Stripe is a payment processing provider that makes it easy to take payments online; but there could be hidden fees and costs nibbling away at your bottom line. Red flags like rising transaction fees, chargebacks, and refund costs could identify selling at a loss.

Here at Synder, we organized and held a webinar to help you identify what exactly kills your profits, spot these red flags early, and make strategic changes. From this comprehensive summary of the webinar you’ll learn – with real-life case studies and expert tips – how to make sure that you’re not losing money.

Our guest speaker for this session was Anna Murphy, CEO and President of Murphy & Associates Consulting. Having been in the industry for over a decade, she knows the ins and outs of business finances, particularly those for digital companies. Anna’s team outsources bookkeeping services that help businesses timely file taxes and maintain their documents in the best order for being audit-proof against the IRS. Let’s get started and protect your profits!

Key takeaways:

- Change your strategy based on your financial and customer feedback.

- Keep track of Stripe transaction fees, chargebacks, and hidden fees to help safeguard your bottom line.

- Catch issues early by using Stripe reports like Revenue Recognition and Payout.

- Consider all the fees to ensure pricing covers costs and doesn’t lose money.

Contents:

What does it mean to sell at a loss?

Anna Murphy started the discussion by describing what selling at a loss actually entails. In very simple terms, it means if it costs more to deliver your product or service than what you’re earning from it, then you’re selling at a loss. That’s what she called it:

“Selling at a loss basically means that your sales are coming in, but it costs more to fulfill that than it is, you know, making a profit. So for example, if you’re selling a product or a service for a hundred dollars, but it’s taking you $120 to service that product or fulfill that product, then you’re basically selling at a loss.“

This is, of course, a common problem for especially new businesses that might not be aware of all the costs that would come in, especially those sneaky fees that come with using platforms such as Stripe.

Spotting the red flags

Throughout the webinar, Anna highlighted some of the key red flags that may signify your business is losing money. These are things you’ll want to know upfront to avoid bigger financial troubles later on.

1. Chargebacks and refunds

“A lot of chargebacks and customers asking for refunds are big red flags,” said Anna. These usually indicate that something else is wrong, such as wrongly priced products, poor product quality, or targeting the wrong markets.

These repeated chargebacks may also lead to an irreversible consequence regarding your relationship with payment processors like Stripe, where they may apply financial punishments or suspend your Stripe account altogether.

2. Unaccounted transaction fees

Another common issue involves not factoring into one’s pricing Stripe transaction fees. Keep in mind that Stripe is a business too, and they’re going to charge transaction and processing fees. You want to make sure you have those figured into your costs so that you’re not selling yourself short and losing profitability.

Without guidance, mentorship, or an accountant who can help businesses make sure their pricing is right, it’s very easy to end up selling at a loss when you’re starting out.

Stripe fees

Stripe fees depend on which payment type and method you select.

| Payment method | Fees |

| Online (Cards/Digital wallets) | 2.9% + $0.30 per transaction |

| In-person (Stripe Terminal) | 2.7% + $0.05 per transaction |

| ACH credit transfer | $1 per payment |

| ACH direct debit | 0.8% per transaction (capped at $5) |

| Wire transfer (ACH credit payment) | $8 per payment |

| Wire transfer (USD payment) | $15 per payment |

Other charges that apply for transactions outside the U.S. include 1.5% per international card transaction with a further 1% of the amount to convert to currency (if the transaction needs it), and a further 0.5% if card information is keyed in. There are additional charges for disputes and payment fails, such as $4 for each failed ACH direct debit transaction and $15 for each disputed ACH debit or disputed card transaction.

3. Inadequate integration with accounting software

One of the most important things is to properly integrate Stripe with your accounting software. “Having the proper integrations for your bookkeeping is key,” Anna emphasized. “That would mean when businesses get paid through Stripe, for instance, charging $100, Stripe may take, say, $5 for processing and deposit $95 in the bank account. What happens is that most businesses don’t record that 5-dollar fee in their books ahead of time before it posts. Because of this, I see too many new businesses miss out on valuable tax deductions from those fees because their bookkeeping isn’t set up right.”

