Bank accounts play a crucial role in managing personal finances. Whether you’re saving for the future, making everyday transactions, or planning for retirement, choosing the right type of bank account is essential. In this comprehensive guide, we’ll explore the various types of bank accounts available and help you make an informed decision based on your individual needs and financial goals. Read on to discover everything you need to know!

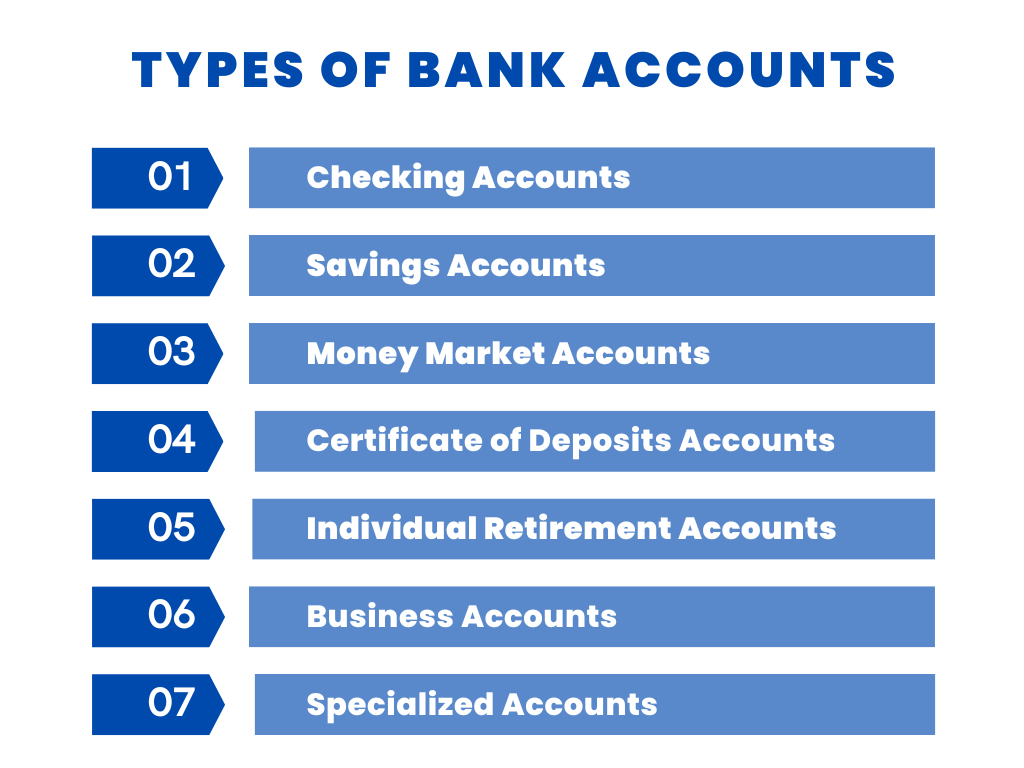

Bank accounts: types of bank accounts

There are many different types of accounts, each serving a particular purpose. To streamline the understanding of accounts, we’ve prepared a useful scheme:

Now, let’s review bank account types.

Checking accounts: Checking account basics

A checking account is a fundamental banking tool that allows for easy access to your funds. It is designed for daily transactions and provides features such as debit cards, online banking, and check writing. A checking account is commonly used to manage personal finances, pay bills, make purchases, and receive direct deposits such as salary or income. Checking accounts provide convenience and flexibility in managing your money.

Let’s take a closer look at a checking account and its key features.

1. Checking account deposits and withdrawals

You can deposit money into your checking account through various methods, such as direct deposit, cash deposits at a bank branch or ATM, or electronic transfers. You can withdraw money from your account using checks, debit cards, online transfers, or by visiting a bank branch or ATM.

2. Check writing

Checking accounts allow you to write checks as a payment method. Checks are written instructions to the bank to pay a specific amount from your account to the recipient.

3. Checking accounts and debit cards

Most checking accounts come with a debit card, which can be used for purchases at point-of-sale terminals, online transactions, and cash withdrawals at ATMs.

4. Online and mobile banking

Checking accounts often provide access to online banking platforms and mobile apps, allowing you to manage your account, view transactions, transfer funds, pay bills, and monitor your balance from the convenience of your computer or mobile device.

