There are multiple payment processors that help businesses to manage their transactions, such as Stripe, Square, PayPal, GoCardless, and more. But how do you choose the one that will cover all your business needs and will be convenient for your customers?

The right payment processor is one of the most important factors in ecommerce sales. Depending on your payment processors, you may pay greater or fewer fees, get money to your bank account faster (or slower) and manage orders from your mobile or only via a laptop. Online payment processing is not only a useful solution for ecommerce businesses but also a convenient way of payment for customers.

It’s projected that in North America non-cash transactions will reach 281 billion by 2026. When you factor in the transaction estimates for Europe (467 billion) and the Asia-Pacific region (1,232 billion) for the same year, it becomes evident that businesses must be prepared to accept a substantial volume of payments through credit and debit cards, digital wallets, direct debits, and credit transfers.

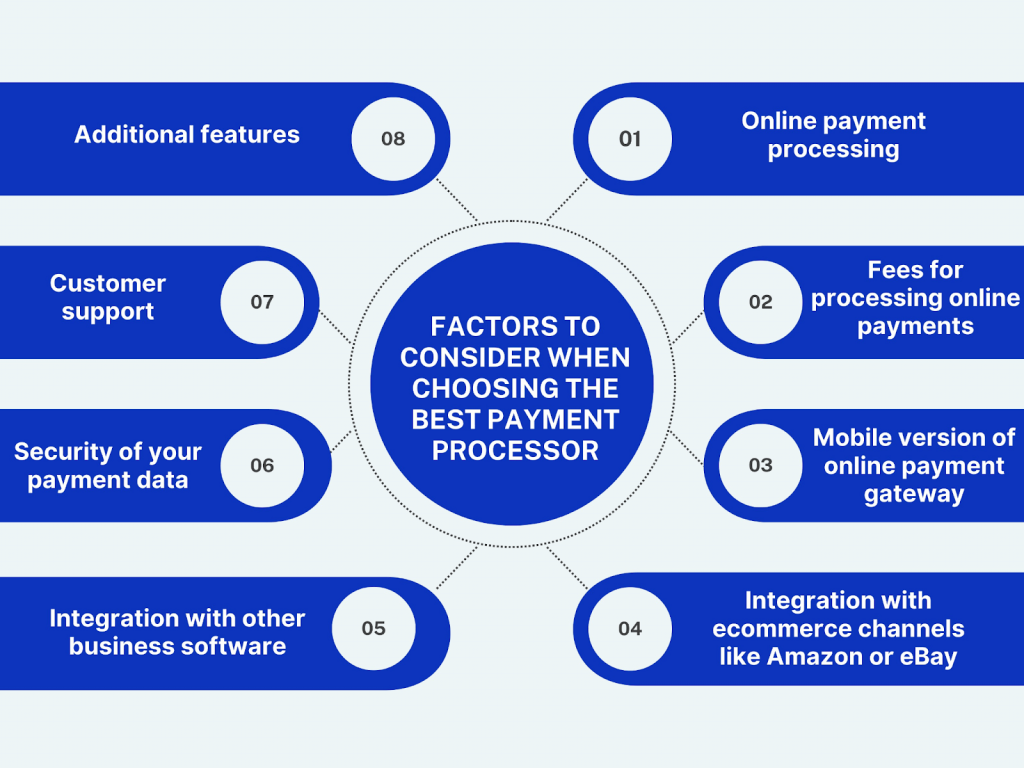

Let’s have a closer look at the most important factors that should be taken into consideration when choosing a payment gateway.

What is a payment processor?

A payment processor often referred to simply as a “processor” or a “payment gateway” is a financial institution or a third-party company that facilitates electronic transactions between buyers and sellers by securely handling the processing of payments. Payment processors play a crucial role in the modern financial system and ecommerce landscape, as they enable the smooth and secure transfer of funds in various online and offline payment methods.

Key functions and roles of a payment processor

Authorization

When a customer makes a purchase or a payment, the payment processor verifies the transaction details, including the validity of the payment method (credit card, debit card, digital wallet, etc.), the availability of funds, and whether the transaction should be approved or declined. This is known as authorization.

