Accounting is vital for a business, being a language of numbers that tells business owners about their financial health and guides them toward the right business decisions. Big companies can rely on their accounting departments to handle financial matters and interpret financial data. However, small business owners usually have to manage a significant portion of accounting, which can be challenging and time-consuming.

In this article, we’re looking at accounting apps small businesses might fancy giving a try to facilitate accounting, so you can choose the one to suit your needs and help you make the most of your finances and resources.

Contents:

1. Peculiarities of small-business accounting

3. Best accounting and bookkeeping apps for small businesses

4. Factors to consider when choosing an app to fit your needs

5. Benefits of accounting software for a small business

Peculiarities of small-business accounting

I believe I’ll be quite accurate saying that accounting for small businesses is tricky. With limited resources, wearing multiple hats to handle countless tasks vying for attention and staying on top of financial matters can feel like navigating a treacherous sea. Even a tiny mistake in bookkeeping or accounting can send shockwaves through a business, causing money losses or raising compliance issues.

Imagine running a small bakery. You’re the owner, the head baker, the marketer, and the accountant – all rolled into one. Every day, you’re knee-deep in dough, quite literally. But amidst the flour and the sweet aroma of freshly baked goods, you should juggle numbers and keep track of expenses, sales, and profit margins. If you will, it’s like trying to catch a dozen slippery eels while ensuring your croissants rise to perfection in the oven.

What if you accidentally mix up some numbers or forget to record an expense? It may seem like an oversight, but its consequences can be as bitter as a burnt loaf of bread. Your financial records become distorted, making it harder to understand how much money is coming in and going out. This way, you might end up overpaying taxes or facing penalties for non-compliance, which no small business owner wants.

To complicate matters, you need accurate financial information to make informed pricing, inventory, and expansion decisions. You want to know if that new espresso machine will bring you closer to your dreams or drown you in debt. But without proper accounting practices, it’s like navigating blindfolded through a maze of numbers, hoping you’ll stumble upon the right path.

That’s why small business accounting is a beast of its own. It requires tenacity, attention to detail, and the ability to wear multiple hats without losing balance. At this point, you might want a sturdy financial compass to guide you through stormy waters, ensuring your ship stays afloat. And here’s where accounting and bookkeeping apps come to aid. While they can’t do all the work for you (and make you a nice cup of coffee as a bonus), they can be your trusted first mate, lightening the load and helping you steer in the right direction.

With the above in mind, let’s explore the world of accounting apps and how they can transform your small business’s financial journey.

What are accounting apps?

Accounting apps represent a wide group of software designed to help you manage your finances. You can install them on your computer, laptop, mobile phone, or tablet, or access them through the internet. The cool thing about today’s accounting apps is that they give you real-time access to your financial data, which means you always have the most up-to-date information for accurate accounting.

Usually they offer various features to make your financial life easier. You can track your expenses, manage your cash flow, predict future trends, send invoices, and handle payroll. Some apps may connect with other business tools, so you can seamlessly integrate your data across different programs, giving you a clear, comprehensive view of your entire financial situation and making it a breeze to manage your money.

Depending on your needs, accounting apps can assist you with various aspects, such as bookkeeping, financial reporting, or budgeting. They work well for different small business types, whether you’re a service provider, retailer, manufacturer, wholesaler, or something else.

Now, let’s talk a bit more about the different types of accounting apps out there. While having similarities, they might have their focus and features, which make them fall into two major categories. The first one comprises more specialized apps – such as, for example, bookkeeping apps, financial reporting apps, expense tracking, or invoicing apps, and more – that take care of, let’s say, a particular area of your finances. The second one is the general accounting apps category comprising software being more of an all-in-one solution. Let’s look at some of the most popular types of accounting apps in more detail.

Bookkeeping

Bookkeeping apps cater perfectly to small businesses with simple financial needs. They act as financial assistants, handling transactions, expenses, earnings, and cash flow analysis. These applications automate the process of tracking and documenting business transactions, eliminating the requirement for manual data entry and laborious spreadsheet work.

Efficiently tracking cash flow becomes second nature with these apps, giving business owners valuable insights to inform their financial decisions. Moreover, they streamline the invoicing process, allowing users to create invoices and receive payments directly through the app. This convenience not only impresses clients but also ensures timely and accurate record-keeping.

Financial reporting

Financial reporting apps offer a clear, comprehensive view of your finances. They reveal your earnings, expenses, assets, and cash flow with vivid charts and graphs, sparing you the agony of deciphering intricate figures in dull spreadsheets.