5. Overdraft protection

Many checking accounts offer overdraft protection, which allows you to make transactions even if you have insufficient funds in your account. This may be in the form of an overdraft line of credit or the option to link your checking account to a savings account to cover overdrafts.

6. Transaction limits

While checking accounts generally offer unlimited transactions, some accounts may have limitations on the number of transactions or checks you can write per month. It’s important that one review the terms and conditions of your specific checking account.

7. Minimal or no interest

Unlike savings accounts or other investment-focused accounts, checking accounts typically offer minimal or no interest rates on the deposited funds. The primary purpose of a checking account is to facilitate day-to-day financial transactions rather than accumulate interest.

Checking accounts are essential for managing your everyday expenses and providing easy access to your money. They provide a safe and convenient way to handle your finances while offering various features and benefits to suit your individual banking needs.

Savings Accounts: understanding your savings

A savings account is a type of bank account designed for individuals to save money and earn interest on their deposited funds. Unlike checking accounts that are primarily used for day-to-day transactions, savings accounts focus on accumulating and growing your savings over time.

What are the key features of a savings account?

1. Saving and accumulating funds

The primary purpose of a savings account is to encourage individuals to save money for future needs, such as emergencies, specific goals, or planned expenses. It provides a secure place to store your savings while earning interest on the deposited funds.

2. Interest earnings on an savings account

One of the main advantages of a savings account is the ability to earn interest on your balance. The interest rate can be either fixed or variable, and it is typically calculated on a daily or monthly basis. While the interest rates may be lower compared to other investment options, savings accounts provide a safe and reliable way to grow your money.

3. Liquidity

Savings accounts offer a high level of liquidity, meaning you can access your funds relatively easily when needed. Unlike long-term investments, such as certificates of deposit (CDs), savings accounts allow you to withdraw money or transfer funds to your checking account as required without any penalties.

4. Limited withdrawals

Although savings accounts provide liquidity, they often have limitations on the number of withdrawals or transfers you can make per month. This is typically done to encourage individuals to maintain their savings and resources and discourage excessive spending. However, there may be exceptions for in-person withdrawals at bank branches.

5. Minimum balance requirements

Some savings accounts may require a minimum balance to be maintained in order to earn interest or avoid monthly service fees. It’s important to review the terms and conditions of the specific savings account to understand any minimum balance requirements.

6. Access to money: online and mobile banking

Similar to checking accounts, most savings accounts offer banking online and mobile apps, allowing you to monitor your account balance, track transactions, and transfer funds conveniently at any time.

7. Safety

Savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) in the United States or similar deposit insurance schemes in other countries. This means that even if the bank were to face financial difficulties, your deposited funds, up to the insured limit, would be protected.

Savings accounts provide a secure and accessible way to save money while earning interest. They are suitable for short to medium-term savings goals and serve as an important financial tool for building an emergency fund, saving for a down payment, planning for a vacation, or achieving other specific financial objectives.

Money market accounts: striking a balance

Money market accounts strike a balance between checking and savings accounts. They offer higher interest rates than traditional savings accounts while still allowing you to access your funds relatively easily. Money market accounts are suitable for short-term savings and emergency funds. However, they may have higher minimum balance requirements and limited check writing and transaction capabilities.

Let’s explore the key features of a money market account.

1. Higher interest rates

Money market accounts generally offer higher interest rates compared to traditional savings accounts. These rates may vary depending on market conditions and the specific financial institution. While the interest rates may not be as high as those offered by certain investment vehicles, MMAs provide a relatively safe way to earn more on your savings.

2. Limited check writing

Money market accounts allow a limited number of check writing or electronic transfer transactions each month. This feature provides the convenience of accessing your funds when needed while encouraging you to maintain a higher balance in the account to earn interest.

3. Minimum balance requirements

Money market accounts often require a higher minimum balance compared to regular savings accounts. This minimum balance requirement ensures that the account holder maintains a certain level of funds in the account to take advantage of the higher interest rates and avoid monthly service fees.

4. Tiered interest rates

Some money market accounts offer tiered interest rates, which means that higher balances may earn higher interest rates. This structure provides an incentive for account holders to save more money in the account to maximize their earnings.

5. Access to funds

While money market accounts offer more accessibility compared to some longer-term savings options, there may still be limitations on withdrawals and transfers. Similar to savings accounts, there may be a limit on the number of transactions allowed per month, typically with a fee for exceeding that limit. However, MMAs generally offer the ability to withdraw funds using checks, electronic transfers, or by visiting a bank branch or ATM.

