A sound financial strategy is the driving force every successful business operates by. Creativity, interaction with clients under certain economic conditions, streamlining all the business processes and utilizing investment opportunities – all that demands professionalism and decision-making skills. And all that can be covered by a top-notch financial specialist – Chief Financial Officer or CFO.

A competent CFO guarantees that the resources of the company are used wisely, optimizing the financial flow and overseeing investment. CFOs consult the management of the company on choosing the right financial strategy to succeed and thrive. Seems like there’s nothing to discuss here and hiring an experienced CFO isn’t really an option, rather a must. But here’s a catch: if we take a startup, a small business or even a medium-sized one (SMB), they’re likely to lack funds for hiring a full-time CFO with a high level of financial expertise.

Luckily, today the choice of a CFO isn’t limited to hiring an in-house professional. Small businesses and startups can also benefit from using the advice of an experienced C-suite professional by using the services of fractional or virtual CFOs. In this piece, we’re going to focus on fractional CFO services, as well as the difference between fractional and virtual CFOs.

Contents:

3. Benefits of hiring a fractional CFO

- Financial expertise

- Scalability and flexibility

- Cost-effectiveness

- Fresh perspective

- Validation of the business model and profitability of the product line

- Financial forecasting

- Business partnership

- Raising capital

- Identifying ERP and related infrastructure needs

4. What’s the difference between a virtual CFO and a fractional CFO?

5. Bottom line

What is a CFO?

CFO or Chief Financial Officer is a C-suite position which specializes in analyzing and managing cash flows of the company. The responsibilities of this position include bookkeeping, financial planning and reporting, and investment programs. In today’s business world, the responsibilities of a CFO shifted from reporting to fostering informed decision-making and generally overseeing all the financial operations of the company.

When talking about C-suite professionals we have to admit that the salary they deserve based on their input is beyond the budget of startups, small companies, and sometimes medium-sized businesses. According to salary.com, a median CFO salary in the United States is about $437.000 as of December 23, 2023. That’s why the range of CFO services today includes various cost-effective solutions we’re going to look at briefly.

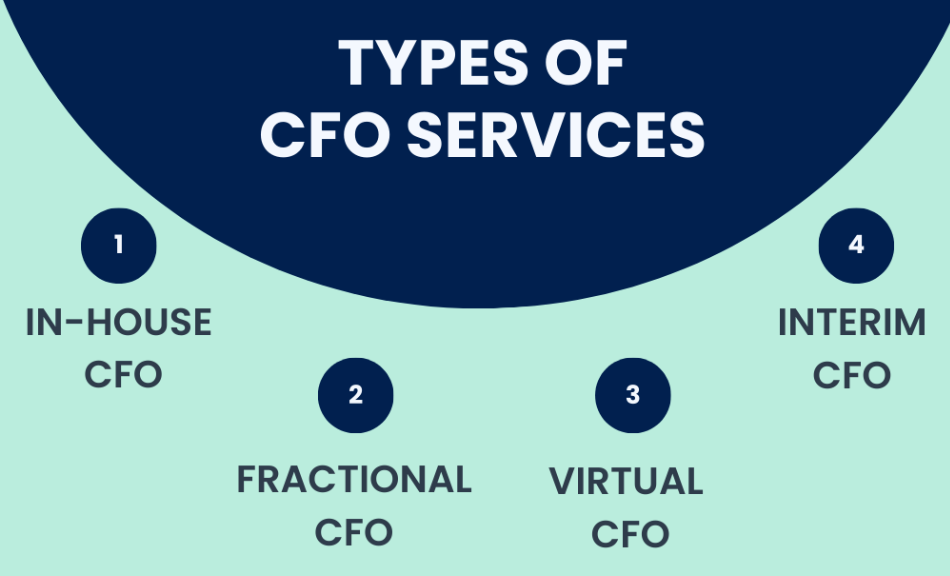

Types of CFOs

There are a number of ways that provide successful collaboration between CFO services and businesses, each having its own benefits, and some overlapping with others.

Full-time CFO

The very basic and coming to mind first, a full-time or in-house CFO provides its services based on a full-time contract. This option is for companies with annual revenue of $10 million or more. In this case, a CFO normally works in the office and handles all financial issues going their way.

Fractional CFO

A fractional CFO divides their working day between their clients, working part-time for each of them. A fractional CFO service is a good option for early-stage companies or companies with annual revenue under $10 million.

Interim CFO

Interim CFOs might provide part-time or full-time services for a certain period of time, most often from one month to a year. So in this case, financial assistance is provided over a limited time.

Virtual CFO

A virtual CFO is often known as an outsourced CFO. The main idea of a virtual CFO lies in the very name “virtual” – they provide services remotely via phone/web calls.

Full-time, fractional and interim CFOs can as well be virtual. Because of such overlap in functions and types, CFO titles might be used interchangeably, while CFO services today are developing to cater to various needs of their clients. So the financial service options are available to all kinds and sizes of businesses.

Benefits of hiring a fractional CFO

As we’ve already mentioned, a fractional CFO serves a number of companies simultaneously, providing financial services, business insights and data on an as-needed basis. A fractional CFO represents the trend of specialization and personalization in financial consulting, as fractional CFO services aim to meet the changing needs of their clients. These needs may vary from investment consultation to moving into a new tax system. In a nutshell, fractional CFOs can help a business identify and solve financial problems.

