Running a business means wearing a dozen hats, some more comfortable than others. If you’re using Stripe to collect payments and QuickBooks Online to keep your books in order, you’ve probably noticed that the numbers don’t always add up neatly. Payments come in, deposits show up days later, fees chip away at your totals, and refunds sneak in when you’re not looking. It’s like trying to piece together a puzzle where half the pieces are upside down.

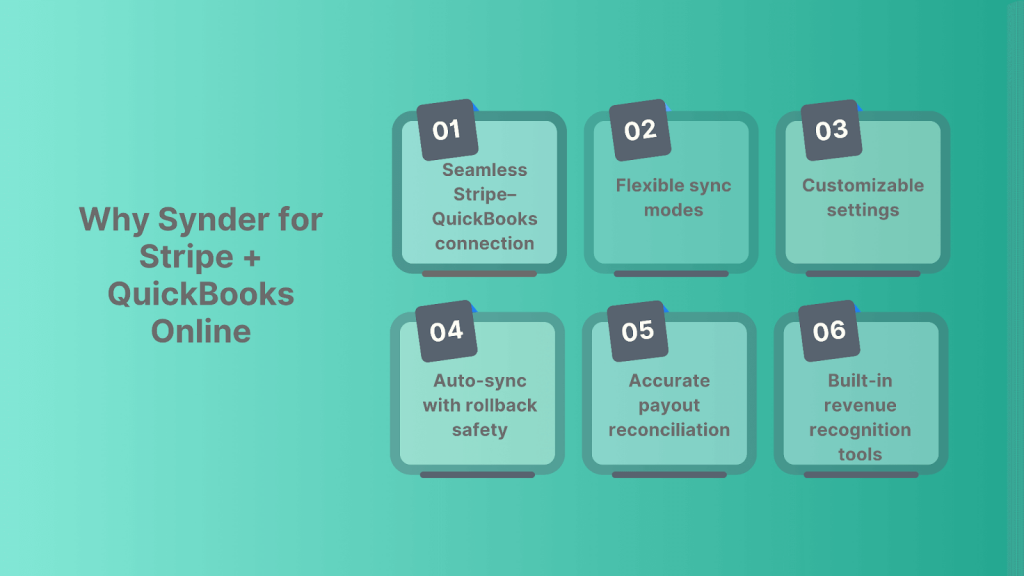

The good news is that you can sync Stripe payments, fees, and refunds into QuickBooks Online automatically, without spreadsheets or late nights. All it takes is the right integration tool. Let’s walk through how to do it using Synder, a solution built specifically for this kind of bookkeeping.

A guide to syncing Stripe transactions with QuickBooks Online

Step 1: Connect your accounts to Synder

Think of Synder as a translator between Stripe and QuickBooks—it speaks both languages fluently. To get started, sign up for Synder and connect your Stripe and QuickBooks Online accounts. It’s a few clicks, and the platform walks you through it like a GPS.

Example: If you run an ecommerce business and make sales through Stripe, Synder will automatically pull in those transactions and categorize them correctly as product income in QuickBooks.

Step 2: Choose your sync mode

Synder gives you two syncing options:

- Per Transaction – records each sale, fee, and refund individually for detailed tracking.

- Summary Sync – combines all daily activity into one clean entry.

Tip: If you’re running a low-volume Shopify store, use Per Transaction Sync for detailed tracking. And in case of managing a high-volume business, switch to Summary Sync to keep your books clean and manageable.

Step 3: Tweak the settings to match how you work

In Synder, you can set rules for:

- Where to post income

- How to record Stripe fees as expenses

- How to handle taxes

- What to do with refunds

This is your chance to match the sync logic with how you think about your business. You don’t have to fit into a rigid system, Synder adapts to yours.

Example: Let’s say you charge $100 for a workshop, Stripe takes $3.20 in fees, and a customer asks for a refund two weeks later. Synder will show the $100 income, the $3.20 fee, and the $100 refund, so QuickBooks always shows the full story.

Step 4: Test before you commit

Before flipping the “Auto-sync” switch, run a few manual syncs. Think of this like taste-testing soup before serving it. If something’s off, such as a refund shows up in the wrong place or fees aren’t categorized properly, you can adjust your settings and roll back the changes.

Bonus: Synder’s rollback button is your “undo” safety net. It makes testing stress-free.

Step 5: Turn on auto-sync and let it run

Once things look good, enable auto-sync. From that point on, your Stripe payments, fees, and refunds will flow into QuickBooks like clockwork.

You’ll open QuickBooks and see deposits that match your bank, refunds that cancel out the right sale, and fees that show up where they belong.

Tip: Consider it an always-on bookkeeper who never misses a receipt, never delays, and never takes a break.

Step 6: Reconcile Stripe payouts automatically

Stripe batches payouts, often mixing multiple charges and refunds into a single deposit. Synder mirrors this exactly in QuickBooks, using a clearing account to bridge the two.

Example: If you sold $500 today but only see $482.50 in your bank account, Synder makes sure the $17.50 in fees is logged and explained, so your books aren’t full of mysteries.

Bonus: Track subscriptions & automate revenue recognition

If your business runs on recurring payments, like monthly memberships or annual software plans, Synder offers built-in tools to handle the tricky part: when to recognize the revenue.

Smart revenue recognition (RevRec)

Let’s say you collect $1,200 today for a 12-month plan. That money hits your bank now, but you haven’t earned it all yet. With Synder’s revenue recognition feature, the system automatically spreads that income across the service period in QuickBooks: $100 per month, fully compliant with ASC 606. As a result, your profit and loss report finally reflects what you’re actually earning, not just what came in.

Separate subscription and one-time charges

Need to track different income streams? Synder lets you tag or categorize transactions. So if you’re offering both a recurring subscription and one-off consultations, they’ll land in separate buckets in QuickBooks Online, making performance easier to track.

Example: A design studio sells $500/month retainers and $200 one-time design templates. Synder keeps those streams separate for accurate reporting.

Why it matters

Clean revenue data is essential for growth planning, tax prep, and investor reporting, especially if you’re building a SaaS business or preparing for funding.

Start your 15-day free trial and join our 1-1 demo to see how Synder fits your business in real time.

FAQ

Why don’t my Stripe deposits match what shows in QuickBooks Online?

Because Stripe deducts fees and batches deposits. Synder uses a clearing account to track gross payments, fees, and refunds, so what lands in your bank always matches your books.

How can I have Stripe processing fees recorded automatically as expenses in QuickBooks Online?

Synder automatically records Stripe’s fees as business expenses and posts them to your chosen account, helping you track profitability accurately.

What’s the best way to log Stripe refunds so they offset the original sale in QuickBooks Online?

Synder links refunds directly to their original transactions, reversing income properly and adjusting your books automatically.

Can I separate subscription-based and one-time charges when syncing Stripe into QBO?

Yes. You can apply tags or create custom mappings in Synder to distinguish between subscription and non-subscription income.

How do I avoid duplicate charges or fees when I use Synder to push Stripe data into QuickBooks?

Synder has built-in duplicate detection and rollback options. It flags previously synced transactions so nothing gets entered twice.