process but also provides convenience for your clients, as they won’t have to worry about remembering to pay each month.

2. Virtual Terminal

Square’s Virtual Terminal lets businesses accept payments directly from their computer, eliminating the need for a physical terminal. You can easily set up recurring payments through any web browser, and once a customer’s credit card information is saved, you can schedule automatic charges at regular intervals.

It’s really worth it, if you, for instance, own a small business like a cleaning service that offers weekly packages – using Square’s Virtual Terminal, you can set up a recurring weekly payment plan, making it much less of a headache both for you and your clients.

3. Square Subscriptions

Square Subscriptions offer a highly efficient and flexible way to handle subscription-based services. Businesses can create and manage subscription plans with billing cycles that fit their needs, whether weekly, monthly, quarterly, or more.

For example, you run an online yoga studio. With Square Subscriptions, you can set up monthly plans for your clients. You can even offer a one-week free trial to attract new yoga-lovers. All subscriber details and updates can be easily managed from a single place on the Square dashboard. This means you can modify subscription plans, monitor your active guests, and handle billing seamlessly, all in one spot. This makes it easier to grow your customer base and ensure a smooth experience for your clients.

How to set up recurring payments on Square

Using Square online dashboard

- Log in to your Square online dashboard.

- In the Payments section, click Virtual Terminal.

- Click Take a Payment.

- Use the Quick Charge for a custom amount, or use Itemized Sale for specific goods.

- Enter details of the transaction, such as discounts, taxes, service charges, tips, or even a note.

- Click Add a Customer to either select an existing customer or add new details.

- Turn on Make this a Recurring Payment.

- Select payment frequency: Daily, Weekly, Monthly, Yearly.

- Select end date: Specific end date, After, or Never.

- Review the payment details.

- Click Save and then Charge to complete the setup.

After setting it, send a digital receipt via email or SMS to the customer.

Using Virtual Terminal

- Log in to the Square dashboard.

- Navigate to Payments > Virtual Terminal.

- Create a payment by following the above steps, add details for the transaction, and allow recurring payments.

Square will automatically process charges with this saved card information upon setup.

Using Square invoices

- Head to the Invoices section of your Square dashboard or in the Square Point Of Sale app.

- Click Create Invoice.

- Enter customer information and invoice details.

- Toggle on Make this a Recurring Payment.

- Set the frequency and duration.

- Save your recurring invoice settings and send it to your customer.

Using Square Subscriptions

- From the Square dashboard, go to Online Checkout.

- Create a Subscription Link Head to a new or existing checkout link.

- Select Collect payments or Accept donation.

- Add a title and amount, then toggle Allow customers to subscribe.

- Set the frequency: Daily, Weekly, Monthly, Quarterly, or Yearly.

- Click Create link to create a unique URL; share this link via your website, social media, email, or text message.

Square fees on recurring payments

Square charges specific fees for processing recurring payments, which are relevant for businesses when they set up and maintain such payments. Both for keyed transactions, including those setup for recurring payments, and for the card-on-file of customer cards with autobilling, Square charges 3.5% + 15 cents per transaction, and Square payment processing time typically ranges from 1-2 business days for standard transfers to your linked bank account.

Note: Square may have other, customized pricing options for those businesses that process over $250,000 annually, taking into account factors such as processing volume and average transaction size.

Easy accounting for Square payments

Tired of the hassle and mistakes in keeping your Square transactions in order? Let Synder make your financial life easier. This powerful accounting automation app seamlessly connects more than 30 payment channels, including Square, and sales platforms like Amazon with accounting software like QuickBooks.

How does it work? Let’s take Square and QuickBooks Online integration via Synder, for example. The tool accurately catches real-time and historical Square data and transfers it to your QuickBooks Online account, giving you the chance to prepare your financial records for smooth reconciliation with bank statements. Besides, it offers detailed cash flow insights to users in order to obtain accurate financial documents. Above all, Synder can boost your accounting by linking Square Gift Cards to the proper Liability account.

Using Synder, you can effortlessly account for your Square payments without confusion, and be sure of the accuracy of the financial data.

Closing thoughts

Recurring payments are one of the drivers changing how business is done because they provide predictable cash flow, reduce administration costs, and improve customer loyalty. Square offers tools to manage these payments seamlessly and efficiently, such as Virtual Terminal, Square Subscriptions, and recurring invoices, which can be set up from the Square dashboard or from the Square Point of Sale app.

You could be wasting a lot of time by not automating your bills with Square. Automate, streamline, and grow with Square: be the best business for your customers!

Share your thoughts

Eager to set up recurring payments on Square? Or maybe you’re already using it? Share your questions and experience in the comments below!