Gift cards and gift certificates are pretty common choices for gifts, and they can actually bring in some good money for businesses, especially those operating online. However, when it comes to handling accounting for these gift cards, it can get a bit confusing. But don’t worry, Synder will help you get the hang of some basic gift card rules and best practices and automate the whole accounting process for Shopify and Square gift cards. How? Let’s explore the depth of gift card challenges and dive into the experience of our customers.

Contents:

1. Problem: Gift card revenue recognition

2. Solution: How Synder eases the management of Shopify and Square gift cards

Problem: Gift card revenue recognition

In accounting, the conventional approach to gift cards might be to record gift card sales as income, similar to other products. However, the accounting process for gift cards is more intricate.

In reality, gift cards should be viewed as a liability for deferred revenue because they signify an obligation on the part of the business to provide products or services of equal value to the gift card holder.

When customers purchase gift cards, the cash is received upfront, but it can’t be recognized as revenue at that moment since no goods or services have been exchanged.

Instead, these gift card purchases are logged as deferred revenue, indicating that the revenue will be realized in the future when the gift card is redeemed.

In essence, gift card sales aren’t immediately recognized as income but are considered deferred revenue until the recipient actually uses the gift card to make a purchase, at which point the revenue gets recognized. This approach ensures accurate accounting and aligns with the business’s obligation to fulfill the value of the gift card.

Rachel Dauchy & NetDeposited: Shopify gift card management

Rachel Dauchy, an Advanced Certified QuickBooks Elite ProAdvisor and the owner of NetDeposited, has a rich background spanning banking, accounting, and operations. Transitioning from a career in these fields, Rachel was driven by her entrepreneurial spirit and passion for accounting, training, and software as a service (SaaS).

As a Shopify Affiliate, Rachel specializes in assisting sellers with multiple Shopify stores and various other channels. This is how she encountered challenges such as clients who want manual data entry instead of utilizing automation tools, and clients who don’t understand the importance of proper accounting practices for Shopify gift cards.

You may wonder what the main problem is. According to Rachel, the key issue with gift card management is the incorrect setup of gift cards by the client from the very beginning. Here’s how she describes her experience:

“The beginning balances are often in disarray, requiring significant time to rectify. Clients frequently mismanage their gift card issuance and redemption – they issue a ton of gift cards and then don’t apply the redemption correctly. This leads to imbalances that need careful correction and mapping. My dream here is to go in once at the end of the month and reconcile. And that’s usually impossible until I fix everything up.”

Consequences of improper gift card management

If gift card management isn’t handled properly, the consequences can be quite troublesome. When gift cards are overlooked or mismanaged, it can lead to significant errors in financial reporting. These errors may include incorrect mappings, accumulation of balances in the wrong accounts, and improper transactions reconciliation.

“When gift cards aren’t mapped to the right general Ledger account, then everything is totally out of whack. Sometimes, I’ll see that it’s accruing on one side and then it’s not clearing out, it’s clearing up somewhere else or not clearing out at all. Eventually, you’re going to run into an incorrect balance sheet. And you don’t want that.”

Moreover, misclassifying gift card sales as revenue instead of liabilities builds up the problem. This can distort the company’s financial picture and make it challenging to track and manage gift card liabilities effectively. The possible consequences of these errors may require significant cleanup work, such as locating and fixing transactions that have been misclassified.

“Another thing that I’ve seen is that people put the gift card sale in revenue, which it’s not. It’s a liability. Imagine the mess you have to deal with when you realize that you should go back and find all those gift cards and do the work for them.”

This not only adds to the workload but also undermines the reliability of financial data and reporting, potentially eroding trust with clients and complicating financial analysis and planning efforts.

How can you avoid such situations in the first place? Rachel suggests that accounting professionals should proactively manage the flow of information by using automation tools and maintaining access to client systems instead of relying solely on information provided by clients.

“My advice here is: do not set up gift cards in Shopify unless you understand the money movement behind it, or hire a specialist who can do it for you with the help of automation.”

This is where Synder comes into play, helping thousands of businesses and accounting pros automate the repetitive bookkeeping processes, including mapping Shopify gift cards.

