Let’s face it—nobody wakes up excited to tackle complex accounting tasks. And when you’re running a SaaS business? Well, let’s just say your accounting challenges pile up. Recurring revenue, subscription tiers, deferred income—you name it.

If you’re feeling overwhelmed, don’t worry—you’re not alone. Whether you’re struggling to keep up with accounting or navigating the unique quirks of the SaaS business model (or both!), you’re in the right place. As a SaaS company ourselves, we’ve walked in your shoes and felt the same frustrations. That’s why we’re here to break down the most painful parts of SaaS accounting, and—most importantly—give you the remedy.

Key takeaways:

- Financial challenges are a major obstacle for SaaS companies, making effective financial management a top priority from day one.

- Nearly 90% of IT professionals agreed that automation is vital when managing SaaS operations.

- Before picking accounting software, take time to identify your unique pain points—no one-size-fits-all solution here.

Contents

- How is SaaS different from traditional business models?

- How accounting software addresses the main SaaS accounting pain points

- Choosing accounting automation software: Which questions to ask yourself before committing

- Top 7 best accounting software for SaaS businesses

- Bottom line: Best SaaS accounting software

How is SaaS different from traditional business models?

If you’ve ever wondered why SaaS businesses seem to be a world apart from traditional models, the answer lies in how they operate—and, more importantly, how they make money. Unlike businesses that rely on one-and-done sales, SaaS thrives on subscriptions and scalability.

So, what exactly sets SaaS apart? If we take the top three differences, they’ll be:

- Revenue model: SaaS businesses rely on recurring revenue. Customers pay a monthly or annual fee, creating predictable income streams.

- Service delivery: SaaS operated entirely on the cloud. Customers access the software through web browsers or mobile apps, requiring no physical products or installations.

- Cost structure: While traditional businesses often focus on tangible goods, SaaS pours money into R&D and infrastructure, followed by low marginal costs for each additional user.

Catch the connection here? Cash management. Whether it’s securing recurring revenue, managing large upfront investments, or scaling infrastructure, everything ties back to how well you manage your cash flow. And for that, automation can be a life-saver. Though, it can’t be just a guessing game – you need to know exactly what your business is lacking and which areas should be optimized in the first place.ion we need to define the specific features, needs and challenges startup may face.

How accounting software addresses the main SaaS accounting pain points

Complex revenue recognition, subscription changes, deferred income—the list goes on. Add to that a stack of repetitive manual tasks, and you’ve got a recipe for burnout. But here’s the exciting part: accounting automation can change everything.

The point is, before you commit to any subscription plan, you need to make sure the software actually does what it promises. Unfortunately, not every provider gives you a test drive. That leaves you with two options: trust your gut (risky) or do your homework (better, but time-consuming).

To save you from both, we’ve put together the top SaaS accounting challenges and how accounting software can swoop in to save the day. Based on real issues our SaaS customers have faced, here’s what you need to know:

Revenue recognition

SaaS companies must comply with standards like ASC 606 and IFRS 15, recognizing revenue progressively as services are delivered. Advanced accounting platforms automate the revenue recognition process, ensuring accurate revenue allocation and seamless integration with billing systems.

Deferred revenue

Payments for future services are recorded as deferred revenue, and classified as liabilities until delivered. Automated systems track and convert deferred revenue to recognized revenue, reducing errors and simplifying audits, especially during tax season or fundraising.

Subscription management

Frequent subscription changes—upgrades, downgrades, cancellations—make manual subscription management inefficient. Integrated accounting tools automate recurring billing, prorated adjustments, refunds, and discounts.

Expense management

Tracking operational costs like cloud hosting and customer acquisition is essential for profitability. Accounting software automates expense categorization, real-time tracking, and reporting, helping identify cost-saving opportunities and optimize spending.

