According to the report on CFOs’ responsibilities shifting, 82% of experts noted that their role has grown significantly. It means that the amount of work for CFOs is constantly growing.

So, what’s the secret to success? A perfect blend of two worlds. At Synder, we say, “Machine accuracy. Human approach.” And it’s the winning formula — powerful accounting software combined with the insight and expertise of a CFO.

But to make this formula work, you first need the right software that ticks all the boxes:

- Reliable real-time automated bookkeeping;

- Expenses recording;

- GAAP compliance.

But no more spoilers. Stick with us, and in a few seconds, we’ll introduce you to the CFO software solutions for bookkeeping and accounting tasks that might just be the solution you’ve been searching for.

Key takeaways:

- Before selecting the right accounting software, identify the must-have features your business needs.

- The ideal approach to financial management combines automated tools with the strategic expertise of the finance team and CFO.

- While many accounting solutions offer similar core features, they stand apart with their specialized focus areas and extra functionalities.

Contents:

Top 8 accounting software solutions for CFO

Based on the features provided by each tool and top reviews from platforms like G2 and Capterra, we’ve picked 8 best accounting software for CFOs. Some of them might be familiar to you, still, we decided to add the software you might consider useful so you can compare the features and overall functionality inside one article.

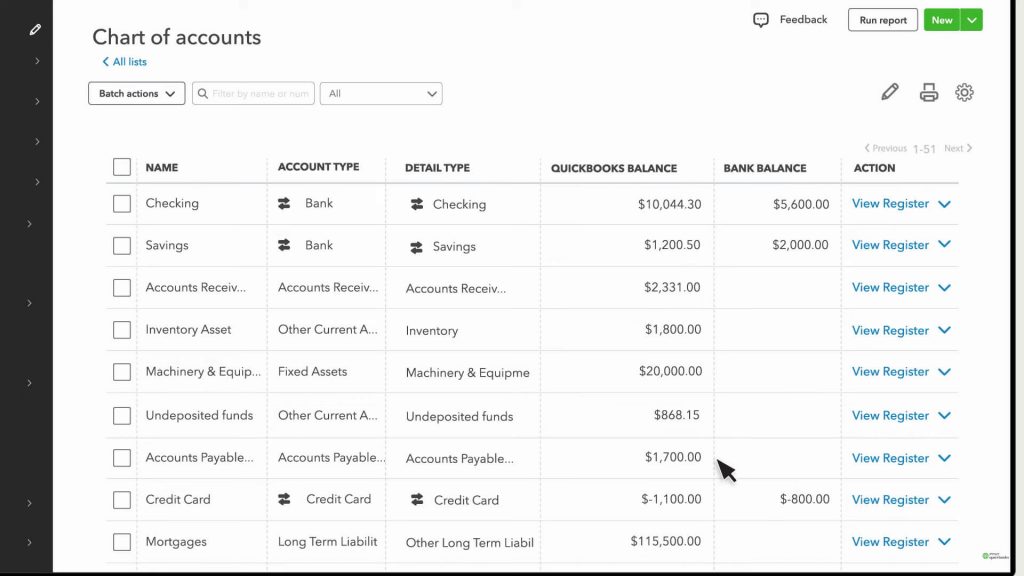

QuickBooks Online

Source: Intuit QuickBooks – YouTube channel

Best for: Small to midsize businesses looking for a powerful, scalable accounting system with real-time financial insights.

Why QuickBooks

You’ve probably heard of QuickBooks Online, and maybe it’s already part of your routine. Or you might be on the hunt for a fresh QuickBooks alternative right now. Whatever the reason is, this shows how well-known and widely used QuickBooks has become, thanks to its impressive features and reputation.

QuickBooks Online offers cloud-based solutions, giving CFOs real-time financial insights, automating tedious tasks, and providing comprehensive reporting. On top of that, it integrates seamlessly with countless third-party apps, making it a powerful tool for streamlining your entire financial workflow.

Popular features:

- Automated bookkeeping and invoicing;

- Real-time financial reporting (P&L, balance sheets);

- Multicurrency support;

- Integration with payroll management tools, ecommerce, and banking;

- Customizable access controls and workflow automation.