Solution: How Synder eases the management of Shopify and Square gift cards

As we’ve already mentioned, gift cards represent merchant’s or retailer’s commitment to providing customers with products or services equivalent to their value, that’s why they’re categorized as liabilities for deferred revenue. To effectively track them using Synder, you’ll need to establish a dedicated Liability account. Please note that this feature is currently accessible for Shopify and Square users exclusively.

How to configure the liability account for gift cards in Synder?

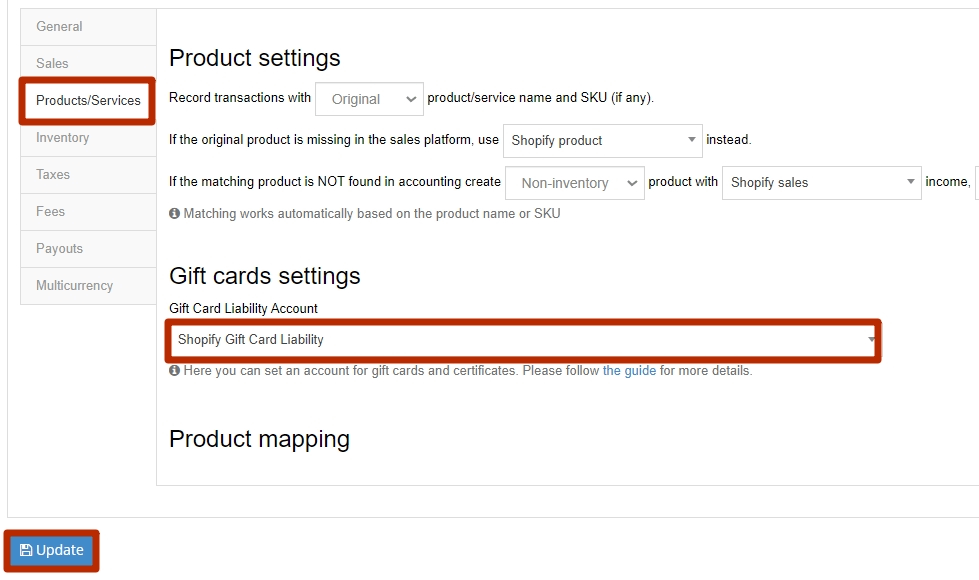

By default, when Synder encounters a new product, it automatically assigns it to a designated Product Income account specified in the Products/Services settings. However, for gift cards, a separate account may be preferable due to the unique nature of these transactions.

To set up the liability account for creating the gift card item, follow these steps:

