When choosing a payment processor for your business, you want it to be secure, reliable, and convenient to manage for you as a merchant, as well as easy to use for your customers. What’s more, as payment processing services usually charge merchants or their customers for receiving or making payments, you might want to be aware of all the fees and charges applied that impact your revenue.

Stripe is one of the payment processors with a pretty transparent fee structure. It’s one of the reasons many businesses choose Stripe over other payment systems. In this article, we’ll take a closer look at Stripe as a payment system, some of its pros and cons for merchants, and break down the fees a merchant might face depending on the character of their business operation.

Make every transaction count:

Get your Stripe guide! 📖

Dive deep into the world of Stripe, understand the nuances of payment processing, and learn how to harness this knowledge to enhance your profitability. Download our guide now!

Keep reading to learn more about:

2. What are the pros and cons of Stripe for businesses?

3. A guide to Stripe payment processing fees for business owners

4. Why is understanding Stripe fees important to business owners?

5. How to record Stripe fees in accounting

What is Stripe?

Let’s first take a quick look at Stripe as a payment system and what services it offers to businesses.

By nature, Stripe is a payment processing platform that allows businesses to receive payments for their goods and services from customers using various payment methods. Founded in 2009, Stripe offers payment processing software and application programming interfaces (APIs) that allow the implementation of a payment gateway into e-commerce websites and mobile applications.

How does Stripe work?

Stripe aims to simplify payment processing for businesses, offering a platform one can easily set up and manage. We’ll go through the steps it takes to process payments with Stripe so that you better understand how the system works.

- To start using Stripe as a payment processor, you need to register a Stripe account and connect it with your website or mobile app checkout page (through the Stripe API).

- Once a customer makes a purchase, they go to the checkout form where they can enter their financial data (such as their credit card details, etc.).

- The Stripe payment gateway verifies the data, making sure the funds are available and enough for making the purchase.

- Then Stripe processes the payment, withdraws its fees, and sends the rest to the merchant’s account.

- Ultimately, the merchant receives the payment, and a confirmation is sent to the merchant and the customer.

What businesses can benefit from Stripe most?

While Stripe had previously aimed at businesses that accepted online payments only, in 2019, the company introduced Stripe Terminal, its point of sale service, offering physical credit card readers for in-person payments. This way, Stripe became available for offline businesses and merchants. So today, Stripe can help various companies process their financial transactions, including ecommerce, online/offline retail, B2B/B2C platforms and marketplaces, SaaS, non-profits, etc.

However, Stripe can be the best fit for businesses that mostly sell online, sell internationally, and have software developers on the team to take care of the implementation and customization of the checkout.

What are the pros and cons of Stripe for businesses?

Just like everything else in the world, Stripe has its advantages and disadvantages. And now, we’ll take a look at what makes Stripe one of the most popular choices for businesses, and some of the potential hardships they can face while using the platform.

Stripe pros

Stripe offers a wide range of payment methods which include credit and debit cards, ACH payments, Buy Now Pay Later, and numerous local payment methods in foreign markets. Stripe also helps accept payments from mobile wallets, such as Apple Pay, Google Pay, and more.

Stripe features strong support for multiple currencies. Stripe allows payments in more than 135 foreign currencies, which makes it a perfect fit for businesses selling abroad.

Stripe enables its users to accept and manage recurring payments, which is something that makes Stripe suitable for a wide range of subscription-based businesses.

Stripe undertakes impeccable security measures. Stripe features HTTPS for secure connections on both the website and the back end. All the financial data gets encrypted. Stripe’s infrastructure for storing, decrypting, and transmitting card numbers runs in a separate hosting environment and doesn’t share any credentials with its primary services, such as API and website.

Stripe features advanced reporting tools available for merchants. Stripe’s merchant dashboard allows users to keep an eye on all the transaction data, giving businesses an overview of their sales. This way, Stripe makes the decision making processes for businesses much easier.

Stripe offers a high level of customization, which enables businesses to go the extra mile and provide customers with a better checkout experience and also tweak it to answer peculiar business needs.