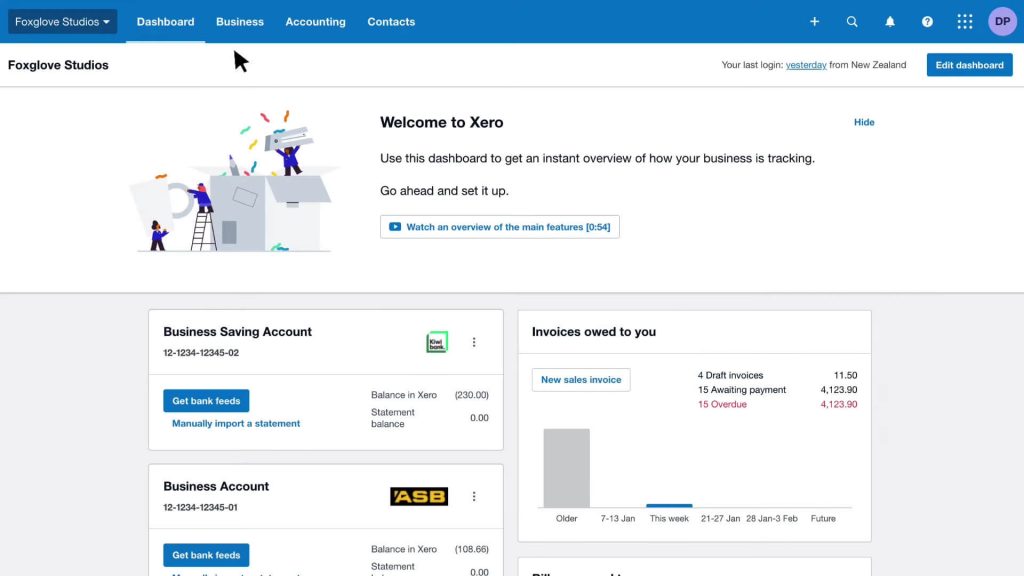

Xero

Source: Xero Accounting Software – YouTube channel

Best for: Midsize businesses looking for a streamlined accounting solution that excels in automation and integrations.

Why Xero

Xero has quickly become a favorite among CFOs, and it’s easy to see why. With its cloud-based accounting system, Xero automates the heavy lifting in financial management, offering real-time insights, seamless bank feeds, and streamlined invoicing, making it potentially the best CFO software solution for your accounting tasks.

Similar to QuickBooks, Xero supports integration with over 600 additional apps listed on Xero Marketplace. This means that CFOs can easily customize their Xero account with everything from inventory management tools to CRM systems. Such extensive integration capability makes Xero a go-to solution for CFOs in search of flexible and customizable software.

Popular features:

- Real-time financial reporting;

- Bank feeds and reconciliation;

- Automated invoicing and billing;

- Inventory Plus integration for Amazon FBA and Shopify users;

- Sales tax automation with state-based sales tax reports.

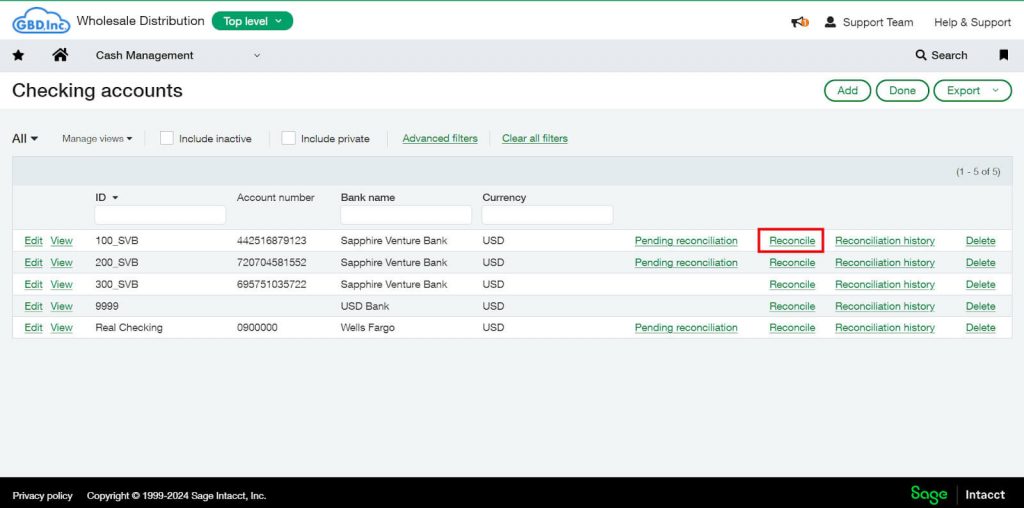

Sage Intacct

Source: Synder – Help Center

Best for: Midsize and growing businesses looking for a highly scalable financial management system with advanced automation and multi-dimensional reporting.

