In real estate, comparative market analysis (CMA) is a valuable tool, acting like a guide to help professionals determine property values accurately. However, it can lead to more harm than good if approached unwisely.

Today, we explore the essentials of CMA and how to use it effectively.

Key takeaways

- In real estate, Comparative Market Analysis (CMA) is a personalized assessment, blending data with human insight to figure out exactly what a property is worth.

- To nail a CMA, you’ve got to understand the dance of supply, demand, and economic factors. It’s like reading the room at a party – knowing who’s there and what they’re looking for helps you set the right vibe.

- Even though CMAs are super useful, they’re not without their hiccups. But now, with cool tech like HubSpot, things are getting smoother. It’s like having a personal assistant who keeps all your data organized and helps you make sense of it all.

Level up your real estate business with smart accounting automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

Understanding Comparative Market Analysis (CMA)

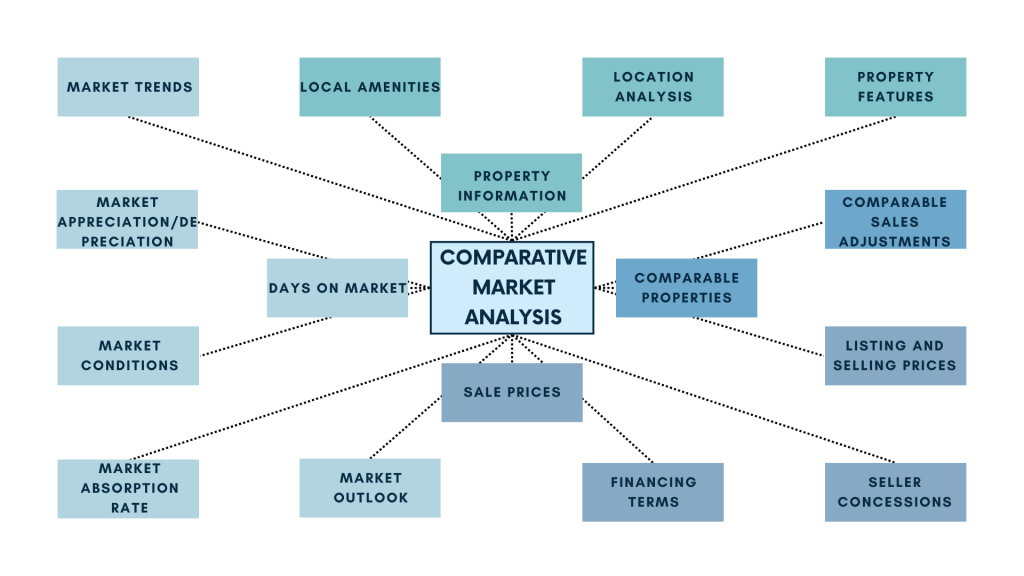

To truly understand the power and precision of comparative market analysis (CMA) in the idustry of real estate, it’s imperative to differentiate it from other market analysis methodologies. CMA is not a uniform concept applicable across the board, distinguishing itself from competitive analysis and automated valuation models (AVMs), carving its niche in the intricate world of property valuation.

Comparative market analysis vs. Competitive analysis

While CMA and competitive analysis share the common goal of comprehending market dynamics, they diverge in their scope. Competitive analysis tends to cast a wide net, focusing on the broader market trends, economic indicators, and external factors impacting the real estate landscape. It’s akin to viewing the real estate market from a bird’s-eye perspective, capturing the macro-level movements.

In contrast, Comparative market analysis zeroes in on the microcosm of specific property comparisons. It is the fine-tuning of the lens, the meticulous examination of individual homes and their unique attributes. CMA is the art of distilling the broader market trends into granular insights, providing a tailored evaluation for a particular property based on its distinctive characteristics.

Comparative market analysis vs. automated valuation models (AVMs)

In the digital age, automated valuation models (AVMs) have gained prominence for their efficiency in processing vast amounts of data rapidly. These models rely heavily on algorithms and mathematical computations to determine property values. While AVMs offer speed and scalability, they lack the nuanced understanding that human analysis suggests.

