Using Affirm to pay for purchases has recently become extremely popular among customers. Being a loan provider, Affirm allows users to buy goods or services from online merchants by splitting the payments into fixed monthly chunks. No wonder many popular marketplaces, such as Amazon and others offer this payment method to their customers (so you can easily add or remove Affirm as a payment method).

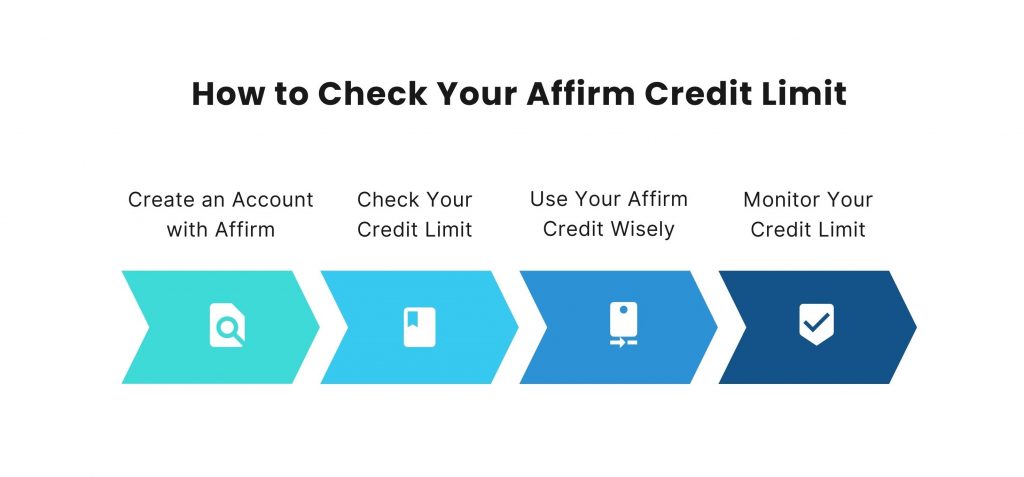

This guide will walk you through the steps needed to learn how much you can spend with your Affirm credit. We’ll also provide tips on how to get the most out of your Affirm credit limit. So, if you’re ready to make the most of your Affirm credit, let’s get started.

Take control of your numbers with Synder to scale your business efficiently.

Step 1: Create an Account with Affirm

The first thing you need to do is create an account with Affirm. You can do this directly from the Affirm website by clicking Get Started and following the prompts; you’ll need to provide basic information, such as your email address and name. Creating an account with Affirm is a simple, straightforward process, and you shouldn’t run into any issues. Once done, you’ll be able to manage your payments, track your account activity, and view your payment history. This way, you can always stay on top of your account and make your payments on time.

Step 2: Check Your Credit Limit

After creating your Affirm account, you can check the available credit limit. In the Account tab, select Credit Limit, and click Show. As a result, you’ll see your credit limit and other credit information, such as payment due date, terms, and interest rate. Now that you know your credit limit, it might be a good idea to take a few minutes to examine your payment terms. It’ll give you a general idea of how long you’ll be paying for your purchases and the total interest you’ll end up with. This way, you get a better sense of how Affirm fits into your financial plan and how to use your credit wisely.

Step 3: Use Your Affirm Credit Wisely

As we mentioned above, by taking a few minutes to review the details of your Affirm credit, you’ll get a clearer idea of how your credit works. It will help you later to use the credit wisely and avoid overpaying. At this point, you can start with a decision on a product you want to obtain using your Affirm credit.

Once you’ve selected a product, you can head to your account and click the Apply Now button to begin the application process. If you have several products in mind, you can also create a Wish List of items you’d like to purchase to keep track of what you want and when you want to buy them. Using a Wish List, you can plan your purchases and spend your Affirm credit wisely.

Step 4: Monitor Your Credit Limit

If you applied for a product using your Affirm credit and got it approved, you need to pay within a few days. Failing to keep within the specified time will decrease your credit limit. The thing is, Affirm doesn’t just give you a credit limit: they give you a line of credit. The credit line fluctuates when you make payments, so you might want to monitor it to keep track of your credit and know when you’re approaching your credit limit. To do it, navigate to the Account tab and look at the Credit Limit part.

Conclusion

Now that you know how to check your credit limit with Affirm, it’s time to sum up your knowledge. The first thing you need to do is review your payment terms. It can give you a general idea of how long you’ll be paying for your purchases and the total interest you’ll pay. Once you’ve done this, you can decide on a product to buy using your Affirm credit. From there, you can start shopping and make sure you make the most of your Affirm credit.

Are you an e-commerce business? Get the most of your e-commerce accounting for Amazon, Shopify, Walmart and other platforms with Synder and enjoy accurate reporting, flawless reconciliation and a smooth tax season!

%20(1).png)