Budgeting is a word that is mostly linked to financial constraints rather than financial surplus. But is the budget really only needed for lean times? Seeing it as a tool that helps businesses avoid financial issues, misses the full potential of budgeting. It’s not merely a safety net but a trampoline that can propel businesses to new heights.

In this article, we’ll dive into the importance of monthly budgeting and how it applies to your business all year round. We’ll also review what a good monthly budget template should look like and how to apply that knowledge to the practicalities of business operations.

Are you an ecommerce or SaaS business owner looking for an accounting solution that will streamline online payments? Check it out!

Contents:

1. Budget planner basics: What is a business budget?

2. The importance of the budget planner for your money and beyond

3. Are budget templates a good solution?

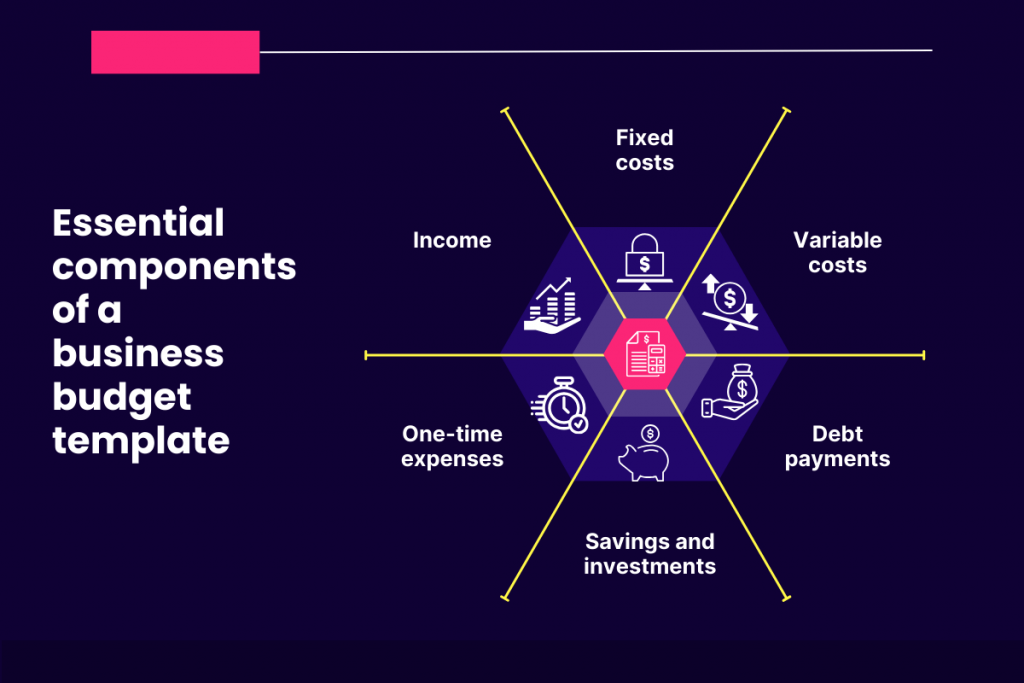

4. Expenses and revenues: What are the essential components of a good budget template?

5. Free monthly budget worksheet

6. Calculator, Excel, or budgeting software?

Budget planner basics: What is a business budget?

The short answer would be that a business budget is a structured financial tool that presents an itemized summary of expected income and expenses over a specific period.

Here are some details:

It’s both your financial GPS and dashboard, which not only charts your path but gives real-time insights into how the business is performing against the set financial goals. With a well-constructed budget, you can make informed decisions, optimize resource allocation, and anticipate any financial challenges or opportunities down the road.

The importance of the budget planner for your money and beyond

With the above definition in mind, the possibilities of what a business budget can offer begin to widen. Let’s have a look at the advantages that a good budget can give.

Vision and direction

A budget provides a clear picture of where your business is headed. By allocating funds to different departments or projects, you’re essentially highlighting the business’s priorities for the coming period.

Ensuring profitability

Regular budget reviews help you monitor profit margins, ensuring the business remains lucrative and competitive. By understanding where the money goes, businesses can make informed decisions on price adjustments, discounts, and promotional activities.

