If you’re doing business in Australia, you most likely came across a unique term called BAS (Business Activity Statement). Remarkably, a significant number of people remain unfamiliar with what it entails and why it’s important. Managing your Business Activity Statements might seem complex, especially if you’re new to running a business or even if you’ve been in the game for a while. But don’t worry, as a BAS agent, I’m here to make it simpler for you.

In this guide, we’ll start with what BAS really means for your business, then step by step, I’ll show you how to lodge it right and on time – just like we do it for our clients. We’re going to tackle the common errors head-on and give you some of my tried-and-tested tips. Plus, I’ll share stories from my own experience with clients, showing you how these tips apply in real business scenarios. My goal is to help you get a grip on BAS so you can handle your business’s tax responsibilities confidently and efficiently. Let’s get started!

Contents:

1. What is BAS?

2. Getting started: Basics of lodging BAS for small businesses

- Lodge online via your Business Portal

- Lodge through a tax or BAS agent

- Lodge by mail

- Nothing to report (‘Nil’ BAS)

4. What are the common mistakes businesses make when handling their BAS and how to avoid them?

5. What are the key deadlines associated with BAS submission?

6. When things go wrong: Failure to Lodge on time penalty

7. What are the specific responsibilities and benefits of working with a BAS agent for a business?

8. How to lodge BAS: Tips and best practices for efficient and accurate BAS preparation and submission

9. BAS fixup work in practice: How I help my clients

What is BAS?

The BAS (Business Activity Statement) process for small businesses involves reporting various tax obligations to the Australian Taxation Office (ATO). Small businesses are required to submit their BAS either monthly or quarterly, depending on their annual sales turnover.

The BAS typically includes reporting on goods and services tax (GST), pay as you go (PAYG) withholding tax, pay as you go (PAYGI) business instalment, and other tax obligations you may have for your business.

Getting started: Basics of lodging BAS for small businesses

If you run a small business and you think you need to lodge BAS, here’s what you should know:

- The first thing that needs to be done for any small business in Australia is to have their own ABN number (Australian Business Number). This is like your business ID to the ATO.

- You need to know what your turnover is depending on your sales, you’ll need to register for GST, if your annual turnover is over $75,000.

- Once you register for GST, you’ll need to lodge BAS. You’ll be submitting this lodgement either every month, quarter or annually. Your accountant or BAS agent can help you with this.

N.B. When it comes to filling out the BAS, businesses need to report the total sales, GST collected on sales, GST paid on purchases, and other relevant tax obligations. It’s vital for small businesses to reconcile these figures with their accounting records to ensure accuracy. After completing the necessary calculations, the BAS can be lodged either online using the ATO’s Business Portal, or through a registered Tax or BAS agent.

How to lodge BAS?

Business owners have several options for lodging their Business Activity Statements or BAS. These options provide flexibility for businesses to choose the most convenient method for their circumstances.

Lodge online via your Business Portal

When submitting your BAS, you have a few options to lodge online, namely through:

- Online services for individuals and sole traders (via myGov);

- Online services for business using your Business portal;

- SBR-enabled software.

Lodge through a tax or BAS agent

If you’re using a registered Tax or BAS agent, they can handle all your BAS needs — submitting it, making any changes, and taking care of payment deadlines, all online. But even when your agent is managing these tasks, you can still view your BAS details yourself. Just log into the ATO’s Online Services for Business or your myGov account, and you’ll be able to access all information there.

Lodge by mail

If you’re a business owner, you can send your filled-out BAS form by post using the envelope that comes with your BAS paperwork. If you spot a mistake on the form, it’s okay to use white-out to fix it. And if you’ve misplaced your BAS form or haven’t gotten one, just give the ATO a call to get a new copy. **Note this is being phased out

Remember, if you’re lodging BAS online, then you can’t send it by mail.

Nothing to report (‘Nil’ BAS)

If your business has nothing to report for the period, you can lodge a ‘nil’ BAS online or by phone using an automated service available 24/7.

Keep in mind that you’ll need your BAS document identification number (DIN) to use this service, this is found on your BAS paperwork received.