Why Sage Intacct

Next up is Sage Intacct, a powerhouse when it comes to automation and real-time financial insights. Companies with multiple locations or subsidiaries can streamline multi-entity consolidations easily by using Sage Intacct. Moreover, with role-based permissions, sensitive data is only accessible to those who truly need it.

The platform seamlessly integrates with third-party apps and is tailored to tackle the most pressing challenges CFOs face, including accounts payable, revenue recognition, and project accounting. Unlike the previous solutions, Sage Intacct is designed for more complex tasks, making it a great fit for larger enterprises.

Popular features:

- Multi-dimensional reporting (departments, locations, projects);

- Automated workflows (AP, revenue recognition);

- Real-time customizable financial dashboards;

- Budgeting & forecasting;

- Advanced analytics.

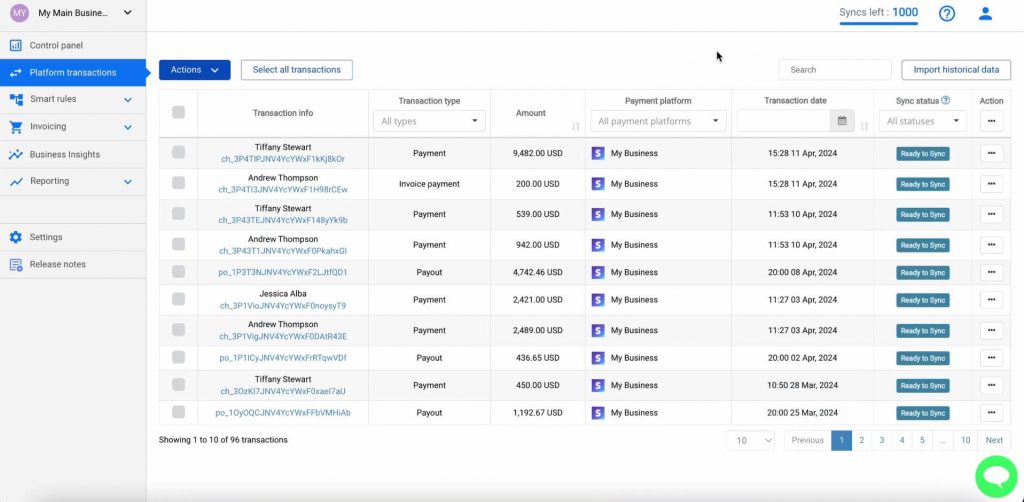

Synder

Source: Synder

Best for: Midsize businesses, ecommerce companies, and SaaS businesses looking for automated financial processes, real-time transaction syncing, and seamless multi-platform integrations.

Why Synder

Synder is an AICPA startup program alumni built to simplify the reconciliation and recognition of sales and subscriptions. This bookkeeping software provides the highest level of security and compliance.

What truly sets Synder apart? It’s not just another standalone tool. It’s a dynamic bridge, connecting your business channels with payment platforms like Stripe and PayPal, ecommerce giants like Shopify and Amazon, and top accounting systems like QuickBooks Online, Xero, and Sage Intacct. Overall, Synder supports integration with 30+ platforms, each one tailored to the specific need of the platform with no manual data entry.

Synder offers two powerful tools: Synder Sync and Synder RevRec. While the first one is tailored to the best-known bookkeeping needs, providing advanced features, Synder RevRec focuses on subscription-based businesses, providing GAAP-compliant sync and addressing specific regulatory demands like IFRS 15 and ASC 606. It automatically tracks and syncs subscription changes right into QuickBooks Online.

Popular Synder Sync features:

- Automated multichannel data sync;

- Tax data collection;

- Accurate real-time reconciliation;

- COGS tracking;

- Advanced reporting (P&L, balance sheet, and cash flow reports).

