Nobody likes monotonous work. At first glance, reconciliation seems like just such a process. However, it’s a must for cash flow management. To properly handle payout reconciliation, you need to understand what it is, what the process looks like, and why it’s so important. Once you know this, automating and simplifying reconciliation becomes much easier. So, let’s explore these questions together, shall we?

Key takeaways:

- Payment reconciliation is a comparison of payments received in your bank account, corresponding payment batches, and other related transactions.

- There are several types of payout reconciliation: credit and debit card, bank, cash and digital wallet reconciliation.

- The reconciliation process involves collecting data, recording transactions, matching transactions, finding discrepancies, and troubleshooting problems.

Contents:

1. What is payout reconciliation?

2. Types of payout reconciliation

- Credit card and debit card reconciliation

- Bank reconciliation

- Cash reconciliation

- Digital wallet reconciliation

3. How does reconciliation work?

4. How to optimize the payment reconciliation process with Synder?

What is payout reconciliation?

First of all, let’s define account reconciliation. It’s the process of comparing financial records with an actual bank balance to ensure the figures are consistent.

But how is payout reconciliation different from account reconciliation? Payout reconciliation is more specific and helps you match the payouts you receive in your bank account with corresponding payment batches and other related transactions. This guarantees that all payments and disbursements are fully recorded, keeping financial records secure, preventing discrepancies, and maintaining data integrity.

Types of payout reconciliation

Credit card and debit card reconciliation

Most businesses use credit and debit cards in their business. But what does reconciling an account involve in this case? Credit and debit card reconciliation involves comparing center records with monthly statements and bank statements to ensure all transactions have been recorded correctly, avoiding potential discrepancies.

For example, let’s say you purchased office supplies using a credit card. You may want this activity to appear on your credit card statement, your company accounts, and your bank account statement.

Bank reconciliation

This common type of reconciliation involves checking bank records against various transactions. Failing to balance records properly can lead to consequences of unbalanced reconciliation, such as mismatched payouts, inaccurate deposits, or errors in accounting for fees and penalties.

For instance, if your company pays a vendor $500 and deposits $1,000 in sales, you need to make sure that both the payment and deposit are accurately reported on your bank statement and internal records.

Cash reconciliation

In physical stores, cash reconciliation is essential. This process involves comparing the cash collected to the sales receipts to identify any discrepancies. It helps detect potential issues like employee theft or accounting errors.

Imagine this: if a store reports $500 in sales receipts for the day, the cash reconciliation process would involve counting the actual cash collected to ensure it also totals $500. Any discrepancies might indicate problems that need to be addressed.

Digital wallet reconciliation

As digital wallets become more popular, businesses need to reconcile transactions made through these platforms. However, keep in mind that statements from digital wallet providers aren’t always available, and there are significant security challenges to consider.

For instance, if a customer pays for a product using a digital wallet like PayPal, the business must ensure that this transaction appears correctly in their internal records. Because detailed statements from PayPal might not always be available, businesses need to be vigilant in tracking these transactions to avoid any discrepancies or security issues.

How does reconciliation work?

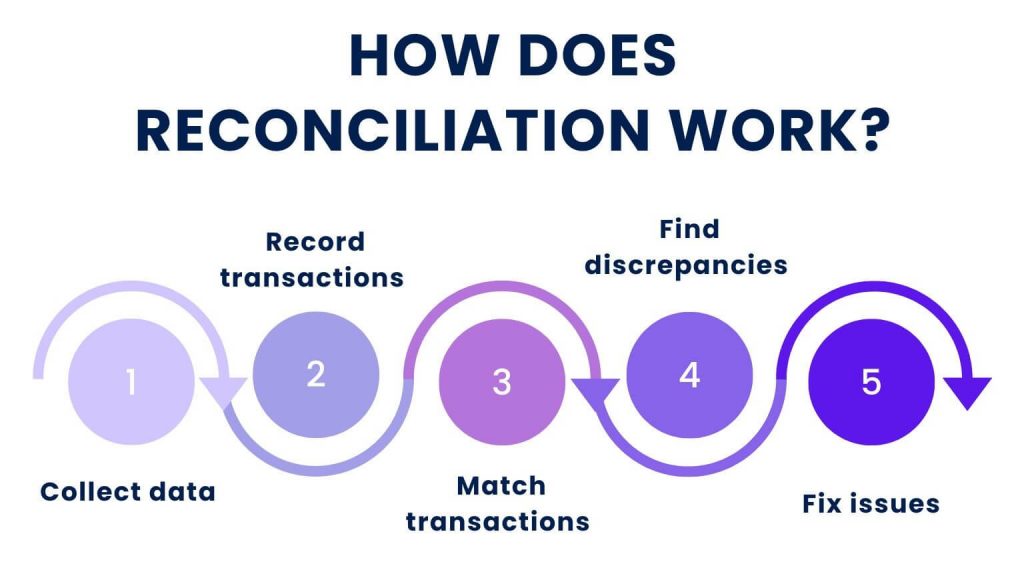

As we already know, payout reconciliation involves comparing a physical transaction to its recorded data to ensure accuracy. Here’s how the payment reconciliation process looks:

Step 1: Collect data

Collect transaction data from your company’s accounting system, including payments made and receipts. Also, obtain transaction reports from banks, payment service providers, and other financial institutions.

