Environmental, social, and governance (ESG) is a growing focus for businesses, investors and auditors as sustainability practices are gaining momentum in the business world over the recent years. Businesses are increasingly encouraged to share about their ESG strategies and performance based on the demands of investors and consumers, intensified by ESG regulatory changes.

The emergence of sustainability accounting, which integrates ESG metrics into financial reporting and decision-making processes, proves that we can see a shift towards sustainability in the mindset of many people. This growing concern for environmental, social, and governance factors isn’t new and doesn’t seem to be a passing fling, rather a practice that’s here to stay.

In this article, we’re going to take a closer look at what ESG is and what it means for accountants, regulations pertaining to ESG and the benefits of introducing ESG practices in your business.

Contents:

1. What is ESG and ESG accounting?

2. Why is ESG important for businesses and public accounting?

3. The benefits of ESG accounting

5. The role of accounting specialists in the rise of ESG reporting

6. Some tax benefits of adopting ESG reporting

What is ESG and ESG accounting?

ESG or Environmental, Social and Governance criteria are a series of standards for a company’s performance used by socially and environmentally conscious investors to evaluate their potential investments. In a nutshell, these criteria help determine whether a business is socially and environmentally responsible and goes beyond just maximizing profit, which makes it worthy of investments. Initially ESG was more a concern for investors, who wanted to find the companies with the values matching theirs. Today ESG is the concern for investors, consumers, regulatory bodies, governments and companies themselves, including management and employees. ESG criteria consist of three parts:

Environmental criteria (E) show how a company works toward safeguarding the environment, which might include policies addressing climate change like minimizing the amount of carbon emissions, using renewable sources of energy and reducing waste.

Social criteria (S) are focused on the relationships with people: employees, suppliers, customers, and the communities where a company functions. Social criteria might include such factors as employee diversity and inclusion, labor practices and human rights to mention just a few.

Governance criteria (G) help measure a company’s leadership, board composition, executive pay, shareholder rights and risk management.ESG accounting, in its turn, is the process of measuring and reporting on a company’s ESG performance. Let’s look at why ESG factors are becoming increasingly important to investors and other stakeholders.

Why is ESG important for businesses and public accounting?

With ESG accounting, the traditional focus of profit-loss statements shifts towards sustainability including environmental consciousness, social responsibility and good governance. There are three clear factors proving the importance of ESG.

On the one hand, taking into account ESG factors contributes to long-term sustainability and gives the company insights into its non-financial performance, which is crucial in terms of risk management and decision making.

On the other hand, ESG accounting helps build trust with the stakeholders, including investors, customers and employees, who are more and more interested in investing, buying and working for a company with stronger ESG commitments.

According to the survey, conducted by Morgan Stanley’s Institute for Sustainable Investing in 2017, 75% of all investors and 86% of Millennial investors wanted to invest in companies which would turn their investments into a positive impact. ESG is the driving force for the individual investor’s portfolio and younger investors are more and more often requiring information on companies’ ESG performance.

Finally, governments around the globe are introducing new ESG regulations that companies have to comply with.