How to keep track of your profitability on Stripe

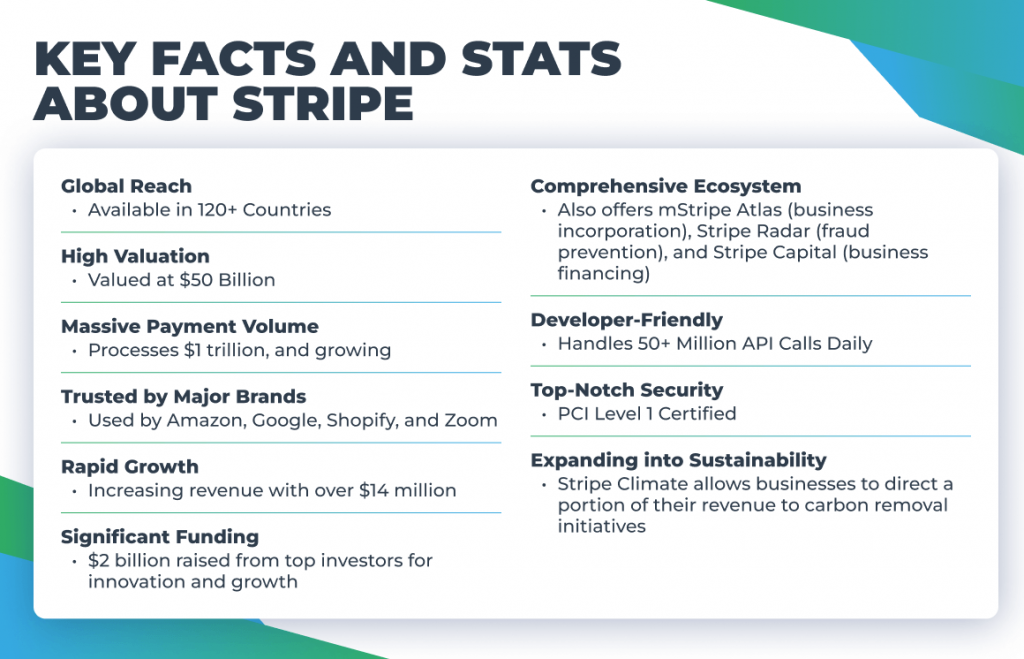

Stripe has many great features, making it one of the leading recommendations in POS systems for business owners. Among several ways to take advantage of that, it hosts many reporting tools.

- Check your revenue recognition report

One of the most important tools Anna discussed is the revenue recognition report. This report helps you see how profitable your products or services are after accounting for all fees, making it essential for understanding your business’s financial performance.

Discover how to maximize revenue recognition efficiency for a subscription-based business.

- Check payout and sales reports

You should also go through payout and sales reports on a regular basis. These reports show you which products or services are gaining money and which ones can pull you down. With such data analysis, you may make informed decisions to increase profitability while reducing losses at the same time.

Spotting and fixing losses: Case studies

During the webinar, we shared real-life examples of businesses spotting red flags that signaled selling at a loss. By leveraging Stripe data, they were able to identify these issues early and adjust their pricing strategies and operations, leading to improved profitability.

Case study 1: Fixing high refund rates

A digital business got stuck with an extremely high refund rate and, correspondingly, chargebacks were eating hugely into its profits. After Anna’s team dug deep enough into the data, they found out that the problem wasn’t at the core product but at the market the business had been targeting. It means that the business was selling to an audience that either couldn’t afford the product or didn’t understand the value of it, so they constantly asked for refunds and issued chargebacks.

Chargebacks carry very high fees and further increase the burden on the business’s bottom line. As Anna mentioned, chargebacks don’t just cost a business revenue; there are additional Stripe fees, typically $15 per chargeback, which makes chargebacks even more destructive than refunds.

Anna explained, “We helped them pivot to a more appropriate target market.” This simple change had dramatic consequences: refund rates fell dramatically, chargebacks were reduced, and the business saw a noticeable uptick in profitability.

What this case study points out is how important it is to know your market and be willing to adjust course when the data indicates that your current strategy simply isn’t working.

It also underlines how important it is to scan your sales data and consumer behavior periodically. If not for these insights, this business may have moved in the same direction and might have never known what actually had gone wrong. Digging deep into the data and making better decisions helped this company revive and boost its bottom line.

Case study 2: A subscription service success

A subscription-based business faced the problem of high churn and profitability. The business was selling monthly subscriptions and suffering from customers quitting too fast, thus contributing to bad customer retention performance and making the business operate at a loss.

