When the tax season is just around the corner, there are many things to consider and prepare in advance to go through it smoothly. One of the things to have in mind is how to deal with charitable donations. Just to be more exact, we’re talking here about claiming a tax deduction for any contribution that a company has made. To be able to do so, you must follow some rules and guidelines imposed by the IRS. In this article we’re going through these rules and recommendations as well as explain the main things at play when it comes to tax-deductible charitable contributions. We’ll also give an example of an application (Donor Receipts) that simplifies the process of generating and sending donation receipts.

What is a donation receipt?

Donation receipts, also called donation tax receipts, are a form of written proof that provide official documentation of a contribution made by a donor. Donation receipts are often written in the form of an acknowledgment letter that proves the fact that a certain donation has been received. Such a form of communication is also an opportunity for a nonprofit organization to express their gratitude to their donors and provide them with the necessary documentation for claiming a tax deduction.

Why are donation receipts needed?

As it has just been mentioned, donation receipts serve both donors and recipients. Let’s see what the benefits are for both sides.

Benefits for donors:

- Deductions on Tax Returns. Claiming a tax deduction for any charitable contribution is impossible without proper and timely documentation.

- Acknowledgement. Getting donation receipts confirms the reception of a donor’s contribution and expresses gratitude from a recipient.

- Tracking expenses. Donation receipts help to keep track of the donor’s finances in relation to charitable giving.

Benefits for recipients (nonprofits):

- Legal requirements. Donation receipts are required by the IRS in certain situations. The penalty of $10 per contribution is imposed on a charity that doesn’t make the required disclosure in connection with a quid pro quo contribution of more than $75 (a contribution made by a donor in exchange for goods or services is called a quid pro quo contribution). The penalty doesn’t exceed $5,000 per fund-raising event or mailing.

- Donor retention. Confirming the reception of a donation with an acknowledgement letter preferably right after the donation builds certain relations between donors and recipients, which makes donors contribute more.

- Tracking donation history. Sending donation receipts is a way of tracking a donor’s history of contributions.

- Accurate financial records. Donation receipts provide nonprofits with the needed accounting documentation.

When are donation receipts needed?

According to the IRS rules of recordkeeping and substantiation:

- Donors must have a bank record or written communication from a charity for any monetary contribution before the donors can claim a charitable contribution on their federal income tax returns. Which means that if a donor intends to claim a tax deduction, a donation receipt must be provided by a charity on request.

- Donors should get a written acknowledgment from a charity for any single contribution of $250 or more.

Charitable organizations are required to provide a written disclosure to a donor who receives goods or services in exchange for a single payment of $75 or more.

What should a donation receipt template include?

In its guideline on charitable contributions the IRS states that donation tax receipts should include the following information:

- The donor’s name.

- The organization’s name, federal tax ID number, and a statement indicating that the organization is a registered 501(c)(3).

- The date of the donation.

- The type of the contribution:

- cash contribution (amount);

- non-cash contribution (description, not value).

The donor is responsible for assigning cash value for donated items or in-kind contributions.

- A statement that goods or services, if any, were provided by the organization in return for the contribution. If any goods or services were provided, a written disclosure might be included.

- Name and signature of the authorized representative of the organization.

It isn’t necessary to include either the donor’s Social Security number or tax identification number on the acknowledgment.

It’s important that a donation receipt is contemporaneous, which means that a donor must receive the acknowledgment by the earlier of:

- the date on which the donor files their individual federal income tax return for the year of the contribution; or

- the due date (including extensions) of the return.

A good example of a donation receipt text would be:

“Thank you for your cash contribution of $300 that (organization’s name) received on December 12, 2015. No goods or services were provided in exchange for your contribution.”

It’s wise to create donation receipt templates as it simplifies the procedure. But it’s even more important to make donation receipts compelling by adding creative short videos, photos, educational and informative blog posts, which will surely contribute to donors’ engagement.

Written disclosure

In case goods and services were provided by the charity in return for the contribution, a written disclosure might be required with some exceptions we’ll get into a bit later. It’s important to have in mind that a donor can get a contribution deduction on the amount of money that exceeds the value of goods and services provided by an organization in return.

As the IRS states it, “a required written disclosure statement must:

- inform a donor that the amount of the contribution that’s deductible for federal income tax purposes is limited to the excess of money (and the fair market value of property other than money) contributed by the donor over the value of goods or services provided by the organization;

- provide a donor with a good-faith estimate of the fair market value of the goods or services.”

In a nutshell, a recipient (nonprofit) organization must provide a written disclosure statement to a donor who makes a contribution over $75 and gets goods and services in return.

According to the IRS, the exceptions when a written disclosure isn’t required are:

Token exceptions

Those are insubstantial goods and services with the value less or equal to 2% of the donation or $106, or the payment is $53 and up and the gifts such as mugs, calendars have a company’s logo on them with the cost up to $10.6. Free or unordered low-cost items are considered token exceptions too.

