Synder streamlines the accounting process by automatically importing business transactions from various ecommerce and payment platforms directly into your accounting system. For users who prefer to post aggregated data to their books, Synder provides a Summary Sync feature. This feature offers two ways of compiling your data: the Daily Summary (read more in this guide) and the Per Payout Summary.

This guide will delve into the Per Payout Summary mode, helping you understand if it’s the right synchronization option for your needs and how it can simplify the reconciliation process.

Overview:

- Who can benefit from Per Payout summary period synchronization

- How the Per payout period works

- Check the preview of Per payout summary

- Synchronize Your Per Payout Summary

- Reconciling Per Payout Summary

Who can benefit from Per Payout summary period synchronization

Managing reconciliation for ecommerce businesses, particularly those operating on platforms like Amazon, eBay, Shopify and Stripe can often present challenges. The daily reconciliation of financial data can become less efficient as a result of the reporting characteristics of these platforms.

Platforms like Stripe offer balance change reports for any given date, providing clear insights into financial activities. However, Amazon, eBay, Shopify tend to provide more consistent and detailed information through summary reports generated based on payouts rather than daily transactions.

To align financial data with these payout-based summaries for smoother reconciliation, Synder offers Per Payout synchronization, making it an efficient solution for ecommerce operations on these platforms.

How the Per payout period works

If you’re currently aggregating your summaries daily and would prefer them to be organized per payout, follow these steps in Synder:

Step 1. Go to Settings on the left-side menu.

Step 2. Stay on the General tab.

Step 3. Find the section ‘Summary period’.

Step 4. Select the ‘Per Payout’ option near the platform you’d like to sync using this mode.

Note*: Currently, the Per Payout Summary period is available for Amazon, eBay, Shopify and Stripe integrations. For other platforms, switching to the Per Payout Summary period synchronization is currently unavailable.

Note**: In case you notice some inconsistencies in your books after the switch and see duplicated data as the same transactions are included in both Per-Payout summaries and Daily ones, please contact our Support team and we will address this matter for you.

With the Per Payout Summary period enabled, summaries for Amazon, eBay, Shopify and Stripe will capture and aggregate all transactions associated with a specific payout. This ensures that the summary totals directly correspond to the payout amounts displayed on your ecommerce platform or payment processor.

Here’s an example to illustrate this logic for you:

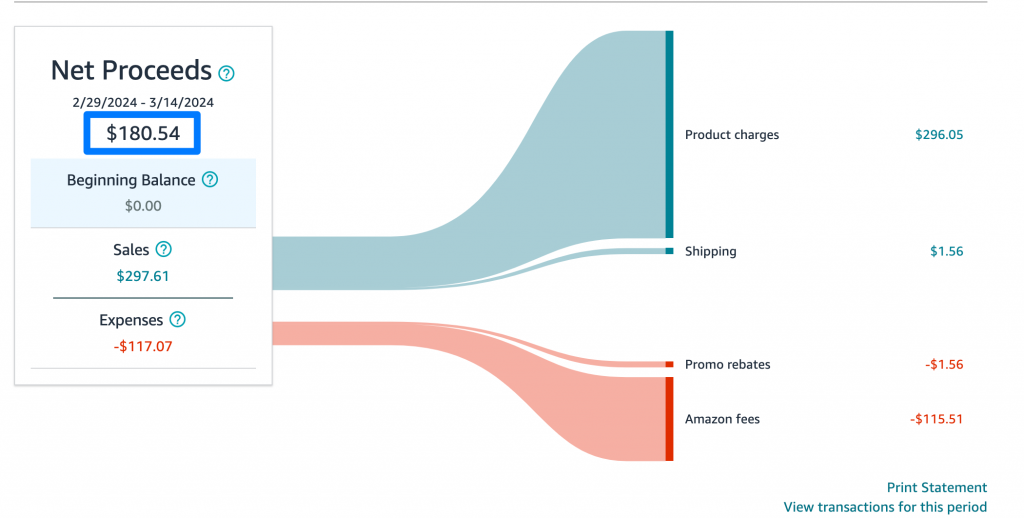

- Suppose you have a payout from Amazon for the period of February 1, 2024. This is how it will look.

