Known for its consistency, meticulous attention to details and respect for tradition, the accounting industry sees a major shift fostered by the digital transformation now. For centuries, accountants were at the forefront of guarding ledgers, reconciling transactions and ensuring the accuracy of financial records. The recent advances of digital technology such as automation, cloud and blockchain technologies, and data analysis are there to be embraced by accounting professionals. This change is already transforming the traditional accounting practices, freeing up time for strategy and analysis, personal growth and better work-life balance. While automation, cloud accounting and data analysis are already the tools of the progressive accounting professionals, blockchain accounting is yet in its early stages.

Imagine a world where financial records are incorruptible, accessible to all authorized parties, and automatically reconciled. Sounds like the far future, but it’s closer than you might think. The rise of blockchain, known first as the technology behind cryptocurrencies, has the potential to shapeshift the world of accounting with blockchain accounting software. In this article, we’re going to plunge into blockchain accounting and get an idea about its features, benefits, challenges and potential to transform the industry.

Contents:

2. Blockchain or crypto accounting and how it differs from traditional accounting?

3. Benefits of blockchain/crypto accounting

4. Limitations of blockchain/crypto accounting

5. Blockchain accounting software

Key takeaways

- Blockchain accounting significantly differs from traditional accounting by introducing the triple-entry accounting.

- Blockchain accounting has the potential to reduce costs, enhance security, efficiency and compliance.

- The main hurdle for blockchain accounting today is the lack of clarity about the legal regulations.

- It’s vital to follow the development of blockchain accounting and new blockchain accounting software as its full potential is yet to be uncovered.

What is blockchain?

Blockchain is considered a somewhat elusive concept. Being explained in lots of articles and videos, it’s still something that many people who are not directly connected to the sphere would have difficulties grasping.

Blockchain technology is largely associated with bitcoin, which was introduced in 2009, just 14 years back. Since then, the use of blockchain resulted in emergence of various cryptocurrencies, decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and smart contracts.

A blockchain was created as a public ledger that records all bitcoin transactions, with the huge benefit of eliminating the need for a third party to process payments. It can be seen as a full history of banking transactions. A blockchain transaction is recorded as a block, while the blocks or the most recent transactions being recorded are like an individual banking statement. Each new block is added to the chain, forming the constantly growing blockchain, which isn’t regulated by a central authority. It’s the users who dictate and verify transactions when one person pays another for goods or services.

Essentially, all completed transactions are publicly recorded into the blockchain and verified by other bitcoin users. Blockchain is seen as bitcoin’s main technological innovation. Since it provides proof of each transaction, it can review transaction histories to determine how much value a particular address owned at any time. It’s made possible because every computer that’s connected to the bitcoin network receives a copy of the block chain after joining the network.

Blockchain or crypto accounting and how it differs from traditional accounting?

Although the start of blockchain was closely connected to bitcoin and later other cryptocurrencies, its current use isn’t limited to them. A blockchain is seen as a distributed database that’s shared among the network of users, providing a decentralized, transparent algorithm for recording transactions.

The wow effect of blockchain technology is that it could potentially eliminate the need for reconciliations, minimize fraud and simplify audits. As it’s impossible to change a block in blockchain, the data recorded is considered to be immutable and this technology can potentially be used to make data in any industry tamper-proof. Such benefits are more than clear for accounting professionals, although the way this technology functions may be a little blurred for understanding.

If we compare the traditional accounting system with blockchain or crypto accounting, probably the most significant difference between them will be opposition of the double-entry method (traditional accounting) and triple-entry method (blockchain accounting).

While both methods are used to record financial transactions, they’re notably different in structure.

Double-entry accounting

Under the double-entry accounting, required by GAAP, every transaction has two equal and opposite entries, impacting different accounts, so all the transactions are recorded in terms of debits and credits.

A credit entry increases a liability account or decreases an asset account, while a debit entry does the opposite. Hence, the sum of all debits must equal the sum of all credits, which gives an accurate picture of financial positions. Double-entry accounting focuses on internal record-keeping and accuracy within a single ledger and doesn’t provide external verification.

Triple-entry accounting

Triple-entry accounting, on the other hand, includes all double-entry elements but adds a third entry recorded on a shared, decentralized blockchain ledger. This third entry acts as a tamper-proof digital receipt representing the transaction, visible to all parties involved, which enhances trust and eliminates the need for reconciliation. Thus, triple-entry accounting adds external verification and immutability through blockchain technology.

