Accounting automation has become more than a buzzword for quite a long time already. Today, it symbolizes the convergence of traditional accounting practices with cutting-edge technologies, transforming the role of modern accountants and streamlining finance management for businesses of all sizes.

Let’s delve into the world of accounting automation, exploring its multifaceted benefits for businesses and accounting professionals.

The evolution of accounting automation

The evolution of accounting automation has marked a pivotal turning point in the financial world.

Accounting, often regarded as the backbone of any business, has undergone a remarkable transformation over the years. Accounting automation, as a term, refers to integrating technological advancements into the traditional accounting processes to streamline operations, enhance accuracy, and elevate the role of accountants.

The origins of accounting automation can be traced back to the late 20th century when businesses began adopting computers to handle financial calculations and record-keeping. It marked the initial steps towards automating repetitive tasks, liberating accountants from the confines of manual ledger entries and calculations. With time, the evolution of technology gave birth to more sophisticated accounting software and systems, propelling accounting automation into a new era.

Fears and concerns about automation in accounting

Throughout its evolution, accounting automation has been met with a mix of anticipation and apprehension. When the term first emerged, fears loomed over the potential displacement of human accountants. The prevailing concern was that automation would render the expertise of seasoned professionals obsolete, leading to job losses within the accounting industry.

Furthermore, data security and accuracy concerns came to the surface. Skeptics wondered whether automated systems could uphold the same level of accuracy as their human counterparts and whether they would be susceptible to cyber threats. These concerns were not unfounded, as businesses hesitated to embrace automation without assurance of its reliability.

Today, the situation is different, as with the evolution of the technology behind accounting software, more businesses and financial specialists have become appreciative of the way it facilitates the management of business finances and transforms the accounting practice.

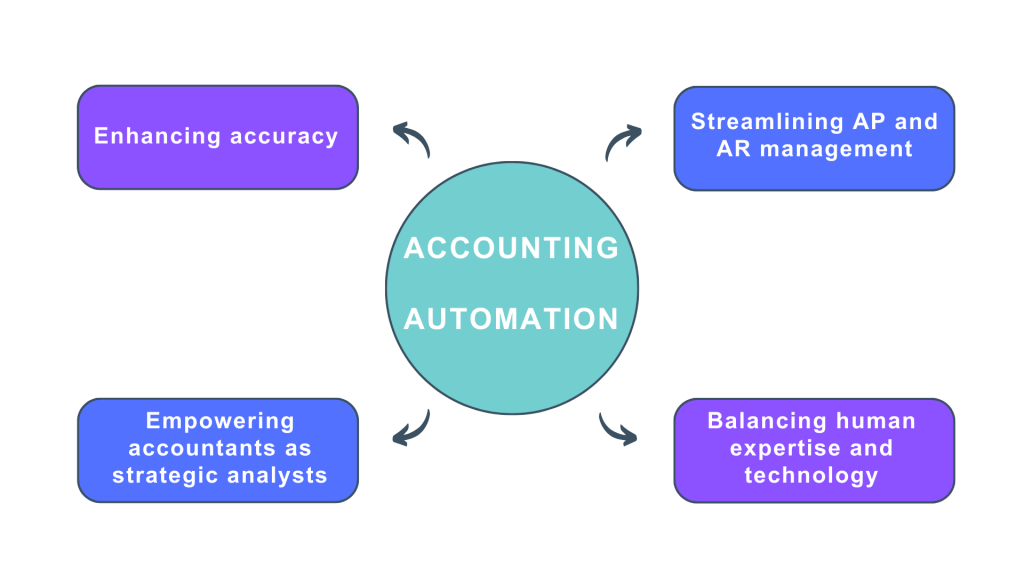

How automating accounting transforms traditional accounting and the role of accountants

As previously mentioned, accounting automation has ushered in a comprehensive overhaul of conventional accounting practices. The days of laborious manual data entry, a process fraught with the risk of errors, are now fading into history.