Comparative market analysis, by contrast, marries data-driven insights with the expertise and intuition of real estate professionals. It is not merely about crunching numbers but understanding the story behind each property. The uniqueness of a home, its subtle features, and the intangible aspects that an algorithm may overlook—CMA incorporates these elements into its evaluation. It embraces the artistry of real estate analysis, acknowledging that a property’s value extends beyond the quantitative metrics encapsulated in algorithms.

As you can see, comparative market analysis is not too broad like competitive analysis, not too algorithmic like AVMs, but just right in its ability to provide a tailored, human-centric evaluation of a property’s worth in the market. It is a balance that makes CMA an indispensable tool for both seasoned real estate professionals and those navigating the complexities of property transactions.

Exploring the market dynamics in CMA

Real estate markets are intricate and dynamic ecosystems, akin to living organisms responding to endless influences. Understanding the market dynamics is essential for anyone engaged in Comparative Market Analysis (CMA), as it provides the contextual backdrop against what property values are determined. In essence, the real estate market is a symphony of factors, and the interplay of these elements significantly impacts the conditions under which CMA operates.

The relationship of supply and demand

For a real estate market, dynamics becomes a balance between supply and demand. The ebb and flow of these two fundamental forces shape the conditions that define property values. Understanding the demand for housing in a particular area, within an awareness of the available supply, allows for a nuanced comprehension of the market’s pulse. CMA, as a result, is not a static assessment but a reflection of the dynamic equilibrium between what’s available and what’s sought after.

Economic factors and the ripple effect

Beyond the fundamental forces of supply and demand, economic factors are a substantial influence on the real estate landscape. Interest rates, for instance, play a pivotal role in shaping the affordability of homes. When interest rates are low, borrowing becomes more accessible, stimulating demand and potentially driving property values upward. Conversely, higher interest rates may curb demand, influencing CMA outcomes in a different direction.

Broader economic indicators, such as employment rates and GDP growth, contribute to the overall health of the real estate market. A thriving economy often correlates with increased housing demand, influencing CMA evaluations. Understanding these economic undercurrents is essential for real estate professionals conducting CMA, as it allows for a more comprehensive and forward-looking analysis.

The necessity of comprehensive evaluation

A successful CMA is a snapshot of a property’s current value and a comprehensive view of its place in the larger market context. Real estate, being a long-term investment, requires understanding trends and forces. A property’s value is not isolated but interconnected with the higher dynamics in the market. Therefore, a keen awareness of the market’s pulse, the rhythm of supply and demand, and the melody of economic indicators are crucial for conducting CMA, offering clients a nuanced and forward-thinking perspective on their real estate ventures. In navigating the intricate dance of market dynamics, Integrating risk management best practices into the CMA process ensures that potential pitfalls, such as market downturns, zoning changes, or environmental risks are anticipated and addressed, further strengthening the foundation for informed and strategic decision-makin

The role of comparable market analysis in real estate

Comparable market analysis (CMA) offes a vital framework for setting realistic home prices. It is not merely a tool but a strategic guide that plays a pivotal role in the delicate dance between sellers and buyers. In the realm of real estate transactions, CMA emerges as the compass that navigates both parties through the intricate maze of property valuation.

Guiding sellers to realistic valuations

For sellers, the process of determining the right price for their property can be challenging. Comparable Market Analysis becomes their guiding light in this journey. By meticulously examining comparable properties in the vicinity, CMA provides sellers with a tangible understanding of their property’s value in the current market. This comparative approach ensures that sellers set realistic and competitive prices, aligning their expectations with the dynamic realities of the real estate market.

CMA’s role is not confined to a mere pricing exercise; it goes beyond numbers, considering the unique features and nuances that make each property distinct. This comprehensive analysis allows sellers to present their property in the best light while ensuring that the listing price is attractive and reflective of the current market conditions.

Empowering buyers with Informed decisions

On the flip side, buyers embark on their real estate journey armed with CMA as a compass. As they explore potential properties, CMA aids in making informed purchase decisions. Comparing the property of interest with similar homes that have recently sold or are currently on the market, buyers gain a realistic understanding of its value. It empowers them in negotiations and helps in avoid overpaying for a property.

CMA becomes a strategic ally for buyers, allowing them to identify opportunities and assess whether a property is priced in line with market trends. In a competitive real estate landscape, where timing and precision matter, CMA serves as a tool for buyers to navigate the market with confidence and make decisions that align with their budget and preferences.

