It pays to outsource. Well, it can. Like most options available to business, it depends on what you’re doing and what the business is.

While outsourcing your payroll operation can certainly deliver many advantages, it makes sense to avail yourself of all the details before making the leap. Because when it comes to payroll, you have to get it right. You’ve got to pay your staff the right amount, and you need to stay compliant with government regulations.

So, we’ll cover what’s great about outsourced payroll, and why it can be such a good idea to implement. We’ll also go into what caveats there are, so you know what to look out for. Let’s clock on.

Contents:

1. What is an outsourced payroll?

2. Advantages of outsourcing payroll

3. What to consider before you outsource your payroll

What is an outsourced payroll?

Time was, a company’s wages were all taken care of in-house in a specific payroll department. Pay packets were made up, and everybody got their money in real dollars and real cents. They were popped in a little envelope ready for collection, for spending in a speakeasy or trading post on the way home.

Yes, OK, this is a while back, and things have changed a little since then.

Nowadays, it can make sense to contract out the whole activity to an external body. Obviously, this external body has to be a trusted party – payroll’s not the kind of thing you can take risks with. Unless that is, you have employees with a remarkably offhand attitude to remuneration and/or a government that’s pretty breezy about tax deductions.

No, neither is very likely. So, just like any other core component in your business, you should sign it over to a body you have complete confidence in. This is as true for small business accounting as for much larger frameworks.

You also need to be sure that whoever you outsource to gives sufficient priority to confidentiality, as they’ll be privy to a lot of data. This includes macro, in terms of general payroll information concerning your business, and micro, in terms of potentially sensitive information concerning individual employees.

What gets included?

One thing to highlight here is that outsourced payroll is usually just that: payroll. It doesn’t necessarily mean that any other HR activities get outsourced too. Other HR activities like recruitment are usually separate.

So what generally gets included in payroll outsourcing? Tracking time worked and calculating pay due is obvious. What else? Well, setting up payroll accounts for each employee is a good start, and ensuring they’re paid is a key requirement too. Just as important is keeping the business legal by observing the tax framework of any territories that the business is operating in.

Providing yearly reports for compliance purposes is of vital importance. And providing reports for the business itself to access on an ad hoc basis is pretty crucial too.

Let’s now turn to why you might be well advised to outsource your payroll.

Advantages of outsourcing payroll

Cost savings

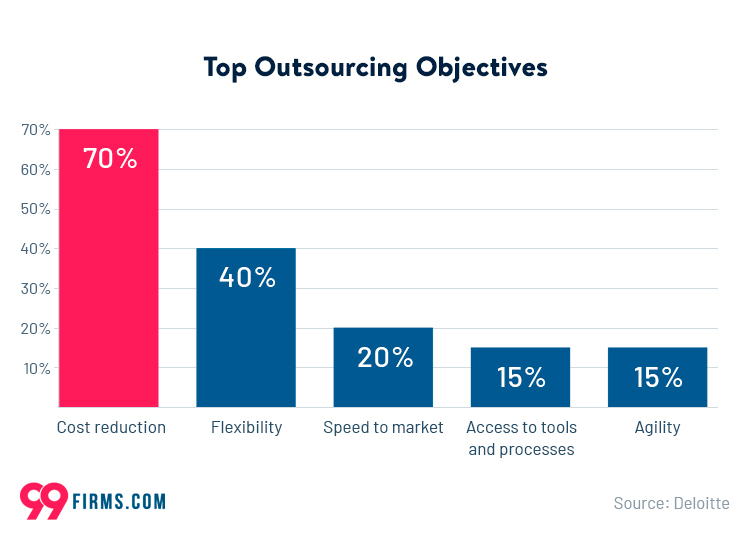

This probably comes as no surprise. Cost savings tend to be the main reason why most businesses decide to outsource in general. 70% of businesses surveyed by Deloitte named cost reduction as the most important outsourcing objective.

Going back to that internal payroll department we alluded to earlier, it doesn’t take much imagination to realize how much internal offices cost to run. Of course, all your payroll staff will want payment, and the office itself will have attendant costs such as lighting, heating, and rent.

So, it can make a great deal of financial sense to contract the operation out. This is particularly the case where the business operates in a high-pay region, which will necessitate a high wage outlay in order to compete for the best staff.

