Running a business is somewhat like juggling a dozen plates that are all spinning in the air: operations, marketing, employee management, and finances all shout for your attention. Of all these tasks, accounts receivable — or AR — is one plate you just can’t afford to drop. Why? It’s the lifeblood of your business in cash flow, and managing it properly is paramount to healthy operations.

When you deal with your company’s AR, there’s a thing to keep in mind: 48% of B2B invoices in the United States are paid late. Just think about it—almost half of your forecasted cash flow can be delayed, which severely disrupts your business operations and growth plans. This is where knowing what net accounts receivable (NAR) means becomes critical.

From this guide, you’re going to understand what net AR is, how one can calculate net accounts receivable, why one needs to know this, and most importantly, how one can make this job a little easier using smart tools like Synder.

Key takeaways:

- The calculation of NAR gives a clear picture of what one is actually going to collect.

- NAR is your gross AR minus allowances, discounts, and bad debts which is a key figure for accurate financial planning.

- Tools like Synder automate AR management, saving you time and giving you better cash flow insights.

Contents

- What is net accounts receivable?

- How to calculate net accounts receivable

- Breaking down the components of net receivables

- Net accounts receivable calculation example

- Calculating the average net accounts receivable

- Why net accounts receivable matters

- How Synder simplifies the management of accounts receivable

What is net accounts receivable?

Net accounts receivable refers to an amount your business is likely to receive from customers after accounting for potential deductions such as allowances, discounts, and bad debts from the total—or gross—accounts receivable. Think of it as a realistic view of what your accounts receivable figure will actually turn into in cash once all customer payments are processed.

For example, you might see that your books show high gross AR. Don’t get excited just yet. Some customers will be late, some customers might take advantage of an early payment discount, and some will never pay at all. The formula for net accounts receivable helps give the more realistic outlook about the percentage of gross AR that is collectible.

Pro tip: Think of NAR as your financial health check—regularly calculating net receivables keeps your company financially fit.

How to calculate net accounts receivable

Calculating net receivables is straightforward, but you should know what elements you need to factor in.

The formula for calculating NAR

Breaking down the components of net receivables

Let’s take a closer look at each component that constitutes NAR:

1. Calculating gross accounts receivable

Gross accounts receivable is the total amount owed by customers for goods or services provided on credit; it doesn’t consider allowances, discounts, or bad debts—a sort of total amount of outstanding invoices.

Example: Suppose you own a service-based company and have the following outstanding invoices:

- Invoice 1: $6,000

- Invoice 2: $4,500

- Invoice 3: $2,500

Your gross AR would be $13,000. While this is a good starting point, it doesn’t give the exact cash that’s collectible.

2. Deducting allowances and discounts

While allowances and discounts can be a good way to build customer relationships and provide an incentive for faster payments, they reduce your receivables. For example, you might offer a refund or credit if products are defective, damaged in delivery, or late in arriving. And a discount is usually an incentive to pay faster. The customer might receive up to a 2% rebate for paying in 10 days instead of the standard 30 days.

Example:

- Allowance for damaged goods: You had $300 in damaged goods, reducing your net AR by that amount.

- Early payment discount: A customer paid early on a $4,000 invoice, qualifying for a 5% discount. This means they received a discount of 5% off $4,000, which equals $80.

These total $380, which reduces your gross AR from $13,000 to $12,620.

Learn more about accounting for sales discounts.

3. Accounting for bad debt

Bad debts are a fact of life when doing business on credit. This is how you can factor bad debts into your calculation to see what portion of your gross AR is realistically collectible:

Example:

If you estimate $400 of the debts are bad, you adjust your net AR to $12,220.

Net accounts receivable calculation example

Let’s walk through a potential NAR calculation using real numbers to wrap up everything we’ve covered in the previous section.

Assume that your company has a gross AR of $15,000 for the sale of a batch of electronic goods. Some of these goods—say, a shipment of headphones valued at $1,500—arrived late or were damaged upon delivery, so you allow a deduction for them. And one customer who ordered a batch of tablets worth $7,000 pays for the order in 10 days, earning an early payment discount of $140. Lastly, another customer has bought accessories worth $1,000 but doesn’t pay for the merchandise; this you write off as bad debt. Each of these eventually adjusts your gross AR, reducing that total to show a truer, collectible value.

Keeping in mind the formula when calculating net accounts receivable:

NAR = Gross accounts receivables – (Allowances + Discounts) + Bad debt

Here’s how you would calculate your NAR:

$15,000 – ($1,500 + $140 + $1,000) = $12,360

In this example, your net AR is $12,360. This amount is what you realistically expect to collect in cash.