These apps paint a complete picture of your financial landscape, serving as a guiding roadmap through your business’s monetary terrain. They effortlessly transform complex data into easily understandable reports.

With financial reporting apps, crucial questions about your money find swift answers. How much profit did you make last month? Are expenses aligning with revenue? Are cash flow patterns hinting at issues requiring your attention? Digestible insights empower you to make sound financial decisions.

Expense tracking

Expense-tracking apps are digital solutions created to diligently record and categorize expenditures, enabling businesses to gain valuable insights into their spending patterns.

Their streamlined data entry and automated processes mirror the precision and efficiency sought in the business world. Moreover, the ability to analyze historical data and generate personalized budgets equips businesses with a strategic advantage in resource allocation and cost optimization.

Usually, such apps can integrate with existing financial systems to provide real-time updates, empowering businesses to maintain financial health control. Timely reminders and notifications act as vigilant sentinels, guarding against oversights and inefficiencies.

Accounting

Though often perceived as tailored for larger enterprises that need extensive accounting solutions, accounting software also extends its benefits to smaller businesses. With the help of accounting applications, businesses of any size can efficiently handle customer and supplier management, inventory management, asset management, and other critical resources. These apps also aid in tax-related issues and produce essential financial reports.

Embracing accounting apps brings a host of valuable features within reach. From seamless invoice creation to meticulous tracking of sales and earnings, these tools provide indispensable assistance for efficient financial management. Moreover, they offer streamlined inventory management, ensuring businesses can optimize their operations and boost productivity. In a world where precision and speed are paramount, accounting apps might become essential allies, empowering small companies to thrive alongside their larger counterparts.

Best accounting and bookkeeping apps for small businesses

You’re about to explore some of the accounting and bookkeeping applications that can assist you in managing your finances more efficiently. Let’s find out what solutions can take your accounting and bookkeeping to the next level.

Synder

Synder is an accounting software tailored to cover the needs of ecommerce businesses and online small businesses with both low and high amounts of monthly transactions. Synder allows for joining all the company’s data sources, such as accounting solutions, payment processors, and ecommerce platforms, into a single ecosystem, drastically facilitating bookkeeping and accounting for business transactions. This way, business owners can seamlessly and accurately import transaction data from all their channels into accounting, making bookkeeping a breeze, generating correct and informative financial statements for accounting and taxation purposes, and having a 360-degree view of their business with instant sales, customer, and product insights.

Should you believe Synder can be the solution you’re looking for, don’t hesitate to book a seat at our webinar or sign up for a free trial to learn more about how it can help your particular business.

QuickBooks

As a veteran in the accounting software grounds, QuickBooks has earned its stripes as a reliable and comprehensive tool for small businesses. Whether you’re a startup or a growing enterprise, QuickBooks offers versatile solutions to address your specific needs.

This powerful software provides an array of features, including income and expense tracking, invoicing, inventory management, and bank reconciliation. It also integrates with various financial institutions, making it seamless to connect and manage your accounts.

QuickBooks’ user-friendly interface ensures that even those less familiar with accounting lingo can navigate it with ease. The mobile app extends its capabilities on the go, keeping you in control of your finances no matter where you are.

QuickBooks Self-Employed

Designed with freelancers and independent contractors in mind, QuickBooks Self-Employed simplifies the accounting process for sole proprietors. This specialized version of the QuickBooks software offers robust features, such as automatic mileage tracking, expense categorization, and quarterly tax estimation. It allows you to separate personal and business expenses efficiently, making tax time a breeze. With its user-friendly mobile app, tracking your income and expenses on the fly becomes second nature, empowering you to focus on your work and passion without worrying about the numbers.

Zoho Books

Zoho Books might be a commendable choice for small businesses seeking a scalable and cost-effective accounting solution. Geared towards streamlining accounting tasks, Zoho Books provides an intuitive interface that facilitates invoicing, expense tracking, project management, and time tracking. With its automation capabilities, you can set up recurring transactions and payment reminders, saving you precious time. Zoho Books’ mobile app extends the convenience, letting you manage your finances on the move.

Wave

For those searching for free accounting software that doesn’t skimp on essential features, Wave fits the bill. Tailored for small businesses, freelancers, and consultants, Wave offers core functionalities such as invoicing, expense tracking, and receipt scanning. It also supports bank connections for easy transaction imports and reconciliation. Although it’s free, Wave’s user-friendly interface and robust capabilities make it a compelling choice for many small business owners.