Settlement

After a transaction is authorized, the payment processor initiates the process of settling the funds. It transfers the money from the customer’s account to the seller’s account, often through the Automated Clearing House (ACH) network or other electronic payment networks.

Security

Payment processors prioritize the security of payment data and personal information. They employ encryption and data security measures to protect sensitive customer data during the transaction process.

Payment method handling

Payment processors support various payment methods, including credit cards (Visa, Mastercard, American Express, etc.), debit cards, digital wallets (e.g., PayPal, Apple Pay, Google Pay), bank transfers, and more. They ensure that transactions using these methods are processed correctly.

Currency conversion

For international transactions, payment processors can handle currency conversion, allowing sellers to receive payments in their preferred currency while customers pay in their local currency.

Reporting and settlement

Payment processors provide reporting tools and settlement services to help sellers track transactions, reconcile payments, and manage their finances.

Chargeback management

When customers dispute a transaction, payment processors manage the chargeback process, which involves investigating the dispute and handling the necessary financial adjustments.

Compliance

Payment processors must adhere to strict regulatory requirements, including anti-money laundering (AML) and know your customer (KYC) regulations, to prevent fraud and ensure the legality of transactions.

Popular payment processors include PayPal, Stripe, Square, Adyen, Authorize.Net, and many others. Businesses often choose payment processors based on factors like transaction fees, ease of integration, the availability of features, and the types of payment methods supported.

Payment processors are a crucial intermediary in the financial ecosystem, enabling businesses of all sizes to accept payments securely and efficiently, both online and in physical retail environments.

What factors to consider when choosing the best payment processor?

When beginning an ecommerce business, it’s important to choose the payment gateway that best suits your business. You should take into account the popularity of the gateway, the processing method, fees, interface, and compatibility with other platforms. You may also find that you need to connect a few payment processors in order to optimize your business bookkeeping and accounting in advance.

1. Online payment processing

The flow of payment processing may be different. Depending on your type of business and product features, you may choose the best option for you. In general, there are three ways of payment processing: integrate a payment form into your website, use a redirect for payments, or have an Escrow system. All these ways have both advantages and disadvantages that may affect your sales.

Ecommerce businesses can integrate a payment form into their website. So customers’ bank details are transported to the payment processor through a secure form. However, not all types of websites allow integrating a form, for example, websites created on some website builders.

Redirect payments are the most common way of payment processing. To pay for a purchase, a customer is redirected to a secure page of a payment processor to enter their credit or debit card details. This way is convenient and secure for customers, as well as it’s much easier for a seller to connect the payment gateway to the website.

The Escrow system is less popular among ecommerce businesses as it suits only a few types of companies. The Escrow system withholds the customer’s money for the purchase until the authority is granted. Usually, such a system is used by companies who act as an intermediary between a payer and a beneficiary.

2. Fees for processing online payments

The fees for processing online payments can vary depending on several factors, including the payment processor you use, the type of payment method, the volume of transactions, and the specific pricing structure offered by the processor. Here are some common types of fees associated with processing online payments:

Transaction fees

These fees are charged for each individual transaction and are typically composed of two components:

- Fixed fee: A flat fee charged for each transaction, regardless of the transaction amount.

- Percentage fee: A percentage of the transaction amount, usually calculated as a fraction of the total transaction value.

Monthly or annual fees

Some payment processors may charge a recurring monthly or annual fee for the use of their services. This fee may cover access to certain features or support.

Chargeback fees

In the event of a chargeback (a disputed transaction), a fee may be assessed to the merchant to cover the administrative costs associated with handling the chargeback.

Cross-border or international transaction fees

When processing payments from customers in other countries or when accepting foreign currencies, additional fees may apply to account for currency conversion and international processing.

Gateway fees

If you use a payment gateway to securely transmit payment information from your website or online store to the payment processor, there may be fees associated with using the gateway service.