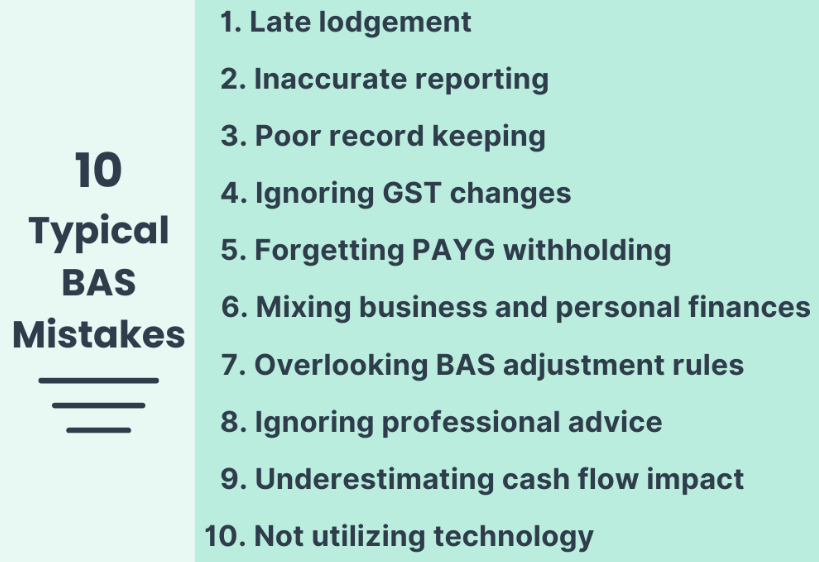

What are the common mistakes businesses make when handling their BAS and how to avoid them?

Handling BAS can be a bit tricky, and businesses sometimes stumble into common pitfalls. Here are 10 typical mistakes and avoidance tips on how to sidestep them.

1. Late lodgement

Mistake: Submitting your BAS past the due date can lead to penalties.

Avoidance tip: Set reminders or use accounting software to stay on top of lodgement deadlines. It’s like having a virtual assistant that never forgets.

2. Inaccurate reporting

Mistake: Making errors in your BAS calculations or providing incorrect information.

Avoidance tip: Double-check your numbers before submitting. If math isn’t your forte, consider getting a trusted accountant or BAS agent to lend a hand.

3. Poor record keeping

Mistake: Misplacing invoices, receipts, or other crucial documents.

Avoidance tip: Create a system for organizing your financial records and use accounting software such as QuickBooks Online. It’ll save you from a treasure hunt when the tax season rolls around.

4. Ignoring GST changes

Mistake: Not keeping up with changes in GST regulations.

Avoidance tip: Stay informed! Follow updates from the ATO, attend workshops, or consult with a tax professional to ensure you’re in the loop.

5. Forgetting PAYG withholding

Mistake: Neglecting to report PAYG withholding accurately.

Avoidance tip: Keep detailed records of amounts withheld and paid. Your employees and the tax office will appreciate the transparency. The best practice is to use Payroll software such as QuickBooks Payroll that automatically works out all your ATO compliance figures.

6. Mixing business and personal finances

Mistake: Using the same account for personal and business expenses.

Avoidance tip: Open a separate business account. It streamlines your financial management and makes reporting way less complicated.

7. Overlooking BAS adjustment rules

Mistake: Failing to adjust for mistakes in previous BAS submissions.

Avoidance tip: If you find errors, don’t panic. Correct them in the next BAS. The ATO understands that we’re all human.

8. Ignoring professional advice

Mistake: Assuming you can handle everything without seeking expert advice.

Avoidance tip: A good accountant or tax/ BAS advisor is like a superhero for your business. Don’t hesitate to seek their wisdom, especially when things get a bit too complex.

9. Underestimating cash flow impact

Mistake: Forgetting that your BAS payment affects your cash flow.

Avoidance tip: Budget for your BAS obligations. Knowing when payments are due helps you plan your finances better.

10. Not utilising technology

Mistake: Ignoring the benefits of accounting software and technology.

Avoidance tip: Explore accounting platforms that automate calculations and reminders. If technology can help us save time and money, why not use it?

Case study: The importance of accuracy in BAS lodgements and the power of expert review

By steering clear of these common missteps, you’ll make your BAS journey smoother and maintain a harmonious relationship with the taxman. Remember, it’s okay to ask for help when needed. Quite often when a client approaches me to review their QuickBooks file and historical BAS lodgements for accuracy, it’s the accuracy of the data in the file that’s not correct. And therefore, the BAS has been overpaid or underpaid.

