One common task within QuickBooks Desktop is the issuance and recording of checks, a fundamental component of maintaining accurate financial records. However, situations may arise where a check needs to be voided due to errors or unforeseen circumstances.

In this article, we’ll explore the process of voiding a check in QuickBooks Desktop, why it might be necessary, and the implications of such actions on financial reports.

Key takeaways

- Voiding a check in QuickBooks Desktop is essential for correcting errors and maintaining accurate financial records without erasing the transaction.

- Before voiding a check, it is crucial to verify details and consider the impact on financial statements to ensure alignment with accounting practices.

- Voided checks are irreversible in QuickBooks Desktop and will appear as zero-amount transactions in financial reports, preserving a transparent correction history.

Level up your QuickBooks accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What is QuickBooks Desktop (QBD) and how does it handle financial transactions?

QuickBooks Desktop stands as a stalwart in the realm of accounting software, serving as a vital tool for businesses to manage their financial transactions. Essentially, it functions as a centralized hub, allowing users to record and monitor various financial activities. In the context of checks, QuickBooks Desktop facilitates the issuance and recording of payments, providing a user-friendly interface for efficient financial management.

The software excels in simplifying the complexities of financial transactions. Its intuitive design ensures that users can seamlessly record checks, capturing crucial details such as payment amounts, recipients, and the purpose of the payment. QuickBooks Desktop emerges as an invaluable asset, offering businesses of all sizes a reliable means to organize and track their financial data.

What are checks in QuickBooks Desktop (QBD) and how are they utilized in financial transactions?

Checks in QuickBooks Desktop play a pivotal role in the financial landscape, representing digital records of payments made by a company.

These checks serve as tangible proof of outgoing funds, contributing to the systematic organization of financial records. When a company issues a check through QBD, it encapsulates essential transaction information, including the amount paid, the recipient, and the purpose of the payment.

The significance of checks in QBD lies in their ability to act as a dynamic tool for financial management. Not only do checks facilitate the smooth execution of payments, but they also provide businesses with a structured approach to tracking and analyzing their expenditures. Through the utilization of checks, companies can not only streamline their payment processes but also gain valuable insights for informed decision-making.

Why would someone need to void a check in QuickBooks Desktop (QBD)?

Voiding a check in QuickBooks Desktop becomes imperative in instances where errors or unforeseen circumstances compromise the accuracy of payment information. For example, an issued check may contain an incorrect payment amount, an erroneous payee, or, in cases where the check was not received by the vendor, necessitating reissuance. Voiding rectifies these issues without entirely erasing the transaction from the records.

Voiding a check in QBD ensures that the erroneous transaction is corrected transparently, maintaining an accurate financial history. It allows businesses to address mistakes with precision, offering a mechanism to set the record straight without compromising the integrity of their financial data.

How can one void a check in QuickBooks Desktop (QBD)?

Voiding a check in QuickBooks Desktop is a straightforward process designed to rectify errors without entirely removing the transaction from the records.

