As a business owner, you can leverage various performance tracking metrics to understand your business financial health and predict future development. The run rate is one of such metrics. Understanding the run rate is crucial for businesses as it provides valuable insights into their financial performance and sustainability. The run rate refers to the projected annualized revenue or expense based on current financial information. It helps estimate future business financial performance and make informed decisions.

Let’s take a deeper look at the run rate, and see how businesses can leverage it.

Understanding the run rate

At its core, the run rate refers to the projection of current performance over a specific time period to estimate future results. It serves as a snapshot of a business’s performance, enabling stakeholders to make informed decisions and forecast potential outcomes. The calculation of the run rate involves taking the current data for a particular metric, such as sales or expenses, and extrapolating it by an appropriate factor to estimate performance over a more extended period.

Why is the run rate important for businesses?

Understanding the run rate is crucial for businesses as it helps with financial planning, performance evaluation, investor confidence, strategic decision-making, risk management, and goal tracking. It provides insights into projected annualized revenue or expense, enabling businesses to anticipate trends, make informed decisions, and ensure financial sustainability.

Related: Read about more business-critical metrics, and how you can use them to get insights into your business performance, understand customer behavior, manage inventory more efficiently, and drive sales growth.

Let’s look at the reasons why businesses need to understand and leverage the run rate in more detail.

Financial planning

Analyzing the run rate is a vital aspect of financial planning for businesses. By studying the run rate, companies can forecast their financial performance over time. This analysis helps them anticipate revenue and expense trends, enabling them to plan budgets effectively. Understanding the run rate also allows businesses to allocate resources efficiently and make informed financial decisions that align with their long-term goals.

Performance evaluation

Comparing actual revenue and expenses with the run rate provides businesses with a means to evaluate their performance. This comparison helps identify any gaps or discrepancies between projected and actual results. By promptly identifying such variations, businesses can take corrective actions to address issues, make necessary adjustments, and ensure that their financial performance aligns with expectations.

Investor confidence

Investors and stakeholders often rely on the run rate as an important metric to evaluate a company’s growth potential and financial stability. When businesses understand the run rate and effectively communicate it to investors, it instills confidence in the company’s financial outlook. This increased investor confidence can enhance the company’s credibility, attract potential investors, and open up funding opportunities for future growth and expansion.

Strategic decision-making

The run rate serves as a valuable tool for strategic decision-making within businesses. By comprehending the run rate, companies gain insights into their financial capacity and stability. This understanding enables them to make informed decisions regarding expansion plans, investment opportunities, and resource allocation. The run rate helps businesses identify potential areas for growth or improvement, facilitating strategic decision-making that aligns with their overall objectives.

Risk management

Analyzing the run rate helps businesses identify potential risks and vulnerabilities in their financial position. By understanding the projected revenue and expenses, companies can proactively manage risks and develop strategies to mitigate uncertainties or unforeseen challenges. The run rate analysis provides valuable information for businesses to assess their financial resilience, identify potential areas of concern, and take preventive measures to safeguard their financial health.

Setting and tracking goals

The run rate acts as a benchmark for setting and tracking financial goals within businesses. Companies can compare their actual performance against the run rate to evaluate progress and measure their performance. This comparison helps identify areas of improvement and allows businesses to make necessary adjustments to stay on track towards their objectives. By using the run rate as a guiding metric, businesses can set realistic financial targets, monitor their progress, and ensure that their operations align with their desired outcomes.

How to calculate run rate: Steps for calculating run rates

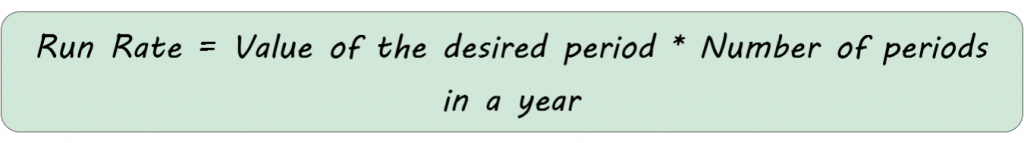

The run rate is typically calculated by multiplying the value of a specific period (such as a month or a quarter) by the number of periods in a year. Here’s a step-by-step guide on how to calculate the run rate:

- Determine the desired period

Decide on the period for which you want to calculate the run rate. For example, if you want to calculate the monthly run rate, you’ll use the value for a month.

- Collect the relevant data

Gather the financial data for the selected period. For instance, if you are calculating the monthly run rate, collect the revenue or earnings figure for that month.

- Calculate the run rate

To calculate the run rate, multiply the value from the desired period by the number of periods in a year. For example, if you are calculating the monthly run rate, multiply the monthly value by 12 to get the annual run rate.

