Klarna is a popular payment service that allows you to make purchases now and pay later. It offers a flexible and convenient way to shop online without having to pay the full amount upfront. It has gained widespread popularity due to its ease of use and the fact that it doesn’t charge any interest or fees if you make your payments on time. However, it’s important to know your spending limit to avoid any surprises or issues when making a purchase.

In this article, we’ll explain what the Klarna spending limit is and how to check it.

Running an ecommerce or SaaS business? Find out how Synder Sync, a single tool, can connect all your payment gateways, marketplaces and accounting software for flawless reconciliation. Sign up for a free trial to learn everything firsthand or book a spot at our Demo session where our specialists will talk you through the whole process.

Contents:

1. Klarna and its spending limit

2. How to check your spending limit on Klarna

3. How does Klarna Credit work?

4. Tips to increase your limit on Klarna

Klarna spending limit

Klarna spending limit is the maximum amount of credit that the platform has approved for you to use. It may assign a spending limit or credit limit to customers when they use their services, and this limit determines how much they can spend using Klarna’s payment options.

The specific spending limit assigned to a customer can vary based on a variety of factors, including the customer’s credit history, financial stability, and payment behavior. The platform uses algorithms and data analysis to assess the risk associated with each customer and to determine an appropriate spending limit.

Check out how to use Klarna on Amazon.

How to check your spending limit on Klarna

To check your spending limit, you need to have an account. If you don’t have one already, you can sign up for one on Klarna’s website or through the Klarna app. Once you have an account, you can follow these steps:

- Log in to your account on the website or the app.

- Click on Spending Limit in the menu.

- Your spending limit will be displayed on the screen.

If your spending limit isn’t displayed, it could be because the platform hasn’t yet approved your account or because there’s a technical issue. In this case, you can contact Klarna’s customer support for assistance.

How does Klarna Credit work?

Checkout

When you shop online at a store that offers Klarna as a payment option, you can choose to pay with Klarna at the checkout.

Klarna credit check

The platform typically performs a credit check when you apply for their services like Klarna Credit. They gather your personal information, including identification details, and assess your creditworthiness by obtaining your credit report from one or more credit bureaus, reviewing your credit history, and calculating your credit score. The decision to approve your application and the terms offered, such as credit limits and interest rates, is based on this assessment.

It’s essential to be aware that a credit check can slightly affect your credit score, so it’s advisable to apply for credit selectively and responsibly.

Note that the specifics of Klarna’s credit check process may change over time, so refer to their official website or contact their customer support for the most up-to-date information.

Options to pay offered by Klarna

The platform offers several payment options, including:

- Pay later: You can delay payment for a set period, usually 14 to 30 days after the purchase is shipped. If you return the item within this period, you won’t have to make any payments.

- Pay in installments: You can split your purchase into equal monthly payments over a fixed period, typically 3 to 36 months. Interest rates may apply, depending on the terms of your agreement.

Klarna payment reminders

Klarna sends its customers payment reminders which include details about upcoming payment due dates, the amount due, and available payment options. They help customers stay on top of their financial commitments. The platform communicates these reminders through various channels such as email, SMS, or app notifications, based on the customer’s preference.

Missing payments may result in late fees or interest charges, so it’s crucial to pay attention to due dates and manage payments responsibly. The platform may also offer some flexibility in payment rescheduling or adjustments, subject to their policies and the terms of your specific agreement.

Klarna interest and fees

Klarna charges interest and fees as part of its financing services. Interest rates can vary based on your creditworthiness and agreement terms, typically stated as Annual Percentage Rates (APR). Late payment fees may apply if you miss due dates, and there could be account-related fees such as annual charges for Klarna Credit Accounts.

Learn what happens if you don’t pay Klarna.

Klarna flexibility

The platform provides customers with flexibility in managing payments. You can choose from various payment plans to align with your budget, reschedule payments when necessary to avoid late fees, and even make early repayments without incurring additional charges. However, it’s important to adhere to your agreement’s terms.

But keep in mind that specific features and flexibility options may vary based on your creditworthiness and the terms of your financing agreement.

Please also note that the availability and terms may vary depending on your location and the specific online store you are shopping at. Always review the terms and conditions provided by the platform and the retailer before using it.