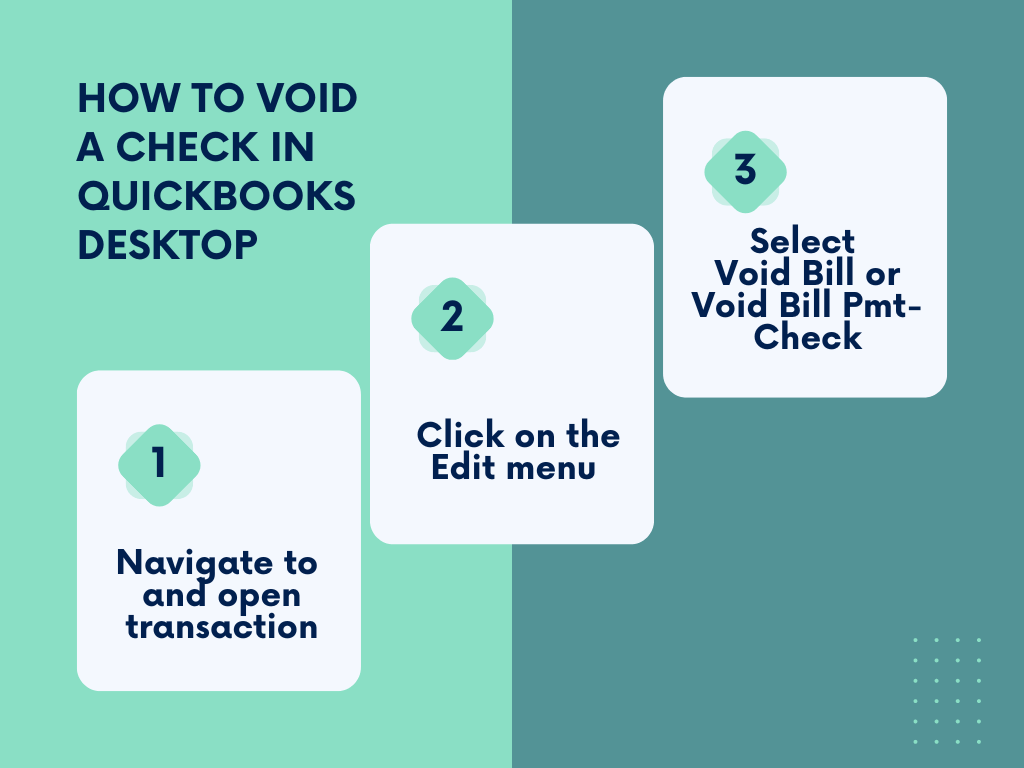

To initiate the voiding process:

- Step #1 – Navigate to the specific transaction within QuickBooks Desktop that requires voiding and open it.

- Step #2 – Once in the transaction, locate and click on the Edit menu at the top of the interface.

- Step #3 – Select Void Bill or Void Bill Pmt-Check from the Edit menu, choose the option that corresponds to your transaction type.

Upon following these steps, you’ll se that the check’s amount is adjusted to zero. This way, you’ll correct the error while maintaining a transparent record of the voided transaction.

Please bear in mind that the process is described as of today. Provided the software gets updated, the steps might change. So, you might want to consult with updated QBD guides to fulfill this action in the future.

What precautions should be taken before voiding a check in QuickBooks Desktop (QBD)?

Before voiding a check in QuickBooks Desktop, it’s paramount to exercise caution and conduct a meticulous review. Key precautions include:

- Double-check accuracy

Verify the accuracy of check details such as payment amount and payee information before proceeding with the voiding process. - Consider broader implications

Reflect on the broader impact of voiding the check, particularly concerning financial statements and reports.

By taking these precautions, users minimize the risk of errors and ensure that the voiding process aligns seamlessly with established accounting practices. Attention to detail in this regard is crucial for maintaining the accuracy and integrity of financial records within QuickBooks Desktop.

Can voided checks be retrieved or reversed in QuickBooks Desktop (QBD)?

Once a check is voided in QuickBooks Desktop, the action is typically irreversible. The voiding process is designed to transparently correct errors while retaining a record of the voided transaction. Unfortunately, built-in mechanisms for reversing the voiding or retrieving the original check are generally not available.

To mitigate the risk of irreversible errors, users should exercise caution, thoroughly reviewing information before initiating the voiding process. In cases of uncertainty, consulting accounting professionals can provide valuable insights and guidance.

How does voiding a check affect financial reports in QuickBooks Desktop (QBD)?

Voiding a check in QuickBooks Desktop has specific implications on financial reports generated by the software. When a check is voided, the amount of the transaction is adjusted to zero, effectively correcting the error while maintaining a comprehensive historical view.

In financial reports, voided checks may appear as transactions with zero amounts, ensuring that corrections are transparently reflected. This transparency is vital for accurate financial reporting, providing a clear trail of corrections without compromising the overall integrity of the financial data.

Related:

Convert QuickBooks Desktop to Online

How to accept credit card payments in QuickBooks

Final word

To wrap it up, voiding a check in QuickBooks Desktop is a fundamental process for correcting errors and maintaining accurate financial records. By comprehending the reasons for voiding, following the correct procedural steps, and being mindful of the potential implications, users can navigate the voiding process confidently, contributing to the overall accuracy and transparency of their financial management in QuickBooks Desktop.

Continue reading: What’s internal rate of return?