Taxation

Operating across regions involves complex tax compliance, as sales tax rates and regulations vary significantly by state. Navigating these differences can be quite a challenge, especially with each jurisdiction imposing unique rules. SaaS-focused accounting tools simplify this with automated sales tax calculations, real-time liability tracking, and streamlined reporting, reducing compliance risks and administrative effort.

Financial reporting and forecasting

SaaS businesses require accurate monthly P&L, balance sheet, and cash flow reports. Automated platforms offer tailored templates with cash flow projections and revenue trends, ensuring accurate forecasts based on historical trends.

Customer churn and LTV

Metrics like churn rate, CAC, and LTV are vital for SaaS growth. Integrated analytics tools provide real-time insights into customer behavior and profitability, helping businesses improve retention strategies and demonstrate financial health to investors.

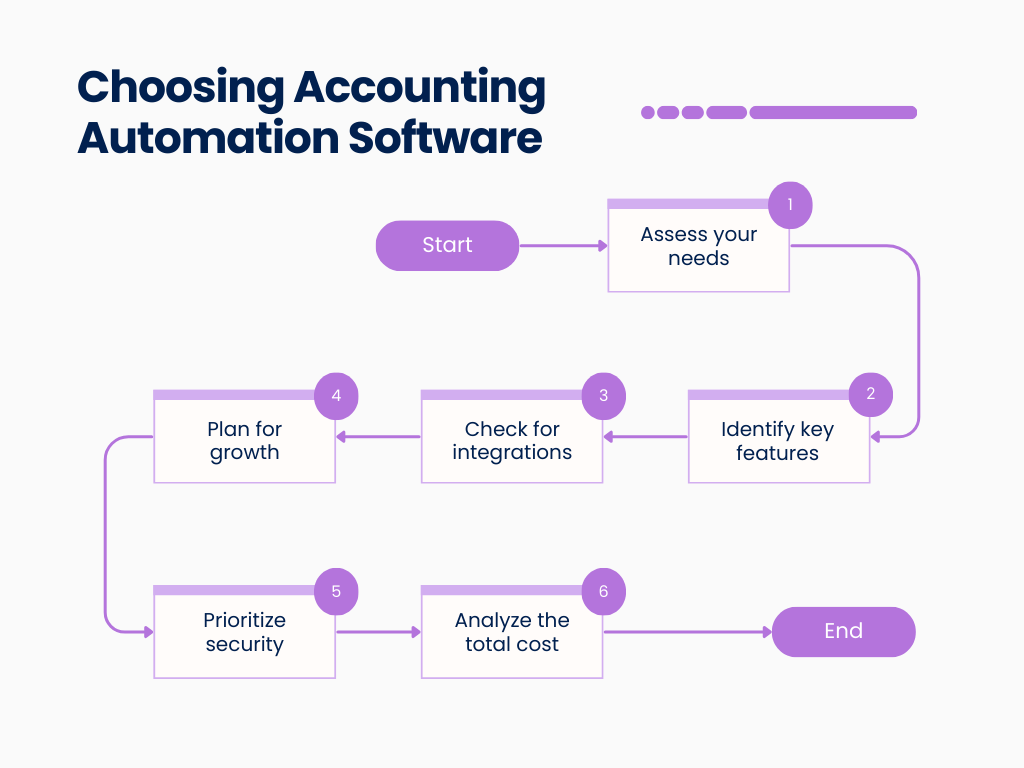

Choosing accounting automation software: Which questions to ask yourself before committing

Experiencing financial troubles is one of the top reasons SaaS businesses fail—research shows 82% of businesses close due to cash flow problems. Despite this, many SaaS founders attempt to manage accounting themselves, often to save money. While this approach may work initially, it’s not sustainable as the business scales. The smarter way? Implementing accounting software that fits your business needs and growth trajectory.

But with countless options, how do you pick the right one? Let’s walk through the key steps and questions to ask yourself before making the final decision.

