Accounting for medical practices is a specialized field that combines fiscal responsibility with healthcare service. This comprehensive guide delves into the essential components and practices of accounting in the medical sector, highlighting its significance and complexity.

Fundamentals of medical accounting

The fundamentals of medical accounting involve several key concepts and practices essential for managing the financial operations of healthcare facilities. Understanding these basics is crucial for ensuring the financial health and regulatory compliance of a medical practice. Here are the core elements:

Financial statement preparation and analysis

This includes creating and interpreting critical financial documents such as balance sheets, income statements, and cash flow statements. These documents provide a comprehensive view of the practice’s financial health, showing assets, liabilities, revenues, expenses, and cash flow.

- Balance sheet: This statement provides a snapshot of the practice’s financial status at a specific point in time, detailing assets, liabilities, and equity.

- Income statement: This reflects the practice’s financial performance over a period, showing revenue, expenses, and profit or loss.

- Cash flow statement: It tracks the inflow and outflow of cash, crucial for understanding the liquidity of the practice.

- Analysis: Regular analysis of these statements helps identify financial trends, assess business health, and make informed decisions.

Revenue cycle management

A crucial aspect of medical accounting is managing the flow of funds from patient services. This involves billing, coding, accounts receivable management, insurance claim processing, and ensuring timely collection of payments. Effective revenue cycle management is key to maintaining steady cash flow.

- Billing processes: Efficient systems for patient billing, including itemized billing and electronic billing options.

- Insurance claims: Managing insurance claim submissions, follow-ups, and appeals to ensure timely reimbursements.

- Accounts receivable: Monitoring outstanding payments and implementing effective collection strategies.

- Payment posting and reconciliation: Accurate posting of payments and reconciliation of accounts to keep financial records up-to-date.

Expense tracking and cost control

As was said above, this involves monitoring and managing the costs associated with running a medical practice. It includes tracking operational costs, payroll, supply expenses, and equipment maintenance. Cost control strategies are essential for maintaining profitability.

- Operational expenses: Keeping track of daily operational costs like utilities, rent, and supplies.

- Payroll expenses: Managing salaries, benefits, and taxes for employees.

- Equipment and maintenance: Budgeting for medical equipment purchases and maintenance costs.

- Cost analysis: Regularly analyzing expenses to identify areas for cost reduction and efficiency improvements.

Regulatory compliance and reporting

Healthcare accounting must adhere to various laws and regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA). This requires accurate and compliant financial reporting, maintaining patient privacy in billing processes, and understanding the financial implications of healthcare regulations.

- HIPAA compliance: Ensuring all financial transactions and patient data handling are in compliance with HIPAA privacy rules.

- ACA compliance: Adapting to regulations under the Affordable Care Act, especially in areas affecting patient coverage and billing.

- Financial reporting: Maintaining accurate financial records and reporting them in compliance with healthcare and tax regulations.

Billing and coding

Accurate medical billing and coding are vital for ensuring correct patient invoicing and insurance claims processing. Errors in coding can lead to claim rejections or denials, affecting the revenue cycle.

- Coding accuracy: Using correct medical codes for services rendered to ensure proper billing and minimize claim denials.

- Up-to-date knowledge: Staying informed about updates in coding standards like ICD-10, CPT, and HCPCS.

- Claim submission and follow-up: Timely submission of claims and proactive follow-ups for denials or partial payments.

Payroll and human resource management

Payroll management is a significant component of medical accounting, involving the processing of salaries, wages, benefits, and taxes for employees. It also includes managing contracts for freelance or contracted medical professionals.

- Salary processing: Accurate calculation and disbursement of salaries and wages.

- Benefits administration: Managing employee benefits like health insurance, retirement plans, and leave policies.

- Tax compliance: Ensuring accurate tax deductions and compliance with employment tax laws.

- Contract management: Overseeing contracts for part-time, freelance, or contracted medical staff.