Xero

Xero is a cloud-based accounting software that caters to the needs of small businesses across various industries. Its robust features include invoicing, expense tracking, bank reconciliation, and purchase order management. Xero’s real-time collaboration capabilities allow multiple users, such as accountants and bookkeepers, to work seamlessly on financial tasks simultaneously. The mobile app ensures that you’re always in sync with your business finances, making it convenient to manage your accounts while on the move.

To make the right decision, you’ll need a deeper dive into important factors to keep in mind while selecting accounting software for your small business. I’ve got you covered!

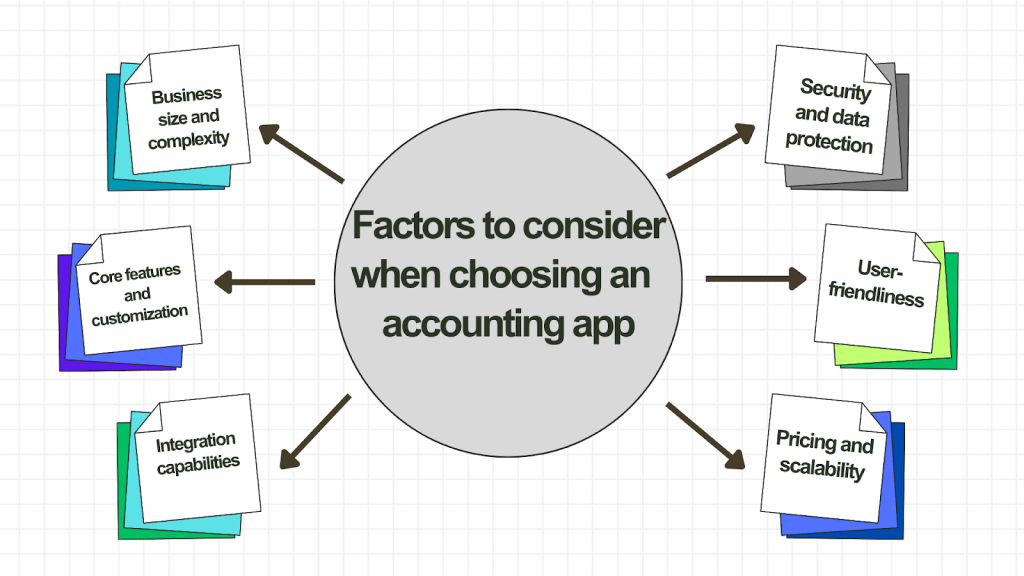

Factors to consider when choosing an app to fit your needs

With so many accounting and bookkeeping apps available on the market, choosing the one that might suit your business the best can be overwhelming. Literally, all of them promise to streamline your processes and boost productivity. However, if you choose unwisely, you might end up with the opposite result: more headaches for you and your accountant trying to find the workarounds to make things work.

For example, incompatible software can cause issues with your current systems, resulting in inconsistencies with your data and requiring more manual work.

Additionally, the software may not have all the necessary features your business requires, which could impede your efficiency and growth. On the other hand, the software might have more features than you need, causing you to pay for things you’ll never use.

If the software can’t keep up with the growth of your business, you may need to switch to another option, which could cause more disruptions. It’s important to note that switching to a new software later can be both time-consuming and expensive, as it requires data migration and staff retraining.

And those are just the tip of the iceberg. There might be a lot of smaller inconveniences hiding below, but altogether, they might turn into a nightmarish experience for you (leaving aside the waste of money).

At this point, knowing what to pay attention to when choosing accounting software for your business can save you time, money, and a good deal of nerve cells in the long run. So let’s look at the factors that might help you make sure the software you select fits your bill.

Size and complexity of your business

This one, probably, is the most important. It’s quite logical: if you want a software to align with your needs, you might want to determine those needs first. So, to begin narrowing your options, assess the size and complexity of your business. Certain accounting apps cater to startups and small businesses with straightforward features and user-friendly interfaces. However, larger enterprises may require more advanced platforms with complex financial transaction capabilities and compliance requirements. Knowing the scope of your business, as well as the project scope will aid in identifying apps that meet your present needs and potential for growth.

Core features and customization

Every business operates differently, and so do their accounting and bookkeeping requirements. Analyze the core features offered by each app and determine whether they address your essential financial tasks, such as invoicing, expense tracking, payroll management, and tax calculations. Additionally, look for apps that allow customization, enabling you to tailor the platform to match your business processes and terminology.

- For example, a small retail store may need more comprehensive accounting capabilities. They’d require features like inventory management, point-of-sale integration, and sales tax calculations.

- A creative agency, on the other hand, might have complex financial tasks that require customization to match their unique billing methods and project tracking. They may bill clients based on hours worked, project milestones, or a combination of various factors.