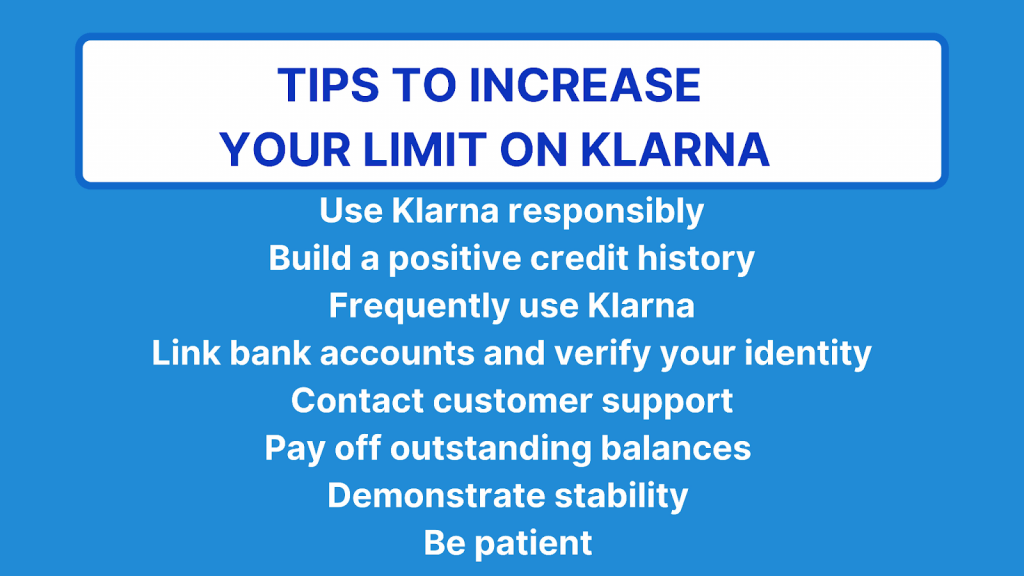

Tips to increase your limit on Klarna

Increasing your spending limit can be beneficial if you want to make larger purchases using their services. Klarna typically evaluates several factors to determine your spending limit, including your credit history, financial stability, and payment behavior. To potentially increase your limit, consider the following tips:

Use Klarna responsibly

Make timely payments on your Klarna purchases and avoid missing due dates or making late payments. Responsible payment behavior can demonstrate your creditworthiness and may lead to limit increases over time.

Build a positive credit history

Improving your overall credit history and credit score can positively impact your spending limit. Pay your other bills, loans, and credit cards on time to demonstrate responsible financial management.

Frequently use Klarna

Regularly using Klarna’s services and making timely payments can help Klarna see you as a responsible customer, potentially leading to periodic increases in your spending limit.

Link bank accounts and verify your identity

Ensure that your account is fully verified by linking your bank accounts and providing accurate identification information. Verified accounts may have access to higher spending limits.

Contact customer support

If you believe you deserve a higher spending limit, you can contact Klarna’s customer support to inquire about the possibility of an increase. Be prepared to provide reasons for the request and any relevant information that may support it.

Pay off outstanding balances

If you have any outstanding balances, make an effort to pay them off promptly. Reducing your existing debt can improve your creditworthiness and may lead to a limit increase.

Demonstrate stability

Stability in your financial situation, such as consistent income and employment, can positively influence Klarna’s assessment of your creditworthiness.

Be patient

It may take some time to see significant increases in your spending limit. Continue to use their services responsibly and maintain good financial habits.

Remember that the platform’s policies and criteria for limit increases may vary, and not all customers will be eligible for higher spending limits. It’s important to use Klarna’s services responsibly and be patient while waiting for potential limit increases. Regularly reviewing terms and conditions and staying informed about their policies can also be beneficial.

Conclusion: How to increase your spending power with Klarna

Knowing your spending limit is important to avoid any surprises or issues when making a purchase, as well as increase the purchase power. Your spending limit is determined by the platform and is based on a number of factors, including your credit score, your income, your spending history, and other factors that Klarna considers relevant. To check your Klarna spending limits, you need to have an account and follow the steps outlined above.

If you want to increase your spending limit, you can improve your credit score, build a good payment history, and use Klarna frequently. By following these tips, you can maximize your chances of getting a higher spending limit and enjoy the benefits of the platform’s buy now, pay later service.

Disclaimer: This article is intended to provide general information about how to use Klarna. The information provided in this article isn’t intended to be a substitute for professional advice or guidance and shouldn’t be relied upon as such. The use of Klarna may vary based on factors such as geographic location, Klarna terms and conditions, and particular merchant’s requirements. Readers are advised to do their own research and seek professional advice before making any financial decisions.

.png)

Just wanting to know what my spending limit is l don’t have one.

Your limit is determined based on factors like your payment history with Klarna, the time you’ve been using their service, and your financial standing. The easiest way to check your spending limit is through the Klarna app. Once logged in, you will find details under the Purchase Power tab, in the ‘You’ section. Also, when you try to buy a product and proceed to pay with Klarna if you exceed your limit, Klarna will visibly display your spending limit on the screen. Remember, your spending limit can change over time based on your shopping and payment behaviors with Klarna.