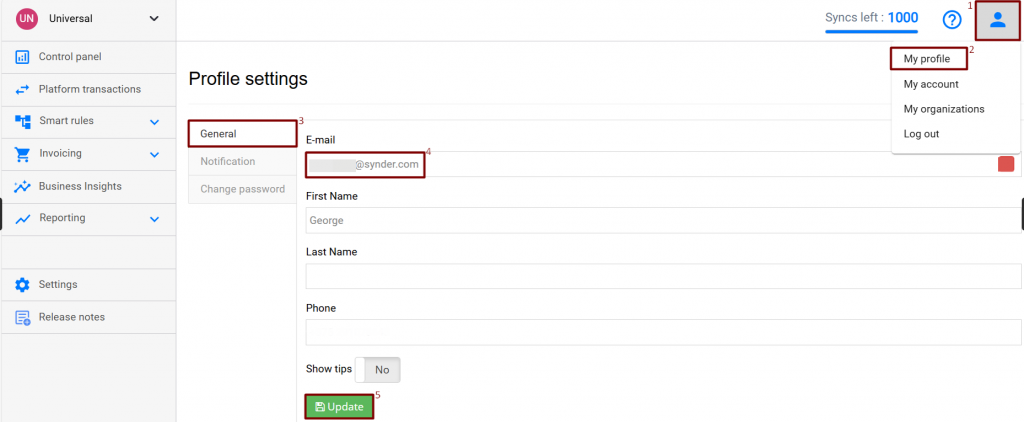

By clicking on the Profile icon in the upper right corner, then My profile tab, you will be redirected to the page, where you can edit your general information.

If you want to change email associated with your account in Synder, go to the General tab → specify the email needed → click on the Update button to save the changes → go to your email inbox to confirm the changes.

If you sign up through QuickBooks Online, then this option will not be available.

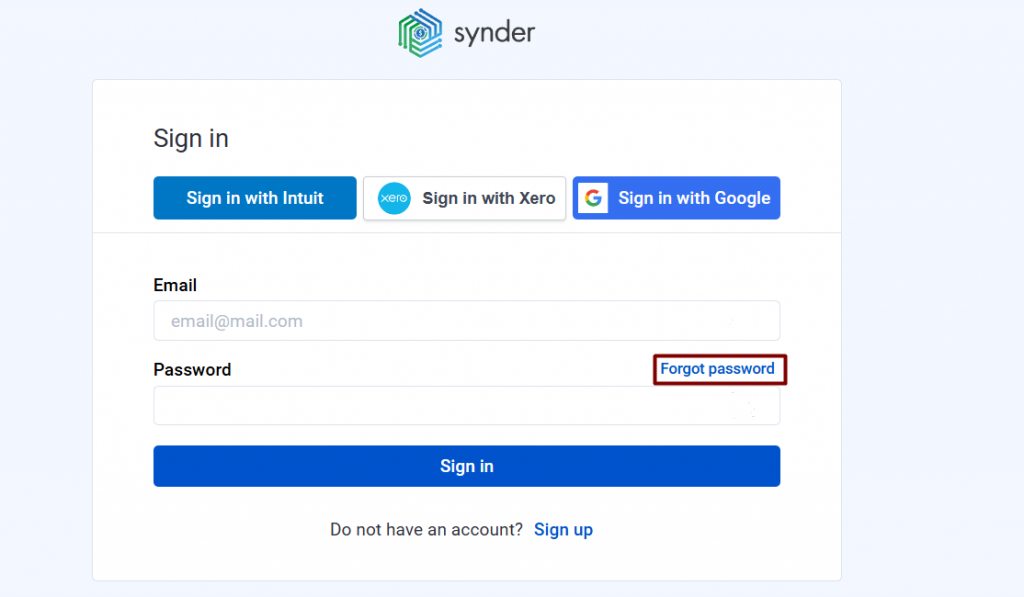

To make it available, you would need to create your own credentials in Synder. Please follow the steps below:

1. On the Sign-in page, click on the “Forgot password” button.

2. You will receive an email to change your password. Once it is changed, the option to change email will be available in Profile settings as well.

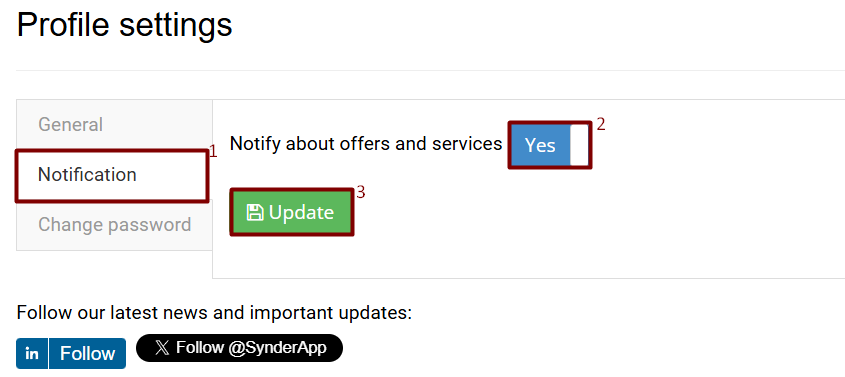

If you want us to notify you about offers and services, go to the Notification tab → turn on the “Notify about offers and services” → click on the Update button to save the changes.

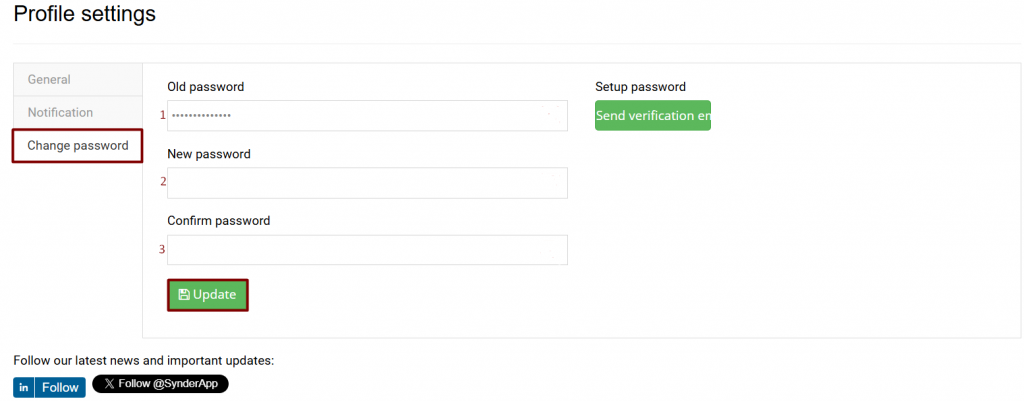

To change your password, go to the Change password tab → specify your old password, enter a new one and confirm it → hit the Update button.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!