Financial health and control

Regular budget checks ensure that revenues cover expenses, preventing liquidity crises and ensuring there’s enough money to run operations smoothly. By tracking actual expenses against the budget, business owners can quickly spot and address cost overruns.

Accountability and efficiency

A budget acts as a standard against which performance can be measured, promoting accountability among departments. Recognizing where money is spent unnecessarily becomes easier with budget planning, allowing for more efficient resource utilization that minimizes wastage.

Strategic growth and expansion

A well-planned budget can set aside funds for future investments, be it new product development, market expansion, or infrastructure enhancement. Prospective investors or lenders often require detailed budgets to gauge the health and potential of a business before making financial commitments. So budget becomes a necessity in such cases.

Anticipating challenges

Budget planning helps you foresee potential financial obstacles. This gives you ample time to devise strategies to navigate or avoid them. With a budget, you can allocate resources where they’re needed most, ensuring no department or project is underfunded.

Bottom line

The budget covers many aspects of your business, from the macro-level of envisioning a financial direction to the micro-level of adjusting the prices of single products or services. Looking from a different perspective, the budget affects many of your different departments from HR (hiring), marketing, product development, and many more. So, your entire business is underpinned by the budgeting potential.

Are budget templates a good solution?

While each company is different, just like financial statements, every business is made up of common and measurable financial operations that help create a budget. This common ground paves the way for the utility of a template.

Uniformity and structure

Much like the blueprint of a house, budget templates lay down a consistent and clear structure, acting as a guiding framework. This ensures that every financial facet is given its due consideration, eliminating the risk of accidentally overlooking critical components.

Using the same template, allows for comparison of the budgets, on a month to month basis – which aids in drawing conclusions and forecasting.

Adaptable flexibility

One of the inherent beauties of budget templates is their chameleon-like ability to adapt. Whether a business is sifting through the finances of a startup with minimal cash flow or a corporate behemoth with multiple revenue streams, templates can be tailored and adjusted to encapsulate all the nuances of varied financial landscapes.

What’s more, as your business grows, so does your template. You can add elements and divide different parts into more components to give you the needed budget structure.

Efficiency and time-saving

Time, in the business realm, is money, and a template can save you both. While you can create your own template from scratch, you can also rely on the ready-made templates too. With a robust structure already in place, just modify the chosen template to suit the unique needs of your business.

Harmonious integration with modern tools

When discussing the templates, not for a moment do we think of a pen-and-paper solution. Living in the digital age, we’re blessed with an array of sophisticated platforms designed to make tasks more efficient. These tools come packed with built-in calculators, graphs, and a plethora of functionalities that transform raw numbers into insightful data.

Expenses and revenues: What are the essential components of a good budget template?

When crafting a budget that stands the test of real-world financial challenges, think of it like piecing together a big jigsaw puzzle. Every cost, investment, or penny you expect to come in is a piece. And just like with puzzles, even the tiniest element matters to get the whole picture right. So, let’s uncover what those little and big parts of your budget are.

1. Fixed costs

Fixed costs are the foundation of your business. It’s the money you have to pay for every month, no matter how well sales are doing. These costs are predictable, and you’ll see them on your bills month after month. They’re essential for keeping your business up and running. Here are some examples of fixed costs:

- Utilities: While these are consistent, seasonal fluctuations, like heating costs in winter or AC costs in summer, should be forecasted.

- Rent or mortgage: This forms the foundation of operational costs, especially for brick-and-mortar businesses. Consider fluctuations in property rates and upcoming renewals.

- Salaries and wages: A business’s lifeline. Beyond mere numbers, consider annual raises, potential new hires, and benefits packages.

- Insurance premiums: These can change based on updated business valuations or changes in risk factors.

- Depreciation and amortization: These non-cash expenses affect taxable income. Ensure they’re tracked and updated as assets age.

- Office supplies: From stationery to software subscriptions, these small expenses can accumulate.

- Other contractual or regular obligations: Memberships, licenses, subscriptions, or routine maintenance contracts – all find their place here.