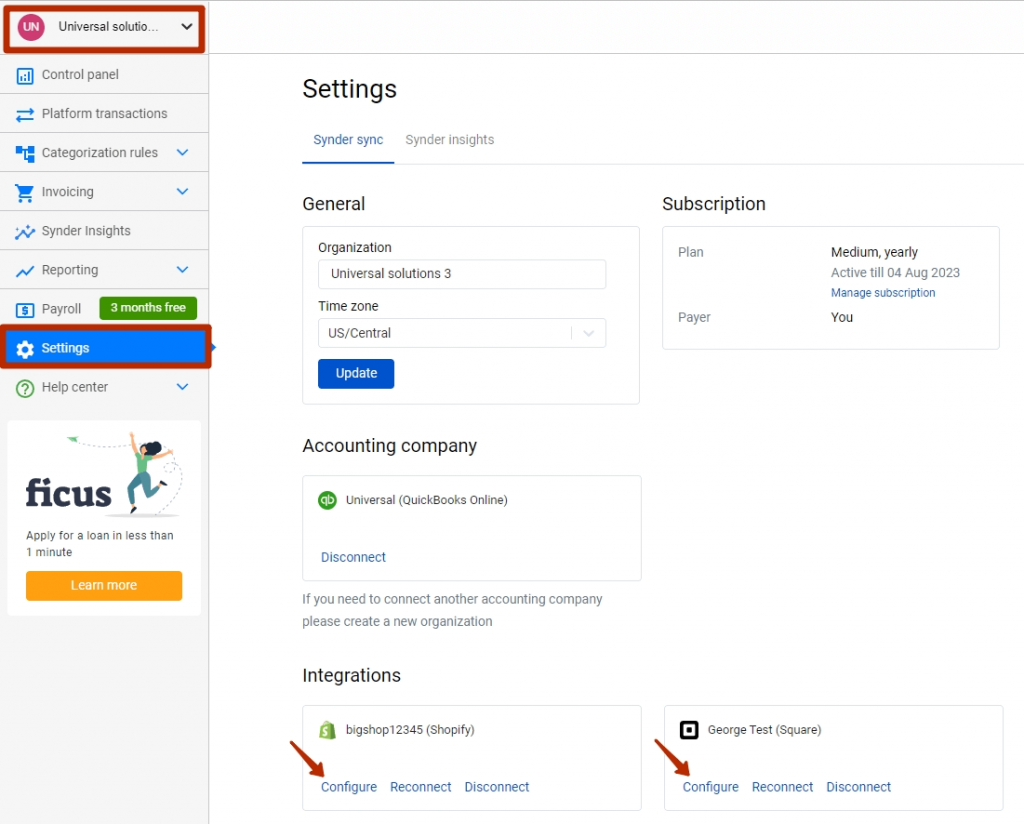

- Choose the relevant organization from the top-right corner of the page.

- Click on the Settings button in the left menu of the app.

- Locate the payment platform (if multiple are connected) for which you want to customize settings, then click on the Configure button.

- Navigate to the Products/Services tab.

5. Select the desired Liability account from the dropdown menu.

6. Click Update to save your changes.

Once completed, any newly synced Square/Shopify gift cards will be linked to this designated Liability account instead of a standard Product income account. Note that Synder automatically creates and maps to this account, so you don’t have to worry about anything.

What to do if you need to update the account for gift cards in QuickBooks or Xero?

In your accounting software, each product is associated with an account to facilitate tracking in Profit and Loss reports. However, if the wrong account was initially selected for gift cards in Synder settings after creating the Gift Card product, changing the setting won’t automatically adjust how the income is categorized. This is because the incorrect account is already linked to the item in QuickBooks or Xero.

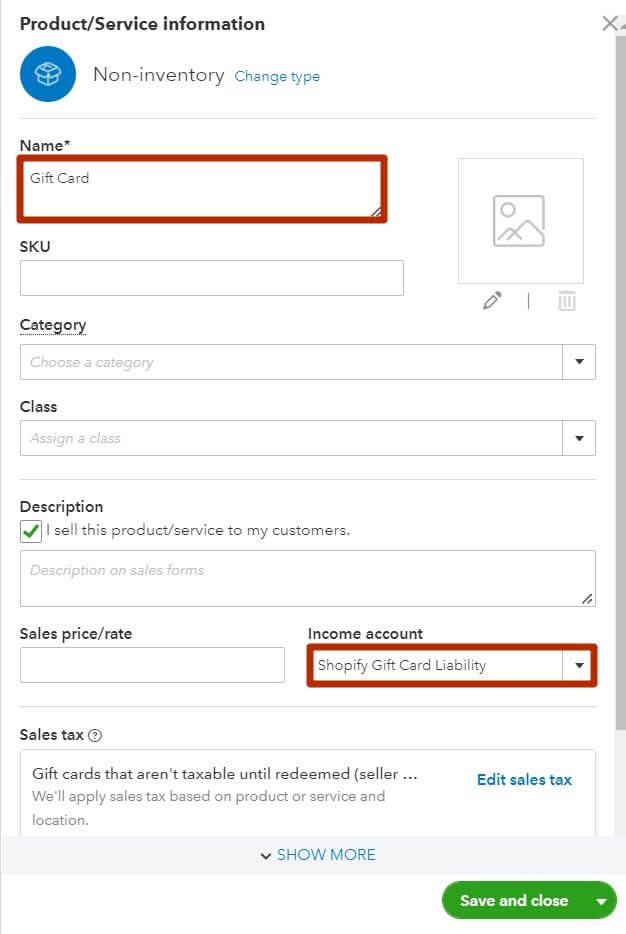

How to update the gift card account in QuickBooks?

