Reconciliation is like putting together a puzzle, ensuring a healthy financial system. It helps keep your records clear, understand a company’s assets and liabilities, timely detect discrepancies and fraudulent activity, and provides insight into your financial position.

So, why is it important to reconcile your bank statements? Let’s find out!

Key takeaways

- Regular reconciliation helps keep accurate and up-to-date financial records, resulting in better finance management and decision-making.

- It helps detect and prevent fraudulent activities early, protecting your business from significant financial losses and promoting transparency.

- You can use accounting software to automate and facilitate reconciliation, making it more efficient and accurate.

A quick look at reconciliation

Before getting the importance, let’s quickly define and explain reconciliation.

Bank reconciliation is comparing the financial records in your accounting system to the corresponding information on your bank statement. Reconciliation allows you to control that the information in your accounting system correctly reflects your fund movements in the bank account.

Basically, you reconcile accounts to have an updated view of your finances at hand, ready for financial reporting, business performance analysis, taxation, and consulting with your financial specialist on your business growth perspectives.

Related:

What Is Reconciliation in Accounting?

Types of reconciliation

Before we move on, it might be worth mentioning that reconciliation isn’t just for your bank accounts. There are a few different types, each serving a specific purpose.

- Bank reconciliation is the most common type. It involves comparing your financial records with your bank statement to ensure everything matches up. This helps catch errors, track outstanding checks, and spot unauthorized transactions.

- Another type is credit card reconciliation. Here, you compare your credit card statements with your own records. This is crucial for identifying unauthorized charges, catching mistakes, and ensuring all transactions are accounted for.

- Lastly, there’s account reconciliation, which is a broader term. This can apply to any account, like your accounts payable and receivable. The goal is always the same – making sure your records are accurate and complete, giving you a clear picture of your financial health.

Automate your reconciliation with Synder! Sign up for our 15-day free trial and experience the benefits firsthand. Or, if you prefer a more personal touch, reserve a spot at our Weekly Product Demo to see smart accounting automation in action.

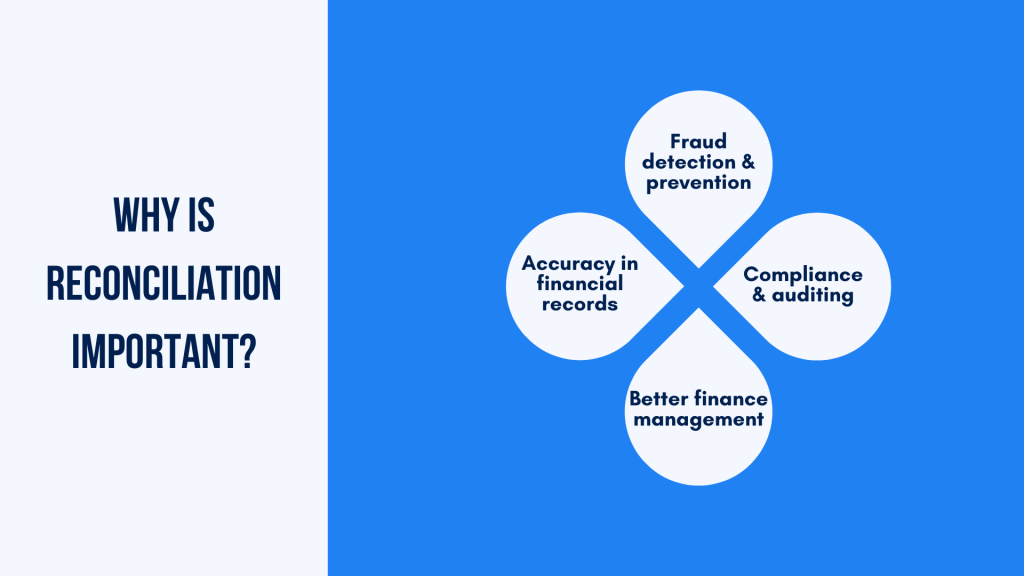

Why’s it important to reconcile your bank statements?

So, we mentioned that regular reconciliation helps you stay updated on the business’s financial state. But there are more reasons why it might be critical to regularly reconcile your bank statements with accounting.

So, we might look at the most significant reasons, shall we?

Accuracy in financial records

Regular reconciliation ensures that your financial records are accurate and up-to-date. By comparing your records with your bank statements, you can catch and correct any discrepancies, like missed transactions or errors in recording amounts. This keeps your financial data reliable and precise.

Why would you need it as a business?

Accurate financial records are crucial for making decisions backed by precise numbers, not assumptions. They help you understand your cash flow, track expenses, and manage your budget effectively. Without accurate records, you risk making poor financial decisions that could harm your business.