Popular Synder RevRec features:

- GAAP-compliant revenue recognition;

- Subscription management;

- Invoices processing with extended payment terms (Net 30, Net 60, etc.);

- Accurate reports with multicurrency support and discount recognition.

Check Synder’s features on a Weekly Public Demo or sign up for a 15-day free trial (no credit card required) and get one month of reconciliation for free.

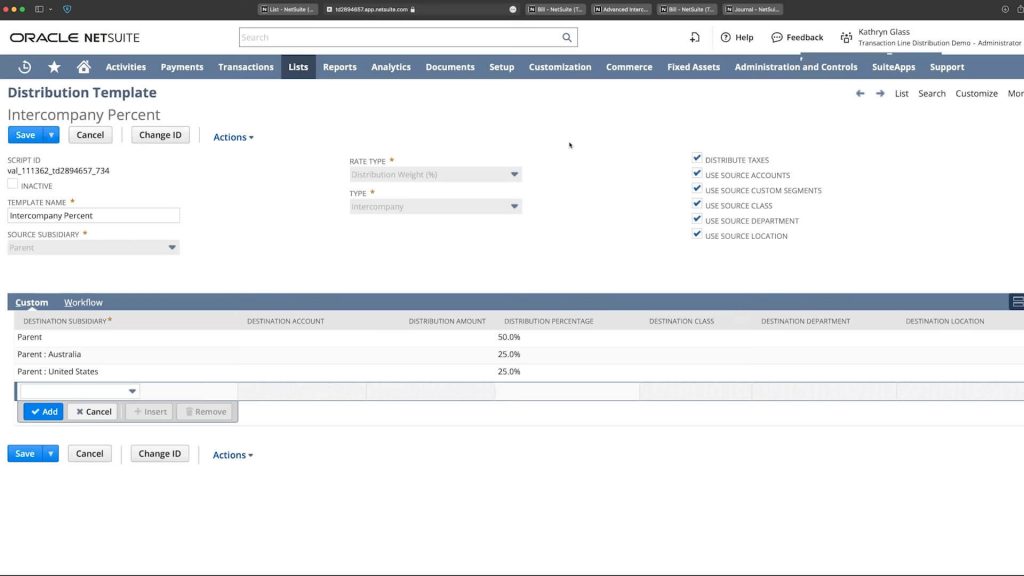

NetSuite

Source: NetSuite – YouTube channel

Best for: Midsize and large business owners looking for a powerful, all-in-one ERP solution with real-time financial management and seamless global operations.

Why NetSuite

NetSuite combines accounting, inventory, CRM, and human resources in one place.

With its real-time financial reporting and multi-subsidiary management, NetSuite helps CFOs maintain financial control and make data-driven decisions across all departments. Its robust integrations and ability to scale make it a powerful tool for companies looking to grow and streamline their operations.

Popular features:

- A highly customizable ledger;

- Automated billing and revenue recognition;

- Global management;

- Financial planning and forecasting;

- Tools for risk management, audit trails, and compliance with regulations like ASC 606 and GAAP.