6. FDIC insurance

Money market accounts provided by FDIC-insured banks are covered by the Federal Deposit Insurance Corporation, offering protection for account balances up to the insured limit in case of bank failure.

Money market accounts are suitable for individuals who want to earn higher interest rates on their savings while maintaining some level of liquidity. They are often recommended for short-term savings goals, emergency funds, or as a place to park funds temporarily before making larger investments. However, it’s important to compare the terms, fees, and interest rates offered by different financial institutions to choose the money market account that best fits your needs.

Certificate of deposit (CD) accounts: stability and guarantees

CD accounts are ideal for long-term savings and earning fixed returns. With a CD account, you deposit a specific amount of money for a fixed term, ranging from a few months to several years, and in return, you receive a fixed interest rate. However, early withdrawal from a CD account may result in penalties. A strategy known as CD laddering involves staggering the maturity dates of multiple CDs to balance liquidity and optimize returns.

What features set a Certificate of Deposit account apart?

1. Fixed term

CDs have a fixed term or maturity period, which can range from a few months to several years. The term is agreed upon when opening the account. During this period, you cannot withdraw the funds without incurring an early withdrawal penalty, except in certain cases, such as the death of the account holder.

2. Fixed interest rate

CD accounts offer a fixed interest rate, meaning the rate remains the same throughout the term of the CD. This allows you to know in advance the exact amount of interest you will earn on your deposit. The interest rates offered by CDs are typically higher than those of regular savings accounts due to the longer commitment period.

3. Guaranteed returns

Because of the fixed term and interest rate, the returns from a CD account are guaranteed. Regardless of market fluctuations, the agreed-upon interest rate remains constant, providing stability and predictability in your investment.

4. Penalty for early withdrawal

If you need to withdraw funds from a CD before the maturity date, you will typically face an early withdrawal penalty. This penalty is a percentage of the interest earned or a set number of days’ worth of interest. It’s important to carefully consider your financial needs and the term of the CD before opening the account to avoid penalties.

5. FDIC insurance

CD accounts provided by FDIC-insured banks are protected by the Federal Deposit Insurance Corporation. This means that if the bank were to face financial difficulties, your deposited funds, up to the insured limit, would be protected.

6. CD laddering strategy

Some individuals employ a CD laddering strategy, where they open multiple CDs with different maturity dates. This approach helps distribute funds across various CDs, ensuring liquidity at regular intervals while taking advantage of potentially higher interest rates on longer-term CDs.

CD accounts are suitable for individuals who have a specific time horizon for their savings and do not require immediate access to their funds. They are particularly useful for individuals looking for a low-risk investment option with guaranteed returns. CDs can be used to save for short-term goals, such as a down payment on a house or a planned vacation, as well as for longer-term objectives like retirement planning.

Individual retirement accounts (IRAs): financial security in the future

IRAs are specifically designed for long-term retirement savings. They offer tax accounting advantages and a range of investment options. There are two main types of IRAs: traditional and Roth. Traditional IRAs provide tax-deductible contributions, whereas Roth IRAs offer tax-free withdrawals in retirement. Contribution limits and eligibility criteria vary depending on factors such as income and employment status. IRAs play a vital role in building a nest egg for a financially secure retirement.

In what way are the Individual Retirement Accounts different?

1. Tax advantages

IRAs provide tax advantages that can help you save more for retirement. There are two main types of IRAs: Traditional IRAs and Roth IRAs.

a. Traditional IRA

Contributions to a Traditional IRA are often tax-deductible, meaning you can deduct the amount contributed from your taxable income in the year of contribution. The earnings within the account grow on a tax-deferred basis until you withdraw the funds in retirement, at which point they are taxed as ordinary income.

b. Roth IRA

Contributions to a Roth IRA are made with after-tax dollars, so they are not tax-deductible. However, qualified withdrawals from a Roth IRA in retirement are tax-free, including the earnings on your investments. This can provide significant tax advantages during retirement.

2. Contribution limits and eligibility

IRAs have annual contribution limits set by the IRS. For 2023, the contribution limit for both Traditional and Roth IRAs is $6,000, with an additional catch-up contribution of $1,000 for individuals aged 50 and older. However, these limits are subject to change, so it’s important to check the current guidelines. Additionally, there are eligibility criteria based on factors such as income, employment status, and participation in employer-sponsored retirement plans.