Financial planning and budgeting

This involves creating a financial roadmap for the practice, including budgeting for short-term operations and long-term strategic planning. It helps in resource allocation, investment decisions, and preparing for future growth or expansion.

- Short-term budgeting: Developing and managing annual budgets, including revenue forecasts and expense allocations.

- Long-term planning: Strategic planning for future growth, expansions, or investments.

- Resource allocation: Making informed decisions about resource distribution based on financial analysis.

Use of technology

Implementing accounting software and integrating financial systems with Electronic Health Records (EHRs) is becoming increasingly important. This integration enhances the efficiency and accuracy of financial operations.

- Accounting software: Implementing specialized accounting software for automated and efficient financial management.

- EHR integration: Integrating financial systems with Electronic Health Records for streamlined data management and billing accuracy.

- Data security: Ensuring the security and confidentiality of financial data in digital formats.

Audit and risk management

Conducting regular financial audits to ensure accuracy and compliance is fundamental in medical accounting. It also involves identifying financial risks and implementing strategies to mitigate them.

- Financial audits: Regular internal and external audits to ensure accuracy and compliance of financial records.

- Risk assessment: Identifying potential financial risks and developing strategies to mitigate them.

- Compliance checks: Regularly reviewing and updating practices to stay compliant with changing healthcare laws and financial regulations.

How do you choose the right accounting method for medical practices?

Consult with a healthcare financial advisor or accountant who understands the specific nuances of medical practice accounting. Professional advice is crucial, especially when deciding on an accounting method that will align with both current needs and future goals.

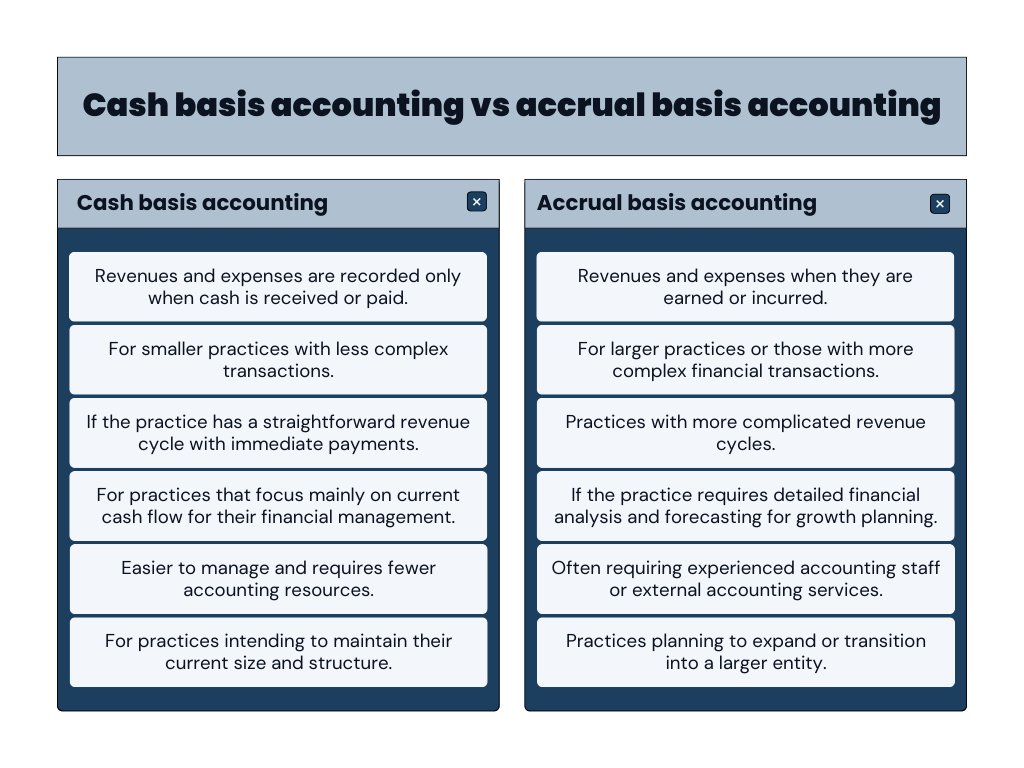

Choosing the right accounting method for a medical practice is a crucial decision that impacts financial reporting, tax obligations, and overall financial management. The two primary accounting methods are cash basis accounting and accrual basis accounting. Here’s a guide to help medical practices choose the most suitable method:

Understand the differences

| Cash basis accounting | Accrual basis accounting |

| In this method, revenues and expenses are recorded only when cash is received or paid. It’s simpler and gives a clear picture of how much cash the practice has at any given time. | This method records revenues and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. It provides a more accurate picture of the practice’s financial health over time. |

Consider the size and complexity of the practice

Smaller practices with less complex transactions may find cash basis accounting easier and more straightforward.

Larger practices or those with more complex financial transactions might benefit from accrual basis accounting for a more accurate representation of their financial position.

Evaluate the revenue cycle

If the practice has a straightforward revenue cycle with immediate payments (like co-pays or direct-pay services), cash basis might be suitable.

Practices with more complicated revenue cycles, including dealing with insurance claims and varying payment schedules, might find accrual accounting more reflective of their financial status.

Assess the need for financial analysis and forecasting

If the practice requires detailed financial analysis and forecasting for growth planning, accrual accounting can provide a more comprehensive view of financial trends.

For practices that focus mainly on current cash flow for their financial management, cash basis accounting may suffice.

Consider the accounting resources available

Cash basis accounting is generally easier to manage and requires fewer accounting resources.

Accrual accounting can be more resource-intensive, often requiring experienced accounting staff or external accounting services.

Plan for the future

Practices planning to expand or transition into a larger entity may choose accrual accounting as it aligns better with more complex business structures.

For practices intending to maintain their current size and structure, the simplicity of cash basis accounting might be more beneficial.

Summing up, the main differences between these two types of accounting look like this:

Common challenges of medical accounting

Medical accounting, while crucial for the successful operation of healthcare practices, presents several challenges. These challenges arise from the unique nature of the healthcare industry, regulatory complexities, and the need for precision in financial management. Here are some of the common challenges:

Complex billing and coding systems

Navigating the complex billing and coding landscape requires extensive knowledge and attention to detail. Medical practices must constantly train their staff to keep up with the latest coding updates and revisions. Additionally, coding inaccuracies can lead to underbilling or overbilling, both of which have significant financial and legal implications.

Solutions:

- Regular training: Provide ongoing training for staff on the latest billing and coding updates, including ICD-10 and CPT codes.

- Use of specialized software: Implement billing and coding software that updates automatically with the latest codes and regulations.

- Outsourcing: Consider outsourcing billing and coding to specialized companies if in-house resources are insufficient.

Regulatory compliance

Compliance with healthcare regulations is a moving target due to frequent legislative changes. This demands continuous monitoring and adaptation of accounting practices. Non-compliance can result in hefty fines, legal challenges, and damage to the practice’s reputation.

Solutions:

- Stay informed: Keep abreast of changes in healthcare regulations through professional associations, legal advisories, and healthcare publications.

- Dedicated compliance officer: Appoint a compliance officer to oversee all compliance-related activities.

- Regular audits: Conduct regular internal audits to ensure adherence to regulations.

Managing accounts receivable

Efficiently managing the cash flow from accounts receivable is a balancing act. Medical practices need to develop strategies to expedite payments, such as offering various payment options, optimizing billing processes, and implementing effective follow-up procedures for overdue accounts. Prolonged delays in receivables can significantly affect the practice’s liquidity and ability to cover operational expenses.

Solutions:

- Clear payment policies: Establish and communicate clear payment policies to patients.

- Efficient billing systems: Use efficient billing systems to promptly issue invoices and follow up on unpaid bills.

- Patient financing options: Offer flexible payment options or patient financing to facilitate timely payments.

