Reconciling eBay payouts in QuickBooks Online often feels like a numbers maze. Your bank shows one figure, your eBay dashboard shows another, and the difference lies in fees, shipping labels, marketplace tax, refunds, and chargebacks. The only way to make those numbers match is to record every component of each settlement in QuickBooks Online and then match the payout to the bank feed.

Doing this manually takes hours and leaves a lot of room for errors. The most efficient solution is using software built for ecommerce accounting. Synder provides a seamless eBay QuickBooks integration that syncs your sales, shipping income, fees, marketplace tax, refunds, and transfers into the right QuickBooks accounts automatically. It also updates inventory and COGS if you track stock, so every payout matches perfectly with just a click.

TL;DR

If you’re pressed for time, here’s a quick summary:

- eBay payouts rarely match what appears in QuickBooks Online because they include sales minus fees, shipping labels, refunds, marketplace tax, ads, and chargebacks.

- If you only record the final payout, your revenue is understated, expenses are missing, and reconciliation becomes a guessing game.

- The right approach is to record every part of each settlement, not just the net deposit, and then match that to the bank feed.

- Synder automates this: it syncs eBay sales, fees, shipping income, marketplace tax, refunds, chargebacks, and payouts into the correct QuickBooks accounts, and even updates inventory and COGS if needed.

- You get clean books, accurate profit per product, easy reconciliation, and no more spreadsheet hassle.

Keep on reading if you’re interested to learn more.

Why eBay payouts often don’t match your bank feed in QuickBooks

eBay payouts don’t reflect what you actually earned. They reflect what is left after eBay takes its share and handles adjustments behind the scenes. So while your eBay dashboard may show great sales volume, the money that arrives in your bank is your net, not your gross.

Inside a single payout, eBay may bundle together things like:

- Product sales and any shipping charges paid by the buyer

- eBay selling and processing fees

- Promoted listing and subscription fees

- Shipping label purchases

- Marketplace tax collected and remitted on your behalf

- Partial refunds or full returns

- Disputes, chargebacks, and adjustments

- Loan repayments if you use eBay Seller Capital

- Currency conversion differences if selling internationally

For example, imagine your business sells a premium skincare serum for $150. That looks like straightforward revenue. But when the order settles, several costs come out:

- Selling and payment fees: –$18.75

- Promoted listing ad fee: –$4.95

- Partial refund for a damaged box: –$20

- Shipping label purchased through eBay: –$7.50

Your final payout becomes $98.80.

If QuickBooks only records that payout, it mistakenly shows $98.80 as your revenue. The remaining $51.20 in real business activity disappears, leaving margin reporting skewed and reconciliation much harder than it needs to be.

This is exactly why sellers struggle to match deposits to their books. Synder can bring in all parts of that transaction to QuickBooks Online automatically.

What Synder syncs from eBay into QuickBooks Online

To fix this mismatch, Synder syncs transaction components in managed payments with proper categorization.

Here are a few examples from eBay sellers:

| Seller action | What Synder posts in QuickBooks Online | Why it matters |

| Sell a batch of branded sneakers across multiple marketplaces | Sales receipt + fee expenses | Revenue and cost visibility across channels for accurate margin reporting |

| Issue a partial refund | Refund receipt linked to sale | Sales, fees, and tax adjust correctly |

| eBay withdraws funds for a dispute | Transfer out of the clearing account | No unexplained balance gaps |

| Purchase shipping label | Shipping expense | Clear fulfillment cost visibility |

| Receive promotional fee credit | Deposit to the clearing account | Credits reduce the true selling cost |

| Receive payout | Transfer to the bank | One-click reconciliation |

How to reconcile eBay payouts in QuickBooks Online with Synder

This workflow keeps the books clean and reconciliation simple.