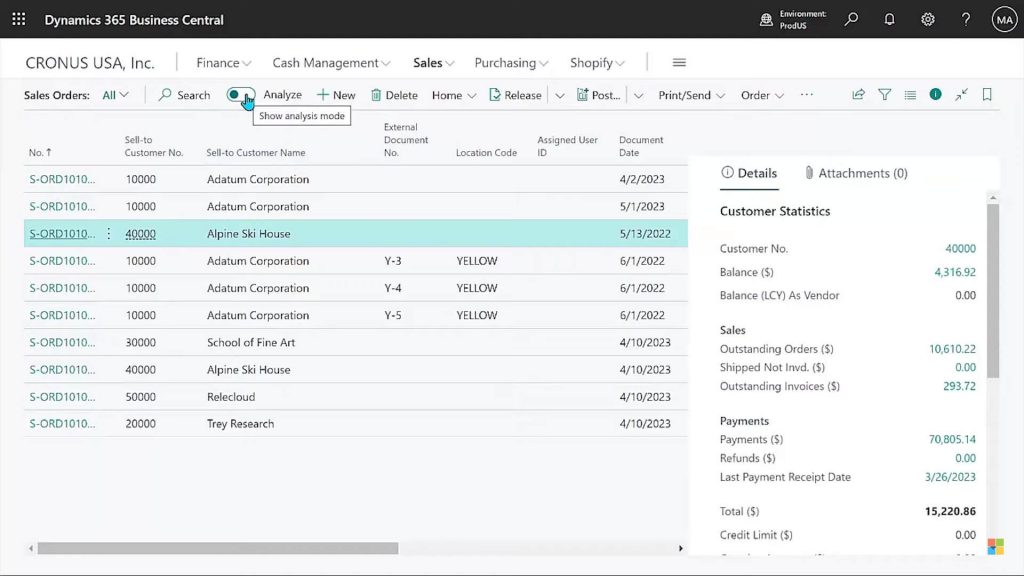

Microsoft Dynamics 365

Source: Microsoft Dynamics 365 – YouTube channel

Best for: Midsize and large businesses seeking an AI-driven financial management solution that integrates with other Microsoft tools like Power BI and Office 365.

Why Microsoft Dynamics 365

Microsoft Dynamics 365 offers a comprehensive platform that automates financial processes, enhances visibility with real-time data, and supports global operations. It excels at helping CFOs manage subscription-based business models, streamline complex billing cycles, and handle revenue recognition in compliance with IFRS and GAAP standards.

The platform also uses AI-driven tools such as Copilot to assist with financial tasks, making it easier to generate forecasts, manage cash flow, and perform what-if scenario planning.

Popular features:

- Automated financial operations with AI-powered insights;

- Subscription billing management;

- Global management;

- Advanced financial reporting with Power BI;

- Compliance with evolving tax and accounting standards across various jurisdictions.

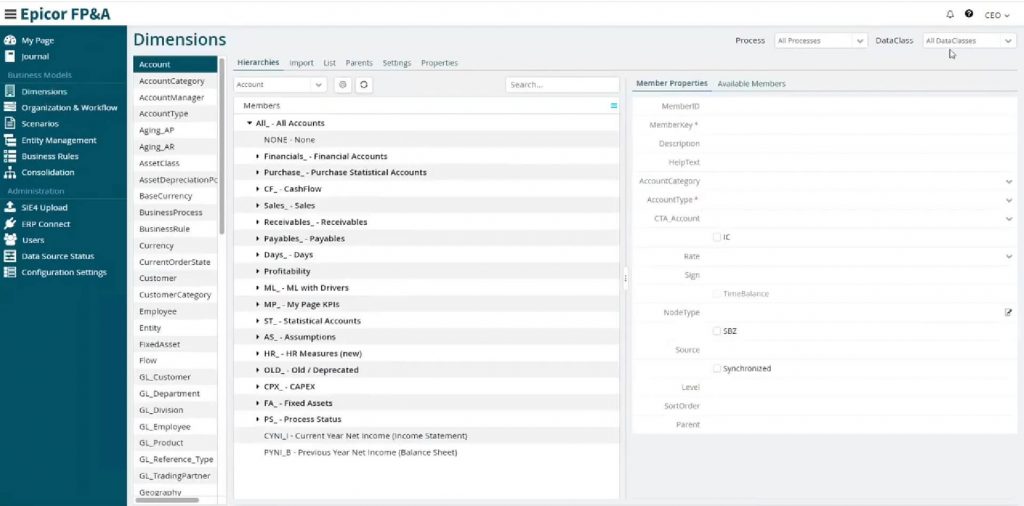

Epicor ERP

Source: Epicor – YouTube channel

Best for: Midsize manufacturing, distribution, and retail businesses looking for a robust, industry-specific ERP system.

Why Epicor ERP

Epicor streamlines complex financial operations and provides CFOs with real-time insights into the organization’s financial health. This ERP platform offers powerful tools for automating financial workflows, managing global financial data, and ensuring compliance with industry standards. Its specialized focus on industries like manufacturing and retail ensures that CFOs can optimize processes, reduce costs, and maintain better control over operations.

With AI-driven data analytics, businesses can not only spot trends but also anticipate future outcomes, which gives them a competitive edge over their competitors.

Popular features:

- Automated accounts payable, accounts receivable, and general ledger management;

- Assets management;

- Real-time financial data visibility;

- Compliance with revenue recognition standards like ASC 606 and IFRS 15;

- Epicor Automation Studio.