Stripe boasts numerous integrations. Stripe can integrate with the most popular accounting software and many other useful products out there to help merchants facilitate the management of their businesses. One can easily find a needed solution at the Stripe app marketplace.

Stripe has customizable plans and discounts, which are available for businesses featuring large payments volume, high-value transactions, or unique business models, including large-volume or multi-product discounts, country-specific rates, interchange pricing, etc.

Stripe boasts a straightforward fee structure. This is what distinguishes Stripe from many other payment processing providers. There are no hidden fees or complicated calculations in Stripe. Moreover, the fees that Stripe charges for processing payments are generally lower, compared to most of the competition. We’ll get to breaking down the Stripe fees just a little later.

Stripe cons

With all of the virtues of Stripe described above, the system still has some drawbacks one might want to be aware of and provide for before making any commitment.

Stripe is developer-oriented. Stripe provides a lot of documentation about how to customize things. Depending on how you look at it, it might be an advantage. However, for non-tech-savvy people, some of those great features might not be available due to the lack of necessary skills. So, if you believe you might need something different from a standard checkout experience, you might want to hire a developer to fulfill this task.

Setting up the Stripe payment gateway might be hard for the same reason. Basically, Stripe does provide an instruction on how to perform the implementation. However, for a non-developer, that may be time-consuming. So again, it might be wiser to leave this to a professional to ensure flawless execution.

Stripe has an in-person payments limitation, which can be a significant drawback for businesses that sell their services or products both online and offline. While Stripe Terminal, a physical card reader service, was introduced, its use is still limited and not widely available.

A guide to Stripe payment processing fees for business owners

Now, let’s get to the fees Stripe charges users for processing their payments. As it was previously mentioned, the structure of fees is a Stripe’s distinctive feature that makes it stand out from its competition.

Basically, Stripe has two pricing plans available for businesses, such as Integrated and Customized.

The Integrated plan is a standard plan that features flat-rate processing fees for each transaction, which is convenient for businesses, as they know how much they owe Stripe per transaction. The rates can differ based on a chosen payment method and the character of a business.

The Customized plan goes with custom pricing (which is quite obvious) that can be agreed between a business and the Stripe team. Usually, the Customized plan suits businesses with high-value transactions or high volumes of transactions, or to some unique businesses with peculiar needs. That’s why this plan often comes with various types of discounts, such as volume or multiple product discounts, etc.

We’ll break down Stripe fees within the Integrated plan, as it’s more widely used.

1. Stripe setup or monthly fees

Integrated pricing means no setup fees or monthly fees. Stripe charges businesses per each successful transaction processed.

2. Stripe fees for cards

Credit and debit cards are the world’s most popular payment methods. Stripe allows online payments by credit and debit cards, and charges processing fees of 2.9% + $0.30 per successful transaction. Starting November 10, 2022, an additional 0.5% is taken for manually entered cards.

For international cards, there are additional fees of 1% as well as 1% for a currency conversion (when required).

3. Stripe fees for mobile wallets

Wallets eliminate the need for customers to manually enter their card and billing information, offering a quick and convenient way to pay. Stripe supports payments with Apple Pay, Google Pay, Alipay, and more.

Stripe fees for wallets comprise 2.9% + $0.30 per transaction.

4. Stripe fees for in-person payments

If customers make in-person payments through Terminal, the fees will include 2.7% + $0.05 per successful transaction.

5. Stripe fees for bank debits and transfers

Stripe enables businesses to collect payment for subscriptions or large transactions. It reconciles credit transfers, wires, and checks to their outstanding invoices.

Here’s the breakdown of Stripe fees for processing bank debits and transfers:

- $1.00 per ACH Credit payment;

- $8.00 per Wire payment;

- $5.00 per each individual Check received (regardless if multiple checks are used to pay a single invoice);

- $15 per returned (bounced) Check;

- 0.8% capped at $5.00 for standard settlement of an ACH Direct Debit payment;

- 1.2% for a two-day settlement of an ACH Direct Debit payment;

- $1.50 per instant bank account validation;

- $4.00 is also charged for failed ACH Direct Debit payments;

- $15.00 charged for disputed ACH Direct Debit payments.

