Sales discounts require specialized bookkeeping with precise and detailed records, which may seem rather unusual to those unfamiliar with accounting.

This article delves into the peculiarities of accounting for sales discounts, demonstrating how they impact your accounts and financial statements. By walking through the steps of recording sales and applying discounts, we’ll shed light on the specific methods accountants use to ensure financial accuracy and transparency when dealing with sales discounts.

Key takeaways:

- Sales discounts come in two types: trade discounts and cash discounts.

- In books, trade discounts are applied before recording sales, while cash discounts involve specific journal entries.

- Sales discounts affect net sales on the income statement and adjust Accounts Receivable on the balance sheet.

- Trade and cash discounts impact financial statements by reducing gross sales revenue and Accounts Receivable.

Contents:

3. How to account for sales discounts

4. How to account for trade discounts

5. How sales discounts impact financial statements

- Sales discounts and the income statement (P&L)

- Sales discounts and the balance sheet

- Sales discounts and the cash flow statement

6. How Synder can automate your sales discounts

7. Accounting for sales returns and allowances

What are sales discounts?

Sales discounts, also known as cash discounts or early payment discounts, are reductions in the amount a customer has to pay if they settle their invoice before the due date. These discounts incentivize early payment, helping businesses improve their cash flow.

Types of discounts

Discounts come in two main types: trade discounts and cash discounts.

Trade discounts

Trade discounts are given at the time of sale, usually to encourage bulk purchases or reward long-term business relationships. These discounts are applied directly to the sale price before it’s recorded in the accounting books, meaning the discounted price is what gets recorded, not the original price.

Example: If a customer buys products worth $1,000 and you offer a 10% trade discount, the sale will be recorded as $900.

Cash discounts (early payment discounts)

Cash discounts are offered after a sale has been made to customers who pay their invoices quickly. These discounts encourage early payments, improving cash flow and reducing the risk of bad debts. They’re recorded separately in the accounting books, with the discount noted in a Sales Discounts account, reflecting the reduction from Accounts Receivable.

Example: Remember our customer? If they receive an invoice for $1000 and pay early to get a 2% discount, they’ll pay just $980. The $20 discount is then recorded separately from the original sale.

How to account for sales discounts

Proper accounting for cash discounts involves using several key accounts:

- Sales Discounts account (a contra revenue account);

- Accounts Receivable account;

- Sales Revenue account;

- Cash account.

To illustrate how to work with sales discounts, we’ll go through each step with journal entries and explanations.

1. Recording the sale

When you sell goods on credit, you need to make an initial journal entry to reflect the transaction. The journal entry to record a sales discount typically involves two accounts: Sales Discounts and Accounts Receivable.

So your company sold goods to our customer worth $1,000. This amount is your gross sales revenue or gross sales.

In this scenario, the journal entry would debit Accounts Receivable because you’re expecting to receive $1,000 from the customer. At the same time, you’ll credit Sales Revenue because you’ve earned $1,000 in sales revenue. Take a look at what the journal entry looks like:

| Date | Account | Debit | Credit |

| [Sale Date] | Accounts Receivable | $1,000 | |

| [Sale Date] | Sales Revenue Account | $1,000 |

2. Applying the sales discount

As we mentioned above, the customer paid early and got a 2% discount – $20, which has to be considered. You record this discount in the Sales Discounts account, which is a contra revenue account.

In this case, the journal entry would debit the Cash account with $980 to reflect the amount of cash received from the customer. Also, there would be the debit of Sales Discounts with $20 to record the discount given to the customer. Finally, you’ll credit Accounts Receivable for $1,000 to remove the amount that was originally due from the customer.

The journal entry for this transaction looks like this:

| Date | Account | Debit | Credit |

| [Payment Date] | Cash | $980 | |

| [Payment Date] | Sales Discounts | $20 | |

| [Payment Date] | Accounts Receivable | $1,000 |

How to account for trade discounts

It’s already been briefly mentioned that a trade discount is a price reduction given to customers at the time of the sale. It’s usually based on the volume of goods purchased or the customer’s business relationship.

Unlike cash discounts, trade discounts aren’t recorded in the accounting books separately. Instead, they’re applied directly to the sales price before the sale is recorded.

Suppose you’re selling $1,000 worth of products to a regular customer, and you offer a 10% trade discount. Instead of recording $1,000 as the sale amount, you’d only record $900.

In this case, you would record the transaction as follows:

| Date | Account | Debit | Credit |

| [Sale Date] | Accounts Receivable | $900 | |

| [Sale Date] | Sales Revenue | $900 |

Note: The discount doesn’t appear in the accounting records because it’s applied before the sale is entered into the books.