2. Variable costs

Variable costs change based on how active your business is, like the cost of materials for your products or commissions you pay out. If you sell more in a month, you’ll spend more on these. If it’s a slow month, they’ll go down. They move in sync with your business operations, so it’s essential to keep an eye on them. Here are some of the variable costs that you should include in your monthly budget:

- Production materials: Directly tied to sales forecasts. As production scales, can you negotiate better vendor rates?

- Marketing and advertising: These evolve with campaigns, promotions, and market competition.

- Shipping and freight costs: These can fluctuate based on the volume of products you’re distributing and the shipping distance.

- Utilities (overages): While a base utility cost might be fixed, excessive usage of electricity, water, or even internet can lead to variable costs.

- Training and development: As your team grows or changes, you might invest more in training programs or resources.

- Licenses and permits: Some licenses need renewing based on business volume or other metrics, causing variability.

- Outsourced services: The use of third-party services, whether it’s for IT support, customer service, or something else, can vary based on demand and growth.

- Inventory costs: These can change based on storage needs, write-offs for damaged goods, or changes in handling costs.

- Seasonal expenses: Certain businesses have seasonal fluctuations that can lead to increased costs during peak seasons.

- Travel and entertainment: Often overlooked but often adding up, especially if your business involves client meetings or industry conferences.

- Commissions and bonuses: Tied to performance metrics, they can vary with business highs and lows.

- Professional fees: Legal consultations, audit fees, or specialized contractors—all play their part.

3. One-time expenses

One-time expenses don’t come around often, but when they do, they can be significant. Whether it’s a new piece of equipment you need to buy or a permit fee for a new venture – these are costs that aren’t part of the regular rhythm of your business but can make a big dent unless planned for. Think of them as guests – whether you expected them or not, you need a plan in case they arrive! Here is a list of such typical expenses:

- Capital expenditures: These are large investments in things like machinery, vehicles, or technology. For instance, if a company decided to upgrade its entire computer system, the cost would be a one-time expense.

- Starting costs: When launching a business, there are often costs associated with getting it off the ground. These can include licensing fees, initial marketing campaigns, and opening event expenses.

- Expansion costs: If a business decides to expand, whether by opening a new location or branching out into a new product line, there will be costs involved. These can range from construction costs to market research.

- Emergency repairs: If a vital piece of equipment breaks down unexpectedly and isn’t covered by warranty or insurance, the repair or replacement cost would be a one-time expense.

- Licensing or permitting fees: While some licenses or permits may be recurring, there might be times when a business needs a special permit or license for a particular purpose, and this would be a one-time cost.

- Legal settlements: If a business faces a legal challenge and ends up having to pay a settlement, this can be a significant one-time expense.

- Training programs: While employee training can be ongoing, special training programs or workshops can be a one-time cost, especially if they’re for introducing a new system or process.

- Special projects or initiatives: If a company undertakes a specific project, such as a rebranding campaign or another major event, the associated costs can be one-time expenses.

Find out how to categorize expenses in QuickBooks Online automatically with Synder Sync.

4. Savings and investments

While savings act as a cushion against unforeseen expenses or downturns, ensuring you don’t stumble during lean periods, investments are your forward-thinking strategy, channeling money today for more significant gains tomorrow. Together, they ensure stability in the present and prosperity in the future. It’s not just about stashing away cash, but also strategically allocating funds to fuel your business’s long-term ambitions.

- Reserves: Key for unexpected opportunities or ventures. Always ensure a portion of profits is siphoned off for future projects.

- Emergency funds: Unexpected hiccups — like equipment breakdowns or market downturns — necessitate a safety net.

- Investments: This is the seed for future growth. It’s not just about stashing cash, but making the money work for the business.

- Research and Development (R&D) reserves: Money saved for innovation, keeping the business competitive.

- Employee training and development: Funds for enhancing employee skills and boosting growth.

- Retirement and pension funds: Savings for employee retirement benefits, attracting and retaining talent.

- Technology upgrades: Allocating funds for updating and enhancing business tech tools.