With one such client after my initial review, I had to re-do his BAS lodgements for over 3 years, as some of the data was added in twice. As a result, he blew out his figures and they were inaccurate. He was very happy at the end as once I completed the review of all 3 years, and relodged his BAS, he was receiving a refund. Happy man!

What are the key deadlines associated with BAS submission?

BAS or Business Activity Statement submissions come with specific deadlines and penalties for non-compliance. The deadlines and penalties can vary based on the reporting frequency (monthly, quarterly or annually) and whether you’re reporting online or through other means. Here are the key dates to remember for each Quarter.

BAS Quarters

- Quarter 1: July, August, and September. Quarter due date to be submitted and paid = 28 October.

- Quarter 2: October, November, and December. Quarter due date to be submitted and paid = 28 February.

- Quarter 3: January, February, and March. Quarter due date to be submitted and paid = 28 April.

- Quarter 4: April, May, and June. Quarter due date to be submitted and paid = 28 July.

Please note: if you have your BAS agent or accountant lodge your BAS on your behalf, you have a BAS agent concession for lodgement and payment date – usually 1 month after the due date, which does not include the December quarter. There is no BAS agent concession for this quarter.

When things go wrong: Failure to Lodge on time penalty

You may receive a Failure to Lodge (FTL) on time penalty if you have an obligation to lodge or report by a particular date but don’t lodge by that due date. This may include lodging your tax return, reporting PAYG installments, GST, or PAYG withholding on an activity statement by the due date. If you use an agent, the safe harbour provisions may protect you. As you can see below, it may come to a hefty penalty if not lodged on time.

How does the ATO calculate the FTL penalty?

This depends on the size of the entity and the period of time since the due date for lodgement. It is calculated per penalty unit this is based on $313 per unit (the amount valid, the last time I researched on the ATO site in January 2024).

Small entities

For a small entity, the ATO calculate the FTL penalty at the rate of one penalty unit for each period of 28 days (or part thereof) that the return or statement is overdue, up to a maximum of 5 penalty units.

Medium entities

For a medium entity, the penalty unit is multiplied by 2. A ‘medium entity’ is a medium withholder for PAYG withholding purposes or has assessable income or current GST turnover of more than $1 million but less than $20 million.

Large entities

For a large entity, the penalty unit is multiplied by 5. A ‘large entity’ is a large withholder for PAYG withholding purposes or has assessable income or a current GST turnover of $20 million or more.

Key takeaways for lodging BAS on time and avoiding penalties

Again, I can’t stress enough to you the importance of lodging on time. There are occasions where as a BAS Agent, at my practice Lauretta Finis Consulting I can contact the ATO on your behalf, which I have done before for clients as they had extending circumstances that they required help with.

One of my new support clients came to me after a long battle with illness and I was able to work with the ATO and help with the removal of his penalties after I lodged all the outstanding BAS’s. The ATO are there to work with us in all circumstances.

What are the specific responsibilities and benefits of working with a BAS agent for a business?

When choosing a BAS agent, it’s essential to ensure they are registered with the Tax Practitioners Board (TPB). This registration signifies that the agent meets the necessary qualifications and ethical standards.

Working collaboratively with a qualified BAS agent can be a strategic investment in the financial health and compliance of your business. What’s more, a BAS agent can bring several benefits for businesses, especially in handling complex financial matters and ensuring compliance with tax regulations.

There are various responsibilities that your BAS agent will help you with and ensure you stay compliant with the ATO at all times especially in regard to late penalties. Let’s look at the specific responsibilities and benefits of working with a BAS agent.

Benefits of working with a BAS agent

- Accuracy and compliance: BAS agents are trained professionals with a deep understanding of tax laws. They can help ensure that your BAS submissions are accurate and compliant with regulations.

- Time savings: Outsourcing BAS-related tasks to a qualified agent frees up your time to focus on running and growing your business, rather than navigating complex tax requirements.

- Reduces stress: Delegating tax responsibilities to a BAS agent can reduce the stress associated with staying up to date on tax laws and ensuring timely and accurate submissions.

- Avoiding penalties: BAS agents are well-versed in deadlines and compliance requirements. Their expertise can help you avoid costly penalties for late submissions or errors.