API or integration fees

Some payment processors charge fees for using their APIs or developer tools to integrate payment processing into custom software or platforms.

Early termination or cancellation fees

Be aware of any fees that may apply if you decide to switch payment processors or cancel your account before the end of a contract term.

Volume discounts

Many payment processors offer volume-based discounts, where the transaction fees decrease as your sales volume increases.

Custom pricing

For larger businesses or high-volume merchants, custom pricing arrangements may be negotiated directly with the payment processor.

It’s essential to thoroughly review the fee structure and terms of service provided by your chosen payment processor. Additionally, consider factors like the types of payment methods supported, security features, customer support, and ease of integration when selecting a payment processor for your online business.

Comparing fees and understanding the total cost of processing payments is crucial to managing your business’s profitability, especially if you’re operating in a competitive online market where margins can be tight. Keep in mind that payment processing fees are just one aspect of your overall operational expenses.

3. Mobile version of online payment gateway

A mobile version of an online payment gateway is a version of the payment gateway’s interface that is specifically designed and optimized for mobile devices, such as smartphones and tablets. Given the increasing prevalence of mobile commerce (m-commerce), it’s essential for payment gateways to provide a seamless and user-friendly experience on smaller screens. Here are some key aspects of a mobile version of an online payment gateway:

- Responsive design: A mobile payment gateway typically employs responsive web design techniques to ensure that its interface adapts to different screen sizes and resolutions. This allows customers to access and use the payment gateway on various mobile devices without encountering issues like distorted layouts or tiny buttons.

- User-friendly interface: The mobile version of a payment gateway is designed with a mobile-first approach, making it easy for users to navigate, input payment information, and complete transactions using touch gestures. User interface elements are optimized for touch interactions.

- Speed and performance: Mobile users often have less patience for slow-loading pages. Mobile payment gateways are optimized for speed and performance to minimize load times, ensuring a smooth and efficient payment process.

- Security: Security remains paramount in mobile payment processing. Mobile payment gateways employ robust security measures to protect sensitive customer data during transactions, including encryption and tokenization.

- Supported payment methods: Mobile payment gateways typically support a variety of payment methods, including credit and debit cards, digital wallets (e.g., Apple Pay, Google Pay), and other mobile-specific payment options.

- Compatibility: Mobile payment gateways should work seamlessly across different mobile operating systems, such as iOS and Android, as well as various mobile web browsers.

- Integration with mobile apps: In addition to web-based mobile payment gateways, many businesses integrate payment processing directly into their mobile apps, providing a native and streamlined payment experience for app users.

- Multi-channel integration: Mobile payment gateways often integrate with multiple sales channels, including websites, mobile apps, and in-store point-of-sale (POS) systems, enabling businesses to accept payments across various touchpoints.

- Analytics and reporting: Mobile payment gateways offer reporting and analytics tools to help businesses track mobile transaction data, monitor performance, and make data-driven decisions.

- Accessibility: To ensure inclusivity, mobile payment gateways should be designed with accessibility in mind, allowing users with disabilities to navigate and use the interface effectively.

The mobile version of an online payment gateway is crucial for businesses seeking to cater to the growing number of mobile shoppers. By providing a seamless and secure mobile payment experience, businesses can increase customer satisfaction and conversion rates in the mobile commerce space.

4. Integration with ecommerce channels like Amazon or eBay

Online payment platforms can integrate with ecommerce channels like Amazon or eBay through various methods and APIs (Application Programming Interfaces) provided by these platforms. Here’s an overview of how this integration typically works:

API integration

Payment gateway providers, such as PayPal, Stripe, Square, and others, offer APIs that allow ecommerce sellers to connect their online stores with these payment systems.

Sellers can integrate these APIs into their ecommerce platforms (e.g., WooCommerce, Shopify, Magento) to facilitate payment processing.

This integration enables customers to make payments using various payment methods (credit/debit cards, digital wallets, etc.) directly on the ecommerce site.

