Ever feel like reconciliation discrepancies are a constant headache? You’re not alone. When these mismatches rear their heads during the account reconciliation process, they can cause significant issues. But don’t give up just yet!

Be it QuickBooks Online or QuickBooks Desktop that you rely on, getting a handle on these discrepancies is a must for keeping your financial records spotless. So, let’s dive into the peculiarities of sorting these discrepancies out and keeping your accounting records in perfect shape.

Key takeaways:

- A journal entry is a record of a financial transaction in your accounting books that shows the date, the accounts affected, and the amounts to be debited and credited.

- Reconciliation discrepancies pop up when your general ledger balance doesn’t match your bank statements or credit card statements.

- A reconciliation discrepancy report pinpoints where things went off-track and ensures your account balance aligns with your bank account.

Contents:

1. What are reconciliation discrepancies?

2. How reconciliation discrepancies affect financial statements

3. Common sources of reconciliation discrepancies

4. How to keep reconciliation discrepancies in check with QuickBooks

What are reconciliation discrepancies?

Reconciliation discrepancies crop up when the balances in your accounting records don’t match the balances on your bank statements or credit card statements. These discrepancies can pop up from bank errors, missing checks, or even human slip-ups in your accounting software, be that QuickBooks Online or QuickBooks Desktop. When you notice such QuickBooks reconciliation discrepancies, the goal is to make your bank reconciliation statement match your general ledger balance.

How reconciliation discrepancies affect financial statements

Reconciliation discrepancies, or unbalanced reconciliation, can seriously impact your financial statements. That’s why keeping them straight is a big deal. If your income statement is off, you might think you’re doing well financially when you’re actually not. An inaccurate cash flow statement can also lead to unpleasant surprises when paying bills. Messy financial records can result in tax discrepancies and trouble with the tax authorities. To avoid these issues, ensure your financial statements are clear and precise.

How to keep your financial records on the up & up

Keeping accurate financial records means performing regular bank reconciliations and addressing reconciliation discrepancies as they arise. This helps maintain the integrity of your internal controls and overall financial health.

To stay on top of things:

- Perform reconciliations regularly, ideally at the end of each accounting period.

- Regularly review reconciliation statements and reports.

- Ensure all transactions are recorded accurately in your accounting software.

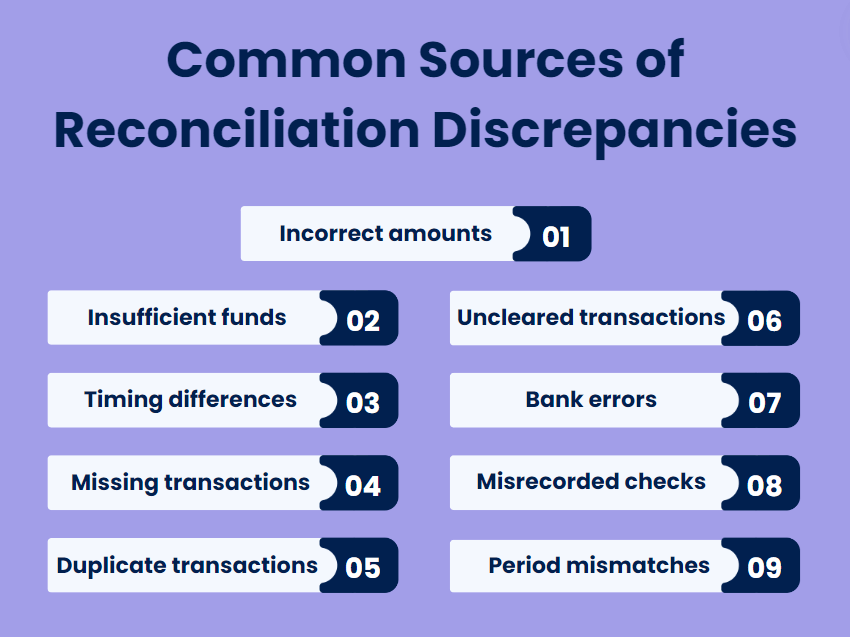

Common sources of reconciliation discrepancies

When trying to keep accurate financial records, businesses often run into issues with their reconciliation process. Let’s dive into some common sources of reconciliation discrepancies that can throw your account reconciliation off.

#1. Entering the wrong amount or missing a transaction can mess up your accounts receivable and account balances.

#2. If you’ve recorded a transaction but had insufficient funds when it was processed, the bank might reject it. In this case it won’t clear, which will lead to discrepancies.

#3. Transactions might be recorded in your books but not yet appear in the bank statement due to timing. For example, a deposit might show up in your checking account later than recorded in your books, causing a mismatch.

#4. Bank fees or charges not recorded in your accounting software won’t match up and create discrepancies. Keep an eye on credit card statements as well watch out for any unnoticed bank charges.

#5. Entering transactions more than once can mess up your general ledger.

#6. If you have transactions that haven’t cleared yet, they can create a temporary discrepancy. Check your bank reconciliation statement to match them up.

#7. The bank might make a mistake, like double-charging a bank fee or incorrectly posting a transaction. These bank errors can lead to differences between your internal financial records and your bank statement.

#8. If checks aren’t recorded properly, you’ll find reconciliation discrepancies. Always check your missing checks report to ensure all checks are accounted for.

#9. Recording transactions in the wrong accounting period can create hard-to-find discrepancies.

