Securing funding is huge for any startup, but there’s one issue that could catch you off guard.

Get this – 90% of startups fail.

It doesn’t happen overnight, of course. But between the 2nd and 5th year 70% of startups have already folded. So, what’s the kryptonite here that causes such devastation? The reasons are many, but topping the list— with a scorching 38%—is running out of cash and failing to secure new capital.

Today, I’m going to show you how to master foolproof bookkeeping.

I’m Ilya, a co-founder of Synder, a robust GAAP-compliant accounting toolset that helps business owners and accountants automatically record transactions and recognize revenue the right way. We’ve also been through Y Combinator and the AICPA startup accelerators, successfully raising capital along the way, so we have firsthand experience from the trenches too.

So, let’s get into the key dos and don’ts of record-keeping to boost your chances of securing funding.

Contents:

How are startups doing?

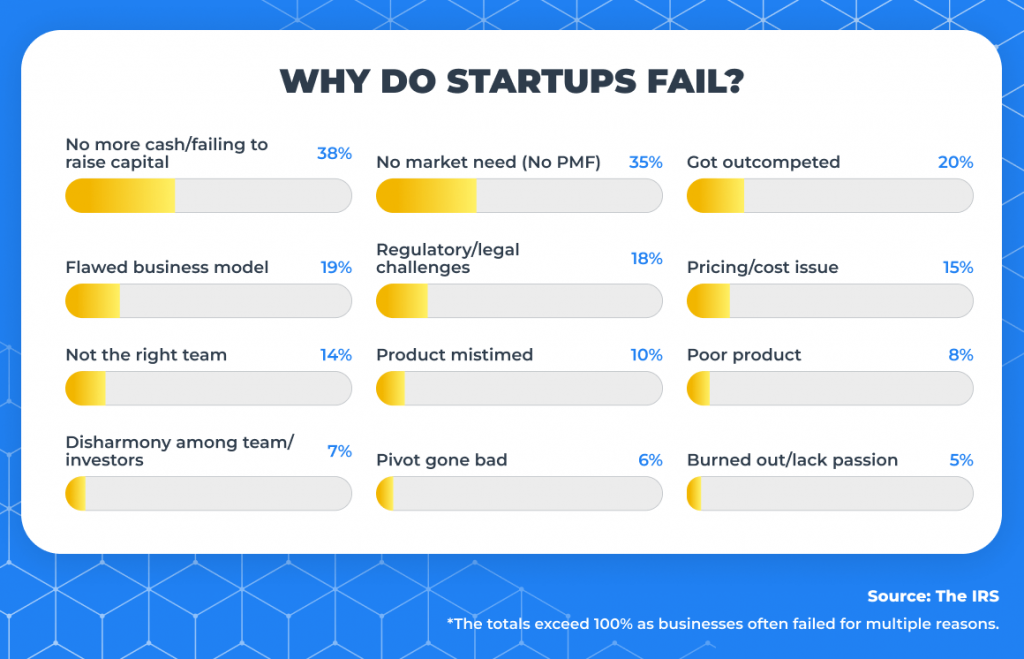

Money issues aren’t the only source of trouble for startups. Based on the above CB Insights research, these are 5 top reasons* why startups fail:

- Running out of cash/failing to raise new capital – 38%

- No market need (no PMF) – 35%

- Got outcompeted – 20%

- Flawed business model – 19%

- Regulatory/legal challenges – 18%

It looks grim but there’s hope. The hope that’s called accurate bookkeeping from the start.

Why you should have your books in perfect order from the get-go

That was my first major lesson as a startup co-founder. I clearly recall our initial attempt to raise funds—it was a mix of excitement and naivety. The reality hit us quickly: there was an immense amount of preparation required. We needed to gather:

- The financial records and statements from the last 2-3 years;

- A comprehensive list of additional documents;

- And all our bookkeeping had to be completed on an accrual basis.

The IRS requires you to switch from cash to accrual accounting when you hit a certain revenue threshold, but here’s the kicker—lenders and investors prefer accrual accounting from day one. Why? Because it showcases recurring revenue, customer retention, and business sustainability—key factors that cash accounting misses.

The gross receipts test threshold for 2023 is $29 million (annual average over 3 years).

Source: The IRS

If your books are not funding-ready, don’t worry, you can still fix it.

Let me show you how.

6 practical ways to fix your books

Every industry has its own set of bookkeeping challenges. Here, we’ll zoom in on retail and SaaS, as these two sectors highlight key issues startups face across industries. I’ll also show how Synder’s automation tools can solve potential issues along the way.

| What is Synder? Synder is an advanced accounting automation platform tailored for businesses handling data from multiple sources. Synder Sync connects your sales channels, payment gateways, ERPs, and inventory systems, syncing everything into one centralized platform. Synder RevRec takes it a step further by automating GAAP-compliant revenue recognition for SaaS businesses. |

1. Don’t manually record your sales

Retail usually means dealing with a lot of sales. If you’re in ecommerce, that also means gathering sales data from different marketplaces and payment processors.

I know many CEOs who manually record all these transactions in the books but that leads to missed transactions, duplicates, and errors. And nothing will turn off lenders more than repeated data entry errors. It makes them not trust your financials, and therefore, they’ll be slow to move on you.

