Choosing the right accounting firm is crucial for the success and financial well-being of your business in Houston, Texas. Whether you need assistance with tax preparation, financial recordkeeping, or long-term financial planning, a reputable accounting firm can provide invaluable support. However, with numerous options available, it’s essential to ask the right questions during the vetting process. By doing your homework and selecting the best fit, you can establish a fruitful partnership with an accounting firm that understands your business needs.

Understanding the role of an accounting firm

Accounting firms provide a wide range of services that are essential for the smooth operation and financial well-being of businesses. Through auditing and bookkeeping, they ensure accurate financial records and compliance with regulations. Additionally, accounting firms offer valuable financial advice and guidance, helping businesses evaluate their financial performance, manage cash flow, and plan for long-term growth.

Let’s look at how an accounting firm can help a business in more detail.

Accounting services – ensuring accurate financial records

Accurate financial records are the foundation of sound business management. Accounting firms play a vital role in maintaining and organizing these records through auditing and bookkeeping services. These services involve the meticulous examination and verification of financial transactions, ensuring their accuracy and completeness.

Auditing – ensuring accuracy and compliance

Auditing is a critical function performed by accounting firms to assess the financial health and integrity of a business. By examining financial records, transactions, and internal controls, auditors provide an independent and objective evaluation of a company’s financial statements. This evaluation ensures the accuracy, reliability, and compliance of financial information with relevant accounting standards and regulations.

During an audit, accounting firms review various aspects of a company’s financial operations, including income, expenses, assets, and liabilities. They scrutinize financial records, supporting documentation, and internal processes to identify any irregularities or discrepancies. By conducting these thorough examinations, accounting firms help businesses identify potential areas of risk, improve internal controls, and maintain the integrity of financial reporting. These are the main practises included in each of Big Four accounting firms.

Bookkeeping – organizing financial transactions

Bookkeeping services offered by accounting firms involve the systematic recording and organizing of financial transactions. Skilled bookkeepers maintain detailed records of income, expenses, assets, liabilities, and equity, ensuring that every financial transaction is accurately documented.

Bookkeepers utilize various tools and bookkeeping software to record and categorize financial transactions, such as sales invoices, purchase receipts, payroll records, and bank statements. They maintain general ledgers, subsidiary ledgers, and financial journals to provide a comprehensive overview of a company’s financial activities.

By outsourcing bookkeeping tasks to an accounting firm, businesses can benefit from the expertise and efficiency of professional bookkeepers. These experts ensure that financial records are accurate, up-to-date, and compliant with accounting principles. Well-organized financial records provide businesses with the information they need to make informed decisions, track their financial performance, and fulfill reporting requirements.

Financial advice and guidance – enhancing financial health

In addition to auditing and bookkeeping, accounting firms offer valuable financial advice and guidance. They work closely with businesses to assess their financial health, identify areas of improvement, and develop strategies for growth and profitability.

Financial analysis – evaluating performance and cash flow

Accounting firms help businesses evaluate their financial performance through in-depth analysis of financial statements and reports. By examining revenue, expenses, profitability ratios, and other key financial indicators, accountants provide insights into a company’s financial position and performance.

Cash flow analysis is a crucial aspect of financial evaluation. Accounting firms assess a company’s cash inflows and outflows to determine its liquidity and ability to meet financial obligations. They help businesses develop effective cash management strategies, ensure sufficient working capital, and plan for future financial needs.

Strategic planning – long-term financial objectives

Accounting firms play a pivotal role in assisting businesses with long-term financial planning. They collaborate with business owners to set realistic financial goals, create budgets, and develop strategic plans to achieve sustainable growth.

Through careful analysis of financial data, market trends, and industry benchmarks, accounting firms provide valuable insights that inform strategic decision-making. They help businesses evaluate investment opportunities, assess the financial feasibility of expansion projects, and develop strategies for cost control and revenue enhancement.

By leveraging the expertise of accounting professionals, businesses can align their financial objectives with their overall business strategy. Accounting firms act as trusted advisors, offering financial expertise, experience, and objective insights that contribute to the long-term success of their clients.

Challenges in finding the right accounting firm in Houston

Houston’s dynamic and diverse business landscape offers a wide array of accounting firms to choose from. However, this abundance of options can also pose challenges when it comes to selecting the right accounting partner for your business. To navigate through this vast selection and make an informed decision, business owners should consider the following factors:

Experience and expertise in Houston’s business environment

Houston is known for its thriving industries such as energy, healthcare, manufacturing, and professional services. Each industry has its unique financial requirements and regulatory considerations. Therefore, it is crucial to find an accounting firm with experience working within the specific sectors relevant to your business. A firm that understands the nuances of your industry will be better equipped to address your financial challenges and provide tailored solutions.

