Marius Gunvaldsen launched his SaaS business in January 2021. While the software was only popular in the US market, tracking new customers was not a big deal. However, after a few months, they started selling three times as much all over the world, and it became apparent that manual accounting was not going to be effective anymore.

Marius is an experienced businessman who was first using accountants’ services, then doing it all by himself, then assigned his employees to track transactions. In the end, he found accounting software that would meet all his needs.

It is an interesting story of one business developing and seeking help to focus on more significant things than accounting.

Contents:

About the business

Marius Gunvaldsen is the owner of a SaaS company; its service is webinar software. The webinar platform has all the tools for customers to create first-class webinars in a couple of minutes.

I used accountants’ services before, but it was truly costly. Then I had an employee, who would take care of my business’ bookkeeping along with their primary job, but in a few months, all they were doing was tracking transactions, no actual work. So I started looking for a solution.

Challenge

As soon as Marius’ business expanded beyond some 500 transactions, manual entry of hundreds of transactions became complicated. So he needed accounting software.

However, there was another issue to solve. Marius’ business sells subscriptions worldwide; therefore, they get payments in different currencies via Stripe. They have a bank account in their home currency (USD) and receive all payouts in USD, as well.

I was concerned about processing multi-currency transactions in QuickBooks, because I had had a bad experience previously when software recorded the amounts with a 1:1 conversion rate.

Solution

First of all, Marius Gunvaldsen needed accounting software that would solve the problem of manual data entry.

When I tried Synder’s free trial, I realized that it was really easy to use! Just a few clicks, and all the data was automatically synchronized.

Marius synchronized his Stripe transactions to his QuickBooks for one-click reconciliation and comprehensive Profit and Loss reports with the help of Stripe integration.

Nonetheless, the main problem that the company faced was finding a solution for multi-currency transactions.

It’s obvious that Synder had one superior advantage over other accounting software – it’s synchronization of multiple currency transactions. Finally, all the payments were put in order. It was such a relief!

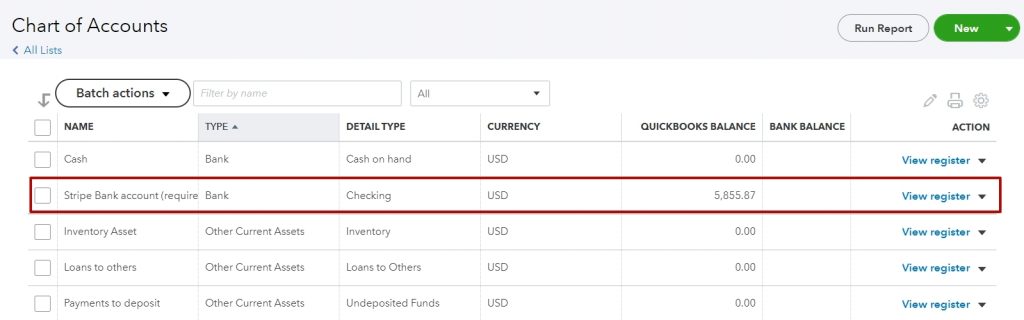

Synder helped the online business configure the accounting software according to their workflow. As they connected Stripe to their accounting books, a clearing account (Stripe multiple currency Bank account) in their home currency was created.

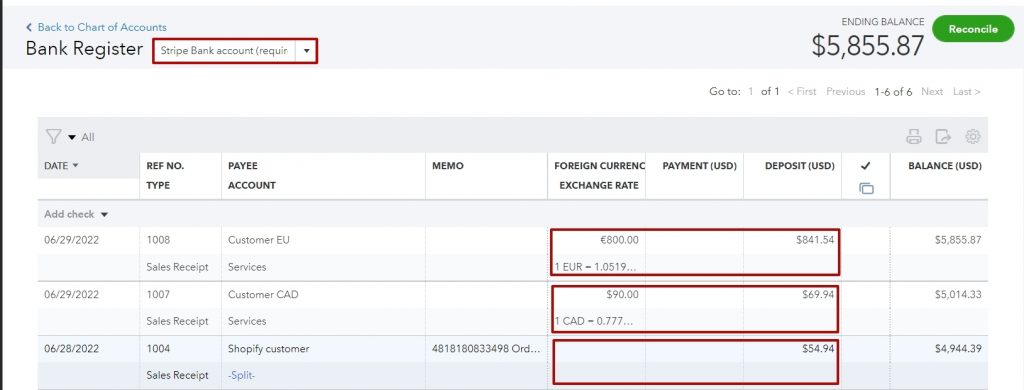

All transactions in all currencies and exchange rates are synchronized to this single account and converted accordingly. When Synder synchronizes a transaction in whatever currency to the company’s Quickbooks, it creates an invoice with payment to account for the income part of the transaction; and to a bill with payment to account for the expense part of the transaction (i.e., commissions and fees); in the case of refunds, it creates a credit memo and a payment.

In addition, during the Stripe payouts synchronization, Synder deposits net sales amounts in USD to the Business Checking account for smooth reconciliation, which took them just one click in the Banking section in QuickBooks.

You may learn additional information on the correct synchronization of multi-currency transactions with your accounting books.

Results

Here is the outcome for Marius Gunvaldsen, the SaaS business owner:

Look at me, I’m just a simple man who always wants to find the best solution for his business to grow at an exponential rate. Your software enabled me to focus my attention towards the cash flow and how to make the income rise. Last month we had over 3000 sales! And another plus is that we’ve never had any problems with our payments since we started using Synder.

Synder took care of the company’s daily bookkeeping. Marius received automated, seamless synchronization and precise reconciliation of all the business transactions. Now multi-currency transactions are accounted for, and accurate conversion rate calculations are automatically carried out.

Simplify multi-currency accounting now!

A lot of businesses find their target audience in different countries all over the world. But don’t let distance prevent you from establishing a foothold in whatever market you fancy. Synder will carry out accurate conversion rate calculations according to pay rate on the day the transaction was made.

Automated synchronization by Synder hinders the occurrence of mistakes. In addition, accurately recorded payment data creates detailed sales and expenses reports. This accounting software saves hours everyday and automatically performs excellent data reconciliation.

Try a free trial and book a demo, and let Synder do accounting for you. It is absolutely worth it! Even if you cannot relate to this story, Synder has many automated and customizable features you may find helpful selling online.

Do you have a story to share?

Write about your experience with Synder to [email protected] and become the next main character in our user case!

%20(1).png)