If we compare traditional accounting and blockchain accounting, the key differences would look this way:

| Traditional accounting | Blockchain accounting |

| Centralized Records are stored in a single server managed by a central authority. Reconciliation required Records need to be manually reconciled across different entities. Auditing Audits involve a third party reviewing and verifying records. | Decentralized Records are distributed across a network of computers. Automatic reconciliation Transactions are automatically reconciled across the network. Transparency All participants have access to the same unalterable record of transactions. |

Both systems have their positive and negative moments to be considered. And as the article focuses on blockchain accounting, let’s look closer at how it fares with benefits and limitations.

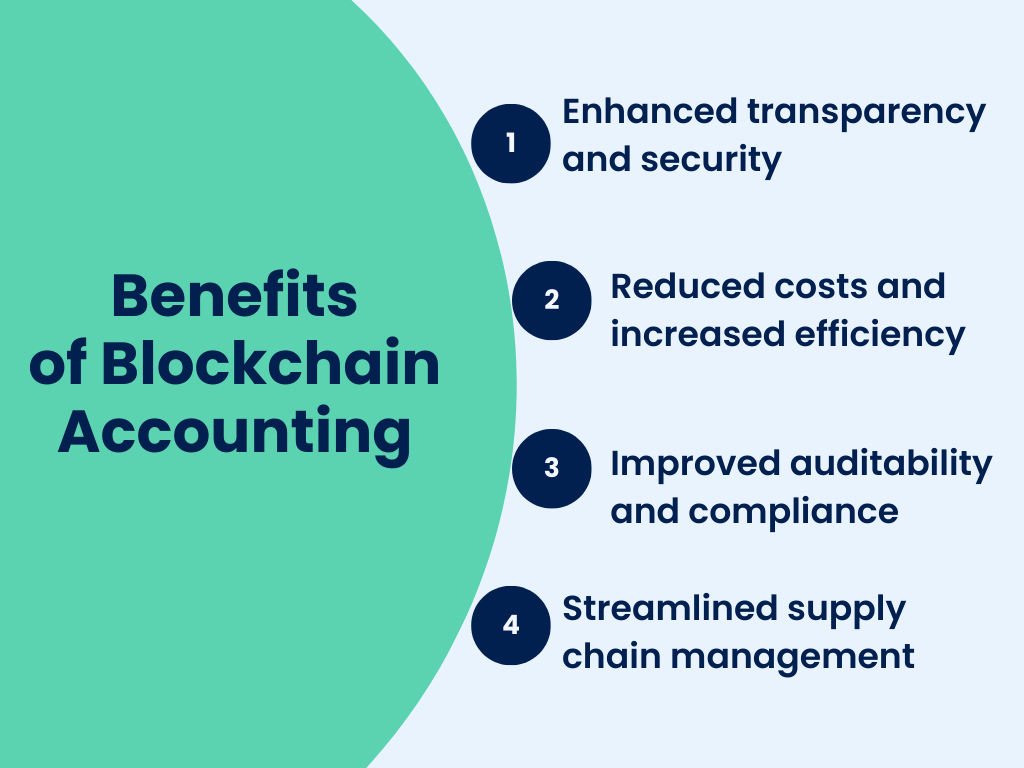

Benefits of blockchain/crypto accounting

When we see a technology gaining traction, it’s obviously for a reason. And this reason is the benefits the new technology brings to the table. Blockchain accounting offers a range of potential upsides that help perfect traditional accounting methods, being an exciting prospect for businesses and individuals alike. Here are some key advantages that blockchain accounting has:

1. Enhanced transparency and security

While every transaction in blockchain’s distributed ledger is cryptographically linked, leaving a permanent and auditable trail, blockchain accounting is virtually immune to fraud or tamper-proof. At the same time, all authorized parties are entitled to real-time access to the same data, which promotes better financial oversight and eliminates discrepancies. This also guarantees transparency and fosters collaboration between the parties. One more point to add here, is that the decentralized nature of blockchain makes it much more resistant to cyberattacks compared to centralized databases.

2. Reduced costs and increased efficiency

Automated reconciliation provided by smart contracts on the blockchain saves time and resources, reducing human error and leading to lower accounting costs. Data sharing and automated transaction recording streamline accounting practices by eliminating paperwork and manual data entry. All this naturally results in improved efficiency.

3. Improved auditability and compliance

As it was mentioned before, every transaction leaves trails, so all the transaction history is available and verifiable, making audits simpler and reducing costs. Such secure and transparent audit trails help businesses comply with complex financial regulations.

4. Streamlined supply chain management

One more significant benefit of blockchain technology is that it can track goods and materials throughout the supply chain, bringing in improved efficiency, traceability, and accountability to the table.

Limitations of blockchain/crypto accounting

Having in mind the potential benefits of blockchain accounting, we have to admit that this technology is still in its early stages, which means that there are a number of limitations that blockchain technology has to overcome. Let’s look at the major hindrances of blockchain accounting:

1. Scalability

One of the most important challenges now is scalability as many blockchain networks struggle to handle high transaction volumes. This can potentially result in delays and increasing transaction fees, which is a considerable hurdle for larger businesses.