Fluctuating healthcare policies and insurance plans

The ever-changing landscape of healthcare policies and insurance plans requires practices to be flexible and responsive. This involves staying informed about policy changes, understanding how they impact billing and reimbursement, and adjusting accounting practices accordingly. The variability in insurance plans also necessitates a thorough understanding of different coverage policies to ensure accurate billing.

Solutions:

- Flexibility and adaptability: Develop a flexible approach to quickly adapt to policy changes.

- Insurance liaison: Appoint a staff member to liaise with insurance companies and stay informed about changes in coverage and policies.

Technology integration and data security

Integrating advanced technology solutions like EHRs, accounting software, and business intelligence software in healthcare can streamline various processes but also introduces challenges in maintaining data security. Ensuring the confidentiality and integrity of sensitive patient financial data is critical. This requires robust cybersecurity measures, regular software updates, and employee training in data security protocols.

Solutions:

- Secure systems: Invest in secure and HIPAA-compliant technology solutions.

- Regular training on data security: Train staff on cybersecurity best practices and the importance of data security.

- Data backup and recovery plan: Implement a robust data backup and recovery plan.

Financial reporting and analysis

Accurate financial reporting is key to understanding the practice’s fiscal health and making informed decisions. Challenges arise in consolidating data from various sources and ensuring the accuracy and timeliness of reports.

Solutions:

- Accurate record-keeping: Maintain meticulous and accurate financial records.

- Professional accounting services: Consider employing a professional accountant or financial advisor specializing in medical practices.

- Regular review and analysis: Conduct regular financial reviews and analyses to understand the financial health of the practice.

Resource allocation and budget management

Effectively allocating resources and managing budgets in a dynamic environment requires strategic planning and foresight. Medical practices must balance immediate financial needs with long-term investments, such as technology upgrades and staff development, while also preparing for unforeseen expenses.

Solutions:

- Strategic budgeting: Develop a comprehensive budget that accounts for both expected and unexpected expenses.

- Regular financial review: Regularly review financial performance against the budget and adjust as necessary.

- Cost-benefit analysis: Perform cost-benefit analyses for significant expenditures.

Learn about the perpetual inventory system and how it differs from the periodic inventory system.

Audits and risk management

Regular internal and external audits are essential to identify and address potential financial discrepancies and risks. Effective risk management strategies should be in place to detect and prevent fraud, errors, and mismanagement.

Solutions:

- Internal control systems: Establish strong internal control systems to detect and prevent errors and fraud.

- Regular risk assessments: Perform regular risk assessments and develop strategies to mitigate identified risks.

Staff training and retention

In the competitive field of medical accounting, attracting and retaining qualified staff is challenging. Continuous professional development and a supportive work environment are key to keeping the accounting team skilled and motivated.

Solutions:

- Competitive compensation and benefits: Offer competitive salaries and benefits to attract and retain qualified staff.

- Professional development opportunities: Provide opportunities for professional development and career advancement.

Patient satisfaction and transparency

Balancing the financial aspects of the practice with patient satisfaction requires transparent and patient-friendly billing practices. Clear communication about billing policies, procedures, and patient responsibilities is essential.

Solutions:

- Transparent billing practices: Ensure billing practices are transparent and understandable to patients.

- Effective communication: Establish clear channels for patient communication and queries regarding billing.

- Patient feedback system: Implement a system for receiving and addressing patient feedback on billing and financial matters.

Conclusion

Accounting for medical practices is a multifaceted and evolving field, integral to the successful operation of healthcare facilities. Mastery of this discipline ensures the economic well-being of medical practice and supports the provision of top-notch healthcare services.

As the healthcare landscape continues to change, so too must the strategies and methodologies in medical accounting, necessitating a proactive and informed approach to financial management.

This is a really insightful piece on practice management! Effective management practices are essential for any organization to thrive, especially in fields like healthcare and law where efficiency can directly impact client satisfaction. I love the emphasis on integrating technology to streamline workflows and improve communication. Tools like electronic health records and project management software can truly make a difference. It’s also crucial to focus on team collaboration and continuous training to adapt to changing needs. Looking forward to more discussions on best practices in this area!