- Audit support: In the event of a tax audit, having a BAS agent on your side can be invaluable. They can provide documentation and support during the audit process.

- Up-to-date knowledge: BAS agents stay current with changes in tax laws and regulations. This ensures that your business is always in compliance with the latest requirements.

- Customised advice: Receive personalized advice tailored to your specific business needs. BAS agents can provide insights into optimizing your financial practices.

As a BAS agent since 2005, I’ve dealt with many, many clients and BAS lodgements. Most clients are happy to throw at me their end-of-quarter QuickBooks account so I can magically wave my wand and get their BAS completed and lodged. They know that I can provide them with an accurate set of financials and BAS completed on time – something that they don’t want to deal with as they know they are better off running their business than sitting out late nights working on their BAS.

How to lodge BAS: Tips and best practices for efficient and accurate BAS preparation and submission

Here are some of my tips to help you streamline the process and ensure the accuracy of your GST and BAS lodgements.

Organise your financial records

Maintain a systematic record-keeping system for all your financial transactions. Keep invoices, receipts, and other relevant documents in an organised manner. This will make it easier to gather information when preparing your BAS.

Utilise accounting software

Use accounting software to automate calculations and streamline the preparation process. Many platforms can generate reports, including those needed for your BAS.

Automate ecommerce bookkeeping

If you have an ecommerce business, look at automating and simplifying your bookkeeping processes of syncing your commerce transactions with your accounting software. This will eliminate the need for manual transaction input and ensure accuracy of transactions. I recommend using Synder as this will integrate with QuickBooks and with most popular ecommerce platforms. It does the work for you, so at the end of month and quarter you know your figures are going to be correct when preparing the BAS.

Regularly reconcile financial accounts

Reconcile your financial accounts regularly. This includes bank statements, credit card statements, and any other accounts relevant to your business. Reconciliation helps identify discrepancies and ensures accuracy in your financial records.

Master GST codes

Familiarise yourself with the Goods and Services Tax (GST) codes applicable to your business transactions. Using the correct GST codes from the outset can prevent errors in your BAS.

Set reminders for key BAS lodgement and payment deadlines

Mark important BAS lodgement and payment deadlines on your calendar or set up reminders. This helps you stay proactive and avoid late submissions or penalties.

Budget for GST payments to manage lodged BAS cash flow impact

Anticipate the cash flow impact of your BAS obligations. Budget for the GST payment to ensure you have the funds available when needed.

If you are unsure about certain aspects of your BAS preparation, do not hesitate to seek advice from a qualified accountant or BAS agent. They can provide guidance on complex matters and ensure compliance.

BAS fixup work in practice: How I help my clients

One of my service’s I provide is the “fixup work”- I review my clients’ BAS and “fix” it for them. And one of the main issues I see is that there are no bank reconciliations, which allows for inconsistent and inaccurate figures. I work with the client to get them to the point of bank reconciling either by training them or getting it done for them myself.

For instance, a client approached me after seeing 2 other accountants as she knew there was something wrong with her figures. Once I reviewed her QuickBooks account, I found out that for some reason her sales from her website were going in twice and sometimes three times. There was never a bank reconciliation completed! Once I ‘fixed’ the accounts for her, I set up Synder to automate her sales from her website to her QuickBooks account and she has had smooth sailing ever since. This has given her accurate financials for year-end and importantly, she is no longer overpaying her BAS obligations with incorrect sales figures. Thank you, Synder!

How to lodge BAS: Closing thoughts

Alright, we are at the end of our journey through ‘How to lodge BAS.’ I hope you’ve found this guide as practical and helpful as I intended it to be. Remember, dealing with your Business Activity Statements isn’t something to be afraid of. With a bit of organization, the right tech tools, and maybe a hand from a seasoned BAS agent – you can master your tax duties without worry. It’s always smarter to ask for help than to stumble in the dark, especially when it’s about your hard-earned business.

It’s all about keeping things tidy, embracing handy software and keeping up with tax changes. Lodging your BAS accurately and on time isn’t just ticking a box for the tax office; it’s a crucial part of keeping your business healthy financially. So use what you’ve learned here, implement these best practices, and watch how much smoother handling BAS can be. Cheers to your success and a hassle-free BAS experience!