Reconciling Shopify payments in QuickBooks Online is one of the most important steps to keeping your books accurate. Every payout from Shopify includes not only sales but also platform fees, refunds, taxes, and even tips. Without proper reconciliation, these moving parts can easily cause mismatches between what Shopify shows and what lands in your bank account.

While reconciliation can be done manually, the process is time-consuming and prone to errors, especially as order volumes grow. That’s why many businesses choose to automate with dedicated tools like Synder, which ensure every component of your Shopify payments flows correctly into QuickBooks Online.

Using Synder to reconcile Shopify payments in QuickBooks Online with ease

When you want to reconcile Shopify payments in QuickBooks Online and sync transactions via Synder, you should start with two essential steps:

Step 1: Connect your platforms

Go through the Synder onboarding process by creating an account, connecting Shopify and QuickBooks Online. This connection ensures all sales, fees, refunds, and taxes will be imported automatically.

Step 2: Choose your sync mode

Select how you want transactions to appear in QuickBooks:

- Summary Sync – groups transactions into bulk journal entries by day, month, payout, or custom period, reducing data volume in QuickBooks Online while keeping reconciliation accurate.

- Per Transaction Sync – posts each sale, refund, fee, and tip individually. Best for detailed reporting and audit-ready records.

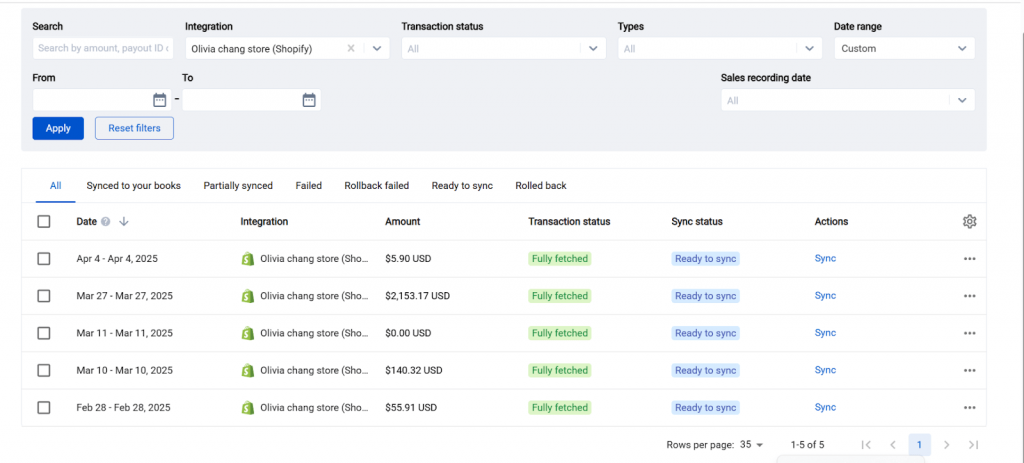

Step 3: Sync data to QuickBooks Online

Sync your Shopify data into QuickBooks through Synder. The records will be posted with sales, fees, refunds, discounts, and taxes mapped to the proper clearing and income accounts. You can fine-tune this categorization later using Synder’s custom rules if needed.

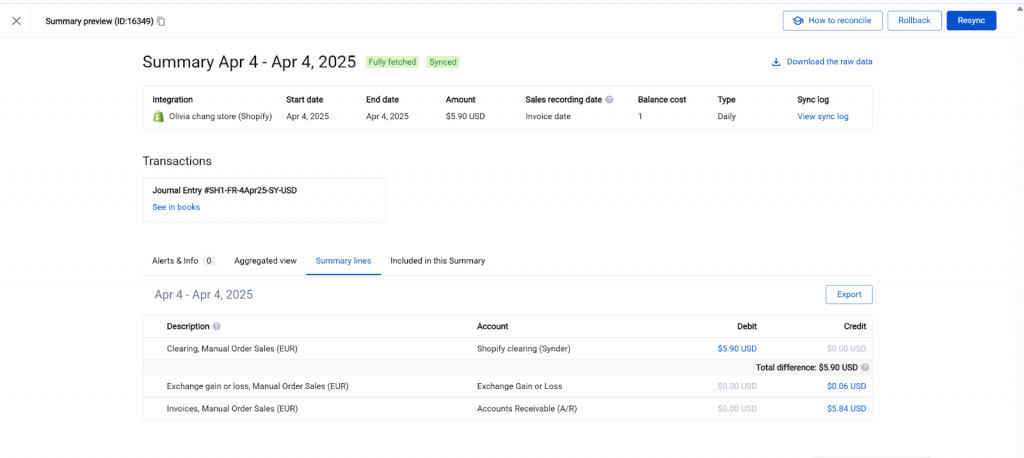

Step 4: Verify synced data

For Summary Sync, review the daily summaries created for each payment method (e.g. Shopify Payments, PayPal) and confirm they show as fully fetched. Compare the totals against Shopify’s Finances summary for the same date to ensure sales, fees, refunds, and taxes align.

For Per Transaction Sync, review individual orders, fees, and refunds recorded in your books. Totals should also match Shopify’s Finances summary for the selected period, with taxes reflected separately.

