The growth in e-commerce has recently been given a significant boost, drastically increasing competition in the domestic market. It was only logical for businesses to start exploring ways of reaching new customers and expanding into new online markets. And the emergence of new e-commerce channels and solutions has made cross-border trade more accessible.

However, operating an international e-commerce business has raised potential concerns, such as accepting international payments online and accounting for transactions in foreign currencies. Let’s take a closer look at what may cause hardships in recording and managing foreign currency transactions in accounting helps dramatically facilitate this task.

Learn other reasons why giving Synder a green light is worth a shot.

What are multi-currency transactions?

Multi-currency transactions are your business transactions in multiple currencies different from your home currency.

Why would you need to deal with transactions in foreign currencies?

When selling internationally, it’s critical to localize your sales to be in line with customers’ expectations. It takes not just translating your product names and descriptions to the language your customers speak. It also means offering them the possibility to pay in their home currency (and often provide the payment methods they’re used to).

So, expanding your business to embrace foreign markets, you’ll inevitably face the need to accept such payments and reflect them in your books.

What do you need to provide for when recording and managing transactions in foreign currencies?

Accounting for international transactions can be complicated and bear potential risks. And the more channels you have to migrate your cross-border sales data into accounting, the higher the risk of errors and discrepancies is. So you’d want to be super accurate not to mess up your books. Let’s break down some of the most common sources of complications you need to provide for when recording foreign currency transactions in accounting.

Currency exchange rates

Running an international business, you’ll be receiving payments in different currencies. However, you might need to convert all foreign currencies into your home currency (in case you’re a US-based business, it’s USD) for the sake of reporting and managing your financial documents more efficiently. You’ll have to ensure you apply the correct exchange rates when recording transactions. If done manually, it can become the biggest source of discrepancies, especially when you’re dealing with a large number of foreign transactions. You have to verify the rate for the dates every transaction occurred, as the rates can change day to day. Also, not all the importing solutions out there can recognize foreign currency transactions, thus recording the wrong numbers into the books and making reconciliation difficult.

Foreign transactions sales taxes

Foreign currency sales are still subject to sales tax, which the IRS taxes on the home currency value. So you need to provide for sales taxes when recording foreign currency transactions and make sure that the exchange rate is up-to-date with when the transaction occurred. Also, you’d want to record sales taxes under the correct category to secure accurate reporting and tax filing.

Foreign currency exchange gain or loss

It’s especially relevant when foreign customers don’t instantly pay for your products or services. You invoice them in their currency, expecting to receive a certain amount in dollars and reflecting this amount in your accounts receivable. However, when the payment occurs, the actual amount in dollars that enters your bank account may be different due to the exchange rate fluctuations — you can either gain or lose some dollars per transaction. The difference should be correctly reflected in your books, otherwise, they won’t balance. Some accounting software can provide for this, however not all of them will do this automatically.

One more important thing to think about is whether your accounting is tailored for managing multi-currency transactions.

You aren’t really doing all the accounting manually, like writing down your transactions using pen and paper (or filling in the books in a spreadsheet). You’re likely to use some accounting software. However, the solution you might be using might not support multi-currency or require you to enable this function before you can record transactions in currencies other than your home currency. Usually, you’ll have to upgrade your subscription, change your settings, or change the accounting solution to ensure you can manage foreign currency transactions in your books.

How does Synder multi-currency help?

The multi-currency functionality in Synder allows for receiving international payments in multiple foreign currencies and automatically synchronizing them with your accounting. Upon set-up, Synder will eliminate the manual work element from the workflow, saving a considerable amount of time and ensuring the accurate and error-free recording of transactions in various currencies into the books.

The software logic provides for applying correct currency exchange rates that it captures from payment providers when converting transactions into the home currency. It also recognizes different details of transactions, including those in foreign currencies, and categorizes them correspondingly. Ultimately, it automatically calculates and converts the sales tax amounts, applying correct exchange rates on the date of the invoice or bill (depending on what you need).

