Collecting, inputting, and processing data are challenging for businesses. Financesonline spotted the most common issues in SMB accounting that include:

- Accounts receivables / collections (51%)

- Cash flow (44%)

- Paperwork (33%)

- Closing the books monthly (28%)

- Payroll management (27%).

Moreover, many SMB owners confirm that they have a lack of knowledge in accounting and finances. That is why they often outsource this task or use various software. In this article, I will highlight the main e-commerce accounting problems and how to keep your books accurate with less effort than you put into it now.

What are the most common problems when it comes to e-commerce accounting?

Precise bookkeeping is fundamental for any e-commerce business. And you can build a successful and growing company on this foundation.

However, many business owners see it as a time-consuming burden and, therefore, try to avoid it or put it off until the last minute. Underestimating the importance of e-commerce accounting can cost tens of thousands of dollars due to not preparing reports on time, or if at the last minute, it turns out that your reconciliation is out of balance.

Since the purpose of this article is to provide you with the necessary knowledge to have your bookkeeping done properly, let’s take a closer look at the most common problems e-commerce businesses face in automated accounting.

Postpone everything until the last moment

When it comes to bookkeeping, many entrepreneurs see a lot of information to study and decide to just turn a blind eye to it. And they don’t care until it’s time to pay taxes and reconciliation doesn’t balance or some payments were made from a personal account together with Social Security Number, some transactions were not saved due to it. All this causes much stress to a business owner although this can be avoided by hiring an accountant or using accounting software.

Refunds and chargebacks

One of the biggest challenges in reconciling e-commerce transactions are the recordings of refunds and chargebacks.

In e-commerce, buyers can return items without giving much of an excuse. Especially if you sell goods via Amazon. For example, here are some cases when a buyer has the right to return a product:

- Sellable. An item a buyer wants to return is still good to sell it to someone else and goes back to the inventory. Here, you have to be careful because sometimes the categorizing mark misses and you have to double-check if you can still sell a returned item. Else, a faulty product may be shipped and it is fraught with bad reviews from customers.

All this also implies that you should have a well-organized return system. Some sellers go for returning goods back to their offices to be able to check them. Which works well if the office has enough space to store goods for a while.

- Damaged. If an item is classified as damaged and it’s your fault as a seller, your company has to refund the cost at its own expense. If it is Amazon’s fault, you can ask for a refund by submitting a request.

- Customer Damaged. All the goods that are opened are considered damaged as they are not “new” anymore. Indeed, some items are damaged and some are not, but Amazon can’t always classify them correctly due to the specificity of a thing.

- Defective. Well, it happens sometimes that a product simply doesn’t work.

- Carrier Damaged. This means that a product was damaged during transit.

What about chargebacks? E-commerce businesses sometimes face chargebacks that can be initiated by a customer, a bank, or by a bank account owner. The most common case is when a purchase is made by a customer but in fact, the payment credentials were stolen and used without the owner’s knowledge. Taking the right steps to avoid chargebacks can have a huge impact on disputes. In fact, preventing chargebacks is one of the best ways to bring in more money and ensure the longevity of your business.

Handling such returns/refunds processes is challenging for e-commerce accounting because you have to decide what to do with the inventory and how to document it. Along with this, you need to decide where to record financial expenses caused by refunds. Make sure that you haven’t written off the items twice, else it may ruin your books. Maybe you will find it easier to create two entries in the account chart for refunds and chargebacks.

Sales tax accounting is confusing

Sales tax is a business’s liability that should be committed to the state according to the required payment schedule. Sales tax is not included in your income. The ideal scenario would be to just separate payable taxes and sales in your accounting software, but things are not that easy.

Before collecting sales taxes, a business owner has to apply for and ID wherever the owner has a nexus.

Those who use Fulfillment by Amazon (FBA) will face more complications. Most of the time when Amazon transfers goods or items into a certain state, it occurs that a business gets a legal nexus which automatically obliges it to tax and everything that is sold to residents of this state.

You have to always track where your goods are and prepare a good risk strategy to be able to protect your business.

There are also states that will prosecute an entrepreneur if a sales tax was collected from a resident without proper registration. This is a serious and big deal that can make accounting even more complicated.

Missing errors

Another common issue is having errors for multiple reasons. Bank transactions not syncing with the bookkeeping system you use and many duplicates created can mess up accounting records. And a bookkeeper will spend hours on the reconciliation process for a certain date when you have to submit statements to your bank if it doesn’t balance.

Reconciliation is a process in accounting which ensures that general ledger accounts are accurate and complete. It is usually done by comparing two sets of records.

If the software you are using doesn’t sync or integrate into your accounting system, your bank will allow you to download a file with your transaction information and then you import the data into the accounting system.

What is small business accounting software?

Accounting software is renowned for its great tools for financial management, transaction recording, reporting, analytics, tax preparation, and more. Accounting software for small businesses varies in complexity. Platforms for entrepreneurs or small companies are not so expensive and sometimes a free version is enough to complete necessary tasks.

Meanwhile, bigger companies with more business processes will appreciate more features and capabilities of the software. But as a rule, such programs are more expensive and the cost may increase depending on the amount of information that needs to be processed or with an increase in the number of users.

And here are a few points to pay attention to when choosing accounting software:

- Price. How much will it cost? Does the price grow when you need to process more information? Will you have to pay more for new users?