Balancing accuracy and flexibility in CMA

The market is not static; it shifts, adapts, and responds to various influences. In this dynamic context, CMA becomes an art form — an art of balancing accuracy with flexibility. While precision in property valuation is crucial, acknowledging the fluidity of the real estate market is equally essential.

CMA professionals navigate this delicate balance by incorporating the latest market data, trends, and local insights into their analyses. This approach ensures that the evaluation remains current and adaptable, allowing for adjustments in response to market fluctuations. The artistry of CMA lies in its ability to provide a snapshot of a property’s value while recognizing the need for agility in response to the ever-changing real estate landscape.

Conducting a successful CMA

Conducting a successful Comparative Market Analysis (CMA) demands expertise and a discerning eye. As real estate professionals delve into the sea of comparable properties, several important considerations come to the forefront, each playing a crucial role in the nuanced art of property valuation.

Discerning characteristics

At the core of a successful CMA lies a discerning eye that can unravel the unique characteristics of each property. Location, size, layout, and distinct features contribute to a property’s value. The neighborhood ambiance, nearby amenities, and the overall vibe of the area are integral aspects that demand attention. A skilled CMA practitioner goes beyond the surface, delving into the intangible aspects that might not be immediately apparent but significantly impact a property’s market value. This discernment ensures that the selected comparables properly align with the analyzed property.

Reflecting market sentiment

Recent sales emerge as the pulse of a dynamic real estate market and carry substantial weight in the CMA analysis. They offer a snapshot of current market sentiment and serve as invaluable benchmarks for property valuation. The emphasis on recent sales ensures that the CMA is not merely a historical document but a real-time reflection of the market’s pulse. Understanding the intricacies of these recent transactions allows for a more accurate assessment, aligning the CMA with the contemporary dynamics of the local real estate market.

Challenges and limitations in CMA

In real estate analysis, Comparative Market Analysis (CMA) emerges as a powerful tool, yet it is not immune to challenges and limitations. To harness the full potential of CMA, real estate professionals must navigate through these complexities with precision and awareness, recognizing that the effectiveness of CMA is contingent upon addressing its inherent challenges.

Ensuring data accuracy and timeliness

At the heart of any robust CMA is the reliability of data.

Ensuring the accuracy and timeliness of information is paramount, as outdated or inaccurate data can significantly skew the results of the analysis. Real estate markets are dynamic, and property values can change rapidly. Thus, CMA practitioners must employ rigorous methods to source the most current and precise data available.

The challenge lies in gathering the data and in regularly updating real estate landscape. Inaccuracies can lead to misguided conclusions, impacting both sellers and buyers in their decision-making processes.

External factors

The real estate market is not immune to external influences, and CMA is not exempt from the ripple effects of economic downturns or unforeseen events. Economic fluctuations, changes in government policies, or unexpected global events can introduce volatility into the market, challenging the predictive capabilities of CMA. These external factors can bring a level of uncertainty, making it essential for CMA practitioners to stay vigilant and adapt their analyses to reflect the current economic climate. Navigating through such challenges requires a combination of market expertise, flexibility, and a proactive approach to adjust CMA models in response to external dynamics.

Subjectivity in CMA results

While CMA relies heavily on data-driven insights, it is not devoid of subjectivity. Real estate is as much an art as it’s a science, and the interpretation of data can vary based on the professional conducting the analysis. Recognizing and navigating subjectivity in CMA results is crucial for real estate professionals to provide a holistic and transparent perspective to clients. It requires a delicate balance between objective data and the nuanced understanding of local market conditions, property intricacies, and the unique factors influencing a particular transaction. The challenge lies in mitigating biases and ensuring that the subjective elements enhance, rather than detract from, the overall reliability of the CMA.

Strategies for overcoming CMA challenges

Addressing the challenges and limitations in CMA involves adopting proactive strategies. Regular training and education for real estate professionals ensure they are adept at sourcing and interpreting accurate data. Developing contingency plans for external market influences involves staying informed about economic indicators and global events. Additionally, fostering a culture of transparency and continuous improvement within the real estate industry can help mitigate subjectivity concerns in CMA.