Step 1: Assess your SaaS company needs

Before diving into software comparisons, take a moment to evaluate what your business truly requires. List your current pain points and map them against your projected growth. If manual invoicing is a nightmare now, just imagine managing 10x the transactions next year.

Questions to ask:

- What’s the biggest bottleneck in our current financial processes?

- Are we struggling with subscription billing, revenue recognition, or multicurrency accounting?

- How complex is our pricing structure, and can we support it manually as we scale?

Step 2: Identify essential features

SaaS businesses aren’t one-size-fits-all, and neither are accounting solutions. Think recurring billing, revenue recognition, and MRR tracking—features tailored to SaaS-specific needs. Don’t just focus on features you need now; consider what you’ll need as you grow.

Questions to ask:

- Does the software support subscription-based revenue recognition (ASC 606 compliance)?

- Can it automate invoicing and payment reminders?

- Does it offer real-time reporting on SaaS metrics like churn rate, ARR, and customer LTV?

Step 3: Check for integrations

SaaS companies thrive on ecosystems—CRMs, payment processors, project management tools. If your accounting software doesn’t play nice with your existing stack, it’ll create more headaches than it solves. And don’t just think about today. Will it still fit seamlessly into your workflows two or three years from now?

Questions to ask:

- Does it integrate with our CRM?

- Can it connect to payment gateways like Stripe, PayPal, or Square?

- Are there APIs available for custom integration if needed?

Step 4: Think big and plan for growth

Your accounting software should grow with your business. In particular, SaaS startups often underestimate how quickly transaction volumes and complexity can balloon. It’s also about handling new business models, such as usage-based pricing or tiered subscriptions.

Questions to ask:

- Can the software handle increasing transaction volumes as we scale?

- Does it support multicurrency transactions if we expand internationally?

- Will additional features or users significantly increase costs?

Step 5: Prioritize security and support

Handling sensitive financial data requires robust security measures and reliable customer support. One breach can destroy your reputation and customer trust. IBM reports that the average cost of a data breach in 2024 was $4.88 million.

Questions to ask:

- Is the software compliant with data protection regulations like GDPR and SOC 2?

- What security features does it offer (e.g., encryption, two-factor authentication)?

- What customer support options are available, and are there additional costs?

Step 6: Analyze the total cost

Cost is a major factor, but it’s not just about subscription fees. Evaluate the total cost of ownership, including setup, training, and potential hidden fees. However, it’s important to look beyond price—think about the ROI—investing in the right software now can save thousands in labor and errors down the road.

Questions to ask:

- Will scaling (e.g., adding users or transactions) result in significantly higher costs?

- What’s included in the base subscription price? Are features like reporting or integrations extra?

- Are there implementation or training fees?

Top 7 best accounting software for SaaS businesses

Our choice of best accounting solutions for startups is based on the features that they provide and their user reviews on G2, the world’s largest tech marketplace.

So, here’s our top:

- Synder – 4.7/5 ⭐️

- FreshBooks – 4.5/5 ⭐️

- Zoho Books – 4.4/5 ⭐️

- Sage Intacct – 4.3/5 ⭐️

- Xero – 4.3/5 ⭐️

- QuickBooks Online – 4.0/5 ⭐️

- NetSuite – 4.0/5 ⭐️

At a glance

| ACCOUNTING SOFTWARE | FREE TRIAL | KEY FEATURES |

| Synder | 15 days | 30+ platforms for integration Revenue recognition Flexible data synchronization for error-free reconciliation Simplified due diligence preparation Financial reporting |

| FreshBooks | 30 days | Invoice management Expense tracking Financial reporting Customer support |

| Zoho Books | 14 days | Project accountingInvoicing Bank reconciliation Mobile app accessibility |

| Sage Intacct | 30 days | Integration capabilities Multi-entity management Metrics tracking Billing & revenue recognition |

| Xero | 30 days | Fixed assets management Financial reporting Project accounting Multi-currency support |

| QuickBooks Online | 30 days | Third-party integrations Scalability with automation Ease of use Clear upgrade path to enterprise systems |

| NetSuite | 14 days | Multi-entity management Integration capabilities Detailed analytics Billing & revenue recognition |