6. Stripe fees for international payment methods (aka additional payment methods)

Stripe works in 46 countries, including Canada, Brazil, Japan, and Croatia, powering payments for businesses and customers. It also accepts more than 135 currencies, enabling companies to set prices in their customer’s home currencies and automatically collect taxes in 30 countries.

Stripe charges businesses the fees of 1.5% for international payments and 1% for currency conversion on top of the international payment processing fees that differ for various payment methods in various countries.

Here’s the list of fees for foreign payment methods that Stripe supports:

| Payment method | Price |

|---|---|

| Bancontact | 1.4% + $0.30 |

| EPS | 1.6% + $0.30 |

| giropay | 1.4% + $0.30 |

| iDEAL | $0.80 |

| Multibanco | 2.95% + $0.30 |

| Pre-authorized debits in Canada | 1% + $0.30 capped at $4.00;+$0.80 fee applies per instant verification;$4.00 is charged for failed or disputed pre-authorized debit payments. |

| Przelewy24 | 2.2% + $0.30 |

| SEPA Direct Debit | 0.8% + $0.30 capped at $6.00$10.00 is charged for failed or disputed SEPA Direct Debit payments. |

| Sofort | 1.4% + $0.30 |

7. Stripe fees for processing Affirm, Afterpay, and Klarna payments

Affirm, Afterpay, and Klarna are payment methods that allow customers to split payments into several settlements.

Stripe supports adaptive checkout with both Affirm options, namely Split Pay and Installments. The former allows for making an online purchase by spreading the cost over four interest-free installments.The latter offers customers up to 36 months of credit.

Stripe also works well with two Klarna payment options: Pay in 4 installments and Financing (access to the latter is available upon inquiry with the Stripe team).

Here’s the breakdown of Affirm, Afterpay and Klarna fees on Stripe:

- Stripe payment processing fees for Affirm equals to 6% + $0.30.

- Stripe fees for processing Afterpay payments in 4 installments or 6-12 monthly installments is 6% + $0.30 (the fee is assessed only after a successful payment).

- Stripe payment processing fees for Klarna include 5.99% + $0.30 per each successful 4-installment payment and 2.99% + $0.30 for the Financing option.

Here, we tackle only payment processing fees. However, Stripe offers a bunch of other useful services, such as billing, invoicing, payment confirmation with the 3D Security option, and more. Depending to what other services a business might want to use, Stripe applies additional fees.

Why is understanding Stripe fees important to business owners?

We mentioned that Stripe’s structure of fees is transparent and simple. But why is that so significant to understand? How do the fees that you pay to a payment processor affect your business?

How does knowing how much you owe in fees affect your business?

First, such fees directly impact the understanding of business profitability and pricing strategy. When you know how much a payment processor like Stripe charges you on every transaction, you can more clearly see and predict your profit from sales.

You can also set prices for your products and services to preview the fees, thus passing your Stripe fees on to your customers. However, before doing so, please ensure that it’s not against the law (in some jurisdictions, for example, in Europe, it can be prohibited, so please, in case you’re uncertain, consult with a lawyer).