5. Debt payments

When your business borrows money, you need to factor in your monthly dues in the budget. Making repayments on time keeps lenders happy, helps you avoid extra fees, and boosts your business’s credit score. Let’s see some of the examples of this type of expenses:

- Loans or lines of credit: Timely repayment of these debts builds trust and creditworthiness in your financial ecosystem.

- Interest payments: These are the hidden costs of borrowed capital. Always factor them into the expense forecast to prevent surprises.

- Principal repayments: The core amount borrowed that needs to be paid back, separate from the interest. Regularly paying down the principal reduces the overall debt burden.

- Late fees and penalties: Additional costs that arise from delayed payments. Avoiding these can save a significant amount of money over time.

- Refinancing costs: Expenses associated with renegotiating the terms of a loan to possibly obtain a better interest rate or loan term.

6. Income

While taking the largest portion in your business planner, expenses can’t occur without the revenue pouring into your company. By including all potential revenue streams, you ensure that your budget planner reflects an accurate financial landscape. Here’s a breakdown of various types of income you might consider:

- Sales revenue: This is the primary source of income for most businesses. It’s derived from selling goods or providing services. Depending on the nature of your business, this could further break down into product sales and/or service fees.

- Recurring revenue: Income derived from ongoing customer payments. This can include:

- Subscription fees (for businesses offering subscription-based services/products);

- Maintenance or support contracts;

- Lease or rental income.

- Interest income: This is earned from business savings, checking accounts, or other investments.

- Asset sale: Money earned from selling business assets that are no longer needed, such as machinery, property, or vehicles.

- Affiliate marketing revenue: Income earned by promoting other people’s or companies’ products/services and earning a commission for every sale made through your referral.

- Grants or sponsorships: Some businesses, especially those in research or those that serve the community, might receive grants or sponsorships.

- Other times of income: These include any other types of income a business receives like dividends, royalties, commissions, and more.

Of course, this long list of costs and revenues isn’t exhaustive. Bearing in mind different industries and business models, it’s impossible to account for every element of every possible business. That’s why it’s best to adapt such a budget to your company’s needs.

Free monthly budget worksheet: Ready to download template

Choosing the right budget planner for your business requires you to include all types of revenue and expenses. While sales revenue might be a number that is easy to get from your bookkeeping records, factoring in each and every piece of your financial puzzle might be much harder, especially the first time round.

That’s why, we’ve created a template for you that includes the above revenue streams and expenses (all broken down into various types) to help you pick something specific to your needs and fill it out based on your numbers.

If you feel that you need more help with budgeting, you can always seek advice from a trusted bookkeeping and accounting professional.

Calculator, Excel, or budgeting software?

Gone are the days of manual spreadsheets and hefty ledger books. Just as online banking has largely replaced checkbooks, it’s time for advanced budgeting software to replace outdated spreadsheet methods (pen and calculator included).

While the template can be a great starting point to create your journey with budgeting, don’t be tempted to calculate the numbers by hand. It’s best to use robust and secure digital tools to help with meticulous budgeting and calculations.

By adopting automation, you’ll not only reduce human error but also save valuable time, and gain real-time financial insights. Comparing numbers of different months also becomes easy when you have everything at hand. What’s more, looking at the actual records and your last month’s budget can help you adjust your budget or forecast for the next month. But trying to achieve all that by budgeting manually is extremely time-consuming and inefficient, to say the least.

Budget templates: Closing thoughts

Gone are the days when budgeting was just a way to weather financial storms. Today, it’s a full toolbox that underpins the functioning of your entire business.

The thought of setting one up can seem like a tall order but with the help of budget templates you are off to a good start. They’re easy to use, adaptable, and perfect for businesses, big and small. And when paired with the latest tech, they turn numbers into stories and strategies.

So, as you dive into your daily business operations, remember to keep your budget close. Let monthly templates and planners be your trusty sidekicks, guiding you toward innovation and steady growth. Embrace them, not as a task, but as your secret weapon in this digital age. Keep evolving and pushing forward, and your budget will do the same, leading you in the right direction.

%20(1).png)