Reputation and track record

Reputation is a vital factor to consider when selecting an accounting firm. Look for firms that have established themselves as reputable and trusted partners within the Houston business community. Seek recommendations from other business owners, industry peers, or professional networks to gauge the firm’s reputation. Online reviews and testimonials can also provide valuable insights into the experiences of past and current clients. A firm with a strong track record of delivering high-quality services and client satisfaction is more likely to be a reliable partner for your business.

Industry knowledge and specialization

Apart from general accounting services, such as tax preparation and bookkeeping, some firms specialize in specific industries or offer industry-specific expertise. Consider whether your business requires specialized accounting knowledge, such as healthcare compliance or oil and gas taxation. Choosing a firm with industry-specific knowledge can provide significant advantages, as they are well-versed in the unique financial challenges and regulations that your business may face.

Range of services offered

Evaluate the range of services offered by the accounting firm. While tax preparation and financial recordkeeping are fundamental, consider whether you need additional services such as financial planning, budgeting, cash flow management, or strategic consulting. Having a comprehensive suite of services available from your accounting partner can streamline your financial processes and provide valuable insights for informed decision-making.

Scalability and flexibility

As your business grows and evolves, your financial needs may change. It is essential to select an accounting firm that can adapt to your business’s evolving requirements. Consider whether the firm has the capacity and resources to scale their services alongside your business’s growth. Flexibility in terms of service offerings and engagement models is also crucial. Determine whether the firm can accommodate fluctuations in your accounting needs, whether it be seasonal peaks or expansion into new markets.

Technology and digital capabilities

The accounting industry has undergone significant digital transformation in recent years, and technology plays a critical role in streamlining processes and enhancing efficiency. Inquire about the firm’s technology infrastructure, software tools, and data security measures. A technologically advanced accounting firm can offer benefits such as cloud-based accounting systems, real-time financial reporting, secure data storage, and seamless integration with other business software platforms. Embracing technology can improve the accuracy, timeliness, and accessibility of your financial information.

Communication and collaboration

Effective communication and collaboration are essential for a successful partnership with an accounting firm. Consider the firm’s communication channels and their responsiveness to client inquiries. Ensure that the firm is accessible and responsive to your needs, as timely communication is crucial for addressing financial matters and seeking guidance when necessary. Additionally, inquire about the firm’s approach to collaboration and whether they provide regular financial reports, analysis, and strategic insights to help you make informed business decisions.

Want to learn more? Find out about Dallas accounting firms with us or have a look at accounting firms in Chicago!

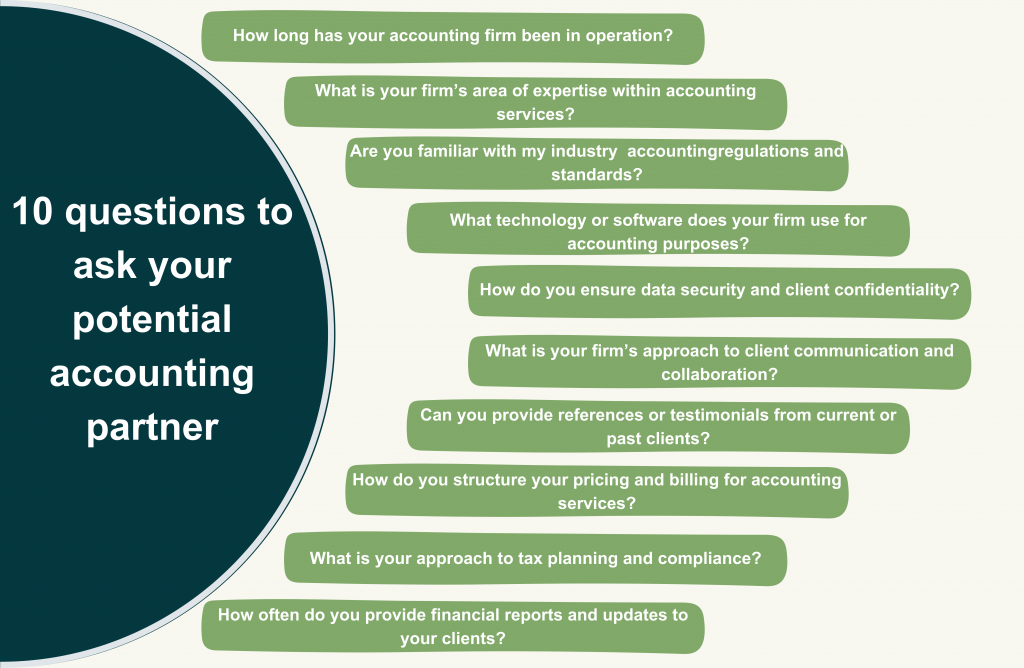

Top 10 Questions to ask your potential accounting partner

As you can see, finding the best accounting firm for your business in Houston requires thorough research and due diligence. So it may take substantial time. However, taking the time to find the right accounting partner will pay off in the long run, as they will become an integral part of your financial management team. With their expertise and support, you can navigate complex financial challenges, stay compliant with regulations, optimize your tax strategy, and make informed decisions that drive the growth and success of your business.