Enhancing accuracy

Automation has emerged as a potent tool for enhancing the accuracy and efficiency of accounting processes. By digitizing financial data and automating calculations, it drastically minimizes the potential for human error, which translates into more reliable financial records, enabling businesses to make informed decisions based on precise information.

Moreover, the integration of automation streamlines data flow and diminishes the risk of duplicated or inconsistent entries that can arise from manual processes.

Streamlining AP and AR management

The integration of automation in accounting brings about a seismic shift in the speed and efficiency of financial operations, particularly in the context of Accounts Payable (AP) and Accounts Receivable (AR). Automation expedites tasks such as invoice processing and payment schedules, revolutionizing the management of AP and AR processes. This acceleration translates into streamlined cash flow management, reduced payment delays, and improved relationships with suppliers and clients.

If you want to learn more about AP and AR, you might want to consider reading the articles:

- Accounts Payable Process: The Ultimate Guide to AP

- What Is Accounts Receivable: Understanding Your AR Accounts

Empowering accountants as strategic analysts

Beyond accuracy and efficiency, the transformative power of automation lies in its ability to redefine the role of accountants. Contrary to concerns about automation making accountants obsolete, it is, in fact, shaping them into strategic analysts and advisors. Automation liberates accountants from the constraints of routine tasks such as data entry and reconciliation. This newfound freedom allows them to channel their efforts toward higher-order activities that require critical thinking and interpretation.

Accountants are no longer confined to the mere record-keepers’ role. They have evolved into interpreters of financial data. With automated systems handling repetitive processes, accountants can dive into the intricacies of financial analysis. Armed with real-time and accurate insights, they play a pivotal role in guiding business decisions, identifying trends, and offering actionable recommendations for growth.

Balancing human expertise and technological innovation

The transformation catalyzed by automation underscores a vital synergy between human expertise and technological innovation. While automation assumes the role of repetitive task handling and data processing, human accountants provide the critical thinking and contextual understanding that machines lack. This balance is pivotal for accurate interpretation, strategic decision-making, and maintaining ethical and regulatory compliance.

What are the benefits of accounting automation for businesses?

While transforming traditional accounting practice and shifting the focus to accountants, accounting automation provides multiple benefits for businesses. Enhancing data accuracy and cutting time on manual work is the most obvious. However, automated accounting for business goes beyond those, as it allows for the consolidation of business data sources into a single, accurate, and comprehensive ecosystem. Let’s explore how automating accounting can benefit businesses.

- Unified business data ecosystem

Modern business generates volumes of data from multiple sources: sales, marketing, operations, customer service, using customer satisfaction survey and more. Ensuring that this data is accurate, synchronized, and accessible is a challenge many businesses face. Enter accounting automation as the cornerstone of an integrated data ecosystem. By automating accounting processes, businesses can seamlessly channel data from various departments into a single repository – the accounting system.

- Holistic financial insights

Automated accounting doesn’t merely crunch numbers; it paints a holistic picture of the business’s financial health by incorporating data from various dimensions. Sales figures, customer information, product data, and operational costs converge within the accounting system. This convergence provides decision-makers with comprehensive insights that transcend siloed views, enabling them to make informed strategic choices that consider the entirety of the business’s operations.

- Data accuracy and consistency

Integrating diverse data sources manually can result in errors, discrepancies, and inconsistencies. Accounting automation minimizes these risks by ensuring all data entering the accounting system adheres to predefined rules and validations. Automated data entry reduces human errors, so the financial ecosystem remains accurate, consistent, and aligned with the operational reality. In turn, it mitigates decision-making based on flawed or mismatched data.

- Data monitoring and trend analysis

Today’s automated accounting solutions often allow for gathering various business data streams that flow into the accounting system into a real-time dashboard that provides a dynamic snapshot of the business’s performance, allowing for immediate identification of trends and anomalies. Such real-time monitoring empowers businesses to respond proactively to shifts in customer preferences, market dynamics, or operational challenges, fostering agility in decision-making.