Cost savings in outsourcing payroll can be significant, even with a small business payroll service. But this is only one of several advantages. Let’s look at the others.

Time savings

Make no mistake, payroll can be time-consuming. Being accurate isn’t necessarily something you can accomplish with speed. And if an activity is time-intensive, then you have to worry not just about the costs attached, but also the possibility that deadlines might be missed. Not paying your staff is a bit of a faux pas, to say the least, so you have to be confident that payroll processing activities are well taken care of.

Outsourcing your payroll means that you won’t get sucked into any of the time-consuming minutiae of payroll processing. Instead, you’re free to devote yourself to other activities.

Statutory observance

This is obviously crucial to get right and can be more complicated than you might think, especially if a business is operating in more than one territory. A payroll business will be on top of the latest accounting regulations so that you can have peace of mind that everything is legally tip-top.

Accuracy

Payroll is a major financial outlay for a business. So, it needs to be accurate as the ramifications of a mistake can be huge for the operation’s bottom line. Even worse than that, employees can find themselves without the money they need to pay rent or even eat that month.

For that reason, it makes sense for payroll to be in the hands of an agent who does it all the time. Ideally, they’ll have built up a degree of experience and therefore, have credentials you can trust. When you outsource your payroll, you’re giving a core process to a professional and trustworthy party.

Crucially, you’re avoiding the situation that occurs in some small companies where payroll is just something someone does once a month, sandwiched awkwardly between a bunch of other activities. The potential for error within a well-meaning but amateur payroll facility like this is huge.

Scalability

With payroll service software delivered via the cloud, you get payroll support that expands to fit your company’s needs. This accommodates sudden and seasonal growth. If you were using the traditional approach, any kind of growth would necessitate a lengthy and expensive payroll staff expansion effort.

Outsourcing your payroll means you get the service you need, when you need it, even if it’s only a temporary surge (like a seasonal blip).

Security

It might seem a little counter-intuitive, but placing your payroll in the hands of a remote party can actually enhance security for your operation. To take communications as an example, advances in remote encryption and cybersecurity have made using a cloud PBX system more secure than a conventional telephone system.

It’s the same with an outsourced payroll. As long as you are using a reputable provider, there’s no reason to believe that your data won’t be just as, if not more secure as it would be if it were kept in-house. This is not just due to encryption and other security technologies, but because outsourced staff are trained in and deal with security issues all the time, and realize the importance of such.

What to consider before you outsource your payroll

There are several factors you should bear in mind before deciding on outsourcing your payroll to a particular party.

- Are your business goals likely to be well-serviced by them?

- What service features do you need and what is being offered? Is what you want included or will it incur an extra fee?

- Is their security up to par? Remember that any data breach will reflect badly on your company.

- How many clients do they have? Are any similar in size or operation to your business? Do you have access to their feelings about the service they’ve experienced?

- Is the tax (and other deductions) procedure robust enough to ensure that you stay on the right side of the law?

- What does your gut say? If you have a nagging doubt about the payroll company you’re looking at, consider looking elsewhere. As important as deciding whether to outsource your payroll is deciding which provider to go with. There are lots of alternatives out there, so find the one that suits you.

Say hi to hybrid

If you decide that you’re not ready to take the leap to full payroll outsourcing, it might be an idea to look at a hybrid incarnation. This usually takes the form of a co-sourcing arrangement, where only certain aspects of the payroll are contracted out. For instance, tax matters could transfer externally, while payment processing remains in-house.

Outstanding outsourcing: Bottom line

It can be quite unsettling to outsource core business components for the first time, especially when it concerns the well-being and remuneration of your valued staff. Nobody thinks it’s anything but a big deal. Should a business pressurize you into making a quick decision, then you should probably look elsewhere.

In the overwhelming majority of cases, it makes sense to outsource. However, you need to come to this conclusion in your own time with all the data in front of you. And, you need to take time to ensure that you’ve found the right partner, so you can be confident that this vital part of your business is in the right hands.

Thanks for also talking about how there are hybrid options to look into when planning to get payroll outsourcing services. I might need to look into that because I plan to start working on starting a new business soon. Once I start hiring employees, I will need to ensure that I could properly handle the payroll processing for that.