Synder

Synder is a SOC 2 compliant accounting automation software that was specifically designed for SaaS businesses, retailers, or accountants juggling complex books. The software brings together 30+ integrations, connecting everything from payment platforms like PayPal and Stripe to marketplaces like Amazon and Shopify—and syncing it all seamlessly with leading accounting tools like QuickBooks Online, QuickBooks Desktop, Xero, and Sage Intacct.

What makes Synder truly stand out? It creates a connected ecosystem for your business, where every part of your operations talks to another one effortlessly.

Key features

- Accounting integration functions

If your SaaS company relies on QuickBooks Online, QuickBooks Desktop, Xero, or Sage Intacct, and you’re managing transactions across multiple marketplaces and payment platforms, Synder Sync can organize the systems for you. It automatically syncs all your transactions directly into your accounting software, making reconciliation effortless.

- Revenue recognition

One more powerful feature Synder provides its clients is Synder RevRec, or GAAP-compliant automated revenue recognition. It allows you to automate revenue recognition for Stripe (or any other platform) subscriptions and handle subscription changes, refunds, custom billing and so much more in your QuickBooks with ease. Synder RevRec gives you complete support for IFRS 15 and ASC 606, recognition of discounts, multicurrency support, a granular view of subscriptions and accurate reports.

- Flexible data synchronization for error-free reconciliation

Synder offers two different kinds of data sync. The Per Transaction mode allows you to get detailed data for each transaction in your accounting platform, while the Summary Sync mode is focused on posting daily transaction summaries for each connected platform, which is more effective for businesses with a great number of transactions. Both modes are designed to facilitate error-free reconciliation.

- Simplified due diligence preparation

If your SaaS company is getting ready for an audit, looking for fundraising opportunities, or considering mergers and acquisitions, then due diligence is an inseparable part of the process. Synder can effectively simplify due diligence by ensuring the accuracy of your financial records through flawless integration of all payment platforms, sales channels, and accounting solutions.

- Financial reporting

With its advanced reporting capabilities, Synder allows SaaS businesses to generate accurate and customizable financial reports, such as P&L statements, balance sheets, and cash flow reports. These reports are not only compliant with accounting standards—they’re built to meet the unique needs of your business. With the customized sync options, you’ll be able to see detailed explanations of where your cash comes from or where you’ve lost on expenses.

Pricing

Synder offers flexible pricing, starting at just $65/mo, scaling up to $275/mo depending on your business size and needs. This software offers a 15-day free trial (no credit card required). Test the waters and see how Synder fits into your business workflow before committing.

Has Synder caught your eye? Join our Weekly Public Demo to see Synder’s full capabilities in action—trust us, we’ve only scratched the surface here.

FreshBooks

FreshBooks, a Canada-based company, began as an invoicing software but has grown into a full-fledged accounting solution for small businesses. Apart from great customer support and strong invoicing features, FreshBooks has project accounting tools and a mobile app that allows you to do almost all the functions of its desktop version.

Key features

- Invoice management

FreshBooks is noted for its outstanding invoicing capabilities. No surprise here—FreshBooks started with invoicing. Invoices are highly customizable with the option of adding a logo and personalized message and creating recurring invoices in the preferred currency.

- Expense tracking

FreshBooks offers a robust expense tracking feature that simplifies managing your business expenditures. By connecting your bank account or credit card, FreshBooks automatically imports and categorizes expenses, eliminating the need for manual entry.

- Financial reporting

FreshBooks provides a suite of financial reports to keep your business in check. The platform delivers insights tailored to your needs, from income statements and balance sheets to general ledgers and profit/loss reports by customer or month.