Hiring a fractional CFO offers a number of benefits for businesses of all sizes, but especially growing businesses. Let’s first look at the key advantages:

1. Financial expertise

By hiring a fractional CFO, you get access to the expertise of a top-tier financial professional with experience across various industries and a network of professional contacts. You can get access to expert knowledge in areas like mergers and acquisitions, or financial modeling, according to your current needs. A fractional CFO can streamline your ongoing financial system, provide strategic financial advice, implement controls, analyze risks and optimize cash flow.

2. Scalability and flexibility

Fractional CFO services can be tailored to the specific needs and demands of the client. There are options to choose working hours and days, projects that your company currently focuses on, which means you can scale your financial expertise and involvement as you need.

3. Cost-effectiveness

Obviously, a fractional CFO costs significantly less than a full-time CFO, as you pay only for their services on a part-time basis. This is especially attractive for startups and smaller businesses with limited financial opportunities. Hiring a fractional CFO allows for cutting expenses on full-time employees.

4. Fresh perspective

It’s well-known that an outsider can offer a fresh objective perspective on your financial situation, identifying potential blind spots and opportunities for improvement.

These are the most visible and tangible benefits of hiring a fractional CFO. If we take a step further and bring some expertise to the table, we’ll be able to see the real ripple effect of positive changes that hiring a fractional CFO can cause.

According to Steven Wasserman, a consulting CFO and a teacher of Finance at Bentley University, Massachusetts, early-stage companies need a fractional CFO. In his article for Forbes, he enumerates five major benefits of resorting to fractional CFO services. Let’s look closer at them.

5. Validation of the business model and profitability of the product line

Steven Wasserman argues that a fractional CFO’s duty is to assess and validate the unit economics within a company’s business model. A fractional CFO is able to define how much cash and profit are generated per unit sold, and whether all product lines are profitable based on direct costs. He points out that the job of a fractional CFO could bring about drastic changes. For example, before hiring a professional, one software company was losing a lot of money because it didn’t take into account the cost of professional services when first establishing prices.

6. Financial forecasting

A fractional CFO brings to the table financial vision. They have the ability to build a robust forecast model providing answers to crucial questions, such as: How long is the company’s cash runway? When will the company attain cash flow breakeven? How much cash is required to fund its projected growth? The example given by the author here was that a growing company had no idea that it would be running out of cash in four months, which means being default dead. An experienced fractional CFO will definitely be able to define whether the company is default dead of default alive.

7. Business partnership

Another substantial benefit is that a fractional CFO is a trusted advisor to the CEO, giving all types of financial guidance in a variety of situations. Strategic planning, product pricing, compensation plans, analysis of customer attrition – these are all the examples of business tasks that might require valuable advice from a fractional CFO. Steven Wasserman refers here to the case when a company’s sales compensation plan resulted in unintended high payouts and only a fractional CFO managed to figure the problem out.

8. Raising capital

Another benefit of hiring a fractional CFO is that they can be of help when raising money by going beyond building a financial model. Potential investors really appreciate it when they can see an experienced financial specialist at the helm building a reliable forecast model, tracking the performance and ensuring that business decisions are based on financial perspectives. Fractional CFOs can also help organize meetings with investors and develop pitch presentations. In the example Wasserman provides here, a CFO helped identify the omitted costs related to preparing the product for the new market, while the revenue from that market was already included in the revenue projections.

One of the benefits a fractional CFO brings is the evaluation of a company’s ERP (enterprise resource planning) system requirements. They help assess if the ERP used by the company is a good fit and it can handle the projected growth. A fractional CFO might as well recommend additional systems, minimizing manual work, like CRM, PIM, accounting automation and others.

As all CFOs need reliable instruments mentioned above, Synder can be a great solution when choosing an accounting integration. Synder Sync provides an automatic sync of your business’s or your clients’ transactions from multiple platforms with your accounting system reducing manual bookkeeping and accounting processes and making your reconciliation process seamless. To get to know Synder better, you can opt for a Weekly Public Demo or go for a Synder free trial to see how it can transform your business.

What’s the difference between a virtual CFO and a fractional CFO?

As it was mentioned before, because of the overlap in functions CFO titles can be used interchangeably. But if we want to distinguish between a virtual and a fractional CFO titles, it makes sense to look at the key points defining these jobs. Both are relatively new services that give small businesses, start-ups, and even medium firms access to financial expertise. But in short, the term ‘virtual CFO’ refers to the use of modern technology and remote work, while the term ‘fractional CFO’ makes an emphasis on part-time involvement.

So virtual CFOs work remotely, having access to the necessary information of your company and maintaining contact via phone calls and the Internet. A virtual CFO is often a full-time job. Fractional CFOs might as well be virtual or come for in-person meetings, but the main idea is that they work for your company part-time on a per-need basis, where you define the degree of their involvement. Fractional CFOs deliver services to multiple companies at the same period of time.

Bottom line

The role of a CFO in a company is hard to underestimate today. The growing number of fractional CFO services is a great new opportunity for early-stage companies, small and medium-sized businesses to benefit from having an experienced C-suite professional on the team. From building a solid financial forecast model to overseeing cash flows and ensuring that the company develops along a robust financial strategy are just the basic advantages of hiring a fractional CFO. However, it’s crucial to consider all the types of CFO services, weigh all the potential benefits and drawbacks and choose the option that fits your business best.

Share your experience

What is your experience with CFO services? Share in the comments below!