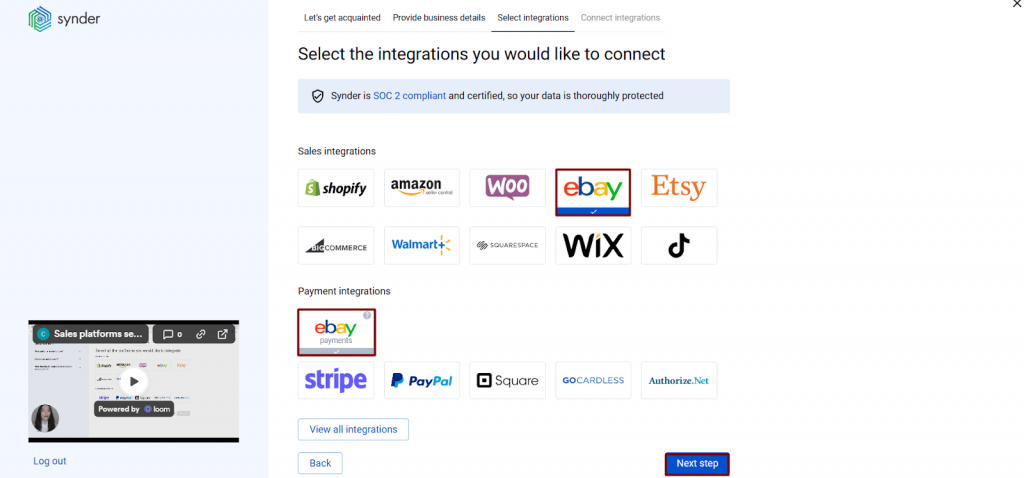

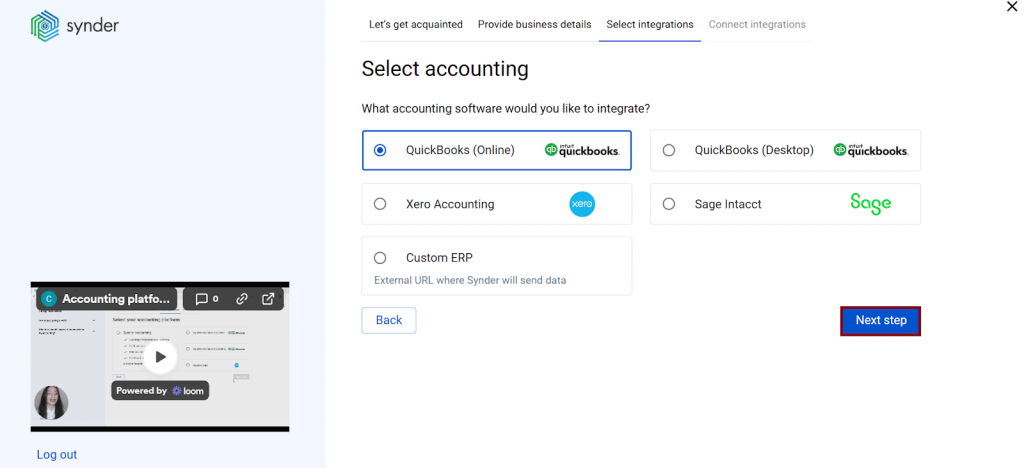

1) Connect eBay and QuickBooks Online

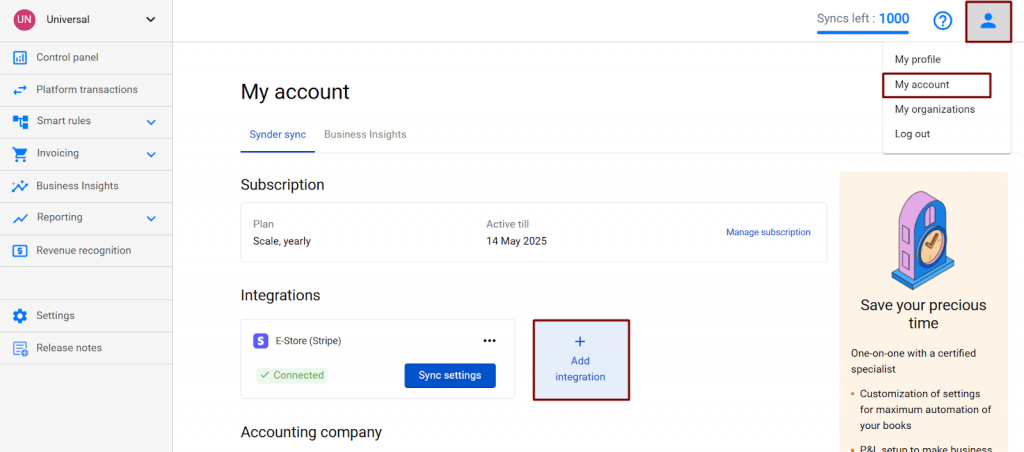

Sign in to Synder, open Select integrations, and connect your eBay account.

Next, connect QuickBooks Online.