2. Compliance and regulations

As blockchain accounting is new, the regulations regarding cryptocurrencies and blockchain tech in general are still under consideration. It means the adoption of the technology by businesses as well as investments is hindered by the lack of certainty about compliance requirements.

Let’s look at some facts. Cryptocurrencies and blockchain have long been the focus of quite a number of federal and state agencies, including SEC (the Securities and Exchange Commission), FTC (the Federal Trade Commission), the Treasury, FASB (the Financial Accounting Standards Board) and others. But despite the considerable engagement by different agencies and recognition of blockchain technology as an important part of the future financial infrastructure, formal rulemaking is yet expected.

It has to be mentioned that since 2022, U.S. Congress has introduced several bills aimed at providing more clarity to the blockchain sector. And one of the most recent changes in the sphere is that the U.S. Securities and Exchange Commission (SEC) approved the first investment fund that tracks the price of bitcoin directly- Bitcoin Spot ETFs in January 2024. This might be seen as a huge leap in blockchain regulations.

3. Complexity and cost

As it goes with all the new tech, implementing and maintaining blockchain accounting systems requires specific technical expertise, hardware and software, which may prove to be costly and time-consuming, especially for smaller businesses. So early adoption can be slow on the uptake.

4. Energy consumption

Some blockchain protocols require significant computing power, which means high energy consumption. This can be an obstacle for sustainable businesses and environmentally conscious consumers.

5. Technology immaturity

Being very promising, blockchain technology is still relatively young and immature. Certain functionalities and features are still under development, which might result in functionality limitations and potential vulnerabilities.

6. Privacy concerns

The increased transparency provided by blockchain technology raises some concerns about privacy, especially when dealing with sensitive financial data. The challenge here is to find the right balance between transparency and privacy.

The potential benefits and limitations should be carefully considered to understand if blockchain technology is the right fit for your business. According to the advice given by Nicholas Pasquarosa, the founder and CEO of a US-based financial technology firm in his article for Forbes, “when it comes to blockchain technology, business leaders need to stay updated on its developments and potential implications.” He believes that as soon as regulatory issues clear up and adoption increases, early adoption could provide a competitive edge.

Blockchain accounting software

There are a number of accounting companies advertising their blockchain consulting services, which testifies to the growing popularity of blockchain accounting and at the same time proves that blockchain accounting by no means aims to replace accounting professionals.

Crypto or blockchain accounting software automates the accounting for companies and individuals that trade cryptocurrency. The most important features of the best blockchain accounting software are:

- Integration with popular business accounting software and crypto wallets;

- Supporting multiple blockchain distributed financial protocols, coin types, and fiat currencies;

- Tracking crypto transactions and balance history;

- Filing taxes on crypto currency transactions;

- Providing automatic spot price calculations of the exchange rate between the cryptocurrency and the fiat currency at the time of the transaction;

- IOS/Android mobility;

- Portfolio analytics;

- Auditing.

While trying to get information on blockchain accounting software, we searched on such trusted resources as G2, Capterra, TrustRadius, Forbes. Obviously, the sphere is yet new, but the names we come across are the same. And largely, the data we get from the ratings built on just a couple of votes isn’t representative enough to make any solid conclusions. But here are some facts worth sharing. Forbes, for example, has recently published the list of the best crypto tax software for February 2024, headed by TurboTax Premium (by Intuit), Koinly and Coin Tracker. G2 and TrustRadius share the names of Bitwave, Cryptoworth, SoftLedger, CoinLedger, Accointing and some others.

While blockchain accounting with its magical promises of reconciliation elimination and unimaginable precision is still in its early stages of development and adoption, you might want to turn your eye to accounting integration. Synder Sync gives a real promise of automatic and 100% precise reconciliation of all financial activities, which reduces manual bookkeeping and streamlines your accounting processes.

To get more information about Synder, you can opt for a Weekly Public Demo or go for a Synder free trial to see how it can give your business a competitive edge.

Bottom line

The full potential of blockchain accounting is yet to be discovered and it’s clear that this technology can really surpass many others existing today and transcend the boundaries it faces now. With precision beyond imaginable, unrivaled immutability and enhanced trustworthiness, blockchain accounting can be the future for many industries. That’s why it seems prudent for forward-thinking businessmen and accounting professionals to keep an eye on the development of blockchain technology and the regulatory changes in the sphere to be among the first to embrace it and use it to their advantage.

What is your favorite blockchain accounting software? Share in the comments below!

Excellent article! Will check out these blockchain accounting softwares.