If you want to learn more about data dashboards and how they can help assess business performance, you might want to read the following article:

- Customer-centric insights

Automated accounting systems can be integrated with customer relationship management (CRM) and sales systems. This integration enriches financial data with customer-centric insights, such as buying patterns, preferences, and demographics. With this merged data, businesses gain a 360-degree view of their customers, enabling targeted marketing efforts, personalized services, and the ability to tailor financial strategies to customer behavior.

- Strategic forecasting and planning

Turning accounting into a single source of truth allows for advanced forecasting and scenario planning. By leveraging historical financial data, operational metrics, and market trends, businesses can create sophisticated models for projecting future outcomes. These predictive capabilities enable proactive resource allocation, risk assessment, and scenario planning, enhancing strategic decision-making in a rapidly changing business landscape.

- Efficient auditing and compliance

Having all relevant business data converging in the accounting system makes audits and compliance checks more efficient. External auditors and regulatory bodies can access a centralized repository of accurate information, expediting the auditing process. Compliance requirements can be automatically cross-referenced against various data sources within the ecosystem, ensuring adherence to regulations without the hassle of manual cross-checks.

- Time efficiency and resource allocation

Manual accounting tasks are time-consuming and resource-intensive. Automation allows redirecting the hours previously spent on data entry, reconciliations, and report generation to more strategic endeavors that drive growth. Accounting automation liberates financial professionals from repetitive tasks, enabling them to channel their efforts toward analyzing trends, identifying opportunities, and devising strategies to propel the business forward. It enhances productivity and fosters a more fulfilling work environment by allowing employees to engage in higher-value activities.

- Informed decision-making

Automation empowers businesses with real-time financial data and insights. Traditional manual accounting processes may take days or even weeks to generate comprehensive reports, making it challenging to respond swiftly to market shifts or emerging trends. With automation, financial information is updated in real time, providing decision-makers with the tools they need to make informed choices that can steer the company in the right direction.

- Improved collaboration and accessibility

Modern businesses often operate across multiple locations or involve remote teams. Traditional accounting processes, rooted in physical documents and on-premises systems, can hinder collaboration and accessibility. Automation, hosted in the cloud, enables real-time collaboration among team members regardless of their geographical location. This accessibility ensures that decision-makers have consistent access to financial data, fostering transparency and enabling more inclusive financial discussions.

- Scalability and adaptability

As businesses grow and evolve, their financial processes must adapt to the changing demands. Manual systems often struggle to keep pace with expansion, leading to inefficiencies and bottlenecks. Accounting automation offers scalability by seamlessly accommodating increased transaction volumes and expanding business operations. Whether a business experiences organic growth, mergers, or diversification, automated systems can readily adapt without sacrificing accuracy or efficiency.

Understanding automated accounting systems

To better understand the benefits of accounting automation, you might fancy a deeper look at the components of automated accounting systems. These systems encompass a range of software solutions designed to streamline financial processes, enhance accuracy, and expedite decision-making. From automated data entry and reconciliation to real-time reporting, these systems enable businesses to navigate their financial landscape with unprecedented efficiency. The integration of automation tools across various business functions paves the way for a cohesive and synchronized approach to financial management.

Synder is a prime example of automated accounting. It seamlessly integrates with 25+ ecommerce platforms, payment processors, and accounting systems, automatically imports transactions, categorizes and maps data, and reconciles accounts. It eliminates manual errors, provides real-time insights, and simplifies tax compliance, allowing businesses to focus on strategic growth. Synder goes the extra mile and offers a comprehensive business performance analytics solution, providing a 360-degree overview of sales, products, and customer behavior across multiple channels.

If you believe you might want to give Synder a try, book a seat at our free weekly webinar to have all your questions answered, or sign up for a free trial to explore Synder and understand whether it fits the bill for you.

Exploring key automation technologies in accounting

The backbone of accounting automation rests upon an array of innovative technologies that harmonize to optimize financial operations.