Fraud detection and prevention

Reconciliation helps detect and prevent fraudulent activities. As you regularly review your transactions, you can spot unauthorized charges or suspicious activity quickly. This early detection is vital for stopping fraud before it causes significant damage.

Why would you care as a business?

Fraud can lead to substantial financial losses and damage your reputation. Regular reconciliation safeguards your finances, helping you identify and address fraud promptly. This way, you can protect your business assets and maintain trust with your clients and stakeholders.

Compliance and auditing

Reconciliation plays a significant role in ensuring compliance with laws and regulations. It provides a clear, accurate record of your financial activities, being essential for meeting regulatory requirements. Besides, it makes audits smoother and less stressful, as your records are organized and accurate.

Why does it matter for a business?

Compliance with financial regulations is mandatory for all businesses. Failing to comply can result in penalties, fines, or legal action. Regular reconciliation helps you stay compliant and prepared for audits, demonstrating your commitment to transparency and proper financial practices. This prevents legal issues and builds credibility with investors and regulators.

Should be these reasons not enough an argument in favor of regular bank reconciliations, let’s look at some advantages or potential positive outcomes of these, if you like.

Benefits of regular reconciliation

Regular reconciliation offers several advantages for businesses, ranging from improved financial management to error detection and correction. Let’s delve into the key benefits:

#1 – Improved financial management

Regular reconciliation can enhance financial planning and management. As mentioned, as you compare your internal financial records with external statements like bank statements, you gain valuable insights into your financial health.

This comparison helps you identify discrepancies, track financial trends, and thus make better decisions about budgeting, investments, and expenditures. With accurate and up-to-date financial information at your disposal, you can devise effective strategies to optimize your finances and drive business growth.

#2 – Cash flow management

Effective cash flow management guarantees smooth business operation. Regular reconciliation facilitates this, as it allows you to monitor and manage your cash flow effectively.

When you reconcile your bank accounts on a regular basis, you can track the flow of incoming and outgoing funds with precision. This way, you can anticipate cash fluctuations, identify patterns in your cash flow, and ensure that you have sufficient liquidity to meet your financial obligations. So, you can stay on top of your cash flow, avoid cash shortages, optimize resource allocation, and maintain stability and sustainability in your business operations.

#3 – Identification and correction of errors

Regular reconciliation is a powerful tool for identifying and correcting errors befor they hamper your performance.

Discrepancies between your internal financial records and external statements may indicate recording errors, missing transactions, or, as previously mentioned, fraudulent activities.

At this point, you might fancy regular reconciliation to quickly spot these discrepancies and take corrective action to rectify them. This proactive approach helps prevent financial losses, maintains the accuracy and integrity of your financial data, and enhances overall trust and credibility in your business operations.

Reconciliation best practices

You might want to follow several proven best practices to make sure reconciliation goes flawlessly, and you can enjoy its benefits as a business.

- Set a regular schedule

You might want to maintain a regular reconciliation schedule – monthly or quarterly – to stay organized and ensure timely identification of any discrepancies. Consistency in reconciliation helps stay on top of your financial records, reducing the risk of errors or oversights. - Use of technology

Accounting software and tools can drastically facilitate and help the reconciliation process, making it more efficient and accurate. These tools automate much of it, matching transactions, flagging discrepancies, and generating reports, saving your time and reducing the likelihood of human error. (I’ll show an example of how it can work for you further.) - Documentation and record-keeping

Proper documentation and record-keeping are essential for reconciliation. Keep detailed records of all financial transactions, including receipts, invoices, and bank statements. This documentation is evidence for reconciliation. Also, it facilitates audits and compliance with regulatory requirements.

How to reconcile your bank statements with accounting?