3. Investment options

IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), certificates of deposit (CDs), and more. The specific investment options available to you depend on the financial institution where you hold your IRA.

4. Withdrawal rules

IRAs are intended for retirement savings, so there are rules and penalties for withdrawing funds before reaching a certain age. In general, withdrawals made before age 59½ are subject to a 10% early withdrawal penalty, in addition to being taxed as ordinary income. However, there are exceptions to these rules, such as for qualified first-time homebuyer expenses or certain medical expenses.

5. Rollovers and transfers

You can transfer or rollover funds from one IRA to another without incurring taxes or penalties, provided you follow the IRS guidelines. This allows you to consolidate your retirement savings or change the type of IRA (e.g., from a Traditional IRA to a Roth IRA) based on your financial needs and tax planning strategies.

6. Estate planning

IRAs can play a role in estate planning. You can designate beneficiaries for your IRA to ensure that your assets pass directly to your chosen individuals upon your death. Proper beneficiary designations can help maximize the tax advantages of an inherited IRA.

IRAs are valuable retirement savings vehicles that offer tax benefits and investment flexibility. They can be used in addition to employer-sponsored retirement plans or as standalone accounts. It’s important to consider your financial goals, current tax situation, and retirement needs when deciding between a Traditional IRA and a Roth IRA. Consulting with a financial advisor or tax professional can help you determine the most suitable type of IRA for your individual circumstances.

Business accounts

Business accounts are specialized bank accounts designed specifically for the financial needs of businesses, whether they are sole proprietorships, partnerships, or corporations. These accounts help separate personal and business finances, streamline banking transactions, and provide access to various banking services tailored to business requirements.

Here are some key features and types of business accounts:

Business checking accounts

Business checking accounts are the most common type of business account. They allow businesses to manage their day-to-day financial transactions, such as receiving payments from customers, making vendor payments, and handling payroll. Business checking accounts often offer features like debit cards, online banking, and mobile banking to facilitate convenient transactions and money management.

Need help to make sure your e-commerce business’s account balance is correct? Use the right automated accounting software and never worry about discrepancies! Synder offers exactly that – it’s an all-in-one accounting solution, offering 25+ integrations and connecting all the sales channels and payment platforms your small business has in use in one source of truth – your accounting platform. Flawless data synchronization, accurate reporting and hassle-free reconciliation are just some of the features available on auto pilot in Synder.

Test out the tool yourself during a 15-day free trial, or book a seat at our webinar to get a guided tour and ask questions. Experience the power of automation!

Merchant services

Many banks provide merchant services to businesses, enabling them to accept credit card and debit card payments from customers. These services typically include the installation of card terminals, payment processing, and settlement of funds into the business’s checking account. Merchant services are especially beneficial for retail businesses and those offering products or services that require payment processing.

Business savings accounts

Business savings accounts are similar to personal savings accounts, but they are specifically designed for businesses to accumulate and save excess funds. They offer interest on the deposited funds, providing a place for businesses to park their surplus cash while earning a return. Business savings accounts can be used for future investments, planned expenses, or to build an emergency fund for the business.

Business credit cards

Business credit cards are designed to meet the unique financial needs of businesses. They provide a convenient way to manage business expenses, track purchases, and separate personal and business spending. Business credit cards often offer benefits and rewards tailored to business needs, such as cashback or travel rewards on business-related expenses.

Business loans and lines of credit

Many banks offer business loans and lines of credit to help businesses finance their operations, expansions, equipment purchases, or other specific business needs. These financing options can provide access to capital to support growth, manage cash flow, or handle unexpected expenses.

Check out How Synder Eases Export of Stripe Loans To QuickBooks.

Cash management services

Banks may offer cash management services to businesses, which include features like remote deposit capture, payroll processing, electronic fund transfers, and automated clearinghouse (ACH) services. These services streamline cash flow management, simplify payroll processing, and improve efficiency in handling financial transactions.

Tailored banking solutions

Banks often provide additional specialized services and solutions based on the specific needs of different types of businesses. For example, they may offer industry-specific accounts for sectors like healthcare, real estate, or nonprofits, along with additional services like escrow accounts, trust accounts, or accounts designed for foreign transactions.

Business accounts provide businesses with the tools and services necessary for effective financial management, separation of personal and business finances, and access to customized banking solutions. When selecting a business account, it’s important to consider the specific banking needs of your business, the fees and services offered by different banks, and how well the account aligns with your financial goals and operational requirements.

