Just imagine that your finance team is fully optimized. They spend less time on manual, repetitive tasks, there are fewer mistakes in the documents, and the data is always analyzed and accurately posted into the books. Sounds like a dream? Actually, it can be a reality with robotic process automation (RPA). But what exactly is it, and how can it transform your business? Let’s figure it out.

Key takeaways:

- Robotic process automation (RPA) is a technology that uses software bots to mimic human actions and complete tasks.

- RPA can automatically update financial models, combine data from different sources, and create detailed reports with minimal human effort.

- When combined with artificial intelligence (AI) and machine learning (ML), RPA can make predictions based on financial data analysis.

Contents:

1. What is RPA?

2. How does RPA work in accounting?

4. What automation tool to choose?

5. How can RPA benefit corporate accounting and finance?

What is RPA?

Let’s start with the question: What does RPA stand for? RPA stands for robotic process automation which uses software bots to imitate human actions and carry out tasks. It can interact with existing systems and applications to perform business processes.

RPA is ideal for handling tasks with structured data, like transaction processing, data entry and report generation. Since RPA follows pre-set rules and actions, it works best for simple, repetitive tasks. For example, an RPA bot can automatically enter data from invoices into an accounting system, saving time and reducing errors.

How does RPA work in accounting?

Using RPA in accounting is like using a powerful Excel macro, but instead of working in just one system, RPA can operate across all the accounting platforms a business uses.

With RPA, tasks like auditing, tax work, invoice processing, data entry, reconciliation, and report generation are simplified. Setting up such a system may be complicated, but the end result is impressive.

The role of RPA in finance

In finance, RPA is primarily used to streamline Excel tasks. These routine and monotonous tasks can take up a huge amount of time. However, RPA can analyze, extract, and edit the spreadsheets. For example, RPA can automatically update financial models, combine data from different sources, and create detailed reports with minimal human effort.

Robotic accounting can be combined with artificial intelligence (AI) and machine learning (ML). These additions expand the functionality of RPA, allowing it to make predictions based on the analysis of financial data.

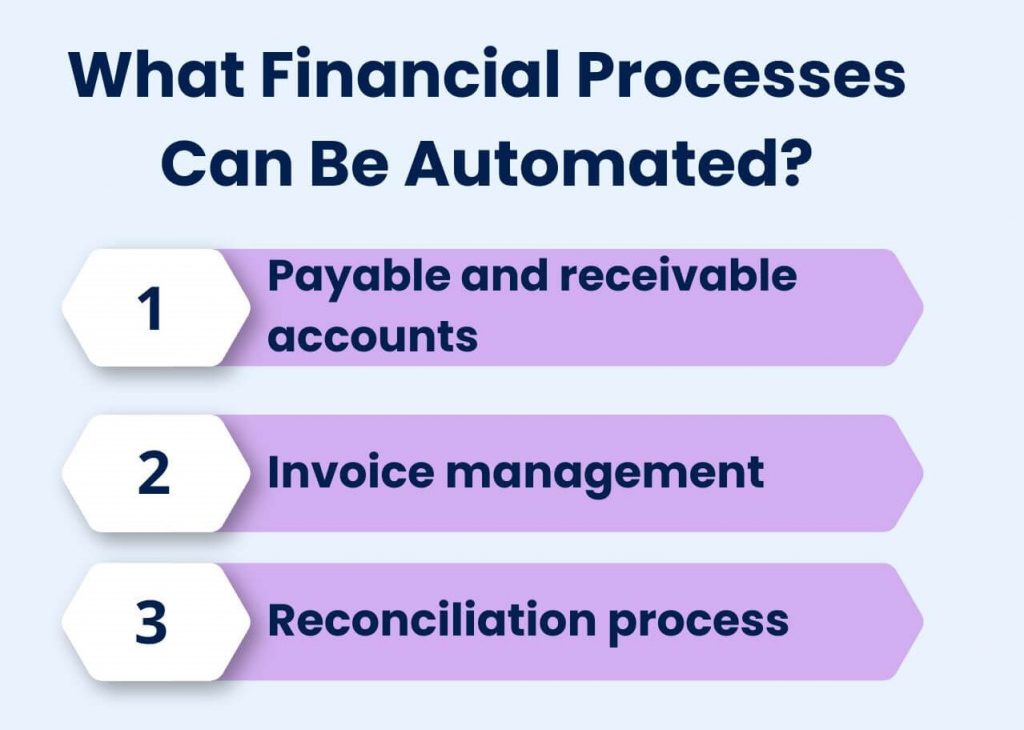

What financial processes can be automated?

1. Accounts payable and receivable

Working with accounts payable (AP) and accounts receivable (AR) is important, but it can be very time-consuming. Manually entering data, reviewing documents, and resolving invoice issues can take hours. How can this be solved? WIth automation. It can speed up approvals, quickly correct invoice errors, and ensure timely payments and receipts.

2. Invoice management

Managing invoices can be tough, with many things to keep track of and rules to follow. RPA is powered by algorithms that are easy to configure to follow these rules. The tool doesn’t get tired or mix up lines, which can lead to mistakes. That’s why companies often use RPA in their invoicing processes — to avoid human errors.

You can also simplify invoice processing with automated data analytics, which can provide insights into supplier behavior, payment cycles, and seasonal cash flows. With this information, businesses can negotiate better terms with suppliers, optimize payment cycles, and manage invoice processing more efficiently.

