Square Capital offers financing to businesses by providing loans based on their sales history and business performance. These loans are typically repaid by taking a fixed percentage of your daily card sales, which aligns repayment with your business’s cash flow—so you pay more when business is doing well.

If your business takes a Square Capital loan, Synder makes managing repayments easier! As of July 23, 2024, you no longer need to manually account for Square Capital payments in your books—Synder handles that for you.

Overview:

Initial step

First, manually add the loan amount to your books. Typically, this should be recorded in the “Loan Payable” liability account. Synder will account for the loan repayments, but the initial loan amount must be entered manually.

How Capital Payments are synced in Per Transaction Sync

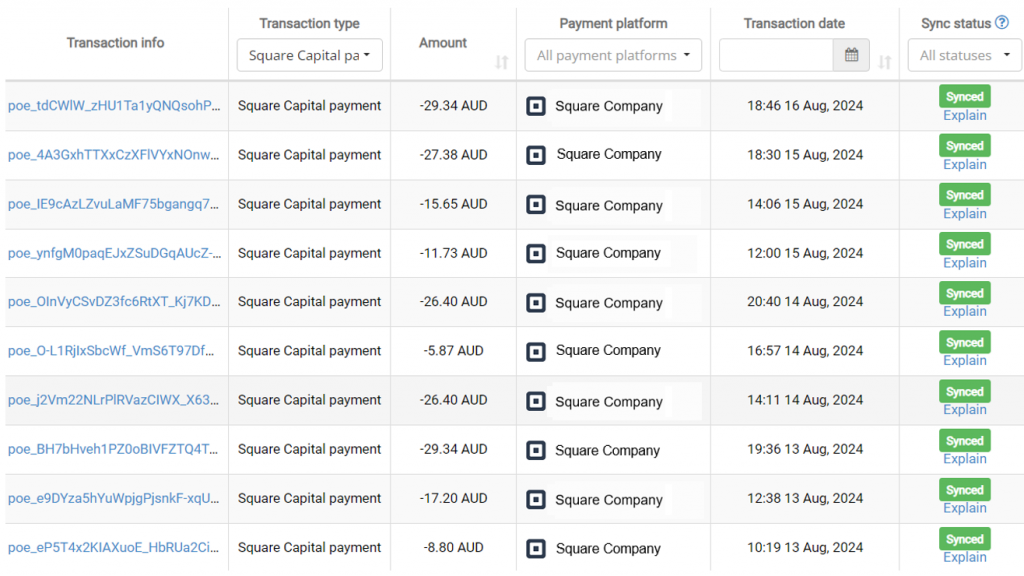

During Per Transaction Sync, Square Capital payments, along with payouts, are directly fetched from Square.

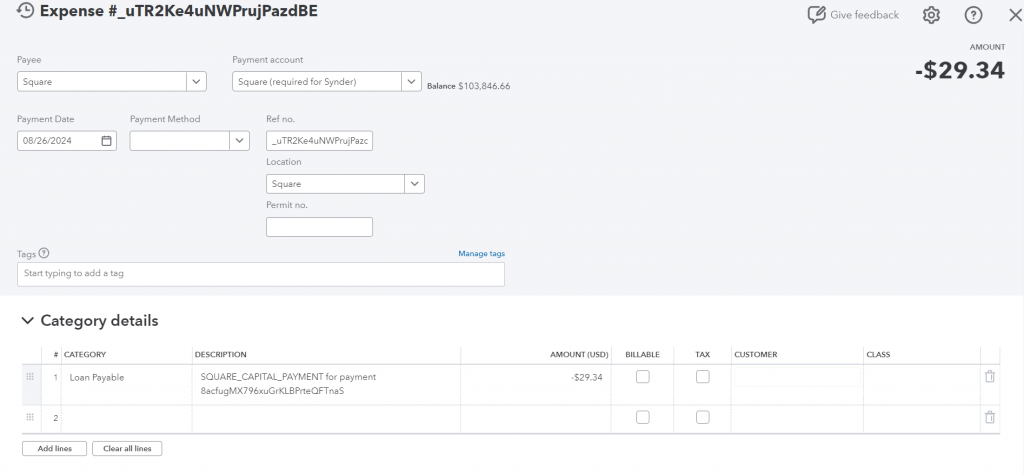

Synder syncs them as Expenses.