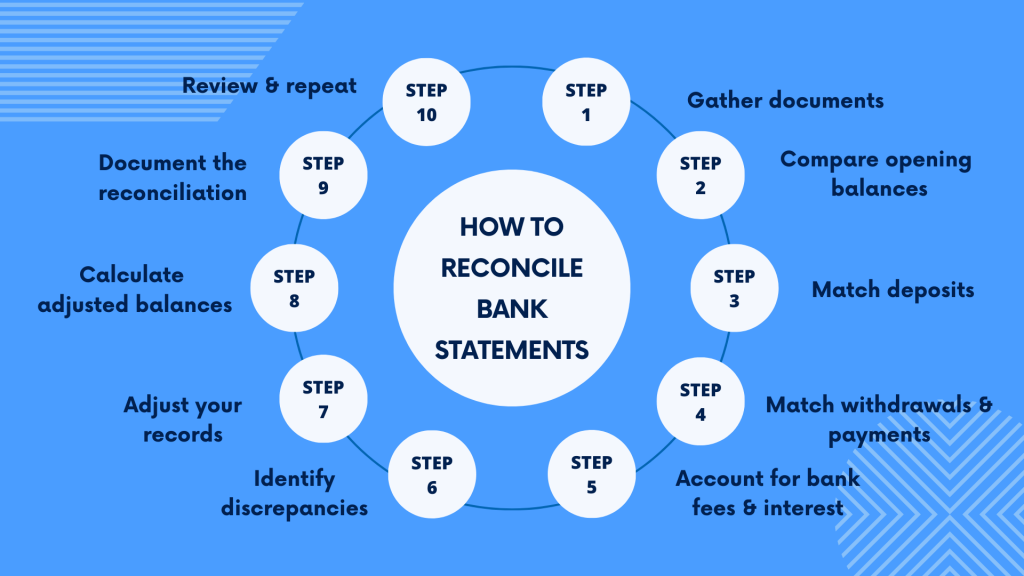

Reconciling accounts requires some preparatory activities and following a particular workflow to fulfill. We’ll go through the steps you might want to consider right away.

Step 1. Gather documents

First, get your latest bank statement, which lists all the transactions for the period. Also, have your financial records ready, whether it’s your checkbook register, accounting software, or spreadsheets where you track your transactions.

Step 2. Compare opening balances

Take care of the opening balance on your bank statement matching the balance in your financial records at the beginning of the reconciliation period.

Step 3. Match deposits

Next, compare the deposits listed on the bank statement with those in your financial records. Check off each deposit that appears in both. If there are any differences, like deposits that haven’t shown up in the bank yet, note them down.

Step 4. Match withdrawals and payments

Now, look at the withdrawals and payments listed on the bank statement and compare them with your records. This includes checks, electronic transfers, and any other payments. Check off each one that matches. Identify any checks you’ve written that haven’t cleared the bank yet or any payments you might have missed recording.

Step 5. Account for bank fees and interest

Adjust your financial records for any bank fees, service charges, or interest that appear on the bank statement but aren’t yet recorded in your records.

Step 6. Identify discrepancies

Carefully look at any differences between the bank statement and your records. Common issues include outstanding checks, deposits in transit, bank errors, and mistakes in your records.

Step 7. Adjust your records

Make the necessary adjustments in your financial records to correct any discrepancies. This could mean adding missing transactions, correcting amounts, recording bank fees or interest, and noting any errors made by the bank (which you should report to the bank to get corrected).

Step 8. Calculate adjusted balances

After making all the necessary adjustments, calculate the adjusted balance for your financial records and the bank statement. Make sure these adjusted balances match. If they don’t, re-check for any missed transactions or errors.

Step 9. Document the reconciliation

You might want to document the reconciliation process, including any adjustments you made and explanations for any discrepancies. This documentation is critical for future reference and for any audits.

Step 10. Review and repeat regularly

Regularly repeat the reconciliation process – monthly is a good practice – to ensure ongoing accuracy and to promptly address any discrepancies or issues.

How does accounting software help bank reconciliation?

Accounting software can drastically help reconciliation since it can automate recording transactions in the books and then matching them with the bank statements in a couple of clicks.

Synder is accounting software that can automate reconciliation for you, taking the hassle out of this essential task. Synder can help you in many ways, including reconciliation.

Let’s break it down.

- Multi-channel integration

Synder integrates with various platforms like bank accounts, payment processors, and accounting software. This means it can pull in all your financial data automatically, eliminating the need for manual data entry. - Automatic reconciliation

You have your transactions matched automatically, speeding up the reconciliation process and ensuring your records are always accurate. - Real-time synchronization

Synder keeps your records instantly synchronized, so you always have the most current information at your fingertips. This is particularly useful for monitoring cash flow and making timely financial decisions. - Comprehensive reporting

Synder provides detailed reports that summarize your financial activities and reconciliation status. These reports are valuable for audits and maintaining transparency and compliance with financial regulations.

Now, let’s look at how reconciliation works in Synder.

Final word

As you can see, regular reconciliation is way beyond a financial housekeeping task. Regularly performed, it allows for the accuracy and integrity of your financial records, gaining clear insights into your financial health, managing cash flow effectively, and detecting discrepancies early. This proactive approach can prevent errors and fraud and secure compliance with regulations, making audits smoother and less stressful.

Reconciliation is a multi-step process that needs your attention at every stage, which can be cumbersome. At this point, using accounting software is the new black, you know, a standard already. It further simplifies and enhances this process, cutting time and effort and providing the level of accuracy you might never get doing it manually.

Share your thoughts

Do you believe regular reconciliation makes sense? How often do you reconciliate accounts? Share in the comments section below!