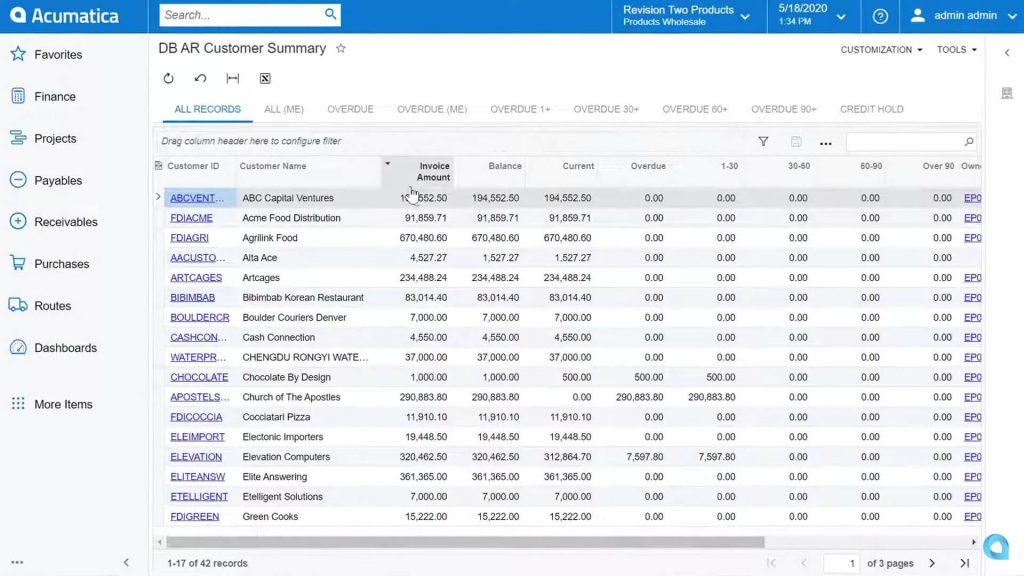

Acumatica

Source: Acumatica. The Cloud ERP – YouTube channel

Best for: Midsize businesses seeking a flexible, cloud-based ERP solution with real-time financial insights.

Why Acumatica

Acumatica is a highly adaptable cloud ERP platform with a modular design covering financial management, project accounting, and operations management. Its standout feature is adaptability — thanks to its open API, Acumatica integrates seamlessly with over 200 third-party applications, giving CFOs the flexibility to tailor and scale the system to their exact needs. What will make the software the ideal solution for growing businesses is that their pricing model focuses on the usage in the system, not the number of users.

Acumatica supports various industries, including manufacturing, distribution, and construction.

Popular features:

- Real-time financial insights and KPIs;

- Automation of billing, revenue recognition, and financial reporting;

- Multi-entity and multicurrency management;

- Project-specific accounting;

- Integrated business intelligence (BI).

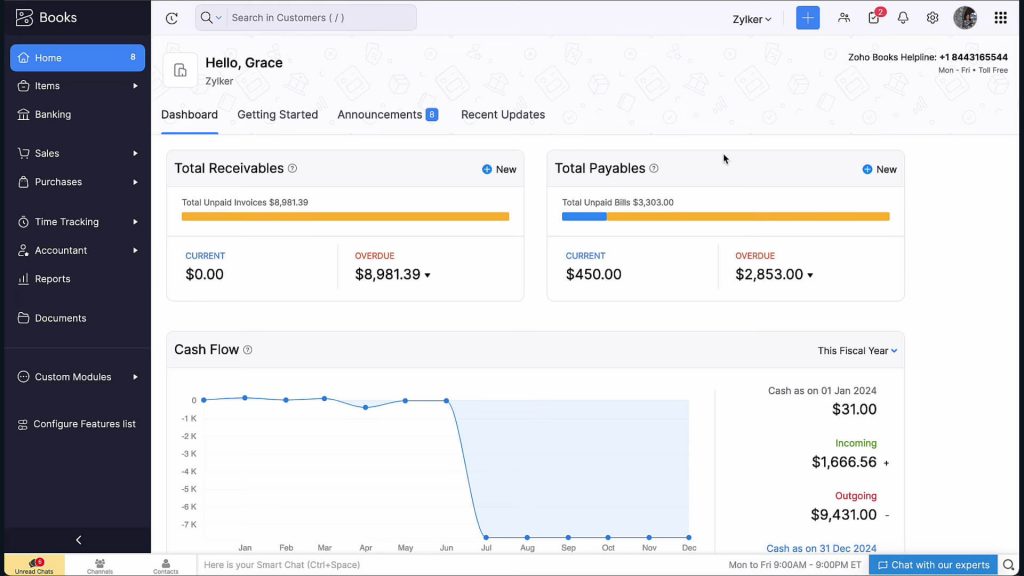

Zoho Books

Source: Zoho Books – YouTube channel

Best for: Small to midsize businesses looking for an affordable, feature-rich accounting solution with customizable workflows.