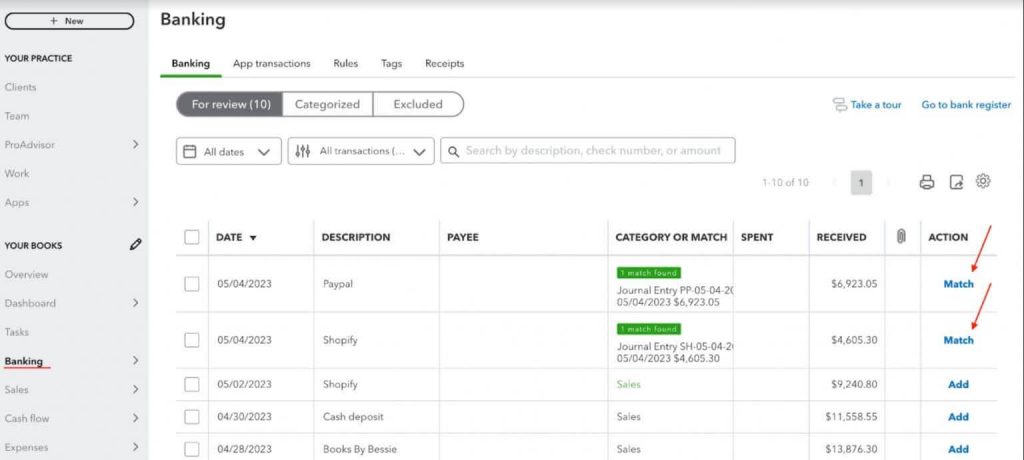

Step 5: Reconcile using clearing accounts

Synder creates a separate clearing account for each payment processor, such as Shopify Payments or PayPal. All synced activity first posts into the respective clearing account. When Shopify issues a payout, the amount is credited there. As the payout appears in your bank feed, QuickBooks automatically suggests a match against the clearing entry, allowing you to reconcile in one click.

Why manual reconciliation falls short and how Synder tackles it

Some Shopify sellers still attempt reconciliation manually by exporting CSV reports from Shopify and entering the data into QuickBooks. While possible, this method has serious drawbacks:

- Error-prone data entry: Copying large datasets into QuickBooks often leads to mismatches between Shopify reports and bank deposits.

How Synder solves it: Transactions flow automatically into QuickBooks, mapped to the right accounts with no manual typing, so your books always match Shopify reports and payouts.

- Lost details: Manual exports rarely separate platform fees, tips, discounts, and refunds cleanly. This creates accounting blind spots.

How Synder solves it: Every component: sales, fees, tips, discounts, refunds, and taxes, is captured and mapped separately, so you always see the full picture.

- Time-consuming: Manually reconciling payouts of daily transactions can take hours, especially as your order volume grows.

How Synder solves it: The tool automates reconciliation end to end, turning what used to take hours into a one-click task. For example, Decimal reduced their bookkeeping workload by 50%, saving 140 hours every month by eliminating manual reconciliation.

- No clear audit trail: Inconsistent categorization or missing transactions make it harder to trace back during audits or tax preparation.

How Synder solves it: Automated mapping and Smart Rules ensure consistent categorization, while synced records provide a transparent, audit-ready record of every transaction.

- Scalability issues: A small store might manage manual reconciliation, but once sales scale up, the workload becomes unmanageable.

How Synder solves it: Synder can handle a large volume of transactions, keeping books clean and reconciled whether you sell a dozen items or thousands each day.

Ready to stop wasting hours on manual reconciliation? See how Synder automates Shopify–QuickBooks workflows and keeps your books accurate at scale. Join a demo to watch it in action and get your questions answered.

FAQ

What syncing methods does Synder offer for Shopify?

Synder supports two modes: Summary Sync (one consolidated journal entry per day, month, payout or custom period for efficient reconciliation without cluttering your books) and Per Transaction Sync (detailed posting of each sale, fee, tax, tip, and refund). You can choose the mode that fits your business needs.

What if my QuickBooks accounts don’t match my Shopify transactions?

Synder uses a clearing account to ensure the recorded transactions align with your Shopify payouts. If you see mismatches, it’s usually due to pending transactions or multi-currency payouts, and Synder flags these so you can correct them.

How does Synder handle sales tax from Shopify?

Taxes are automatically mapped to your Sales Tax Payable account in QuickBooks, ensuring compliance and accurate profit & loss reporting. In Summary Sync, they’re aggregated; in Per Transaction Sync, they’re tracked line by line.

How does Synder categorize Shopify sales in QuickBooks?

Synder automatically maps Shopify activity into the right accounts in QuickBooks:

- Income → sales revenue

- Expenses → processing fees

- Contra-income or liabilities → refunds

- Discounts and shipping → their respective categories

- Clearing accounts → separate accounts per payment processor (e.g., Shopify Payments, PayPal, POS, manual orders) to support reconciliation

You can refine this setup with Smart Rules, customizing categories or applying tags for specific product lines, customer groups, or payment gateways.

Can Synder reconcile multiple Shopify stores in one QuickBooks account?

Synder allows you to connect and sync multiple Shopify stores into a single QuickBooks Online company. You can keep them consolidated or track each store separately using classes, locations, or custom rules.