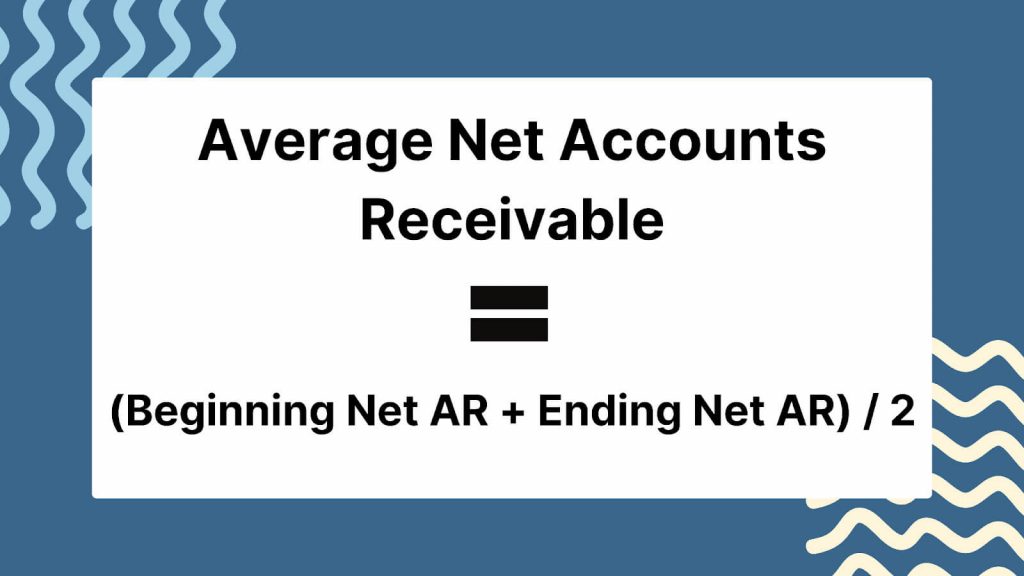

Calculating the average net accounts receivable

We’ve already discussed how to calculate NAR, but what about the average net accounts receivable formula? To find it over a given period, one would consider both the beginning net AR and the ending net AR.

- Beginning net AR describes the total collectible receivables at the beginning of any given period that one might choose to investigate, usually the first day of a month or quarter.

- Ending net AR is the amount at the end of that period or, to use a very similar example, the last day of the month or quarter.

To calculate the average net accounts receivable, you take the beginning and ending net AR amounts, add them together, and divide by two. This average gives a better view over time of cash flow, smoothing fluctuations throughout the period.about its cash management and credit policies.

How to calculate accounts receivable: Average net AR formula

Why net accounts receivable matters

Tracking your net accounts receivable is critical to the health of your company in terms of cash flow. Here’s why it matters to your business:

1. Smarter cash flow control

Cash is the lifeblood of any company; without it, everything can stop. NAR helps you project how much cash is coming in and out, when you’ll have it on hand to pay wages, rent, and inventory – and other obligations.

2. Effective management of credit

NAR can help you determine the efficiency of credit policies and revise them, if a large percent of gross accounts receivable is estimated to be uncollectible. If customers regularly delay payment or default, a consistently low NAR percentage means that the credit terms should be made more stringent.

3. Understanding financial health

A considerably lower NAR compared to gross accounts receivable could reflect issues with your short-term financial health. Keeping track of Nar helps in the early detection of financial warning signals and enables timely corrective action.

4. Knowing your unrecoverable payments

NAR analysis will help in identifying either patterns in non-paying customers or weaknesses in the collection process, thus offering insights to improve cash flow.

Best practices for managing net receivables

Following are a few best practices that would help optimize your cash flow and reduce the risks of bad debts.

- Run AR aging reports regularly: Use AR aging reports to get a snapshot of overdue payments and track how long each receivable is outstanding. This can help you spot trends and identify potential collection issues early. By regularly analyzing these reports, you can take proactive steps to follow up on overdue invoices and keep your cash flow stable.

- Establish clear credit policies: Create well-defined credit policies before extending credit to clients. This includes setting credit limits, payment terms, and interest on overdue accounts. Clear guidelines help mitigate the chance of late payments and bad debts and ensure that only clients who meet your criteria receive credit.

- Encourage early payments: Offering early payment incentives can help speed up cash flow. Discounts or rebates for customers who pay within a set period (e.g., within 10 days instead of 30) motivate timely payments and reduce AR aging. It also strengthens customer relationships and provides more predictable income.

- Automate your AR management: Implement automation to streamline your AR processes, from sending invoices to following up on overdue payments. AR automation can reduce manual errors, minimize fraud risk, and save time. Automated reminders can be sent at different intervals to ensure timely collections and free up your team to focus on more value-added tasks.

How Synder simplifies the management of accounts receivable

Let’s face it, accounts receivable management can be such a drag when trying to pursue it manually across several platforms. That’s where Synder comes in, helping automate and simplify your accounts receivable processes.

Here’s how Synder can make accounts receivables management a lot easier:

- Auto invoice importing: Synder imports your invoices from your payment platform like Stripe and into your accounting software like QuickBooks. No more system hopping or manual entry!

- Real-time tracking of the payments: The tool instantly updates your AR balance as it receives any payments. You’ll always know who’s paid and who hasn’t paid to manage your cash flow.

- Overdue invoice alerts: Synder automatically notifies you regarding upcoming or overdue invoices for easier follow-up with customers and keeping your net account receivables in order.

- Instant AR reporting: Looking for an instantaneous snapshot of your net AR? Real-time reporting from Synder provides at-a-glance insight into your accounts receivable, bad debts, allowances, and more.

- Multicurrency support: Selling internationally? No problem: Synder automatically converts currencies based on the conversion rate from your payments processor or accounting company. This will show you the most accurate accounts receivable information available, no matter where customers are located and help you avoid errors caused by fluctuating exchange rates.

Ready to take control of your AR? Give Synder a try with our 15-day free trial or join the Weekly Public Demo to find out how this robust accounting software can ease managing company finances.

Related read: Accounts Receivable Automation Software.

Conclusion: Why accounts receivables calculation is the key to success for your company

Calculating your net receivables is the easiest way to see how much of your revenue will actually land in your account. Regularly tracking your net accounts receivable keeps your cash flow smooth, your credit policies solid, and your financial health in check. And the best part? Tools like Synder can automate this process, making your financial management effortless.

Share your thoughts

We’d love to hear from you! Share your thoughts on this article. Do you have any questions or experiences to add? Let us know below!

Thanks for the article! This net accounts calculation knowledge will be useful for my own expert financial advice UK business.

Thanks for your comment, David!