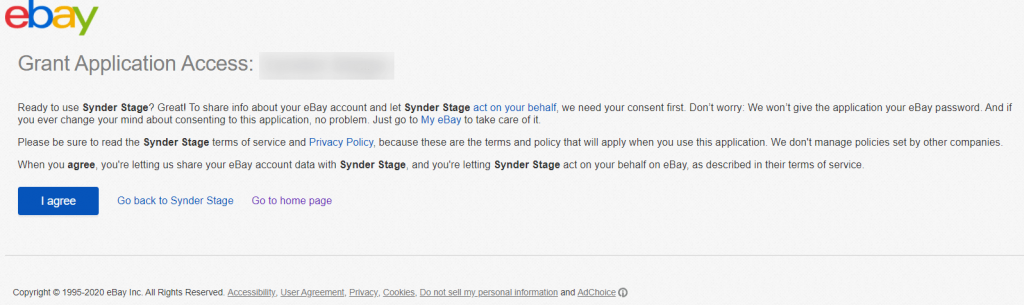

Keep in mind that you’ll have to grant Synder permission.

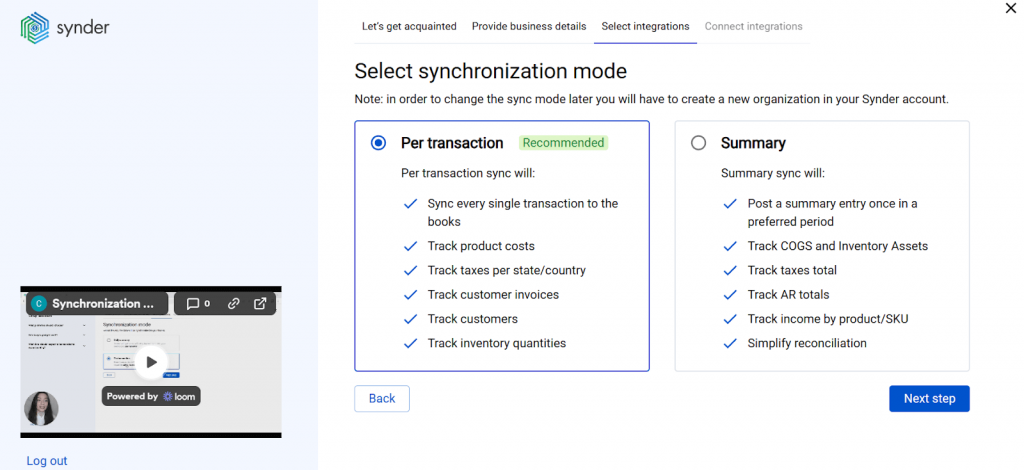

In the setup flow, choose between Per Transaction Sync for detailed SKU-level entries or Summary Sync, which allows you to group transactions by day, month, or a custom period. This ensures every part of your eBay settlements posts into QuickBooks with the level of detail that fits your workflow.

2) Configure accounts

Next, review your account mappings to ensure every part of your eBay activity posts correctly in QuickBooks. Assign income accounts for product sales and shipping income, and map eBay selling fees, promoted listing fees, and shipping label costs to the appropriate expense accounts. Also, make sure marketplace tax goes to a tax liability account and confirm that the correct eBay clearing account is selected for settlements.

This establishes clean, audit-ready financials and accurate profit & loss reporting.

3) Sync ongoing activity

As new orders and account updates occur, Synder automatically syncs sales, shipping income and costs, eBay fees, marketplace tax, refunds, adjustments, and credits into the eBay clearing account in QuickBooks Online. The running balance mirrors the net amount eBay will pay out, ensuring your books stay aligned with your seller dashboard in real time.

4) Match eBay settlements to bank deposits

When an eBay payout appears in your QuickBooks Online bank feed, simply open the Banking tab and review the suggested match to the transfer from the clearing account. One click on Match completes the process, turning reconciliation into a quick confirmation instead of a manual rebuild.

Inventory and COGS tracking

If you track inventory in QuickBooks Online, it is better to use Per Transaction Sync in Synder, since this mode updates quantities and COGS for each item sold or returned. For example, if you sell three units of a product costing $12 each, Synder records the revenue, reduces stock by three, and posts $36 of COGS. If one unit is returned later, Synder restores that unit to inventory and reverses $12 of COGS.

Choosing this sync mode ensures your stock levels and margins remain accurate without manual adjustments or external spreadsheets.

Handling refunds, returns, and adjustments

Refunds and disputes can complicate bookkeeping if they are not linked back to the original sale. Synder handles these automatically, ensuring revenue, fees, marketplace tax, and COGS all stay aligned.

For instance, if a customer receives a damaged product and you issue a partial refund, Synder creates a refund receipt tied to that sale, adjusts revenue and tax proportionally, and reverses COGS if the item is returned to stock. If eBay withdraws funds to cover a dispute, Synder records a transfer out of the clearing account so your balances still reconcile. Even promotional credits are reflected instantly as deposits, reducing your effective selling costs for the period.

