Overview:

US companies

Reason: The Sales Tax center is not setup.

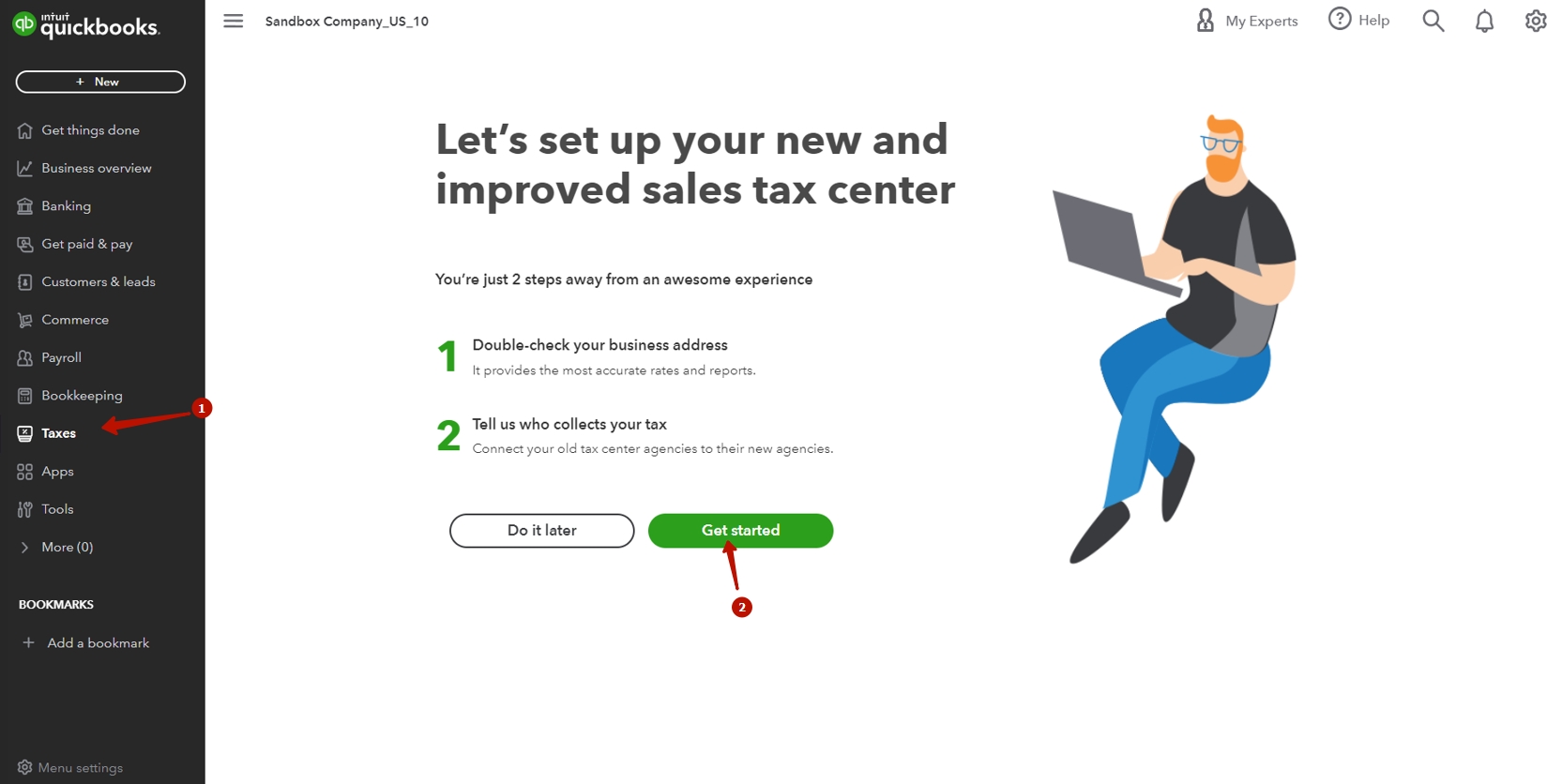

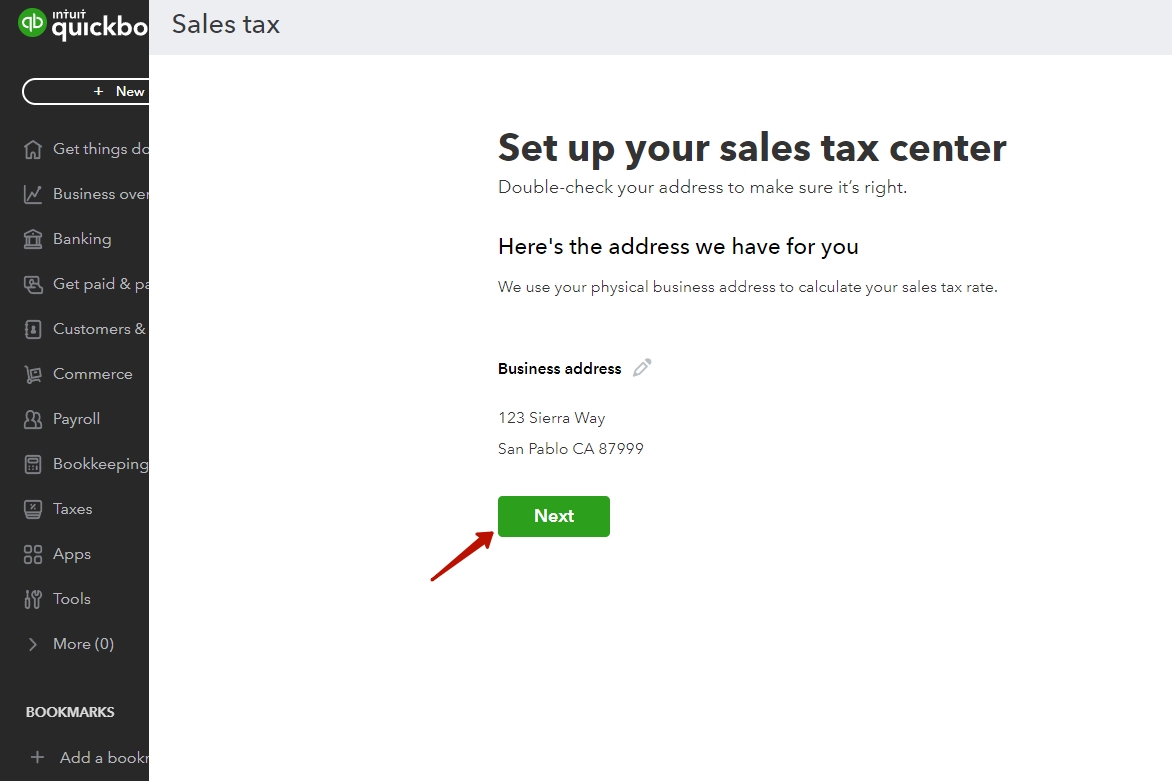

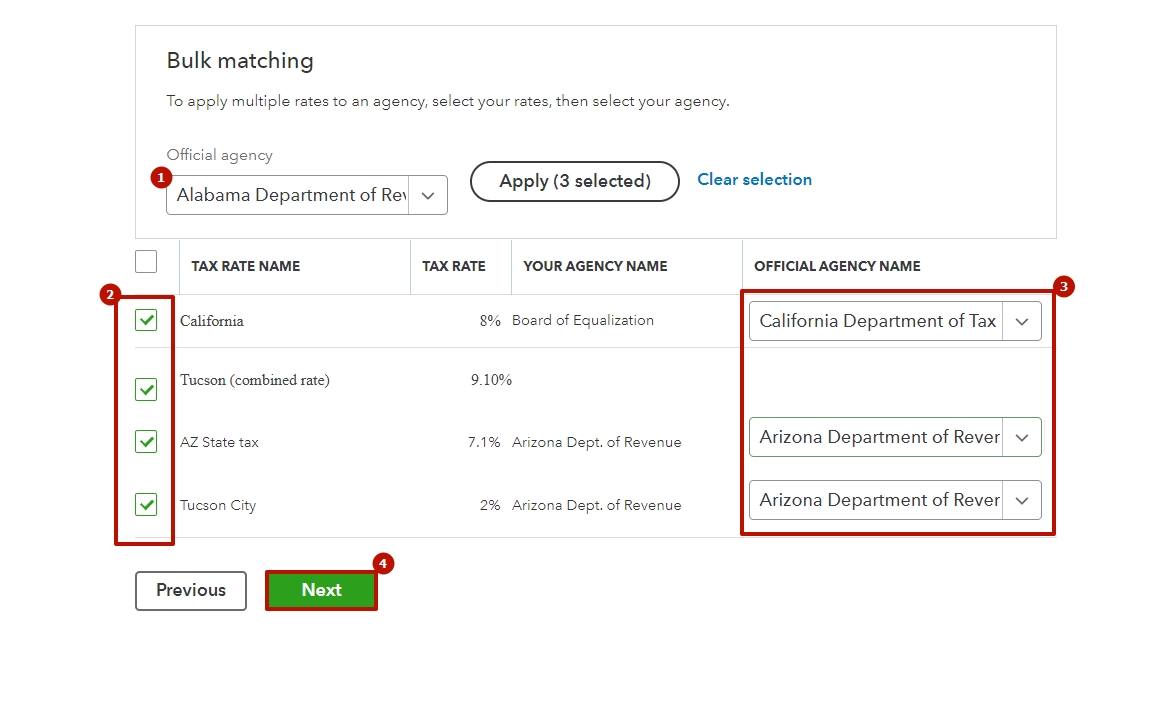

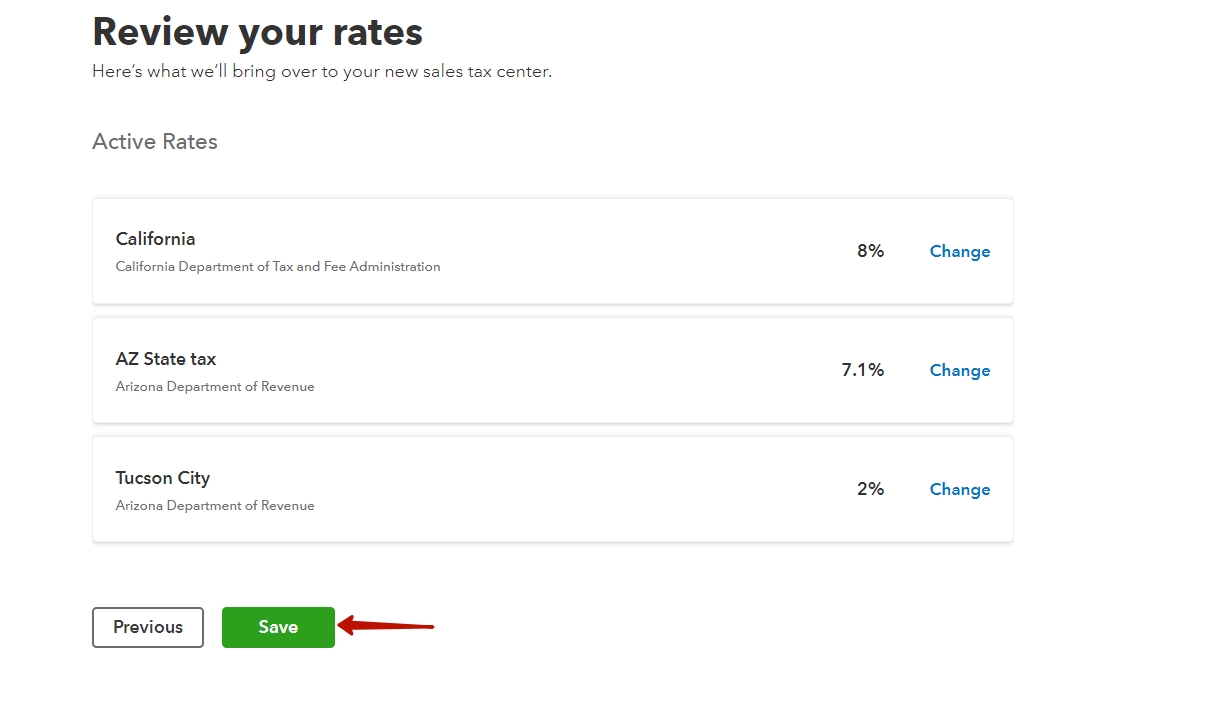

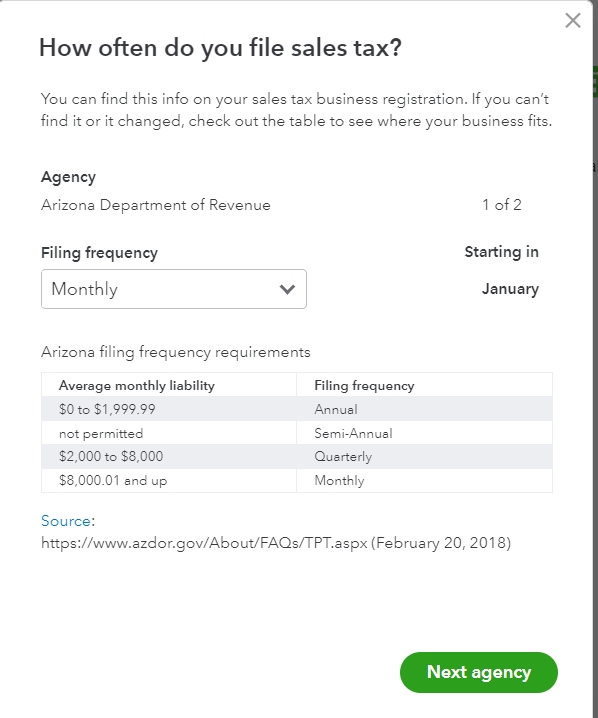

Solution: Log in to QBO → go to the Taxes tab → set up your Tax agency and select the needed tax rates and the filing frequency. Then resync failed transactions.

Non-US companies

Reason 1: There is no tax code of the given rate in your accounting company.

Solution: Discuss with your accountant whether you want to have this tax code created in your accounting company.