Third-party plugins and extensions

Ecommerce platforms often have a marketplace of plugins and extensions that sellers can install to extend the functionality of their online stores. Many payment gateway providers offer plugins or extensions specifically designed for popular ecommerce platforms like WooCommerce, Shopify, and Magento. Sellers can install these plugins or extensions to easily integrate the payment gateway with their ecommerce channel.

Marketplace-specific integration

Amazon and eBay have their own payment processing systems, such as Amazon Pay and eBay Managed Payments. To sell on these platforms, sellers may be required to use the respective payment processing solutions provided by Amazon and eBay. These solutions are integrated directly into the marketplace, simplifying the payment process for both sellers and buyers.

Multi-channel ecommerce platforms

Some ecommerce platforms, like Shopify, provide built-in integrations with multiple sales channels, including Amazon and eBay. Sellers can manage their product listings, inventory, and orders from various channels within a single dashboard, streamlining their operations.

Custom development

In some cases, sellers with unique requirements or custom ecommerce platforms may need to develop custom integration solutions. This involves working with developers to create custom scripts or APIs that connect the online payment platform with the ecommerce channel.

Payment processing settings

Sellers can configure their payment processing settings within their ecommerce channel’s admin panel. They can set up their preferred payment gateways, specify payment methods accepted, and manage other payment-related settings.

Reporting and settlement

Integrated payment systems typically provide reporting and settlement features that help sellers track transactions, manage refunds, and reconcile payments. This data is crucial for managing finances and optimizing business operations.

Overall, the integration between online payment platforms and ecommerce channels is essential for providing a seamless shopping experience to customers while ensuring that sellers can efficiently process payments and manage their businesses across multiple sales channels. Sellers should choose payment solutions that align with their ecommerce platform and sales strategy to maximize their online sales potential.

5. Integration with other business software

At the first step of organizing your payment processes, you must check whether your online payment providers can be integrated with accounting software. It will make your life much easier if you can automate not only the process of making transactions, but also the bookkeeping, preparation of financial statements, and tax filing.

Let’s consider Synder as an example. This smart finance solution allows you to connect your payment processor like Stripe, Square, PayPal,Authorize.net) with your ecommerce platform(s) such as Shopify, Etsy, Amazon, BigCommerce, eBay, and many more and transfer your transaction data into the accounting software you’re using. Such automation simplifies your accounting processes, minimizing the risk of errors and discrepancies for your to enjoy seamless reconciliation come tax season.

Synder simplifies and automates business accounting processes by syncing transactions from payment platforms and sales channels directly into accounting software, which boosts overall business performance and fosters data-driven decisions.

What you get with Synder

- Connecting 25+ platforms with accounting software: Users begin by signing up for a Synder account and connecting it to their preferred payment platforms, sales channels and accounting software like QuickBooks or Xero.

- Two data sync modes: Once connected, users can configure settings within Synder to specify how they want transactions to be synchronized. Synder provides 2 sync modes: Per Transaction or Daily Summary (in bulk). You should also indicate your bank or cash account in the accounting software, set up tax rules, and some more details.

- Seamless transaction synchronization: Synder continuously monitors the connected payment platforms for new transactions, such as sales, refunds, and fees. It categorizes and matches transactions to the appropriate accounts in the accounting software based on the configured settings.

- Multicurrency support: Synder offers support for multicurrency transactions, which can be especially important for businesses dealing with international customers.

- Fee handling: Synder can automatically handle transaction fees associated with payment processing. It separates these fees and records them separately in the accounting software.

- Reconciliation: The software helps reconcile transactions, ensuring that they match the records in the connected payment platforms with the accounting software.

- Data accuracy: Synder’s goal is to improve data accuracy by automating the data entry process, reducing the risk of manual errors.

- Reporting and analytics: Synder offers reporting and analytics features that provide insights into a business’s financial transactions and help with financial analysis.

It’s worth noting that the specific features and integration capabilities of Synder constantly evolve over time, and new payment platforms are added to its list of supported integrations.