Equipped with the robust analytics tools that Stripe offered, Anna’s team was able to deep dive into subscription data: customer lifetime value metrics, churn rates, and other factors regarding overall profitability. According to the data, this business charged for its service at a price that did not correspond to the perceived value their customers placed on it. The customers were not staying long enough to make the business profitable; it was a situation when they were spending more on gaining and servicing customers than what they received from them.

In light of these, Anna, along with her team, made some strategic changes in the business:

- Pricing strategy tweaking: The business had to relook at its pricing strategy to correctly reflect value, ensuring it was competitive but viable. It increased the price slightly to absorb transaction fees, improving margins without being expensive to customers.

- Improved customer retention: Besides revising the pricing, Anna’s team helped the business with better practices regarding customer retention. They introduced incentives such as discounts for long-term commitments and also enhanced the onboarding experience for customers to see the value of the service right from the beginning.

Anna added, “We looked at the data, readjusted the pricing strategy, and put better customer retention in place.” The result was the radical improvement in the overall health of the business: not only did the churn rates drop but, with the increase in customer lifetime value, the business evolved from running at losses to steady profits.

This case study is a perfect example of using data to make business decisions, especially in subscription-based models. Ongoing monitoring of key metrics, such as churn rates and customer lifetime value, helps businesses understand where informed changes should be made before problems become too costly. Through some fine-tuning of the pricing model, focusing on how to retain customers longer, this subscription-based business was able to turn an overall dire situation into a success story.

Best practices to keep your business profitable

In today’s business world, it’ll take a lot more than good products to keep your profits on track. Following are some of Anna’s best tips to help you stay ahead of the game, avoid pricey mistakes, and keep that bottom line healthy.

1. Get your pricing right

Make sure your pricing covers all your costs, including those Stripe merchant fees. Anna advised adding a percentage to your prices specifically to cover these fees so you can stay profitable.

2. Be ready to pivot

“If you’re doing something and it’s not working, pivot quickly,” Anna advised. Being flexible and willing to change your strategies based on financial data and market feedback is key to staying profitable.

3. Monitor your finances regularly

Keep a close eye on your financial statements and be on the lookout for red flags like chargebacks and refunds. Spotting these issues early allows you to make adjustments before they turn into bigger problems.

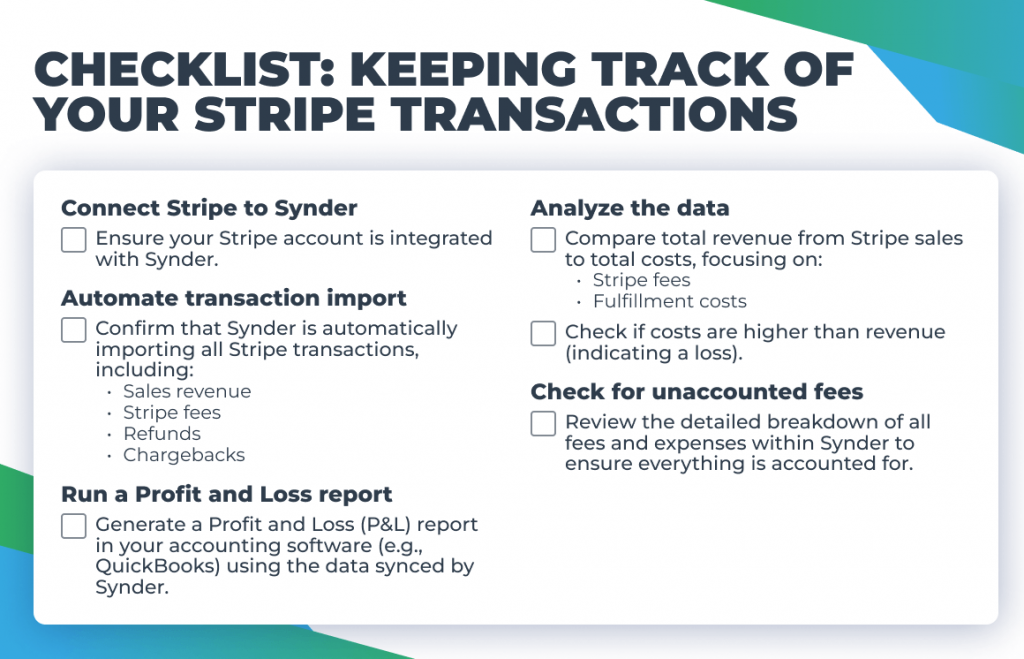

4. Integrate your tools

Using tools like Synder to integrate Stripe with your accounting software can help prevent financial mistakes and ensure all transactions are recorded correctly. This is how Anna puts it:

“Having a third-party app like Synder is going to be helpful because Stripe doesn’t have a direct integration with QuickBooks. And therefore, if you’re looking at your Profit and Loss report in your accounting software, but you don’t have it properly communicating everything that needs to be communicated, your refunds, your chargebacks, and all that stuff, you’re missing a lot of data.“

What’s Synder?

Synder is an easy-to-use accounting tool that helps businesses keep their finances in order without the usual headaches. It automatically records transactions from platforms like Stripe, PayPal, and Shopify, syncing everything up with popular accounting software like QuickBooks.

This is what Anna points out:

“Synder allows you to basically bring all that data together in one place and then send it to your QuickBooks software… It allows you to be able to integrate all that data into one source and then it pushes all that information into your QuickBooks.“

This means you don’t have to spend hours manually entering data or worrying about mistakes. With Synder, your financial records stay accurate and up-to-date, making it simpler to manage your cash flow, reconcile accounts, and get ready for tax time. It’s especially handy for ecommerce businesses and accountants who want to save time and keep things running smoothly. “Anytime we onboard a digital online business and they’re using more than two POS systems, we always recommend Synder to them. So that’s one of our top ones,” says Anna Murphy.

Keep your accounting flowing with Synder! Sign up for our 15-day free trial or join our Weekly Public Demo to discover more ways Synder can benefit your online sales business.

Synder’s bonus: How to lower Stripe fees

In the case of Stripe transaction fees, some of the ways through which businesses can try to reduce Stripe fees include the following:

1. Increasing transaction volume

If your business is processing more than $500,000 in transactions annually, chances are you’ll be able to negotiate directly with Stripe for a lower rate on transaction fees. The bigger the business, the more negotiating power they have; some businesses are even able to lower fees down to 2.2% and lower, based on volume.

2. ACH payments

The fees for an ACH payment are lower than credit card transaction fees. Stripe charges 0.8% per ACH transaction with a cap of $5 maximum, which will considerably reduce costs upward of larger payments.

3. Optimization of payment methods

Credit card transactions generally have a fee of 2.9% + $0.30 per transaction, whereas the debit card or bank transfer fees can be as low as 0.8% with a cap of $5 for ACH. By encouraging your customers to pay through debit cards or bank transfers, you’re reducing the amount of money lost in fees per transaction.

4. Using minimum transaction amounts

Establish a minimum purchase amount, such as $10.00, to help lessen the impact of fees for low purchases. This is because with any transaction, you usually pay a fixed charge of $0.30 in addition to a percentage, perhaps around 2.9%, depending on credit cards. The smaller the purchase, the more this eats into your profit, so limiting low-value transactions will save you money over time.

5. Passing fees to customers

Some jurisdictions allow companies to bill the ultimate customer an additional amount that’s typically within the range of 1.5% to 3% of a credit card transaction to offset their credit card payment processing fees. In some areas, you’ll need to check whether or not it’s legal to do so because of laws prohibiting surcharging. This happens to be a rule at least for states like California and New York within the United States.

6. Batch payments

When possible, combine several small transactions into one larger payment. For example, instead of processing three $20 payments at 2.9% + $0.30 each, you can batch those into a single $60 payment. This cuts down the number of fees charged and, in turn, reduces your overall transaction costs.

7. Avoiding unnecessary refunds or chargebacks

Chargebacks usually involve an extra $15 charge for each instance, but you still have to pay the original transaction fee once you refund a transaction. For example, 2.9% + $0.30. You can avoid as many disputes as possible by having a clear refund policy in place, great customer service, and offering appropriate products that meet customer expectations, thus reducing these charges.

Conclusion

So what’s the bottom line? Staying on top of your Stripe transactions is vital to avoid losing money. Knowing all the hidden fees, chargebacks, and regularly reviewing key financial reports will help protect your profits. By taking control over these things, you’ll be in a better position to understand the actual health of your business and prepared for making informed decisions. Take the initiative, make all necessary changes, and always work toward keeping strong financial stability – it’s the key to long-term success.