Do capture all transaction data from online platforms

Every transaction from your connected sales channel or payment processor should be automatically recorded in real-time. In Synder, all this information comes into one centralized database, so duplicates get filtered out and your books have accurate data. Plus, any discounts or refunds are automatically applied to the sales receipts, so you don’t have to worry about missing a thing.

| Pro tip: I’ve noticed that more established startups often opt for consolidated sales reports. Trends are easier to pick up, which always comes in very handy when it comes to showing growth and being able to forecast—something that creditors and investors love to see. |

2. Don’t create revenue recognition schedules manually

In SaaS, your transactions are in the form of subscriptions which creates a problem when you need to use accrual accounting. Why? Picture splitting yearly subscription payments into 12 months or even 365 days of earned revenue for every customer—then throw in tiered pricing and bundles. Now, imagine raising prices. It’s a bookkeeping nightmare.

Do automate schedule-making

To reap the benefits of the accrual method without the complexity of revenue recognition, there’s no better way than to automate. There are many tools and approaches out there, but at Synder, we help you customize your settings to fit your unique business needs. This way, you tailor the tool to match your workflows—not the other way around.

When the revenue is recognized correctly, you can impress lenders and investors with spot-on bookkeeping from the start—it builds trust and confidence in your management and financials.

3. Don’t forget about subscription changes

Setting up revenue recognition schedules is one challenge; adjusting them for subscription changes is another. Any upgrades, downgrades, refunds, or cancellations can throw off your entire schedule, requiring a full recalculation.

Do let automation handle subscription changes

Have subscription changes tracked and updated automatically in real-time. No manual tweaks needed—Stripe subscription adjustments (if you use Stripe) are instantly mirrored in your records. Plus, open invoices close automatically when paid, making your monthly reconciliation smoother and faster.

4. Don’t manually hunt down fees in your statements

Fees are a pain—they chip away at your profits and are tough to track.

The main problem with accounting for fees is that each payment processor and sales channel—like Amazon, PayPal, Stripe, Shopify, etc.—applies a unique set of fees, and they share this information inconsistently and not always transparently. Fishing these fees out from platform statements is complicated, leading to potential data entry errors, as it’s easy to miss a fee here and there.

Do track all fees in a consistent manner

When fees are synced from connected platforms using an automated solution like Synder, you can trust that all the data will be consistently recorded in your books, no matter which platform applied the fees. You can even categorize different fees—like storage, transaction, or subscription fees—into specific sub-accounts for even more granularity. This not only simplifies expense tracking for tax purposes but also sets the stage for detailed reporting if you ever seek funding.

5. Don’t forget about recording withheld taxes

In online retail, dealing with regular sales taxes is one thing, but marketplace-withheld taxes add another layer of complexity. The IRS now requires large marketplaces to handle tax collection and remission, easing some burden for ecommerce owners. But there’s a twist—you’re still on the hook to record these taxes in your books. How do you log amounts you never actually touched?

Do pull tax-withheld data straight from the marketplaces

You need this data in your books to nail your tax calculations and get a clear picture of your profits. If your software like Synder allows direct integration with industry giants such as Amazon, Walmart, eBay, TikTok, and Etsy, those taxes are recorded seamlessly.

So, with transactions, subscriptions, fees, and taxes squared away, what’s next?

6. Don’t let the month end without reconciling your accounts

When it’s time to seek funding or attract investors, you’ll need more than just transaction records—you’ll need rock-solid financial statements. During due diligence, they’ll dive into your books, and if your general ledger doesn’t perfectly match your external records, you’re in trouble. It gets even trickier with accrual accounting, especially subscription revenue—only income that’s earned is recognized, while the rest is deferred.

Skipping this process or neglecting it monthly is a recipe for disaster—whether at tax time or when a funding opportunity arises.

Do get your books ready for multichannel reconciliation

Whether you’re juggling one platform or many, smart tools like Synder make end-of-month book closing simple. They hold transactions in a clearing account until payouts hit your bank, then automatically move pre-matched transactions to your checking account. When it’s time to close the books, everything’s ready for a seamless, accurate reconciliation.

Have accurate, investor-ready books at your fingertips

Synder is your go-to solution for flawless bookkeeping—automating everything from data entry to GAAP-compliant revenue recognition and seamless multichannel reconciliation.

Of course, the choice is yours, and while you could scramble to fix things at the last minute with an accounting firm, it’ll cost you a lot of money and, more critically, precious time during your fundraising period. With Synder, however, you get effortless integration into your existing platforms from day one, without breaking the bank. Want to ensure your books are ready for funding and investment? Schedule a personal demo with one of our experts today!

Closing thoughts

Your books are the story of your business—every high and low, every strategy and opportunity. That’s why lenders and investors read them like an open book. Make sure these people are inspired to turn the last page, eager to provide the funds your business needs.

But accurate bookkeeping does more than just impress—it’s an early warning system. Spotting financial red flags early allows you to correct your course before needing extra cash.

The ideal time to start accurate bookkeeping is at the beginning, but the next best time is now. Wherever you’re in your startup journey, it’s never too late to fix your books and start benefiting from solid financial management. Wishing you great success with your next funding round!