- Ease of use and training requirements

- The efficiency of the software

- Monthly limits of invoices, transactions, number of syncs

- The quality of customer support and means of communication

- Tax preparation and filing assistance

- Reporting

- Access from any device

- CPA access (if someone helps you with finances management)

- Processing of a credit card

- Third-party integrations

Knowing certain aspects, you can choose an accounting solution that will meet your business needs.

A team of business experts from Business.org names Xero, FreshBooks, QuickBooks, Wave, and Zoho as the best accounting software for small businesses. The team spent hours comparing plans and features, pros and cons which are very well explained.

Getting software that will keep track of every financial aspect of your business already sounds amazing. No more shoeboxes, or worries that you might prepare taxes or reports wrongly because everything will be created in two clicks. And there is still one more “but” like each transaction is recorded manually, which is time-consuming and requires a lot of attention because of a human factor in making mistakes.

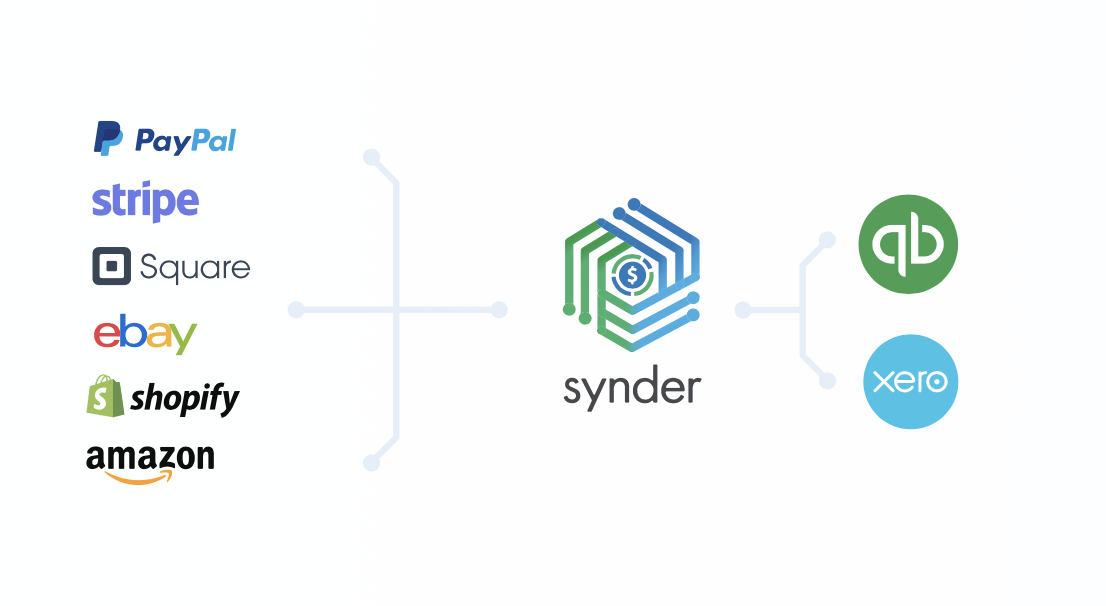

And to make the life of small businesses even more comfortable, achieve machine accuracy and exclude any case for a mistake, some applications automate data entering by connecting to your payment systems and synchronizing all the records with your accounting software. Various applications of the kind are available on the market, so you can choose what better suits your goals and needs. I’m going to show how this automation works using the example of Synder.

How do I benefit from Synder?

As mentioned in the post, Synder will automate recordings for your accounting software. Currently, it can be synchronized with:

- QuickBooks Online (and payment systems like Stripe, PayPal, LawPay, Pin Payments, Square, Ecwid by Lightspeed, Amazon, Shopify)

- QuickBooks Desktop (with Stripe, PayPal, Square, LawPay, Pin Payments, Ecwid by Lightspeed)

- Xero (with Stripe, Square, LawPay, Pin Payments, Ecwid by Lightspeed, and Shopify)

- Gusto (get the lists of employees from Gusto in your QuickBooks or Xero in two clicks)

Read more about all the Synder integrations you are interested in and view a demo of how to sync and how it works.

Also, there is a big Synder help center where you can find very detailed instructions on how to sync transactions, reconcile them, receive credit card payments online, create credit card checkout pages, and more with screenshots and video tutorials.

It should be noted that you configure the synchronization with platforms once and then everything will be done automatically.

Some Synder features are unique and have not been implemented by competitors yet. Here is the list of what you get:

- Send invoices, the open invoices will be automatically closed with received payments.

- Receive Credit Card payments online. Clients easily pay while your books are updated at the same time.

- No limits for bringing previous or current data.

- No duplicates. This is a unique feature that makes your books are 100% safe from creating transactions two times by an accident. When you try to sync an already existing transaction, Synder will notify you.

- Rollback transactions that you didn’t want to sync for some reason, or that you need to edit before syncing.

- Multi-currency transactions. You can add as many currencies as you need.

- 100% accurate reports for each accounting period.

Perhaps small business owners do not think about the need for such software, but those who work in e-commerce processing dozens of transactions a day will come to the conclusion that they need it sooner or later.

And if you also wonder if it is worth trying, don’t hesitate to sign up and use a free Synder trial period, especially since it does not require linking your bank card.

A final word

To summarize all that has been said, I would like to note that e-commerce businesses have their peculiarities and issues. No matter what products or services a business provides, it needs a solid accounting solution. When the process of recording payments, refunds, invoices is fully automated and you are confident in the accuracy of your books, there is more time to focus on other tasks.

Please, share your opinion in the comments. Do you agree or not that accounting software is a must-have for every e-commerce business?