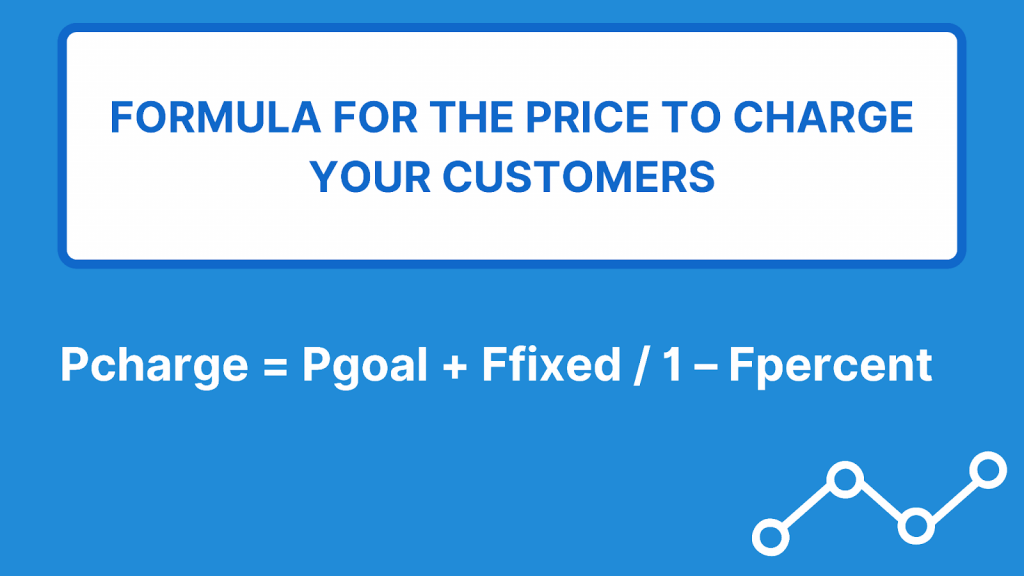

To accurately calculate the price to charge your customers, you can use this formula:

Here, P charge is your final price, P goal is the amount of sale you want to get after the fee is taken. F fixed is the fixed fee, including the VAT/GST, and F percent is the percent fee, including the VAT/GST.

How to record Stripe fees in accounting

Another critical thing about Stripe fees is that you need to accurately reflect them in accounting. First, it impacts the accuracy of financial statements, and consequently, financial forecasting, planning, and other important business decisions. Moreover, it helps correct tax filing. Stripe fees are, by nature, expenses, and they can be tax deductible, so it’s critical to correctly categorize them in accounting.

Here’s an example of how to categorize Stripe fees in QuickBooks Online:

1. First, you might need to set up a separate expense account in your QuickBooks chart of accounts. To do so, you Click on Accounting in your QuickBooks dashboard and select the Chart of Accounts. On the page that appears, click the New button in the upper-right corner of the page.

2. Now, you need to choose the account type. In the pop-up window that appears, you simply select Expenses from the drop-down list in the Account type field.

3. Name your account by filling in the Account name field. You can put in something like “Stripe Fees” just to be able to distinguish this one from other expense accounts. You might also want to select Other business expenses or Bank charges as a sub-category in the Detail Type field.

4. Click Save and Close, and that will be it.

This way, you’ll have a separate account to record all your Stripe fees when bookkeeping for your Stripe transactions. It’s essential to remember that you’ll need to record the full amount of sale on the income account together with creating a new expense equal to the Stripe fee amount applied to this sale in the corresponding account in your QuickBooks.

This is how you do it manually, which, basically, can nicely work for you if your business doesn’t have many transactions. With larger volumes of transactions, it becomes more risky and error-prone to go with manual bookkeeping, so you might want to automate the process to save time and ensure more accuracy of the records. At this point, you can integrate Stripe with QuickBooks or other accounting platforms that you use to facilitate and protect from errors the import and categorization of transaction data in accounting.

A great benefit of such integration can be that the import might run on autopilot, as the software used to provide the integration usually can recognize transaction details and automatically categorize them.

Look deeper into our Stripe vs PayPal comparison article!

Stripe fees: The wrap up

Today, Stripe is arguably one of the best payment processing systems for e-commerce and online businesses that have a high volume of sales transactions, including subscription-based businesses. It’s super safe, protecting both businesses and consumers from fraud. Stripe gives merchants a comprehensive overview of their sales and allows for creating customized checkout experiences helping to decrease the number of checkout bouncing and thus, improving sales.

On top of that, Stripe’s fee structure is very transparent and easy to understand, which makes it much easier to record Stripe fees in accounting, either manually or automatically, after integrating Stripe with an accounting software a business might use.

Synder can help integrate Stripe with the most popular accounting systems, such as QuickBooks or Xero, to automatically record and categorize business transactions from Stripe, including fees. This way, you can always have correct accounting reports and accurate books ready for reconciliation and tax filing.

Book a seat at our webinar to discover Synder’s functionality and ask any questions about Stripe integration.