To get the most up-to-date information about how Synder integrates with payment platforms and its current features, sign up for a 15-day free trial with no commitment or visit Synder’s Weekly Public Demo.

6. Security of your payment data

Some people are afraid of using online means of payment because they think that their bank details may be stolen or used by financial scammers. Usually, online payment processors provide instructions on how to enter your personal data securely. Moreover, all online payment providers should comply with the requirements of Payment Card Industry Data Security Standard. It’s a unified standard for organizations that work with credit cards. So, you can be sure that your bank details won’t be lost.

7. Customer support

It’s better when you can rely on 24/7 customer support in case there are some problems with transactions. Some ecommerce credit card processors provide only ticket or email support, others suggest 24/7 chats and calls. When customers have issues with payments, the company should solve the problem as fast as possible to keep the customer satisfied with their purchases. However, if you are not able to contact your payment processor immediately, you will hardly be able to help your customers.

8. Additional features

Extra bonuses and features are always pleasant and can even be a deciding factor when choosing the right payment processor. For example, some payment processors accept payments in different currencies, which is rather useful for international companies. Also, some of them provide recurring billing or email reminders for clients who delay the payments. Even if you choose a payment processor that doesn’t provide these features, you can always connect Synder who sends ecommerce businesses payment reminders, recurring invoices, and even thank you emails.

What are the most popular payment gateways?

Here are some of the most popular payment platforms:

PayPal

PayPal is one of the most widely recognized online payment platforms, known for its ease of use and wide acceptance. It supports payments from credit/debit cards and bank accounts, as well as PayPal balances. PayPal also offers a business payment solution called PayPal Business for merchants.

Stripe

Stripe is a developer-friendly payment processing platform that is popular among online businesses and ecommerce websites. It provides a range of tools for accepting payments, subscription billing, and managing transactions.

Read more about Stripe payment links.

Square

Square is known for its point-of-sale (POS) solutions, making it a popular choice for in-person transactions. It offers hardware, software, and online payment processing for businesses of all sizes.

Check out our article about how Square POS works.

Authorize.Net

Authorize.Net is a long-established payment gateway that facilitates online payments for ecommerce businesses. It supports various payment methods and offers security features for cardholder data protection.

Adyen

Adyen is a global payment company that provides a unified payment platform for international businesses. It supports multiple payment methods, currencies, and regions.

Worldpay

Worldpay (now part of FIS) is a large payment processing company that serves businesses of all sizes. It offers a wide range of payment solutions, including online, in-store, and mobile payments.

Braintree

Owned by PayPal, Braintree is a payment platform that focuses on making it easy for businesses to accept payments online and through mobile apps. People opt for it because of its developer-friendly features.

Shopify Payments

Shopify Payments is a built-in payment solution for Shopify users, making it easy for ecommerce businesses to accept credit card payments on their websites.

You might want to learn more about Shopify payments vs. alternative payment methods.

Amazon Pay

Amazon Pay allows customers to use their Amazon account information to make purchases on third-party websites. It is popular among ecommerce businesses looking to leverage the trust of the Amazon brand.

Learn details about how Amazon Pay works.

Google Pay and Apple Pay

Google Pay and Apple Pay are digital wallet platforms that allow users to make contactless payments in physical stores and online using their smartphones or other devices. They are particularly popular for mobile payments.

Skrill and Neteller

Skrill and Neteller are also digital wallet platforms that are commonly used for online gambling, gaming, and ecommerce transactions, especially in Europe.

Venmo

Venmo, owned by PayPal, is a peer-to-peer payment app that is popular for splitting bills and making small payments among friends and family.

Other quite popular online payment solutions include Orangepay, Bluesnap, Pin Payments, IntegraPay, and some others. Keep in mind that the popularity of payment platforms may vary by region, industry, and the specific needs of businesses and consumers.

Bottom line

To choose the right payment processor, you should clearly understand your business needs. How many transactions do you need to process, in which currencies are most of your payments, what ecommerce platforms do you want to use, and so on? As soon as you know which online payment provider you will use, you should consider which accounting software would work the best for your business.