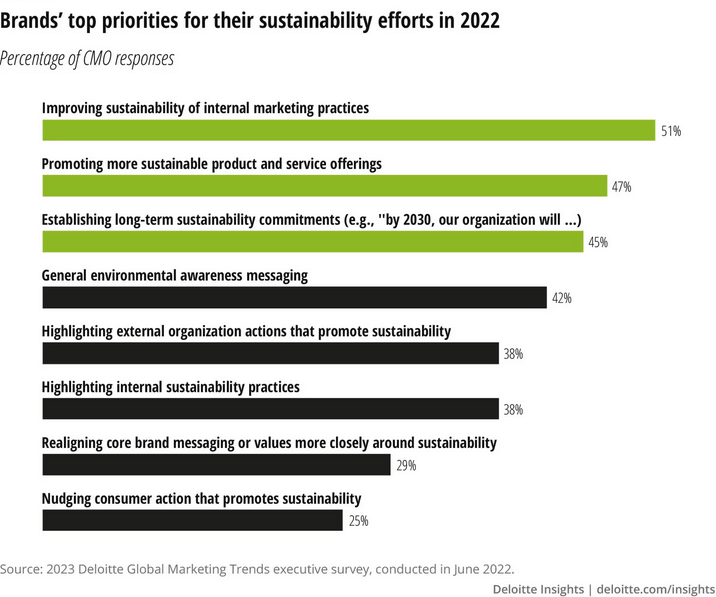

According to the Deloitte 2023 Global marketing trends research, sustainability is an imperative for growth. The results of the research claim that sustainability has come a long way from “a hot-button issue” to a practice that’s not only right to do, but also beneficial for business. Meeting the demands of the market, governments and regulatory bodies makes brands strong and relevant. Based on the views of more than 1000 Chief Marketing Officers, top three priorities for sustainability efforts in 2022-2023 are the following:

- Improving sustainability of internal marketing practices;

- Promoting more sustainable product and service offerings;

- Establishing long-term sustainability commitments.

It makes it hard to underestimate the importance of ESG accounting today.

The benefits of ESG accounting

As ESG performance is gaining its importance for many companies and their stakeholders based on the information in the previous section, there are some clear benefits that a business can count on when implementing ESG strategies.

Access to capital

Companies with strong ESG performance may have access to more investment opportunities as investors are attracted to such companies. Many mutual funds, brokerage firms, and investment advisors now offer investment products with strong ESG principles in place. It’s recommended to avoid companies not committed to ESG practices to keep a good investment portfolio.

Reduced risk

ESG accounting is the way to identify and deal with risks in relation to environmental, social, and governance factors. And once more, reducing risks makes a company more attractive for potential investors.

Improved financial performance

According to Corporate Governance Institute and the research and sustainability data firm ESG Book, companies with strong ESG performance tend to outperform their peers financially, which means that investments in companies with good ESG performance have generated higher returns than the average within their broader market. As it was mentioned by ESG Book’s head of ESG research and sustainable investing, Todd Bridges, there are benefits and better risk-return profiles over a long-term period, which shows that regardless of region, markets realize the importance of ESG. The variation in figures depended on the ESG area with better scores. Governance turned out to be the winner in this respect. Geographically, Europe and Asia came as high achievers in this outperforming trend.

Enhanced brand reputation

ESG accounting can help companies enhance their reputation as responsible and sustainable businesses, which, as it was mentioned before, draws investors and consumers. Making into the top ESG company lists that are compiled by various companies will surely add trust to the brand.

ESG reporting standards

ESG reporting or ESG disclosure is the process of making companies’ ESG activities accessible to the public, which can hold companies accountable for their ESG performance. The European ESG landscape is more mature compared to the US, where there are no mandatory ESG reporting requirements as of now, but it’s very much likely to change due to the shift towards more sustainable business practices over the recent years.

According to the Center for Audit Quality (CAQ), ESG reporting consists the following steps or actions:

- Communicate key ESG risks and opportunities and how these issues are managed.

- Organize business dependencies and impacts on the environment and society.

- Communicate their resiliency to shifts in the environment and society.

- Credibly demonstrate how they execute on their purpose to drive value for all stakeholders.

When it comes to guidelines on ESG disclosures, the Financial Accounting Standard Board (FASB) published the Intersection of Environmental, Social, and Governance Matters With Financial Accounting Standards in March, 2021, covering some major information points and underlining that the documents has an educational status and doesn’t interfere with currently existing GAAP (generally accepted accounting principles).