- Customer support

FreshBooks is known for its super fast customer service provided by phone calls and emails. Customer service reps are dedicated to providing top-notch advice, and you can also take advantage of an excellent knowledge base.

Pricing

FreshBooks’ plans range from $19 to $60 per month, with optional add-ons such as additional users ($11/mo per user) and advanced payment features ($20/mo). The software provides a 30-day free trial.

Zoho Books

Zoho Books is a comprehensive cloud-based accounting software designed to streamline financial operations for companies of all sizes. With strong inventory tracking, project management, and invoicing features, Zoho Books offers a good stack of features needed to keep your finances organized.

Key features

- Project accounting

Zoho Books excels in project management with tools that let you easily track inventory, labor, sales taxes, and other costs. Its Project module allows you to manage multiple projects simultaneously, assign tasks, track progress, and generate project-centric reports.

- Invoicing

With Zoho Books, you can generate invoices in multiple languages and currencies, set up recurring invoices, and send automated reminders to stay on top of receivables.

- Bank reconciliation

Zoho Books streamlines the bank reconciliation process, ensuring your financial records align accurately with your bank statements. By connecting your bank accounts, Zoho Books automatically fetches transactions, allowing you to categorize and match them effortlessly.

- Mobile app

You can stay productive on the go. From sending invoices and receiving payments to categorizing expenses, it offers all the key features your business needs to keep running smoothly.

Pricing

Zoho Books offers plans ranging from $0 to $240 per month, with optional add-ons available to expand functionality. The software also provides a 14-day free trial for new users.

Sage Intacct

Sage Intacct is a cloud-based financial management solution designed to streamline and automate accounting processes for growing and mid-sized organizations. It offers a comprehensive suite of features, including AP and AR, cash management, general ledger, order management, and purchasing.

Key features

- Integration capabilities

Sage Intacct integrates effortlessly with a wide range of third-party applications, including CRM systems like Salesforce, payment processors, and other essential business tools, ensuring consistency across various platforms.

- Multi-entity management

Sage Intacct handles complex ownership structures, including multi-level and subsidiary investments. It offers automated consolidations, currency translations, and inter-entity transactions, facilitating efficient management of multiple entities.

- SaaS metrics and reporting

The platform provides access to more than 200 real-time, investor-grade reports and forecasts, covering key performance indicators such as MRR, CLTV, and churn rates.

- Billing & revenue recognition

Sage Intacct supports over 500 subscription billing scenarios, including usage-based, tiered, and hybrid models. It automates complex revenue recognition processes, ensuring compliance with ASC 606 and IFRS 15 standards.

Pricing

Sage Intacct’s pricing is customized based on factors such as the number of users, selected modules, and specific business requirements. For a specific price, you’ll need to contact their support. The software offers a 30-day free trial.

Xero

Xero is a cloud-based accounting software platform designed to assist small and medium-sized businesses manage their financial operations. The software integrates with over 1,000 third-party applications, including CRM systems, payment processors, and ecommerce platforms.

Key features

- Fixed asset manager

Xero’s dedicated fixed asset manager page lets you keep track of your fixed assets and work with your accountant to manage them. Track purchases, manage depreciation, and handle disposals while keeping your records accurate and up-to-date.

- Financial reporting

Xero has a strong reporting feature that can generate basic financial statements and specialized reports lacking unbilled time and income/loss by customer reports.

- Project accounting

Project accounting is the feature that Xero is particularly proud of. It offers a number of features like project estimate assignment and inventory recording for projects. As an example, you can monitor profit margins and get ready with the quotes using location-based tracking.

- Multicurrency support

Xero offers SaaS businesses the ability to manage transactions in over 160 currencies. This feature is particularly beneficial for global companies, as it allows for seamless invoicing, billing, and reconciliation in various currencies.

Pricing

Xero offers pricing plans starting at $15 and scaling to $80 per month, giving businesses the flexibility to choose what fits their needs, as well as a 30-day free trial.