CMA and the state of modern real estate

The dawn of the digital age has changed every facet of our lives, and the realm of real estate is no exception. Comparative Market Analysis (CMA) stands at the forefront of innovation, leveraging technology platforms like HubSpot to redefine the way real estate professionals analyze and interpret market data. The modernization of CMA is not merely a trend; it is a paradigm shift that is reshaping the very foundations of property valuation.

HubSpot – the role of technology in modern real estate analysis

At the heart of this transformation is the integration of technology platforms like HubSpot into the fabric of CMA practices. These platforms serve as centralized hubs that streamline the gathering, processing, and presentation of data. The days of sifting through stacks of paperwork and manually compiling information are becoming relics of the past. HubSpot and similar tools bring efficiency to the forefront, allowing real estate professionals to focus on the strategic aspects of CMA rather than getting bogged down by administrative tasks.

Centralized data – the backbone of modern CMA

One of the primary advantages of technology platforms is their ability to centralize data. In a landscape where information is scattered across various channels and sources, having a centralized repository ensures accuracy and accessibility. Real estate professionals can swiftly retrieve the latest market trends, comparable property data, and relevant statistics, fostering a more informed and dynamic approach to CMA. The synergy between technology and data centralization lays the groundwork for robust and reliable analyses.

Related:

What Is a Data Dashboard: Leveraging Data Dashboards for a 360-Degree Business Performance Overview

Intuitive tools – enhancing the CMA process

Beyond data centralization, technology platforms offer intuitive tools that elevate the CMA process to new heights. From interactive visualizations to predictive analytics, these tools empower real estate professionals to extract deeper insights from the data at their disposal. HubSpot, for instance, goes beyond being a repository — it becomes a dynamic toolkit that augments the capabilities of CMA practitioners. The result is a more comprehensive and visually engaging CMA report that communicates data and tells a compelling story about a property’s value in the market.

Efficiency redefined – getting rid of manual work

The advent of technology platforms signifies a shift from manual and time-consuming processes to streamlined and efficient workflows. Real estate professionals can generate CMA reports with higher speed, allowing for more agility in responding to the fast-paced dynamics of the real estate market. The efficiency gained through technology does not compromise the quality of the analysis and empowers professionals to conduct more thorough and timely CMAs.

Future possibilities – CMA practices evolution

As we stand at the intersection of technology and real estate, the future holds exciting possibilities for the continued evolution of CMA practices. Ongoing trends point towards an even more seamless integration of technology, with artificial intelligence, machine learning, and predictive modeling playing increasingly prominent roles. The prospect of more sophisticated algorithms and automation opens doors to unparalleled accuracy and efficiency in CMA.

In conclusion, the marriage of CMA with technology platforms like HubSpot signifies a paradigm shift in how we approach property valuation in the modern real estate landscape. The centralized data, intuitive tools, and enhanced efficiency redefine the CMA process, empowering professionals to navigate the complexities of the market with unprecedented precision. As technology continues its progress, the journey towards a more seamlessly integrated and tech-driven future for CMA promises efficiency and a deeper and more nuanced understanding of property values in an ever-changing real estate ecosystem.

Conclusion

As the linchpin in real estate transactions, CMA proves its mettle, guiding sellers to realistic valuations and empowering buyers with discernment. It transcends mere number-crunching, encapsulating the essence of each property—the unique features, the intangibles, and the narrative woven into the real estate market. Navigating the dance of supply and demand, economic influences, and the ever-shifting landscape, CMA emerges not as a static assessment but as a forward-thinking guide, offering a comprehensive view of a property’s place in the larger market context.

The modernization of CMA through technology platforms like HubSpot signifies a paradigm shift, streamlining processes, centralizing data, and opening doors to future possibilities. In this fusion of tradition and innovation, CMA stands as an indispensable tool, shaping successful transactions with its artful blend of accuracy and flexibility. As the real estate landscape continues to evolve, CMA remains not just a process but a cornerstone—a compass guiding stakeholders through the complexities of property valuation, ensuring that the true worth of every property is not just assessed but fully understood.

Continue reading: What are gross receipts?

Share your thoughts

Feel free to share your thoughts and opinion in the comments section beliw! We’d love to hear from you!