How sales discounts impact financial statements

Sales discounts have a direct impact on different parts of the financial statements, influencing how the business’s financial performance is perceived.

Sales discounts and the income statement (P&L)

First, on the P&L, you determine the net sales by deducting the sales discounts and sales returns from the gross sales revenues. This reduction in revenue directly affects the revenue figure reported.

For instance, if your total sales revenue is $5,000 and you give $150 in discounts, your net sales amount to $4,850.

Here’s how it appears on the income statement:

| Date | Item | Amount |

| [Payment Date] | Gross Sales Revenue | $5,000 |

| [Payment Date] | Sales Discounts | $150 |

| [Payment Date] | Net Sales | $4,850 |

Sales discounts and the balance sheet

On the balance sheet, sales discounts reduce the amount in the Accounts Receivable account. This reflects the actual amount you expect to collect from customers, improving the accuracy of your financial position.

So if you had $5,000 in receivables and offered $150 in discounts, your adjusted Accounts Receivable would be $4,850.

| Date | Asset | Amount |

| [Sale Date] | Accounts Receivable | $5,000 |

| [Sale Date] | Sales Discounts | $150 |

| [Sale Date] | Net Accounts Receivable | $4,850 |

Sales discounts and the cash flow statement

The cash flow statement tracks the cash coming in and going out of your business.

Let’s use the same example where you had a $5,000 sale and offered a 3% discount, resulting in $150. The actual cash you received was $4,850.

Your cash flow statement will show this:

| Item | Amount |

| Cash received from customers | $4,850 |

As you can see, discounts show up in different ways across your financial statements. Let’s sum it up:

- On the income statement, discounts knock down your net sales. They reduce the revenue you actually bring in.

- On the balance sheet, discounts adjust Accounts Receivable to show the true amount you expect to collect from customers.

- On the cash flow statement, discounts affect both how much cash you get and when you get it.

How Synder can automate your sales discounts

When you’re dealing with a multitude of payment processing platforms—Stripe, PayPal—and ecommerce platforms like Shopify, manually tracking every discount can quickly become a nightmare. Not only does it eat up your time, which is already worth its weight in gold, but it also opens the door to mistakes, all of which can distort your financial statements.

This is where automation tools step up. One such tool that simplifies this process is Synder. It’s primary purpose is to sync all financial transactions, including sales, fees, expenses, taxes, and those numerous sales discounts, directly into QuickBooks Online/Desktop, Xero and Sage Intacct.

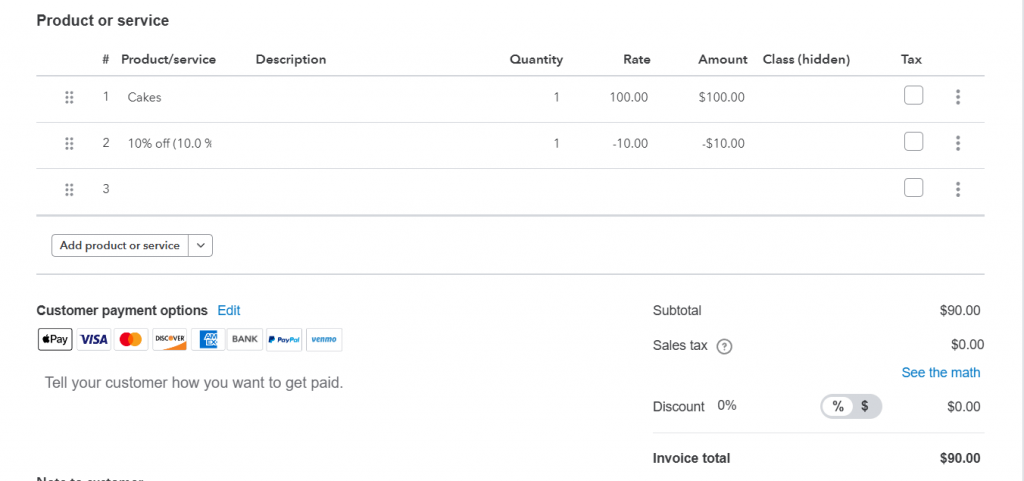

Let’s get straight to discounts. Synder can sync discounts in two different ways, depending on your needs.The first method allows you to sync discounts as separate line items: you’ll need to create a discount product in your accounting platform and assign it to a specific account.