Why Zoho Books

Zoho Books is a cloud-based accounting platform that automates key financial processes, including customizable reports, advanced invoicing tools, and robust expense management. And with a mobile app, you can stay on top of your financials from anywhere.

Its standout feature? Integration. Zoho Books effortlessly connects with other Zoho apps and third-party apps, allowing businesses to manage everything — from accounting to CRM — in one cohesive system. By having all these tools under one roof, businesses can eliminate the need for multiple software subscriptions and avoid the complications of syncing data between separate systems.

Popular features:

- Customizing invoices and payments reminders;

- Expense tracking;

- Project-specific accounting;

- Automated billing and reporting;

- Advanced inventory management.

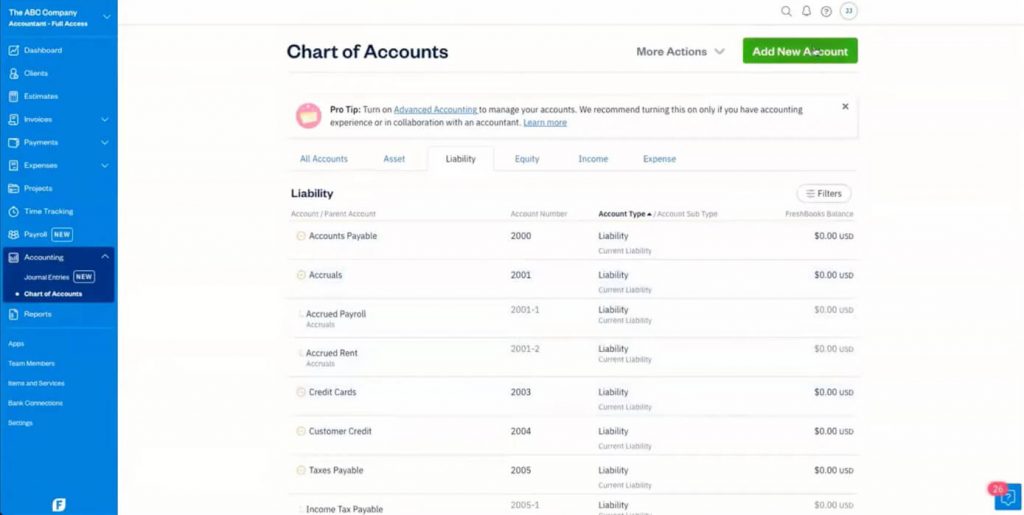

FreshBooks

Source: FreshBooks – YouTube channel

Best for: Small to midsize service-based businesses looking for strong invoicing, time tracking, and client management features.

Why FreshBooks

Like the other tools on this list, FreshBooks is a cloud accounting solution built to streamline financial tasks for small and growing businesses, offering a user-friendly platform that combines time tracking, invoicing, and project management in a single source. The software eliminates the need for manual updates with its automatic bank reconciliation, recurring billing options, and late payment reminders.

One standout feature that you’ll appreciate is FreshBooks’ accessibility. Whether you’re at your desk or on the go, FreshBooks keeps you connected to your financials with the functionality available on both desktop and mobile devices.

Popular features:

- Time tracking and invoicing;

- Invoice payments via FreshBooks Payments;

- Project management with built-in collaboration tools;

- Bank reconciliation;

- Recurring billing and automatic payment reminders.

Key features of automation software for CFOs

As you’ve probably noticed, we’ve highlighted the standout features of each CFO software tool so you could pinpoint what exactly makes a solution strong. If you’ve already made a list of must-have features for your software solution, chances are you’ve already found your match among the options we discussed above. If you’re still here with us, perhaps you’re feeling a little overwhelmed. So, let us help you.