- Here is how a payout summary appears in Synder, closely mirroring what you would see on Amazon. On the ‘Summaries’ page, you will find the period and the summary total displayed in the list. By pressing on the needed summary, you are presented with the total amount at the top, with detailed summary lines outlined in the table below.

You can easily compare summary preview lines with Amazon statement view (sales, shipping, etc.) for visual matching of data.

Thus, Synder precisely reflects your ecommerce platform’s activities, preparing data for synchronization to your accounting system with proper categorization.

Check the preview of Per payout summary

Before proceeding with syncing any summaries to your accounting, it is crucial to visit the ‘Mapping’ page within Synder and configure the allocation of each transaction type to the appropriate accounts. This step guarantees that the categorization is as detailed as possible.

After confirming that the mapping aligns with your preferences, preview the summary (by clicking on a summary line) to get an idea of what the synchronized data will look like:

Note: Although you can see all lines debiting or crediting certain accounts, please note that this is not the final picture. Sometimes, during synchronization from and to certain platforms, some adjustments need to be made, and Synder may rearrange some data and add/skip a few lines in the preview you see before the synchronization.

It is important to understand that although you might be looking at one summary, Synder might create several journal entries, invoices, etc. in your accounting system as a result of one sync.

This may happen for several reasons:

- The payout in question spans several months

Let’s say you have a Shopify payout covering the period from September 28th to October 2nd. In this case, to recognize revenue in proper periods, Synder will post at least 2 transactions (journal entries, invoices, etc.) in your books:

- A transaction for September (September 28 – September 30);

- A transaction for October (October 1 – October 2).

- Multicurrency is enabled and accounting for transactions in various currencies is needed

In this case, to record all currency conversion rates and automatically reconcile Clearing accounts in each of the involved currencies, Synder may need to additionally post transactions involving currency movements/conversions in your books.

- A combination of the two cases described above

The key point is that Synder may prepare several transactions for synchronization, so there is no need to worry if more than one journal entry, invoice, etc., is posted to your books as a result.

Synchronize Your Per Payout Summary

You can choose a preferred method to synchronize the summary:

- Manually: Ideal for beginners or those who prefer to oversee every detail.

- Automatically: Let Synder handle the synchronization for you once all necessary data is prepared.

Once you see the green ‘Synced’ status, your data has been successfully posted in your accounting system. The only thing left is to verify the results of the synchronization. You can press ‘See in books’ next to the synced summary and you will be redirected to your accounting platform.

Reconciling Per Payout Summary

When you begin to synchronize data from Synder to your accounting system using the Per Payout Summary, it is essential to verify the results to ensure accuracy.

The data in your accounting system should perfectly match the bank statement in your books.

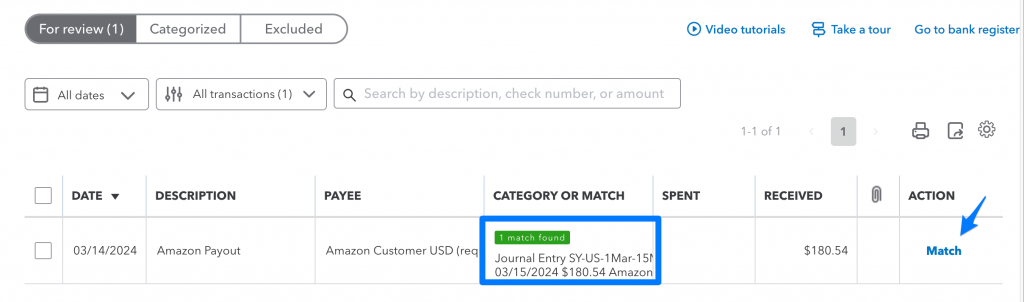

Once you synchronize the summary and a journal entry is created like below:

You will see that on your bank transactions page, the entry automatically matches the available payout:

Post-synchronization, here is what to look for in your accounting system:

- Clearing Accounts: Should be balanced as Synder automatically reconciles them.

- Bank Feed: Transactions corresponding to each payout summarized by Synder should be automatically pre-matched with your bank feed entries.

- Profit & Loss Report: Should reflect accurate sales and expenses categorization that Synder posted according to your mapping set-up.

Ensure these key aspects align with your expectations to confirm that Synder’s synchronization is performing correctly.

Reach out to Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!