To rectify this in QuickBooks:

- Navigate to Sales → Products and Services and find the Gift Card product.

- Click Edit to modify it.

- Specify the correct liability account to track gift cards.

How to update the gift card account in Xero?

For Xero users, follow these steps:

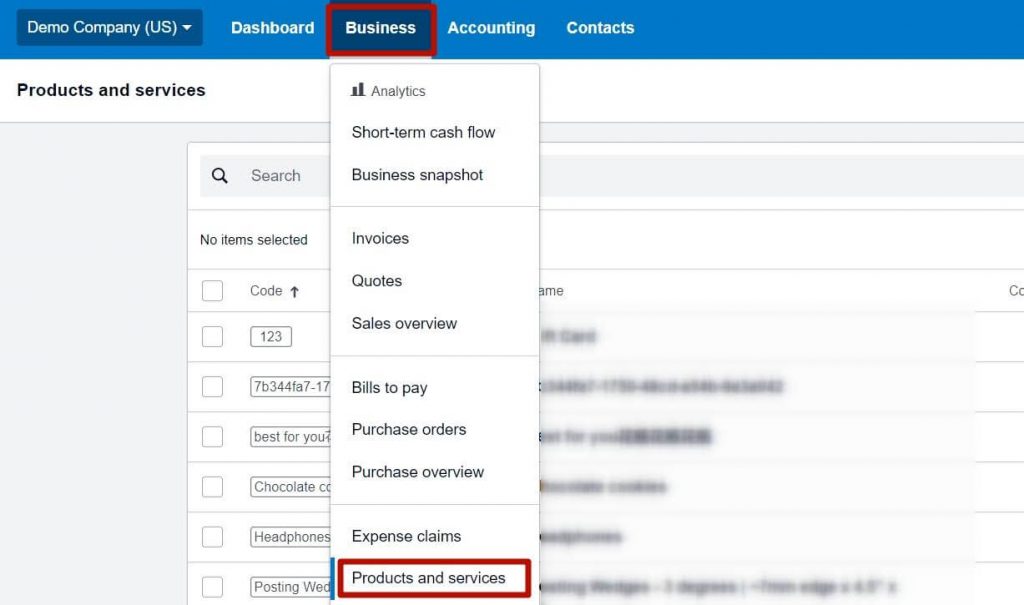

- Go to Business → Products and Services.

- Locate the Gift Card product and click on it.

- Click Edit item to access its details.

- Choose the appropriate Liability account.

With these adjustments, all future transactions involving gift cards will be accurately tracked in the designated Liability account.

Results: How Synder helps Rachel Dauchy address her clients’ needs with Shopify gift cards and beyond

When gift cards are accurately mapped within Synder, they seamlessly align with the data in your reports. With Synder doing the heavy lifting, all that’s left for Rachel to do is periodically check everything to ensure accuracy. Proper setup and mapping allow Rachel to let the system run on autopilot, granting her the freedom to relax while maintaining oversight.

“Well, if gift cards are mapped properly with Synder, then it should be matching what’s in your Shopify Gift Card Liability report. So, it’s doing all the work for you and really, you just need to spot check right by reconciling every so often. And I usually do it quarterly.”

This level of automation is a game-changer for accounting pros, offering the convenience of automated processes while still allowing for periodic manual review. By managing the flow of information and ensuring correct connections and mappings, Rachel can focus on understanding the bigger picture rather than getting caught up in the minutiae of data entry. This streamlined approach not only saves time and effort but also allows her to understand the complexities of her clients’ financial situation on a deeper level.

“I think the most important thing that most accounting professionals are looking forward to is having something that can do the work for you on automation. And then you’re managing the flow of information and you’re making sure that the connections, mappings and information is correct and you’re really understanding things at a higher level instead of just getting bogged down in all the entries of everything.”

Wrapping up

Accounting for gift cards can be a complex process, but proper tools and help from pros make it a whole lot easier. The insights shared by Rachel Dauchy underscore the importance of proper setup and management of gift cards to avoid errors and discrepancies in financial statements.