Step 2: Record transactions

Record all transaction data into your accounting tool or an Excel spreadsheet, noting the date, amount, and type of each transaction.

Step 3: Match transactions

Accounts with similar descriptions must be compared for the date and amount of the transaction shown in the internal statements and in the external statements. You can perform this matching manually or use accounting software for greater efficiency.

Step 4: Find discrepancies

Identify any mismatches between internal records and external statements. Discrepancies may include different amounts, unrecorded transactions, or unauthorized transactions.

Step 5: Fix issues

Correct any errors in your internal records, such as data entry mistakes or missed transactions. If the discrepancy is in the external statement, contact the financial institution to resolve it, providing proof if necessary. Address any unauthorized transactions immediately to prevent fraud, including notifying the bank.

How to optimize the payment reconciliation process with Synder

Reconciling finances for online businesses on platforms like Amazon, eBay, or Shopify can be challenging due to their transaction reporting methods. While Stripe offers detailed daily balance reports, Amazon, eBay, and Shopify provide summary reports based on payouts, which can be more consistent but less efficient for daily reconciliation, making it a real pain.

Luckily, Synder can sync payment data in two modes at your discretion: Per Transaction and Summary Sync. It streamlines the reconciliation process by automating the recording of transactions from payment platforms like PayPal or Stripe or sales channels like Shopify or eBay into accounting systems(such as QuickBooks, Xero, Sage Intacct.

Let’s consider an example with QuickBooks Online. When you connect, for instance, PayPal and QuickBooks to Synder Sync, transactions are initially synced into the QuickBooks Clearing account. They stay there until the payout reaches the bank account, at which point Synder transfers them to the Checking account. The pre-match of records helps identify and resolve discrepancies promptly, saving time and ensuring accurate records.

Conclusion

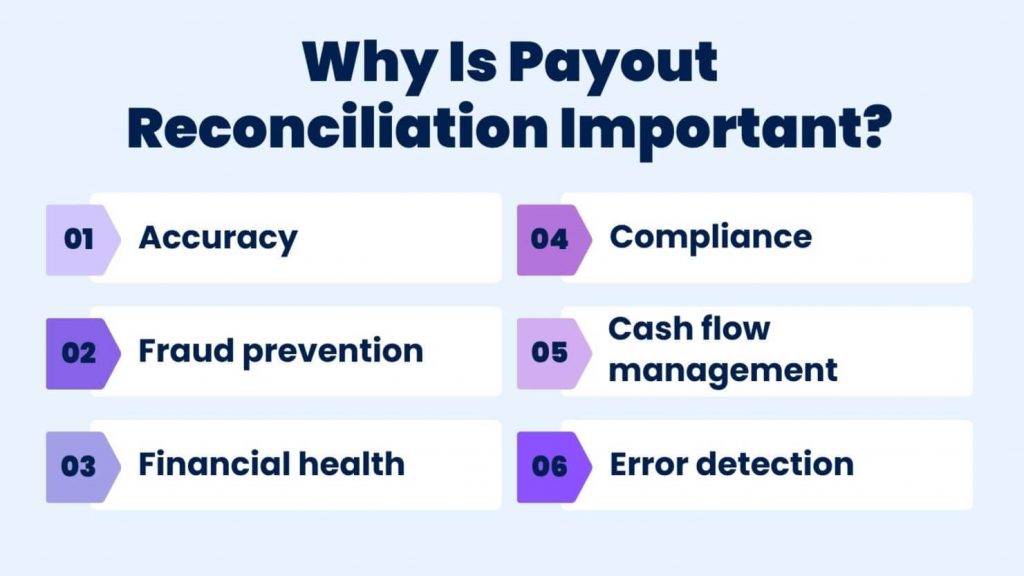

Payout reconciliation is key to keeping your business’s finances on track. While it might seem tedious, it’s vital for accuracy, preventing fraud, and staying compliant with financial rules. Using automation can make this process faster and reduce mistakes, leading to clear and accurate records. This makes managing your finances easier and helps your business grow.

Share your thoughts

How do you handle payout reconciliation in your business? Have you found any particular tools or methods that make the process easier? Share your experiences, tips, and questions in the comments below.

FAQs

What is a payment reconciliation?

Reconciling payments entails the confirmation of the balances that have been recorded in the books of account with the balances in the bank statements. This means that all the payments are clear and if there are any wrong figures, they are corrected.

What is the main purpose of reconciliation?

The main purpose of a reconciliation is to ensure that the total amount of money spent matches the amount shown in the account at the end of the period. People and companies do this regularly to check for errors or fraud.

What is the difference between payment settlement and reconciliation?

Settlement of payment is the transfer of money and completion of the financial transaction. Reconciliation is the comparison of an organization’s internal accounts to ensure they match other published accounts.

What is a transaction reconciliation?

Transaction reconciliation is a process that accountants use to check and verify each entry in a ledger or report. They compare these entries with the original transaction records to make sure everything is right.

How do I reconcile my payouts?

To reconcile your payouts, follow these simple steps:

- Collect data;

- Record transactions;

- Compare transactions;

- Find differences;

- Fix mistakes.

How do you reconcile salaries?

Payroll reconciliation is the process of verifying all employees’ payroll records and information for accuracy. It helps ensure that the staff gets their pay correctly and provides the necessary information for a company to get error-free financial reports.