At this point, you might want to seek recommendations, conduct interviews, and ask probing questions to gain a deeper understanding of each firm’s capabilities and compatibility with your business.

Here are ten questions that you can ask an accounting firm to better understand whether partnering with them will suit your business.

1. How long has your accounting firm been in operation?

Knowing the firm’s tenure provides insights into their experience and stability. A well-established accounting firm with a long track record indicates that they have likely encountered various financial situations and have developed the necessary expertise to handle them effectively. It also suggests that they have managed to stay in business, which can be an indicator of client satisfaction and trust.

2. What is your firm’s area of expertise within accounting services?

Understanding the specific areas of expertise of the accounting firm is crucial to ensure that they possess the necessary skills and knowledge to meet your unique accounting needs. Different firms may specialize in areas such as auditing, tax preparation, financial reporting, or management accounting. By clarifying their expertise, you can determine whether their services align with your requirements.

3. Are you familiar with the accounting regulations and standards applicable to my industry?

Accounting regulations and standards can vary across industries. It is important to partner with an accounting firm that has experience working within your specific industry. They should be well-versed in the accounting principles and regulations that govern your sector to ensure accurate financial reporting and compliance with industry-specific requirements.

4. What technology or software does your firm use for accounting purposes?

Technology plays a vital role in modern accounting practices. Inquiring about the firm’s accounting software and technology infrastructure helps assess their efficiency, compatibility with your own systems, and willingness to leverage technological advancements. The use of robust software can enhance accuracy, streamline processes, and provide real-time insights into your financial data.

5. How do you ensure data security and client confidentiality?

Protecting sensitive financial information is of utmost importance. Inquiring about the firm’s data security measures helps ensure the safety and confidentiality of your data. They should have robust cybersecurity protocols in place, such as encryption, secure servers, access controls, and regular data backups. Additionally, they should have policies and procedures to safeguard client confidentiality and prevent unauthorized access to financial records.

6. What is your firm’s approach to client communication and collaboration?

Clear and effective communication is crucial for a successful partnership with an accounting firm. Inquire about their preferred modes of communication, their availability to address your concerns and questions, and their willingness to work closely with you. A proactive and responsive accounting firm will be accessible, provide regular updates, and be open to discussing financial matters with you.

7. Can you provide references or testimonials from current or past clients?

Requesting references or testimonials allows you to gain insights into the experiences of other clients who have worked with the accounting firm. Positive testimonials or references indicate a good reputation and the firm’s ability to deliver quality services. It also demonstrates their ability to build strong client relationships, which is important for a long-term partnership.

8. How do you structure your pricing and billing for accounting services?

Understanding the firm’s fee structure and billing practices helps ensure transparency and allows you to evaluate whether their services fit within your budget. Inquire about their hourly rates, fixed fees, or any other billing methods they use. Additionally, clarify if there are any additional charges for specific services or if they offer customizable packages to meet your specific needs.

9. What is your approach to tax planning and compliance?

Tax planning is a critical aspect of accounting services. Inquire about their approach to tax planning, including strategies for minimizing tax liabilities and maximizing tax benefits. Ensure that they are knowledgeable about the tax laws and regulations relevant to your business. A proficient accounting firm will help you navigate the complexities of tax compliance while proactively identifying opportunities for tax optimization.

10. How often do you provide financial reports and updates to your clients?

Regular and timely financial reporting is essential for monitoring your business’s financial health and making informed decisions. Inquire about the frequency at which the accounting firm provides financial reports and updates. They should have a structured process for delivering financial statements, such as monthly, quarterly, or annual reports. Clear communication on reporting timelines will ensure that you have access to up-to-date financial information when you need it.

By asking these questions and understanding the details provided by the accounting firm, you can gather essential information to assess their experience, expertise, technology infrastructure, security measures, communication practices, pricing structure, tax planning capabilities, and reporting frequency. This knowledge will enable you to make an informed decision about partnering with the accounting firm that best aligns with your business needs.

Please bear in mind that those are general questions, and depending on the industry you work in, additional questions might arise.

Conclusion

Selecting the right accounting firm in Houston is crucial for the success of your business. By asking these top 10 questions during the vetting process, you can gain insights into a firm’s experience, industry knowledge, reputation, and service offerings. This diligent research and thorough evaluation will help you establish a strong partnership with an accounting firm that not only meets your immediate financial needs but also contributes to the long-term growth and prosperity of your business. Remember, a reliable and knowledgeable accounting partner can make a significant difference in your business’s financial success. Take the time to find the right fit, and reap the benefits of a fruitful and collaborative relationship with your accounting partner.