Integration capabilities

Efficiently managing your finances entails integrating your accounting app with other business tools you already use, such as CRM software, ecommerce platforms, or project management systems. Seamless integration enhances data accuracy and minimizes manual data entry, saving time and reducing the risk of errors. Prioritize apps that offer robust integration capabilities with popular business software to create a unified ecosystem that boosts your overall efficiency.

Let’s look at some examples of how the integration of accounting apps with other business tools might work for different types of online businesses:

Ecommerce platforms

Imagine you run an ecommerce store selling various products. Integrating your accounting app with your ecommerce platform, such as Shopify or WooCommerce, can streamline the entire order-to-cash process. When a customer purchases on your website, the integration automatically syncs the sales data to your accounting software. This integration ensures that all sales, refunds, and inventory updates are accurately recorded in real-time, providing you with up-to-date financial information.

SaaS (Software-as-a-Service) companies

SaaS businesses might want their accounting app to integrate with their subscription management platform – Stripe or Recurly (or other services like these). When new customers subscribe or existing ones renew their plans, the integration automatically generates invoices and records revenue recognition entries, streamlining the revenue management process. This ensures accurate financial reporting and simplifies the complexities of managing recurring revenue.

CRM (Customer Relationship Management) Software

For businesses that rely heavily on customer data and sales leads, integrating the accounting app with a CRM system like Salesforce can have significant benefits. When a deal is closed in the CRM, the integration instantly creates invoices and updates the customer’s financial information in the accounting software. This seamless integration helps the finance team get a comprehensive view of customer transactions, assisting them in managing cash flow and outstanding payments more effectively.

Project management systems

For businesses offering services and running projects, integrating the accounting app with project management software such as Asana or Trello can improve financial tracking and project cost management. As projects progress and expenses are incurred, the integration automatically records these expenses in the accounting system. This real-time synchronization enables accurate project cost analysis and budget tracking, empowering businesses to make informed financial decisions.

Inventory management systems

If you’re an online retailer selling physical products, it can be really helpful to connect your accounting app with an inventory management system like, for instance, TradeGecko or DEAR Inventory. This way, any changes in your inventory levels (like sales, returns, or new purchases) are accurately recorded in your accounting software, helping you keep your inventory at the right level, avoid running out of stock, and manage your inventory storage costs efficiently.

Security and data protection

Many online businesses depend on software and tools to run their operations smoothly. One of the most important factors that demand careful consideration is the safety and protection of their customers and business information. Here’s how certain online businesses prioritize security while selecting and utilizing accounting software:

- Online retail businesses dealing with customer transactions and personal data must prioritize security in their accounting apps. For instance, an ecommerce platform that integrates accounting software will need to ensure that customer payment details and order information are encrypted and stored securely. They should look for accounting apps that comply with Payment Card Industry Data Security Standard (PCI DSS) to safeguard credit card data during online transactions.

- SaaS companies that offer subscription-based services may handle sensitive customer data, such as login credentials and billing information. To ensure the security of this data, they should select accounting apps that use multi-factor authentication to prevent unauthorized access to user accounts.

- Marketing agencies often handle client financial data and billing information, making data protection a top priority. Such businesses should choose accounting apps that offer role-based access controls, allowing them to restrict access to sensitive financial information only to authorized personnel.

- Startups in the financial technology (FinTech) sector need robust security measures for their accounting apps. They might consider apps that provide regular data backups and real-time monitoring of access logs to detect any suspicious activities promptly.

- Companies that develop healthcare software or offer medical services online must adhere to strict data protection regulations like HIPAA (Health Insurance Portability and Accountability Act). For these businesses, it’s vital to use accounting apps that comply with HIPAA’s security and privacy requirements to protect sensitive patient data.

- E-learning platforms handling student payment data and personal information should prioritize the security of their accounting apps. They should verify that the app uses encryption protocols to safeguard student data and check if it aligns with education industry-specific standards like FERPA (Family Educational Rights and Privacy Act) if applicable.

- Security is paramount for cryptocurrency exchanges that deal with financial transactions and hold users’ digital assets. Such exchanges should opt for accounting apps that utilize advanced encryption methods to protect users’ private keys and transaction details.

- Subscription box businesses that store customer billing information for recurring payments must ensure that their accounting apps comply with security standards like ISO 27001, which establishes best practices for information security management systems.

- Online banks and financial institutions need the highest level of security for their accounting apps. They should look for apps that offer end-to-end encryption for financial transactions, utilize secure socket layer (SSL) technology, and undergo regular security audits to maintain compliance with industry regulations.