To make the process of software research smoother, focus on the most common pain points you, as a CFO, face. The right software should offer solutions to these challenges, so when evaluating potential platforms, keep an eye out for these essential functionalities:

1. Financial processes automation

Automation of tasks like invoicing, billing, payroll management, and reconciliation reduces the level of manual work and human error, so the finance team is freed up for more strategic projects. Automated systems ensure consistent workflows and help eliminate bottlenecks by speeding up financial operations. CFOs can also use automated alerts and approvals to monitor cash flow without having to do it by hand.

2. Advanced financial reporting and analytics

CFOs require real-time reporting and analytics tools to make informed decisions quickly. This feature allows CFOs to generate detailed P&L statements, balance sheets and cash flow reports on the fly. Automating these tasks can save CFOs more time for analysis, rather than constant double-checking of the same numbers.

| DID YOU KNOW? Based on the statistics from the same report we’ve mentioned above, CFOs rank accounting, reporting, and tax tasks at the bottom of their priority list. Instead, they prefer to focus their time on strategy and developing financial talent, which they consider top priorities. |

3. Cash flow management

Effective cash flow management ensures a company maintains sufficient liquidity to meet its operational needs. A good CFO software tool should include expense management tools, tools that help monitor cash inflows and outflows, identify potential shortfalls, and optimize working capital. Features like automated invoicing and payment tracking help control whether businesses receive payments on time, avoiding cash flow disruptions.

4. GAAP compliance

Ensuring that all financial reporting is GAAP compliant is a top priority for CFOs. GAAP compliance guarantees that financial statements are consistent, reliable, and comparable across periods. Accounting software must support GAAP guidelines, such as revenue recognition, depreciation, and financial disclosures, to ensure accurate reporting that meets regulatory standards.

| RELEVANT READ: > Learn how Synder’s revenue recognition functionality helped Yoodli scale efficiently. |

5. Tax tracking

Tax management tools are essential for automating tax liabilities tracking, preparing tax returns, and ensuring that businesses comply with local, state, and federal tax laws. Accounting software should automatically calculate taxes, apply correct rates, and generate necessary tax reports, minimizing the risk of costly penalties due to non-compliance.

6. Budgeting and forecasting tools

Accurate budgeting and forecasting tools allow CFOs to plan for the future by predicting revenue, expenses, and capital needs. These tools should support scenario analysis to evaluate different what-if situations and their impact on the company’s financials.

7. Integration with other systems

Accounting software should seamlessly integrate with ERP, CRM, and HR systems, providing a unified view of the organization’s financial health. Integration reduces data silos and allows for smoother workflows across departments, ensuring that financial data is easily accessible and up to date.

8. Data security and audit trails

Data security is the number one priority for CFOs as they manage sensitive financial information. Robust accounting software includes features such as encryption, multi-factor authentication, and role-based access controls. Additionally, an audit trail logs every transaction and change made in the system, helping CFOs maintain transparency, improve compliance, and prepare for internal or external audits.

Understanding the benefits of CFO software

At first glance, many accounting software solutions may seem to offer similar features—and that’s because they’re all built to tackle the common challenges businesses face. But what makes them truly valuable is the impact they have on CFOs and accounting needs in general.

According to Deloitte’s CFO Signals, Q4 2023 report, 80% of CFOs were expected to use additional automation and digital technologies for operations in 2024. And that’s for a reason.

As was already mentioned, by automating tedious tasks like billing, invoicing, and reconciliation, CFO software solutions eliminate the risk of human error and frees up time. But what else?

Customizable reports track KPIs, cash flow, and revenue with precision, delivering the kind of financial transparency CFOs need to ensure compliance and keep stakeholders informed. And with advanced forecasting and scenario modeling, CFOs can look beyond the numbers.

In short, accounting software is a CFO’s strategic partner, ensuring CFOs have full oversight and control over their company’s finances, anytime and anywhere.

Conclusion

While we’ve covered the essentials of the best CFO software, here’s the tricky part: the CFO software stack is always evolving — just like the demands of a growing business. That’s why it’s crucial to regularly assess your company’s requirements and update your accounting and bookkeeping software accordingly.

Your best bet here would be to choose flexible software solutions from the start — like the ones we’ve highlighted in this article. Such adaptable tools can scale with your business, meeting your needs today, anticipating the challenges of tomorrow, and ensuring you’re always one step ahead.