3. Reconciliation process

One of the most monotonous manual tasks in accounting work is reconciliation. You need to match the company’s accounts with bank statements without missing a single transaction. This can be very difficult, and even one mistake can lead to financial problems. What can you do? Once again, turn to RPA. With automation, a company can receive high-quality, verified information that is relevant and guarantees accurate records.

What automation tool to choose?

If you want to optimize accounting processes in your company, automation is a must. And Synder is an accounting automation solution to improve your workflow without an effort of entering endless streams of numbers. With a huge pull of tasks, such an option can be a blessing for accountants. But what exactly will you get from Synder and how can it help you?

Here’s just a sneak peak into the features that this accounting software can offer to streamline your bookkeeping processes:

- Record ongoing transactions, such as sales, purchases, receipts, payments and import years of historical data;

- Customize and organize this data;

- Synchronize data from 30+ ecommerce platforms, payment gateways, and POS systems;

- Reconcile multi-channel sales for hassle-free month-end bookkeeping.

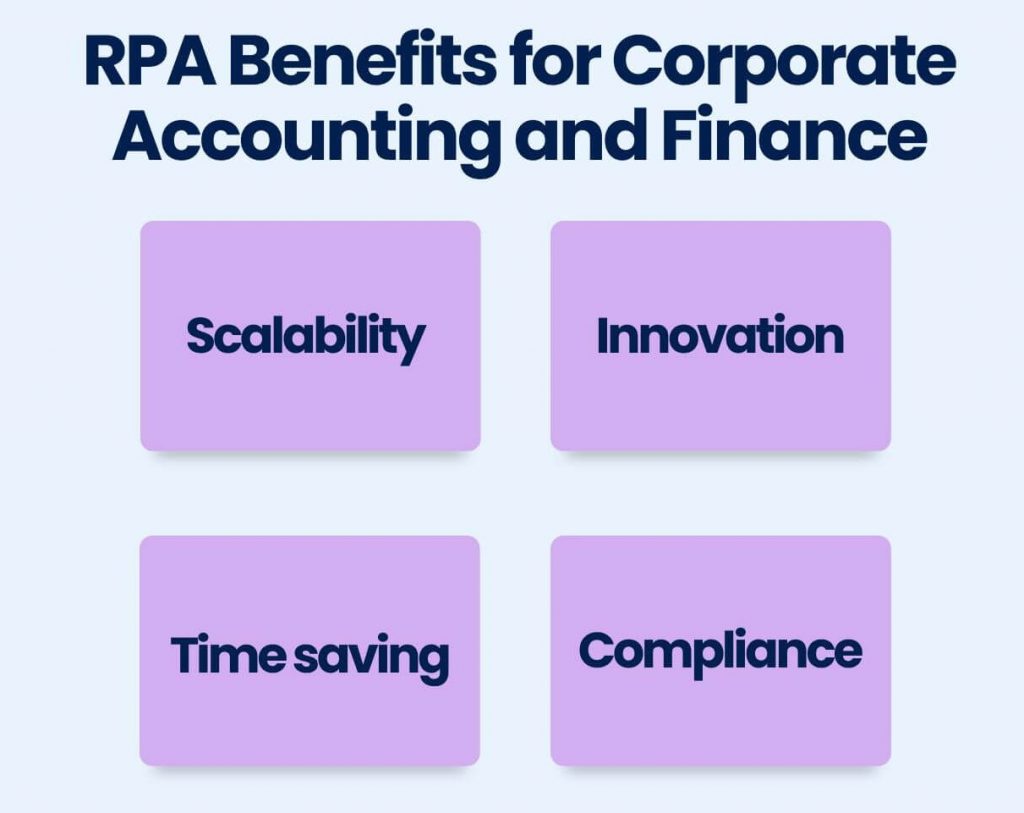

How can RPA benefit corporate accounting and finance?

As you know, accounting isn’t that simple. You need to follow complex rules and work with difficult data. But what will you gain by implementing RPA bots into your accounting operations?

1. Scalability

As your business grows, you might need to expand your staff or change company workflow. With RPA, there’s no need for such changes. You can simply scale the bots’ output to handle increasing workloads and this way you’ll save money for other business needs.

2. Innovation

RPA functionality goes beyond simple employees. Software bots can pull both old and new data from existing systems, automatically analyze it, and create valuable, structured insights.

3. Time saving

Manual tasks are time-consuming. When you have to reconcile transactions or check entire tables in Excel yourself, you waste a lot of time. On the other hand, with RPA, accountants can avoid such time loss and complete their tasks much faster, thanks to automation.

4. Compliance

The human factor is a big problem in accounting. Lots of rules, details, and numbers can be confusing, and even the most experienced accountant can make a mistake. Such mistakes can lead to financial problems for the company. RPA can reduce these human errors and help accounting teams meet compliance standards.

Conclusion

The RPA implementation into finance and accounting operations isn’t just about improving efficiency — it’s about transforming the way businesses handle their financial processes. By automating repetitive tasks, reducing errors, and providing deep insights through data analytics, RPA allows you to make a big step forward for your company.

At first glance, these points might not seem that important, but when you look at the whole picture, it becomes clear that automation is a game changer for every business. No more sleepless nights surrounded by mountains of documents — every accountant’s dream, right?

Share your thoughts

Have you implemented RPA in your organization? What challenges and benefits have you encountered? How do you think RPA will shape the future of financial processes? Share your insights, questions, or any tips below!