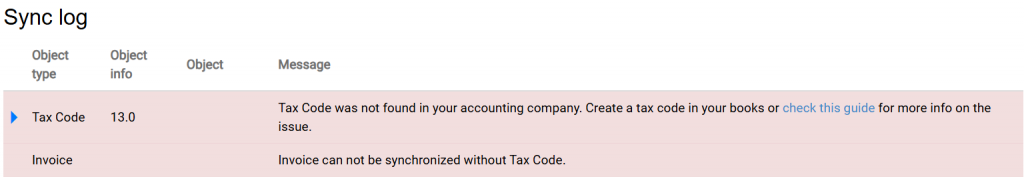

This is the message you will receive in the logs when a transaction fails.

If yes, create it in your books and resync the transaction.

If no, synchronize your transaction with a default tax code (it will keep the original tax amount, but will change the tax name to the one you select in settings):

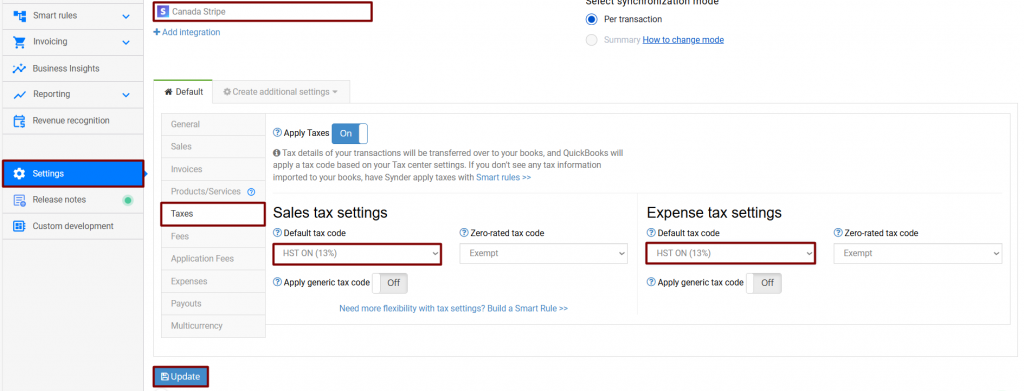

- Go to the Settings on the left-side menu → select the needed platform in the Integrations dropdown. → go to the Taxes tab;

- Select Default tax code, now it will be used any time when the rate needed is missing for further synchronized transactions;

- Click Update on the bottom of the page to save your settings;

- Synchronize the failed transaction again.

Reason 2: Synder calculates taxes and applies them to your accounting company checking the existing rates in it, but sometimes there may be limitations (e.g., whether an Inclusive or Exclusive tax should be applied). In this case, there may be 10.39% tax applied, for example, but the closest rate in your accounting company is 10%.

Solution a: if you are ok to see such a tax code in your accounting company, create it in QBO and resync the transaction.

Note: We recommend you check it with your accountant first.

Solution b: synchronize your transaction with a default tax code (it will keep the original tax amount, but will change the tax name to the one you select in settings):

- Go to the Settings on the left-side menu → select the needed platform in the Integrations dropdown → go to the Taxes tab;

- Select Default tax code, now it will be used any time when the rate needed is missing for further synchronized transactions;

- Click Update on the bottom of the page to save your settings;

- Synchronize the failed transaction again.

Solution c: contact our Support team so that we can advise you further.

Synder has several tax settings that can be adjusted according to your flow. Follow this link to learn more.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!