Specific financial needs: specialized accounts

In addition to the standard bank accounts, there are specialized accounts, which refer to specific types of bank accounts that are designed to meet particular financial needs or circumstances. These accounts cater to unique situations and offer specialized features and benefits.

1. Trust accounts

Trust accounts are established for managing and safeguarding assets on behalf of a beneficiary or beneficiaries. These accounts are often used in estate planning to ensure that assets are distributed according to the wishes of the account holder. Trust accounts are typically managed by a trustee who oversees the administration of the assets and ensures they are used for the intended purpose.

2. Joint accounts

Joint accounts are opened and owned by two or more individuals who have equal access to and ownership of the account. Joint accounts can be useful for married couples, family members, or business partners who need to share funds and manage financial matters collectively. Each account holder has the ability to withdraw funds, write checks, and conduct transactions from the joint account.

3. Custodial accounts

Custodial accounts are opened on behalf of minors by a parent, guardian, or custodian. These accounts are managed on behalf of the minor until they reach the age of majority, which varies depending on the jurisdiction. Custodial accounts can be used to save and invest money for the child’s future education or other financial needs.

4. Health savings accounts (HSAs)

HSAs are specialized accounts available to individuals who are enrolled in a high-deductible health insurance plan. These accounts are designed to help account holders save for qualified medical expenses, such as deductibles, copayments, and other healthcare costs. HSAs offer tax advantages, including tax-deductible contributions and tax-free withdrawals for qualified medical expenses.

5. Escrow accounts

Escrow accounts are temporary holding accounts used to facilitate secure transactions, particularly in real estate transactions. These accounts hold funds until certain conditions or obligations are fulfilled, such as the completion of a home purchase or the disbursement of funds for property taxes and insurance.

6. Foreign currency accounts

Foreign currency accounts allow individuals or businesses to hold funds in currencies other than their domestic currency. These accounts are useful for international transactions, currency conversions, and managing finances in multiple currencies. They provide a way to hold and transact in foreign currencies while minimizing currency exchange fees and fluctuations.

Specialized accounts offer tailored solutions to address specific financial needs and situations. They provide individuals and businesses with the flexibility and tools required to manage their funds effectively and navigate unique circumstances. When considering specialized accounts, it is essential to understand the account features, associated fees, and any specific legal or regulatory requirements that may apply. Consulting with a financial advisor or banking representative can help you determine which specialized account is most suitable for your particular needs.

Looking for a tool that can solve the multicurrency problem for your e-commerce business? Read our article How Daily Summary Helps Streamline Managing Transactions in Multiple Currencies.

Conclusion to different types of accounts: consider your resources and find the type of bank account you need

Choosing the right type of bank account is crucial for effectively managing your finances. Understanding the various types of bank accounts available, such as checking accounts, savings accounts, money market accounts, CD accounts, IRAs, business accounts, and specialized accounts, empowers you to make an informed decision. Consider your financial goals, liquidity needs, risk tolerance, and any specific requirements you may have. Research different banks and compare their offerings. Consulting with a financial advisor can also provide valuable guidance. Remember, the right bank account can help you build a strong financial foundation and achieve your long-term goals.

Read our guide How long does it Take to get Tax Refund.

I found this article about different types of bank accounts quite helpful. It breaks down various account options, their features, and benefits. Thanks for providing such a comprehensive guide!

We’ve very happy you found it helpful. We always strive to make complex topics clear for our readers.

My sister and I are interested in starting a company together next year. We’re glad you talked about business bank accounts and how they help business owners with their banking transactions. Next week, we’ll call and ask about business accounts to keep our finances organized and separated.

That’s great! Best of luck!

It got me when you said that checking accounts are best for everyday expenses and can easily be accessed while being safe and convenient for us. I will look for a bank or financing company to consult with to learn more about the types of accounts before I make a decision. I just need to find something that I can use to protect my savings, especially when I will be allotting it for my future family or when I finally have a kid to take care of.

Hi Mia! We’re glad you found our article helpful and insightful. Best of luck!

Thanks for pointing out that there are various methods to deposit money in checking accounts such as direct, branch, ATM deposits, or electronic transfers. I should look for free checking accounts from companies that can provide all of those, because it will make my life easier. It will depend on what is convenient for me in the future, so I can have the assurance that I can have any option available for me.