Reconciling Square transactions in NetSuite, including sales, tips, fees, taxes, refunds, and bank settlement payouts, can be complex if done manually. The most effective way to reconcile Square payments in NetSuite is through an integration solution such as Synder, which automates the import, mapping, and matching process so your accounting stays accurate and up to date.

Common challenges in reconciling Square and NetSuite

Many merchants experience recurring issues when trying to reconcile Square with NetSuite:

- Square payouts consolidate many individual transactions into one deposit, making matching in NetSuite tricky.

- Square fees (transaction, processing, application fees) often don’t have matching entries or are mis‐posted.

- Tips and sales taxes are sometimes included in gross sales, but need separate handling in NetSuite.

- Refunds and chargebacks may lag or be missing entirely, causing revenue overstated.

- Manual journal entries become the fallback, increasing risk of errors and time spent.

Using an automated integration helps resolve all these because it ensures every component (sales, fees, tips, etc.) is synchronized and properly mapped.

Simplifying Square–NetSuite reconciliation using Synder

Below is a process showing how to set up, sync, and simplify the reconciliation process of Square transactions with Synder.

1. Set up NetSuite and Square integration in Synder

When you create your Synder account, link your Square account and connect NetSuite as your accounting software.

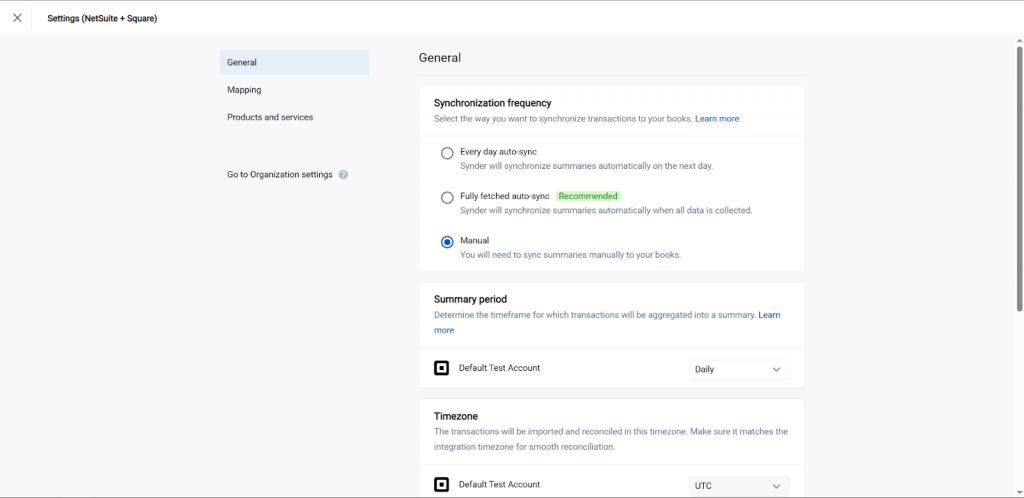

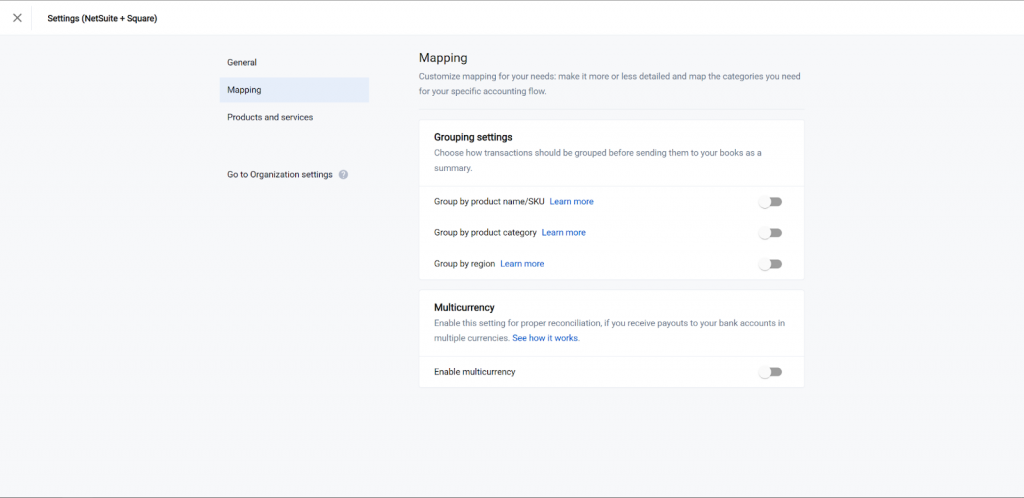

2. Configure Synder mapping and settings

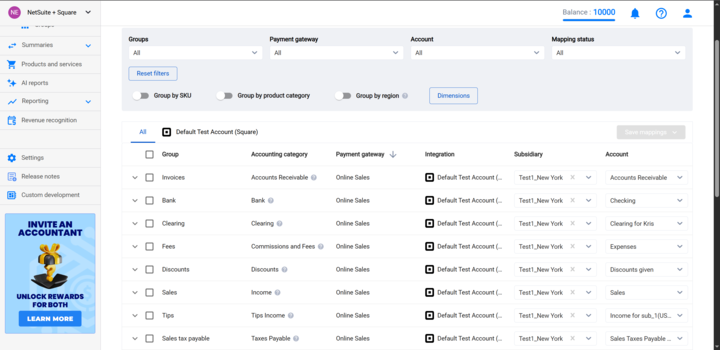

In Synder, go to Settings → Integrations → NetSuite and assign which NetSuite accounts each type of Square transaction maps to:

Refunds / chargebacks mapped so they reduce revenue

Choose the NetSuite bank (or cash) account where Square deposits should land, so Synder can route payouts correctly. Then enable automatic sync for new transactions, or keep manual sync if preferred.

- Sales Income account

- Fee Expenses account

- Tips account (could be liability or income depending on your setup)

- Taxes account (liability or payable)

3. Sync transactions

Once your settings are in place, Synder will automatically sync all new Square transactions, including product and customer details, Square fees, tips, taxes, refunds, and chargebacks. If you also need past transactions for accurate balances, you can import historical data. On lower-tier plans, this option is available as a paid add-on.

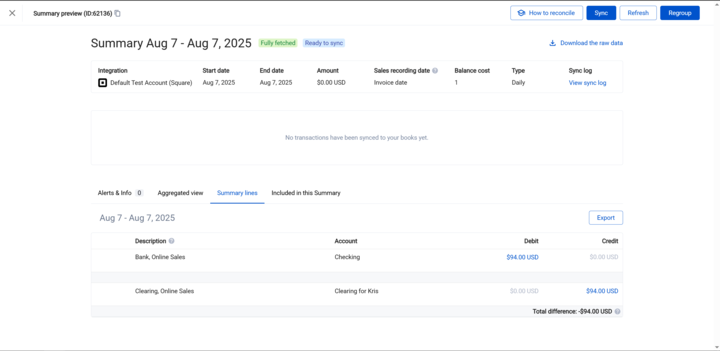

4. Match Square payouts to NetSuite Bank/settlement deposits

Square deposits payouts, not individual sales. These payouts are aggregated amounts that already include fees and refunds. To keep your books aligned, Synder groups transactions to match each payout exactly and posts them to the NetSuite bank or deposit account you’ve chosen. When the deposit appears in NetSuite, Synder’s entries line up automatically, making reconciliation straightforward and hassle-free.

5. Review, reconcile, and adjust as needed in NetSuite

To begin, head over to the bank reconciliation module in NetSuite. You’ll see the Square payout entries already posted by Synder. As you review them, confirm that sales, fees, taxes, tips, and refunds are allocated to the correct accounts.

If something doesn’t match, for example, a deposit off by a few cents due to rounding or timing, Synder lets you roll back or correct entries quickly. And for anything beyond that, you can add minimal journal entries to keep everything balanced.

Benefits of using Synder for Square NetSuite reconciliation

Using Synder to connect Square with NetSuite takes a lot of the manual work out of reconciliation and reporting. Here’s what you actually get from it:

- Reconciliation-ready payouts: Square payouts are automatically matched with your bank deposits in NetSuite, so you don’t have to go line by line to check if they add up.

- Full transaction visibility: Every sale, fee, tip, tax, and refund is recorded, which means you can see the complete flow of money without gaps.

- No manual journal entries: With data coming in automatically, you spend less time entering numbers yourself and reduce the risk of mistakes when closing the books.

- Historical data import: You can pull in past Square transactions, not just the ones after setup, so your records in NetSuite stay consistent.

- Accurate reporting and audit trails: Taxes, tips, and liabilities are tracked properly, which makes financial reports cleaner and easier to review.

FAQ

Can I import historical Square payouts into NetSuite?

Yes. Synder supports importing past Square transactions and payouts so your NetSuite records can be backfilled. You can go as far back as Square allows. This option is free on the Premium plan, includes 3 months of history at no cost on the Pro plan, and is available as a paid add-on for Essential and Basic plans.

How does Synder map Square fees, taxes, and tips in NetSuite?

You configure mapping per type: fees go to expense accounts, taxes to payable or liability accounts, tips may be mapped to either income or liability depending on your business practices. Synder gives you control.

Will Square refunds and chargebacks sync automatically to NetSuite?

Yes. Refunds and chargebacks are brought in just like sales, with negative amounts or adjustments, so your income reflects net activity.

What if a Square deposit doesn’t match my NetSuite bank entry?

Often this happens because of timing delays or rounding. Synder helps by grouping transactions as Square does, and by letting you verify the deposit amounts. If mismatches remain, adjustments or journal entries may be needed (or rollback/resync features used).

How is inventory COGS handled when Square POS is used with NetSuite?

If you’re using Square POS and tracking inventory, Synder can bring through item-level details. Then those map into NetSuite’s inventory and cost of goods sold (COGS) accounts, so you can see what inventory was sold and the corresponding inventory decrease and COGS entries.