What does the reconciliation discrepancy report show?

Generating a reconciliation discrepancy report helps pinpoint where the discrepancies are coming from and spot errors in your account reconciliation process. It helps ensure that your balance sheet accounts and general ledger balance are on the money. An accounting software like QuickBooks offers features that allow you to whip up detailed reports, such as the transaction detail report, which can aid in tracking down these discrepancies.

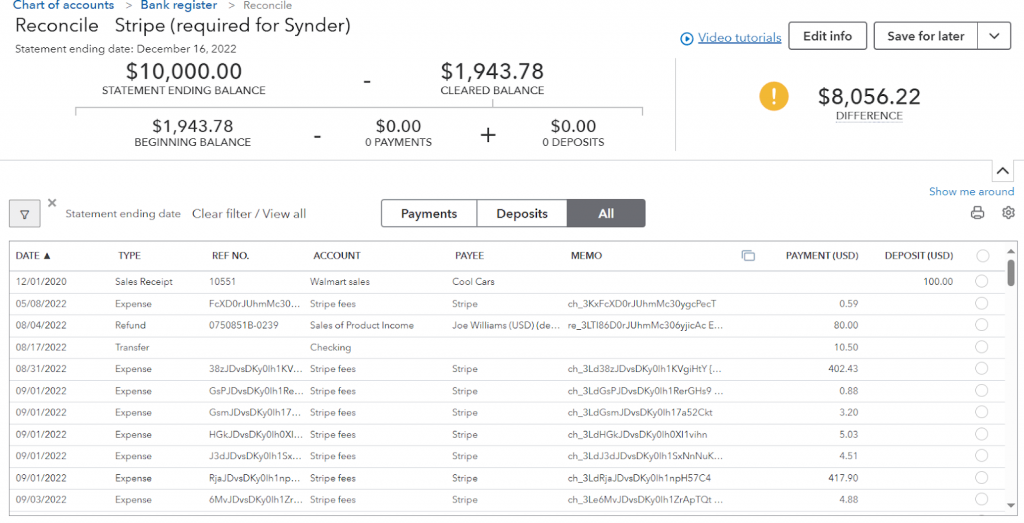

How to keep reconciliation discrepancies in check with QuickBooks

Reconciliation discrepancies can be a real headache, but the best way to avoid them is to keep everything in order. An accounting automation tool like Synder Sync can significantly improve this process.

First, make sure you have enough data. Synder integrates seamlessly with QuickBooks and tracks every penny coming in and going out. It’s pulling sales, fees, expenses, and refunds from the platforms connected directly into QuickBooks. Moreover, it also categorizes your data into the right income and expense accounts.

Secondly, with all the data at your fingertips, there are a few important things you need to do:

- Generate a bank reconciliation statement and a reconciliation discrepancy report.

- Compare internal financial records with bank statements and credit card statements to spot any mismatched transactions.

- Use the transaction detail report in QuickBooks to spot where discrepancies crop up.

- Look at your checking account, accounts receivable, and other relevant accounts.

It’s too complicated, isn’t it?

However, if you have QuickBooks Online or QuickBooks Desktop integrated with Synder Sync, you’ll have the automatic transaction matching, reconciling your bank account and credit card statements. This automation app logs your transaction data into a clearing account and then moves the right amounts to your checking account. When your bank statement comes in, it suggests matches. If something doesn’t match up, Synder will flag it, so you can take a closer look.

And one more trick – QuickBooks provides a reconciliation discrepancy report. It shows you what’s cleared and what’s still there, catching discrepancies early before they cause any major headaches.

You might need to make tweaks to balance everything and ensure accurate financial records. This can be done through reconciliation adjustments. We’ll explore how to create adjusting journal entries in QuickBooks to iron out discrepancies on a deeper level in the next section.

How to make reconciliation adjustments

To fix reconciliation discrepancies in the reconciliation process, we need to use journal entries. They record financial transactions in your accounting books, showing the date, the accounts affected, and the amounts to be debited and credited.

So, what are the steps of adjusting reconciliation?

Step 1. Find out if the discrepancy is due to a bank error, missing check, or incorrect fee.

Step 2. If your bank statement shows a charge not recorded in QuickBooks, you’ll need to make a journal entry to adjust your accounts receivable and bank account balances. For example, if you missed a $50 bank fee, you’ll need to debit the bank fee expense account and credit your checking account. This will help align your ledger balance with your adjusted bank balance.

Here’s how you would record the journal entry:

| Date | Account | Debit | Credit |

| [Date] | Bank Fee Expense | $50 | |

| [Date] | Checking Account | $50 |

Step 3. Update your general ledger and QuickBooks account to reflect this adjustment.

Step 4. Once you’ve made the journal entry, run another bank reconciliation report to ensure that the discrepancy has been resolved.

That’s it!

Wrapping up

Reconciliation discrepancies can be a real pain if left unattended. To keep your finances on point, generate discrepancy reports, make the right journal entries, and use tools like QuickBooks and Synder. Automation sync apps can help you stay on top of things. They cut down on the manual work and help you avoid mistakes, making the whole reconciliation process of your books a total breeze. That way, your financial records will stay spot on.

Share your thoughts

Got tips on QuickBooks reconciliation discrepancies? Share your tricks for fixing bank reconciliation statements and creating journal entries. Tell us how you handle bank errors and keep your financial records sharp!

Thanks for your help and support

You’re welcome, Joseph!