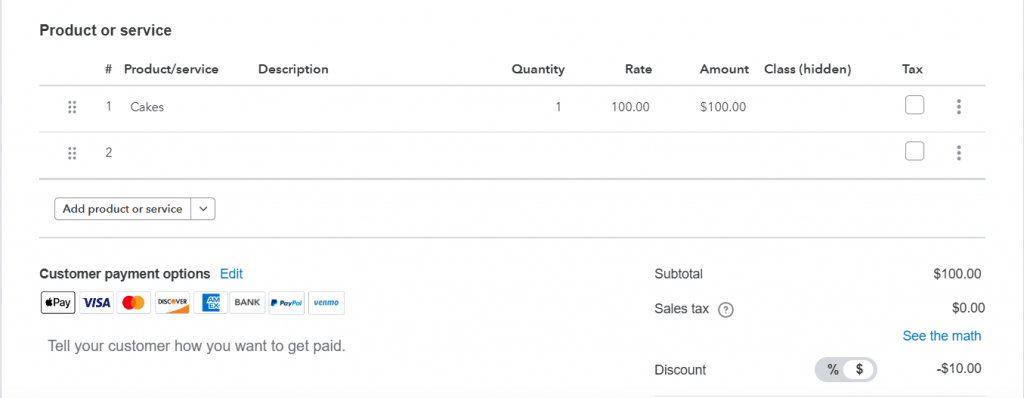

The second method is a bit more straightforward and involves applying a single discount to the entire transaction. Instead of breaking down the discount into separate line items, Synder will store all discounts under one account that you choose in the settings.

As easy as that!

Reasons to try Synder:

- Synder works with over 30 platforms so you can pull everything together into a single dashboard, no more bouncing between apps. And we take requests from our clients!

- Made a mistake or need to fix something from a past sync? No worries—Synder makes it super simple to roll back any previously completed synchronization.

- Synder lets you set up triggers, conditions, and actions to classify your sales or discounts if required. Just set it up once, and Synder will take care of it!

- And finally, Synder automatically matches amounts from your bank statement to your bookkeeping records, so you just need to confirm the match with one click for an easy reconciliation process.

See how it works by booking a seat at a Weekly Public Demo with Synder specialists who can answer all your questions or sign up for a free trial to get hands-on experience!

Accounting for sales returns and allowances

Sales discounts, returns, and allowances can all impact your financial statements and bottom line. Sales returns occur when customers return purchased goods, requiring a reversal of the sale to reflect actual revenue. Sales allowances are price reductions for goods customers keep but are dissatisfied with, like offering a discount for damaged items they agree to keep.

When dealing with returns or allowances, you adjust your financial records to reflect these changes. Here’s how you can handle them.

Recording a sales return

When a product is returned, it’s necessary to update the records to show that the customer received both the goods and the invoice but hasn’t yet paid. To do this, you’ll need to reverse part of the sale. For example, if a customer returns a $100 item, you’d debit the Sales Returns account and credit Accounts Receivable. This adjustment shows that you’re expecting $100 less from the customer.

Let’s take a look at the journal entry for a sales return:

| Date | Account | Debit | Credit |

| [Return Date] | Sales Returns | $100 | |

| [Return Date] | Accounts Receivable | $100 |

Recording a sales allowance

Sales allowances are issued after the sale and invoice are finalized, regardless of whether the payment has been made yet. To record the allowance, you need to debit the Sales Allowances account and credit Accounts Receivable. This entry adjusts the balance of Accounts Receivable to reflect the reduced amount owed by the customer.

Below is a journal entry for a sales allowance to take a look:

| Date | Account | Debit | Credit |

| [Allowance Date] | Sales Allowances | $20 | |

| [Allowance Date] | Accounts Receivable | $20 |

Wrapping up

Figuring out how to handle sales discounts in your accounting can really help you keep your financial records in check and get a better understanding of how your business is doing. When you’re carefully sorting out the debits and credits, you’re on the safe side that your income statement, balance sheet, and other financial statements show the real picture of your business.

And here’s a handy tip for managing discounts: Synder can do the heavy lifting for you. It syncs discounts across platforms like QuickBooks and Xero, allowing you to set up rules and let Synder handle the rest. Plus, it’s easy to fix mistakes or adjust settings. So don’t miss your chance to streamline accounting for discounts!

Share your thoughts

Have you had any experiences with managing sales discounts in your business? What challenges did you face, and how did you solve them? Do you use automation tools like Synder to account for discounts? Share your stories and insights with us!

Excellent article! Thanks for explaining accounting for sales discounts. This info will assist in my management of business tax services UK.

Thank you for your feedback, David! We’re glad the article on accounting for sales discounts will be of help to your business.