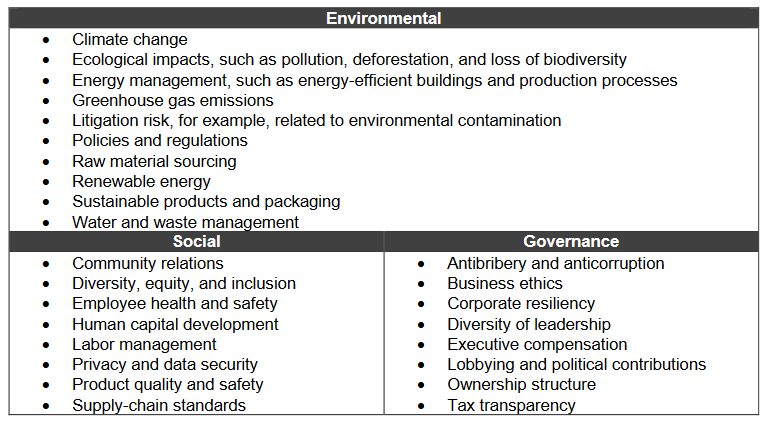

According to the document on ESG disclosures mentioned above, ESG information covers a broad range of topics beyond the ones in financial accounting standards. There are several organizations that have established frameworks and industry-specific recommendations for ESG reporting.

The table below gives some examples of broad topics that are commonly considered as ESG matters covering every type of concern, starting with climate change and ending with tax transparency:

standards or rather the system of standardized ESG metrics.

In November 2021, the International Financial Reporting Standards (IRFS) Foundation, which is in charge of the financial accounting standards applicable in most jurisdictions other than the United States announced the formation of the International Sustainability Standards Board (ISSB) aiming to develop a comprehensive set of global standards on sustainability disclosure. This kind of consolidation of the ESG disclosure ecosystem, the continued enhancement of ESG information standardization should give more clarity on the details of ESG accounting and reporting.

According to the Harvard Law School Forum on Corporate governance, we’re expecting some new regulations on ESG to be adopted in 2023, which might lead to a considerable growth in the amount of ESG information generated by companies.

The US Securities and Exchange Commission (SEC) is expected to adopt final rules requiring detailed disclosure by companies of climate-related risks and opportunities by the end of 2023. Regardless of how various ESG disclosure standards are going to coexist, it’s clear that mandatory, standardized sustainability reporting by businesses will inevitably increase worldwide over the next few years.

The role of accounting specialists in the rise of ESG reporting

Possessing the expertise and knowledge to analyze financial and non-financial data, accounting specialists have the potential to drive sustainability reporting in their organizations. To provide accurate ESG reporting, accountants can collaborate with company teams for establishing performance targets and monitoring the process with the help of accounting software.

Proving this thought, UNC’s Kenan-Flagler Business School and The National Association of the State Boards of Accountancy believe that the essential part of developing and implementing ESG strategies and reporting is the knowledge of business operations and finances, which accountants possess. Based on that, professionals who have the skills to implement ESG practices will become more valuable to companies, as they can enhance transparency, accountability, and stakeholder engagement by communicating sustainability data effectively.

Given that more and more money is invested using ESG standards and companies practicing it, the ESG reporting has a huge potential for consulting and public accountancy firms.

Some tax benefits of adopting ESG reporting

As stated by the firm Warren Averett, tax incentives are an opportunity for governments to encourage businesses to develop and implement strong ESG strategies. Such tax incentives reduce the tax liability of companies and contribute to the building of a sustainable future.

ESG-related tax credit programs can include:

Environmental program: Tax credits for energy-efficient buildings, electric vehicle charging stations, carbon recapture and investing in and producing solar and wind power.

Social program: Tax credits for investing in low-income neighborhoods and building affordable rental housing, school and transportation infrastructure bonds, employer-provided childcare facilities, rehabilitating historic buildings.

Governance: Tax credits for creating good quality jobs in the USA.

These tax implications can increase an organization’s cost of doing business and need to be accounted for. Being aware of details makes tracking taxes easier.

Bottom line

Sustainability accounting is becoming a necessity in the modern business world as all the stakeholders are showing increasingly more interest in getting access to ESG performance data alongside the financial information of the companies. Embracing ESG reporting and sustainability practices might help not only enhance a company’s reputation but also get some financial benefits and build a more sustainable future. Accounting professionals can use their skills and knowledge of the business processes to help integrate ESG practices and reporting in their companies.