This keeps your financial records accurate regardless of which direction the money flows.

Fee mapping and marketplace tax setup

eBay fees and taxes have a direct impact on your profitability, so posting them to the right accounts is essential. Synder takes care of this automatically, ensuring your margin data and tax balances stay accurate and defendable. For example:

- Selling fees and payment processing fees go to a fees expense account

- Promoted listings and ad spend map to an advertising expense account

- Shipping labels purchased through eBay become shipping expense

- Marketplace tax collected on your behalf posts to a tax liability account rather than inflating revenue

- Non-transaction fees (subscriptions, category upgrades, etc.) map to the appropriate expense type

- Insertion fees are included within non-transaction fees, but the description makes them identifiable for Smart Rules

Pro tip: If you want deeper cost control, Synder Smart Rules let you route certain categories of fees to separate accounts for granular analysis.

Matching eBay settlements to bank deposits

This is where everything comes together. When eBay sends a payout, Synder records it as a transfer (journal entry in the summary mode) from the eBay Clearing Account to your bank account, with the exact same amount that appears in your bank feed. In QuickBooks Online, you simply confirm the suggested Match and move on.

As a result, you get a clean reconciliation every time, with a complete audit trail behind each dollar.

Benefits of using Synder for eBay QuickBooks Online reconciliation

Finance teams in scaling ecommerce businesses need accounting processes that keep up with growth, not slow things down. Synder replaces manual cleanup and spreadsheet detective work with a structured, automated flow of data directly from eBay into QuickBooks Online, so you know exactly where your money went.

As your operations expand to other channels such as Amazon, Shopify, Walmart, and multiple payment methods like PayPal, Stripe, and Square, Synder continues to consolidate everything into a single, accurate accounting source. More than 30 integrations are available, so you can grow without adding complexity.

Here are the advantages businesses notice immediately:

- Precise eBay QuickBooks integration without data juggling: Your finance operations move faster when data arrives already organized and complete.

- Every revenue and cost component lands in the right place: Profitability reporting improves when marketplace tax, refunds, shipping, and fee types are all posted accurately.

- Inventory and COGS stay aligned with what is actually selling: Better decision-making on SKU performance, replenishment, and discontinuation.

- Reconciliation remains quick even during peak seasons: Higher order volume does not lead to higher workload or anxiety.

- A smooth month-end close with fewer manual fixes: Cleaner data means leaders get visibility sooner and with more confidence.

- Room to expand to multiple eBay storefronts: Growth into new regions or product lines does not disrupt accounting structure.

- Backlog cleanup for businesses leveling up their financial operations: Historical sync supports accurate catch-up during software migration or process improvements.

Want to see how Synder can streamline accounting for your eBay business? Start with clarity from day one and explore Synder with a 15-day free trial. You could also book a 1:1 demo and get a setup flow tailored to your exact needs.

Final takeaway

The payout that hits your bank account is only the final step in the life of a sale. QuickBooks sees that number, but it doesn’t see the shipping, fees, marketplace tax handling, refunds, or adjustments that define your real profitability. Synder fills in the entire story. It brings every component of each eBay settlement into QuickBooks automatically, turning reconciliation into a simple confirmation instead of a time-consuming investigation.

For ecommerce businesses that want cleaner books, accurate margins, and a stress-free month-end close, Synder offers a smarter and scalable way to connect eBay with QuickBooks Online.

FAQ

Can QuickBooks automatically update inventory and COGS from eBay sales?

Yes, when Synder is connected. By enabling Per Transaction Sync in Synder, inventory quantities adjust automatically and COGS is posted for each sale, with both reversed on returns. This keeps product-level profitability accurate in QuickBooks without manual work.

Will refunds adjust fees and taxes correctly?

Yes. When refunds occur, Synder automatically adjusts revenue, fees, marketplace tax, and COGS (if inventory is tracked), keeping profit and liability balances accurate without creating journal entries or disrupting reconciliation.

How far back can I import eBay transactions?

Synder supports importing historical data as far back as eBay allows. The duplicate detection feature prevents double-syncing previously entered transactions, helping clean up backlogged bookkeeping while maintaining data accuracy.

Does Synder support multiple eBay accounts and currencies?

Yes, Synder allows you to connect multiple eBay accounts and sync payouts in different currencies. Each currency posts to its own clearing account, and Synder relies on QuickBooks exchange rates for accurate conversion during reconciliation and reporting.