QuickBooks Online

QuickBooks Online is a well-established player in the accounting industry and a very popular accounting solution in the U.S. It’s known for its strong inventory management features, a great mobile app, invoice customization, and assisted bookkeeping feature–QuickBooks Live.

Key features

- Extensive third-party integrations

QuickBooks Online offers unparalleled integration capabilities with a vast range of third-party applications, from CRM systems and project management tools to payment processors.

- Scalability with automation

As your business grows, QuickBooks Online grows with you. The platform leverages APIs and bank feeds to automate data entry and streamline bank reconciliations.

- Easy to manage

QuickBooks Online is a go-to choice for most accountants, CPAs, and bookkeepers. Its widespread use means any financial professional can dive in without extra training or onboarding.

- Seamless transition to enterprise solutions

Planning to scale to a larger enterprise system? QuickBooks Online integrates seamlessly with enterprise resource planning (ERP) systems, making it easy to transition your financial data when the time comes without re-entering everything from scratch.

Pricing

QuickBooks Online offers plans ranging from $35 to $235 per month, with options for a 30-day free trial or a 50% discount for three months (without the trial).

NetSuite

NetSuite is a unified platform that allows businesses to operate more efficiently by reducing manual processes and providing a single source of truth for data. Its scalability and flexibility make it suitable for organizations of various sizes and industries, supporting growth and adaptation to changing business needs.

Key features

- Multi-entity management

NetSuite handles complex ownership structures, including multi-level and subsidiary investments. It offers automated consolidations, currency translations, and inter-entity transactions, facilitating efficient management of multiple entities.

- Integration capabilities

NetSuite integrates effortlessly with a wide range of third-party applications, including CRM systems, payment processors, and other essential business tools.

- Detailed analytics

NetSuite delivers real-time financial reporting and analytics, offering insights into key performance indicators. This enables SaaS businesses to make informed, data-driven decisions and effectively communicate financial health to stakeholders.

- Billing & revenue recognition

NetSuite provides robust tools for managing complex subscription billing scenarios, including usage-based, tiered, and hybrid models. It automates revenue recognition processes, ensuring compliance with ASC 606 and IFRS 15.

Pricing

The pricing is tailored to each organization’s specific needs, considering factors such as company size, selected modules, user count, and required customizations. However, the tool offers a 14-day free trial.

Bottom line: Best SaaS accounting software

So, what’s the best accounting software for SaaS companies? Your SaaS business needs accounting software that can keep up with and, better, accelerate it. There are so many choices; what you need is to select a solution that matches your unique business needs, industry challenges, and growth ambitions.

Don’t settle just for basic functionality. Seek tools that offer seamless integrations with your essential apps, automate tedious tasks, and provide robust security to protect your financial data. Remember, your accounting solution should grow with you, evolve with your needs, and help you achieve the ultimate SaaS trifecta: efficiency, scalability, and profitability. Choose your SaaS accounting software wisely, and you’ll get much more than just streamlined finances.

Thanks for the article!

Happy that you like it)

Great article, Irina! As someone involved in a startup, I find your detailed comparison incredibly useful. I appreciate how you highlighted the unique needs and challenges of startups, especially regarding financial management.

Synder’s focus on integrations and revenue recognition seems perfect for SaaS businesses like ours. The flexibility of FreshBooks with project accounting and mobile functionality is also impressive. It’s good to see budget-friendly options like Zoho Books and scalable solutions like QuickBooks Online and Xero, which cater to various business sizes and complexities.

Your breakdown makes it easier to see which software fits different startup needs and stages. Thanks for providing such a comprehensive guide!

Hi Erika, thank you for your kind words! We’re glad you found the article helpful, especially in the context of your startup. It’s great to hear that Synder’s integrations and revenue recognition features align well with your needs in the SaaS sector. We appreciate your feedback and wish you all the best with your startup!