Cloud-based solutions, for instance, facilitate remote access to financial data, enabling collaboration across geographies and time zones. This seamless connectivity empowers businesses to operate efficiently in the global arena.

Machine Learning (ML) and Artificial Intelligence (AI) have unlocked predictive analysis and pattern recognition capabilities. These technologies enable accountants to discern trends and anomalies that might have otherwise gone unnoticed, providing deeper insights into financial health.

Moreover, Robotic Process Automation (RPA) efficiently tackles repetitive tasks, reducing human intervention and the associated risks of errors.

Challenges you face when you decide to automate accounting

The adoption of accounting automation represents a significant and transformative shift in the financial landscape. However, like any profound change, it brings along its challenges that need to be acknowledged and effectively managed. Those require a proactive approach and a strategic mindset to ensure a smooth transition and reap the full benefits of automation.

- Resistance to change

One of the foremost challenges in implementing accounting automation is the resistance to change. Many seasoned accounting professionals have spent years honing their skills in traditional accounting practices. The idea of handing over tasks to automated systems can meet skepticism and even fear. To address this, organizations must invest time in comprehensive change management strategies. Transparent communication about the advantages of automation is essential. Demonstrating how automation can streamline processes, reduce mundane tasks, and elevate the role of accountants from data entry to strategic analysis can alleviate concerns and garner support. - Skill transition and training

As roles evolve due to automation, there is a need for upskilling and reskilling the existing workforce. Accountants, previously focused on manual data entry and basic calculations, now need to be equipped with analytical skills to interpret the insights generated by automated systems. Providing training opportunities and resources to enhance these skills is pivotal in ensuring the workforce remains adaptable and valuable in the automated ecosystem. - Data accuracy and validation

While automation promises increased accuracy by minimizing human errors, it doesn’t eliminate the need for rigorous validation. Ensuring that the automated processes produce accurate results demands attention. Organizations must establish robust validation protocols for testing and verification of automated calculations. Regular audits and quality checks become indispensable to maintain the integrity of financial data, detect anomalies, and rectify discrepancies promptly. - Integration and compatibility

Implementing accounting automation requires integrating new systems with existing software and platforms. Ensuring compatibility and a seamless data flow between various systems can be complex. Technical challenges might arise in data synchronization, software compatibility, and security. Organizations might want to involve IT experts and software developers to ensure these systems work harmoniously, maintaining data security and integrity throughout the integration process. - Initial investment and ROI

While automation promises long-term benefits, the initial investment required can be a deterrent for some organizations, especially smaller ones with limited resources. Calculating the Return on Investment (ROI) accurately and showcasing the potential cost savings, efficiency gains, and improved accuracy over time is crucial in justifying the upfront costs of automation. - Ethical considerations

- As automation takes over routine tasks, ethical considerations may emerge, particularly in more complex decision-making processes. Questions about the responsibility and accountability for decisions made by automated systems can arise. Addressing these ethical concerns requires a combination of legal frameworks, ethical guidelines, and a commitment to transparency.

- Maintenance and updates

Automated systems require continuous maintenance and updates to ensure their efficiency and security. Ignoring regular updates could lead to system vulnerabilities and outdated functionalities. A clear plan for maintaining and updating automated systems is vital to keep them running smoothly and effectively. - Data security and privacy

Automation means a reliance on data storage and processing. Ensuring the security and privacy of sensitive financial information becomes paramount. Robust cybersecurity measures, encryption protocols, and compliance with data protection regulations are non-negotiable elements in the automation landscape.

Bottom line

The marriage of accounting and automation is ushering in a new era of financial management. The benefits are palpable, from heightened accuracy and streamlined operations to empowering accountants as strategic advisors. As businesses embrace the ever-advancing technologies that underpin automation, they position themselves for enhanced efficiency, smarter decision-making, and a competitive edge in the dynamic global marketplace. The journey towards automated accounting is one of transformation, where human expertise intertwines with technological innovation to shape the financial landscape of tomorrow.

.png)