To ensure the loan payments correctly offset the “Loan Payable” liability account (or the appropriate account), follow these steps:

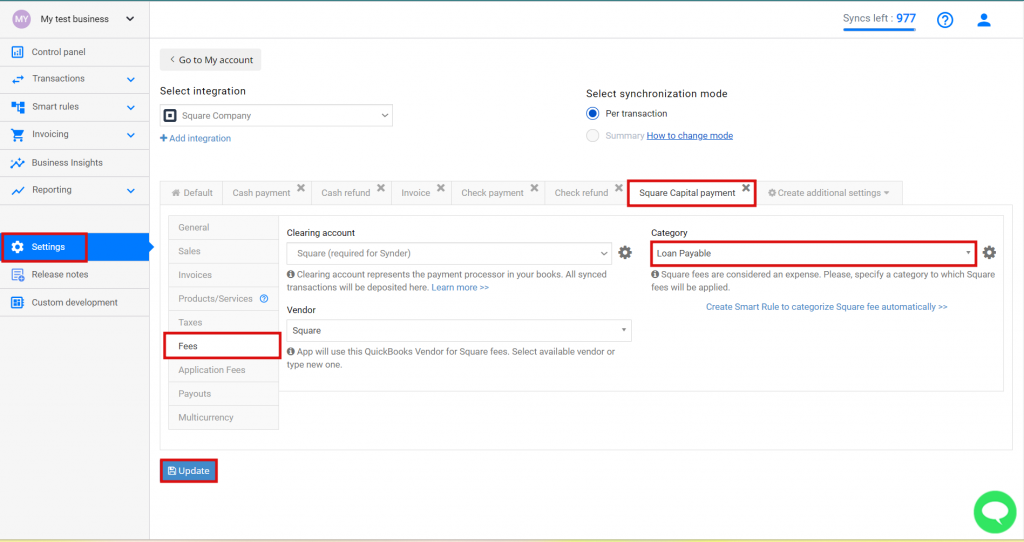

- Go to Synder Settings.

- Add the Square Capital payment setting.

- Go to the Fees tab and select the correct account under Category.

- Click Update.

Note: If funds are returned to you, Synder will sync them as a Deposit rather than recording them as an expense, accurately reflecting the money being returned to your account.

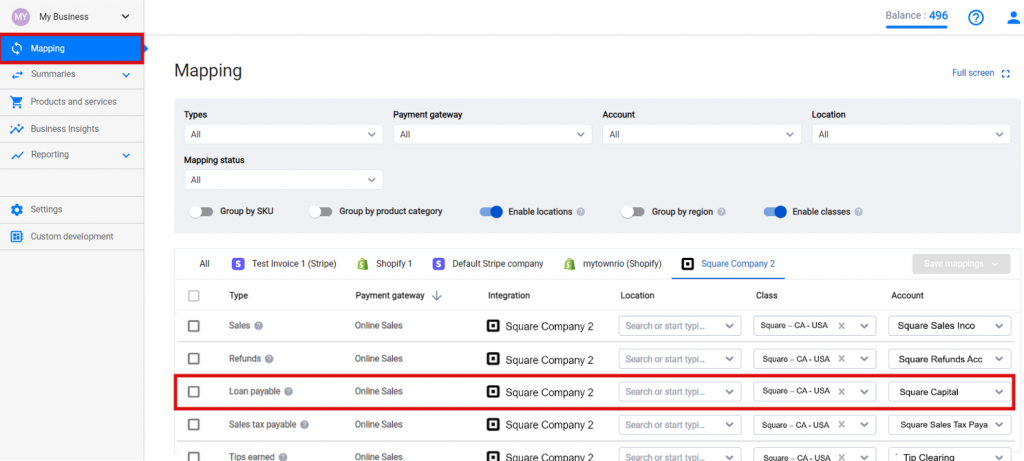

How Capital Payments are accounted for in Summary Sync

During Summary Sync, Square capital payments for the day are consolidated, and the Loan Payable group will be displayed in the Mapping tab. The recommended account type to select for this is Other Current Liability.

And that’s it! Synder now takes care of your Square Loan Payments, making the process easier and saving you time by reducing manual work.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!