- Interpret the result

The result of the calculation will be the projected annual revenue or earnings based on the current period’s performance. It’s important to note that the run rate assumes the current trend will continue unchanged throughout the year, which may not always be accurate.

It’s crucial to remember that the run rate is an estimate and not a guarantee of future performance. It’s always recommended to consider other factors, such as seasonality, market conditions, and potential disruptions, when making financial projections.

Use cases of the run rate in business management

The run rate finds wide-ranging applications in various aspects of business management.

One of the key areas where the run rate proves invaluable is in sales and revenue projections. By analyzing the current run rate, businesses can estimate future sales, identify performance trends, and make data-driven decisions regarding resource allocation, marketing strategies, and sales forecasting. It provides a reliable basis for projecting future revenue and aids in aligning business strategies accordingly.

Another significant application of the run rate is in expense management and budgeting. By extrapolating current expenses, businesses can anticipate future costs and allocate resources optimally. This helps maintain financial stability, assists in efficient budgeting, and enables businesses to proactively manage their financial resources.

Workforce planning and capacity management also benefit from the run rate analysis. By assessing the current run rate, businesses can determine their staffing needs, optimize workforce efficiency, and ensure the right level of human resources to meet demand. The run rate analysis aids in making informed decisions about hiring, training, and scheduling, leading to improved productivity and cost-effectiveness.

Advantages and disadvantages

The run rate offers several advantages to businesses.

Firstly, it provides a quick and straightforward method for estimating future trends and outcomes. By extrapolating current performance, businesses can gain valuable insights into their potential growth or decline. The run rate serves as a baseline for short-term planning and decision-making, allowing businesses to respond swiftly to market changes and make timely adjustments.

Moreover, the run rate is particularly advantageous for startups and businesses in fast-paced industries where agility is crucial. It allows them to showcase their growth potential to investors and stakeholders, providing a metric that demonstrates scalability and market traction.

However, the run rate has certain limitations that should be acknowledged.

It lacks the accuracy and reliability required for long-term projections. The run rate calculations are based on historical data and may not account for changes in market dynamics, shifts in consumer behavior, or unexpected external factors. Therefore, businesses must complement the run rate analysis with other forecasting methods and regularly review and update calculations to ensure relevance and accuracy.

Real-world examples

The application of the run rate is prevalent across various industries. Depending on the industry, it can highlight various aspects of business operations, helping companies manage their financials, inventory, production levels, etc., much more efficiently.

Technology industry

In the technology industry, startups often rely on the run rate to showcase their growth potential and attract investors. By demonstrating a high run rate, startups can highlight their ability to scale operations and generate substantial revenue. Investors view the run rate as a performance metric that indicates market traction and growth potential, making it a crucial factor in funding decisions.

Manufacturing industry

In the manufacturing industry, the run rate plays a crucial role in capacity planning. Manufacturers analyze production the run rate to determine their production capacity, optimize resource allocation, and ensure efficient operations. By accurately estimating future production levels based on the current run rate, manufacturers can avoid overproduction or underutilization of resources, leading to improved productivity and cost efficiency.

Retail and e-commerce

Similarly, the retail sector utilizes the run rate for inventory management and sales forecasting. By analyzing the current sales run rate, businesses can make informed decisions about stock levels, pricing strategies, and promotional activities. This enables them to align their inventory with expected demand, avoid stockouts or excess inventory, and improve overall supply chain efficiency.

Best practices for utilizing the run rate in business management

To maximize the benefits of the run rate analysis, businesses should adopt certain best practices.

- Rely on the run rate combined with other metrics

Firstly, it is crucial to combine the run rate analysis with other forecasting methods. While the run rate provides a quick and simple estimation, incorporating additional forecasting techniques such as trend analysis, regression models, or market research can enhance the accuracy and reliability of projections.

- Review and update the run rate over time

Regularly reviewing and updating the run rate calculations is also essential to reflect any changes in business operations or market dynamics. As businesses evolve, factors impacting their performance may change, requiring adjustments to the run rate calculations. By staying up-to-date and revisiting the run rate analysis periodically, businesses can ensure the relevance and accuracy of their projections.

- Interpret the run rate business-wise

Besides, it is important to consider the context and specific factors of the business when interpreting the run rate results. Each industry and business has unique characteristics and dynamics that may impact the accuracy of the run rate analysis. Therefore, understanding these nuances and making appropriate adjustments or interpretations is critical to leveraging the run rate effectively.

Conclusion

In the realm of business management, the run rate serves as a valuable tool for estimating future trends and outcomes. By understanding the definition of the run rate, exploring its applications, and considering its advantages and limitations, businesses can make informed decisions and projections. Real-world examples across industries highlight the importance of the run rate in strategic planning and operational efficiency. By following best practices and incorporating other forecasting methods, businesses can leverage the run rate effectively and enhance their ability to navigate the ever-changing business landscape.