Membership Benefits exceptions

An annual membership benefit is also considered insubstantial if it’s provided in exchange for an annual payment of $75 or less and consists of annual recurring rights or privileges, such as free or discounted admissions to events and facilities, gift shop purchases, parking.

Intangible Religious Benefits exceptions

Those are benefits that are used exclusively for religious purposes and aren’t sold in commercial transactions such as admission to religious ceremonies or wine used there.

Tech solution to donation receipts issues

If an organization has a lot of donors who contribute regularly, the process of donation receipt generation can be too much on the plate.

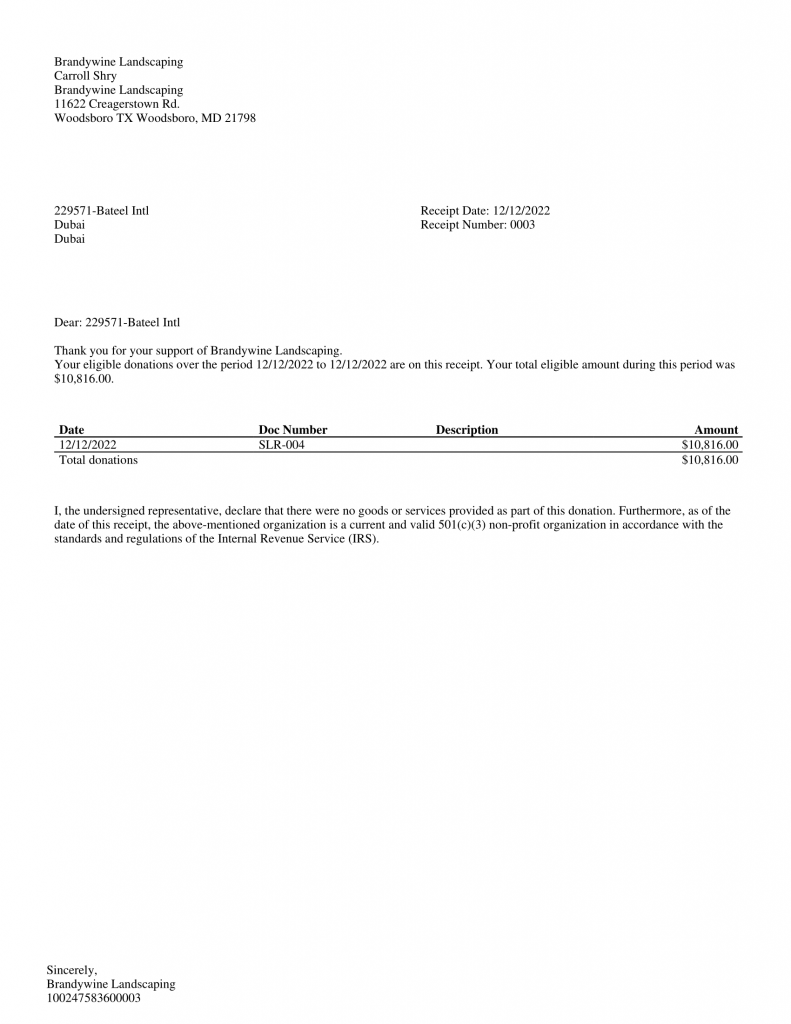

The app Donor Receipts is designed to make the process of donation receipts generation simple and seamless. It’s based on the information from QuickBooks and allows either to download PDFs of the receipts or send them directly to donors’ emails in bulk. The generated receipts match the IRS requirements. Donor Receipts stands out as the best app for receipts, offering comprehensive features tailored to the needs of nonprofit organizations.

The application enables you to:

- Create Receipts. Configure a text to fit the IRS Donation Receipts requirements. Add your Charity number if not retrieved automatically from the QuickBooks profile. Define the starting point for Receipt Numbers. Place your signature on the receipt. Add information about a donation based on the donation receipt template for modern business. Add the disclaimer required by the IRS as a footer for each receipt.

- Preview & Download Receipts. You’ll receive one PDF with all receipts as well as each receipt as a separate file in your email.

Donor receipts allow to:

- Choose the letter format to fit double window envelopes;

- Add special thanks to your donors;

- Upload and place your signature and logo on receipts or sign all receipts by hand.

This is what a donation receipt downloaded from a Donor receipts testing account looks like.

Receipt template

Bottom line:

Donation receipts generation is an inseparable part of a charity (nonprofit) organization functioning. Sending back compelling and timely donation receipts increases the chances of donor retention, and using the right tech solution should minimize the efforts in the process of preparing for the tax season.

![All You Want to Know About Donation Receipts [Synder Guide]](https://synder.com/blog/wp-content/uploads/sites/5/2022/12/all-you-want-to-know-about-donation-receipts-1-800x371.jpg)