By actively engaging with automation tools like Synder and maintaining oversight through periodic spot checks, accounting pros can stay on top of things for their clients. It’s not just about saving time and effort; it’s about having confidence in the numbers and making informed decisions for the business.

If you’re grappling with similar challenges, why not give Synder a try? Dive into our 15-day free trial and see how it fits your needs. Or, hop aboard our Weekly Public Demo for a guided tour with an expert. With automation by your side, you can focus on what truly matters – making a real impact for your practice and your clients’ business.

Gift cards FAQs

What is a gift card?

A gift card is a prepaid debit card, containing a specific sum of money for various purchases and financial transactions. Store-specific gift cards are tailored for use at particular merchants or retailers, while general-purpose prepaid gift cards lack affiliation with any specific merchant and also permit cash withdrawals from ATMs.

What are the two primary types of gift cards?

There are two main types of gift cards – closed-loop cards and open-loop cards.

Closed-loop gift cards are typically associated with specific retailers or merchants. They can only be used for purchases at the designated store or on its website. Closed-loop gift cards are usually not reloadable, may have expiration dates, and are often used for special occasions like weddings or baby registries.

Open-loop gift cards are more versatile and can be used at a wider range of locations, both in physical stores and online. They’re often issued by major credit card companies like Visa, MasterCard, American Express, or Discover. Open-loop gift cards may be reloadable, allowing users to add more funds, and may have activation fees when purchased.

What’s the difference between a physical gift card and a digital gift card?

A physical gift card is a traditional plastic card that you can physically hold. You can acquire it either in a physical store or through online purchase, and it’ll be delivered to the address you provide. On the other hand, a digital gift card can only be obtained online. To acquire one, you must visit the retailer’s website that issues it and place an order. The digital gift card will be sent to you via email, along with all the essential card details.

How does a gift card work?

Gift cards function like debit cards but come with a predetermined and loaded value.

To get a gift card, customers typically purchase it from a retailer or a third-party seller. Before using a gift card, it needs to be activated, either by the retailer or during the customer’s first use at the point of sale.

Each gift card has a specific monetary value assigned to it, which can either be a fixed amount or variable, depending on the purchaser’s choice or the retailer’s offerings.

To make a purchase, the recipient presents the gift card to the cashier or enters the gift card code online during the checkout process. The purchase amount is then deducted from the total value of the gift card.

Gift cards often allow for partial redemption. If the purchase amount is less than the card’s value, the remaining balance can be used for future purchases until the card is depleted.

Some gift cards may have expiration dates, rendering them unusable after a certain time. Additionally, specific gift cards may have associated fees, such as inactivity fees or reloading fees, which vary depending on the retailer and the card’s terms and conditions.

Learn how Stripe POS and Square POS work.

What is breakage?

Breakage refers to the revenue gained by retailers when customers fail to redeem gift cards or prepaid services they’ve purchased. Essentially, it represents the unclaimed portion of the value of the gift card or prepaid service. This unclaimed value is retained by the retailer, providing a form of income without the corresponding provision of goods or services.

What’s the accounting treatment for gift cards to employees?

Gift cards given to employees, regardless of the amount, are considered taxable income. Therefore, the accounting treatment for gift cards to employees involves reporting the cash value of the gift cards as part of the employees’ wages on Form W-2. This means that the value of the gift cards is treated as compensation to the employees and must be included in their taxable income for the year. Additionally, if the employees are covered for Social Security and Medicare Tax, the value of the gift cards is also subject to withholding for these taxes in the same way regular wages are taxed.

Accounting for gift cards cash basis vs accrual basis: How is gift card revenue taxed?

If your tax return accounting method follows the cash basis, all proceeds from gift card sales are taxed in the year they’re sold. Similarly, if your tax return accounting method follows the accrual basis, the same principle applies unless you choose to defer it.

And if you opt to defer it, only the amounts redeemed from gift card sales are taxed in the year of redemption. However, any unredeemed portion of gift cards must be taxed in the following year if not redeemed within the first year, and deferral can’t exceed two years.