User-friendliness and training

Implementing new accounting software shouldn’t cause chaos in your business operations. Look for apps that offer intuitive interfaces and provide sufficient training resources to help your team quickly adapt to the new system. An easy-to-navigate platform will reduce the learning curve, ensuring a smooth transition and a more positive user experience.

For example, an ecommerce platform with an intuitive interface and comprehensive training materials might improve productivity and order management. Similarly, a customer support solution with easy navigation can reduce response times and increase customer satisfaction. As you can see, prioritizing user-friendliness and training seems pretty vital for the successful integration of new tools.

Pricing and scalability

Considering the previous factors usually help come up with a kind of short list of accounting software that might suit your business. So the final step is to align your choice with your possibilities, in other words, your budget. You might want to look for an option that fits your budget and provides the necessary features for your current business stage. You might also want to consider the app’s scalability with your business growth and watch out for any hidden costs that may arise as your usage expands.

- For instance, ecommerce platforms often offer tiered pricing based on product quantity and sales volume. A startup might begin with a basic plan, while a more established business might need to upgrade to access advanced features.

- Similarly, email marketing services may start with a free plan for limited subscribers but might require a higher-tier plan as the email list grows and more advanced automation is needed.

- Cloud hosting services should be scalable to handle increased website traffic without unforeseen costs due to bandwidth limitations or hidden fees.

- Analytics and business intelligence tools may offer free or low-cost plans initially but could entail additional charges for advanced reporting and visualization features.

- Customer support software should be adaptable to accommodate a growing support team and rising support requests without unexpected expenses.

You got the idea. Pricing is a significant factor affecting your decision-making. Therefore, it’s important to approach it carefully and explore all available options. It’s recommended, however, to consider pricing towards the end of your journey in selecting accounting software to ensure that the chosen solution fits your bill, literally.

Benefits of accounting software for a small business

As mentioned, running a small business can be tough, with time and money being precious resources. Efficiency and accuracy are crucial in this world, and modern entrepreneurs are turning to accounting apps to help them navigate the sea of numbers that hide away in stacks of paper and confusing ledgers. Let’s break down the benefits of accounting apps for small businesses.

- Streamlined bookkeeping

The days of tedious manual data entry and calculations are over. Accounting apps can now automate these tasks, minimizing errors and allowing business owners more time for other activities.

- Real-time financial insights

Small business owners can quickly obtain financial information through accounting apps, allowing them to track expenses, monitor cash flow, and assess profitability quickly and easily. These apps provide a snapshot of the business’s financial status almost instantly.

- Invoicing at the speed of thought

With the tap of a finger, invoices are dispatched to clients, ensuring prompt payments and nurturing healthy cash flow. Gone are the days of invoices lost in the mail or buried beneath a mound of paperwork.

- Effortless tax compliance

Accounting apps help lessen the stress of tax season. They efficiently organize transactions and provide reliable reports. This way, they free small business owners from a substantial chunk of tax-related problems.

- Financial collaboration and accessibility

In today’s world of connectivity, accounting apps promote collaborative efforts. Business owners and accountants can work together seamlessly, accessing data from anywhere without being restricted to a static office.

- Cost-effectiveness

Accounting apps might provide an affordable alternative to hiring a dedicated accounting staff, allowing businesses to allocate more resources toward their growth.

- Security

Don’t worry about your financial information being compromised. Accounting apps usually have strong digital security measures in place to keep small businesses safe from hackers who may try to access them.

- Simplicity

Accounting apps make financial management an easy-to-use terrain. The interface simplifies the complexity of accounting and makes it approachable for everyone.

- Integration in harmony

Accounting apps can easily integrate with other business tools like payment gateways and banking systems, creating a streamlined system where data can flow freely and efficiently. It can improve the overall harmony and productivity of your business.

- Time travel with reports

Detailed reports help explore the archives of your financial history with ease. Lessons from the past can guide small businesses toward a brighter and more prosperous future.

Bottom line

If you strive to understand your business’s financial health, accounting is the language you need to be fluent in. At this point, you might want to have a trustworthy accounting app as your ally to help you navigate through rough patches. Accounting software offers multiple benefits to your business: from faster and more accurate bookkeeping to tax compliance to real-time insights into your financials. Still, those benefits might be in vain if you choose software unsuitable for your business. So, you might want to consider your business size and needs to start searching for the right app with features, customization, integration capabilities, pricing, etc., that address those needs and fit your budget.

With the right app, you can keep your business afloat and even compete with larger companies. Take your time to explore different options and choose wisely.