With Synder, you’ll still need to put some effort into the initial set-up, enabling multi-currency. However, when you’re done with it, it puts your accounting for foreign currency transactions on autopilot. It doesn’t matter how many sales or payment platforms you receive payments in foreign currencies from, you’ll have accurate books, correct financial reporting, and frictionless reconciliation.

How to enable multi-currency transactions synchronization in Synder

Before you can manage and track your international sales transactions, you’ll need to make sure multi-currency is enabled in Synder.

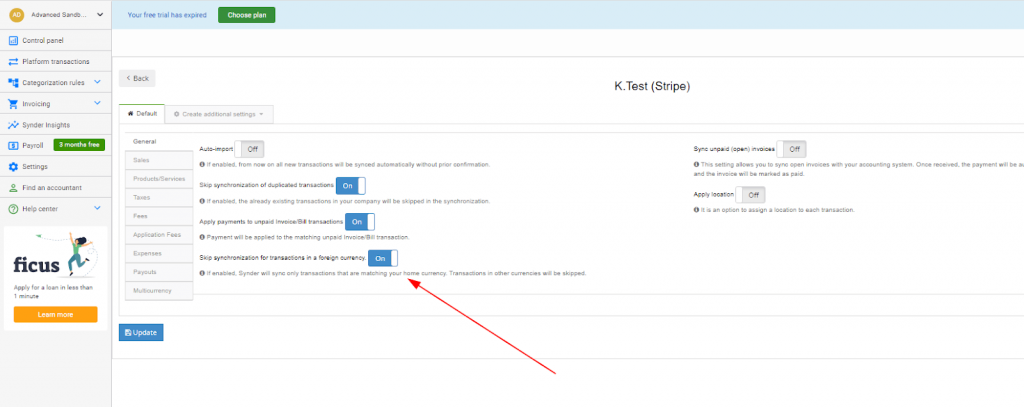

To do so, just go to Settings > General tab and switch off the Skip synchronization for transactions in a foreign currency setting. Otherwise, Synder will only synchronize transactions in your home currency. Here’s how it looks:

You’ll also need to ensure that your accounting solution allows for multi-currency or enable the functionality (if needed).

Depending on how you want your transactions to be recorded in accounting, Synder offers two options: synchronizing multi-currency transactions into one account or recording transactions in each currency to its own account. In the first case, no matter the currency of the transaction, Synder will convert and record it in your home currency, applying the exchange rate provided by the connected payment processor. In the other case, transactions will be recorded in their original currencies and separate accounts. Which option you choose is totally up to you, based on your preferences and situation. As the setup workflow will be different at some point, let’s take a closer look at the steps you need to take to configure each option.

- To go with a single account for all multi-currency transactions, you’ll need to:

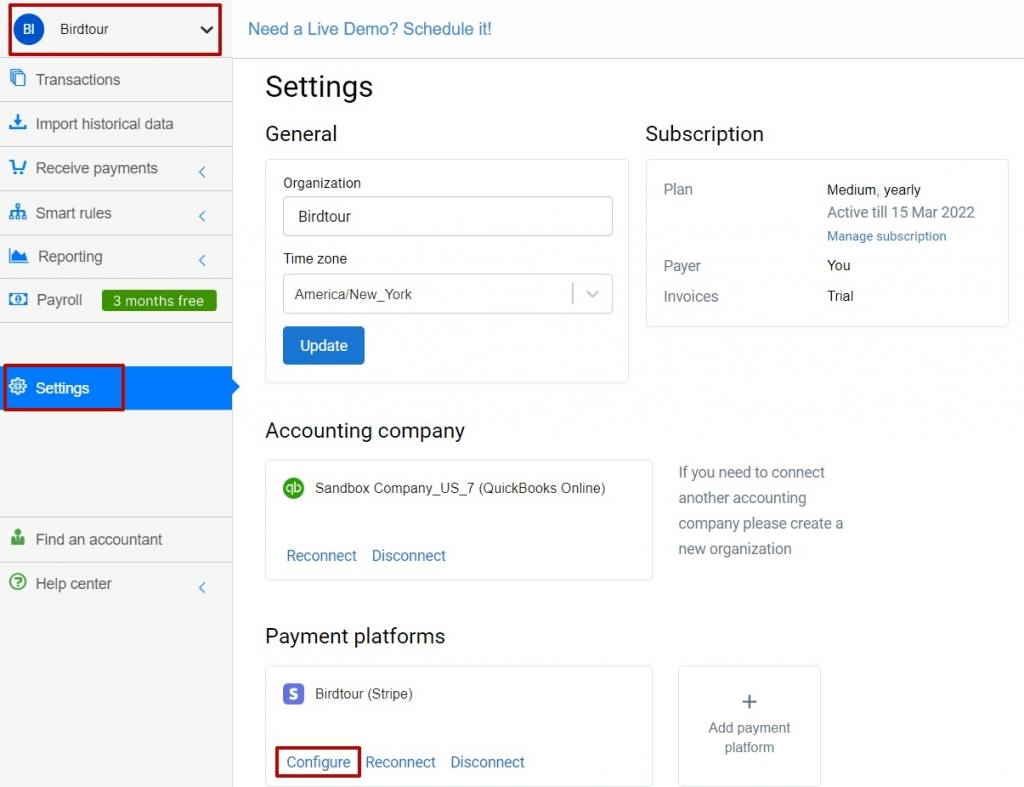

1. Choose the needed organization at the top right of the page and click the Settings button on the left menu;

2. Select the payment platform (if you have several connected) you want to customize settings for and click on the Configure button.

3. The preset configuration will show up, so you basically won’t need to change anything at this point, only click the Update button at the bottom left.

Going with separate accounts for each foreign currency will require some more steps.

1. Create accounts in each currency manually in your QuickBooks or Xero:

- go to your QuickBooks or Xero Chart of Accounts,

- create a new Bank type account in QuickBooks for each currency (like Stripe Bank Account – CAD, Stripe Bank Account – EUR, and so on).

2. Back in Synder, go through the initial configuration, as described in the first option;

3. Click on Settings;

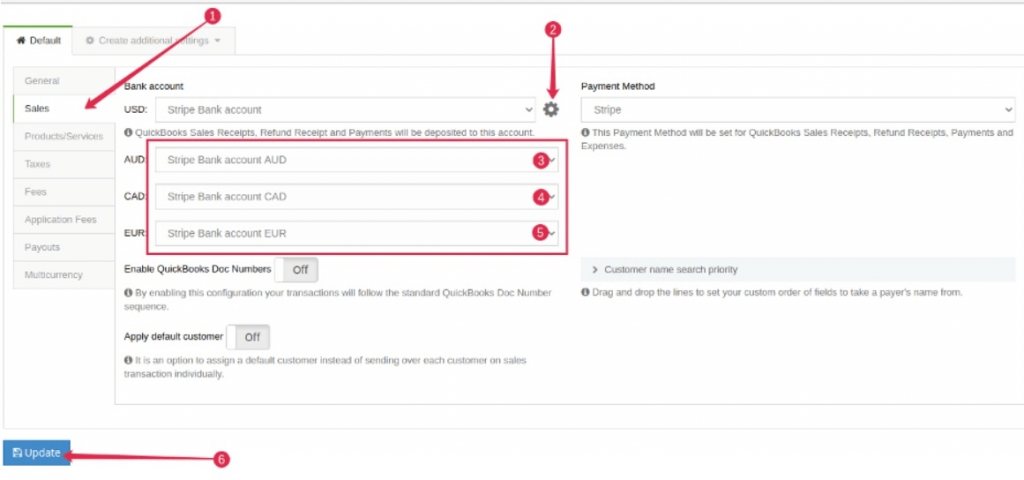

4. Go to the Sales tab and press the Gear icon.

5. Choose any of the currencies that you’ve enabled in your QuickBooks/Xero and set up a Bank account where Sales Receipts, Refund Receipts, and Payments received in each currency will be stored.

6. Repeat steps 4-5 for the Fees, Application Fees, and Expenses (only for PayPal) tabs.

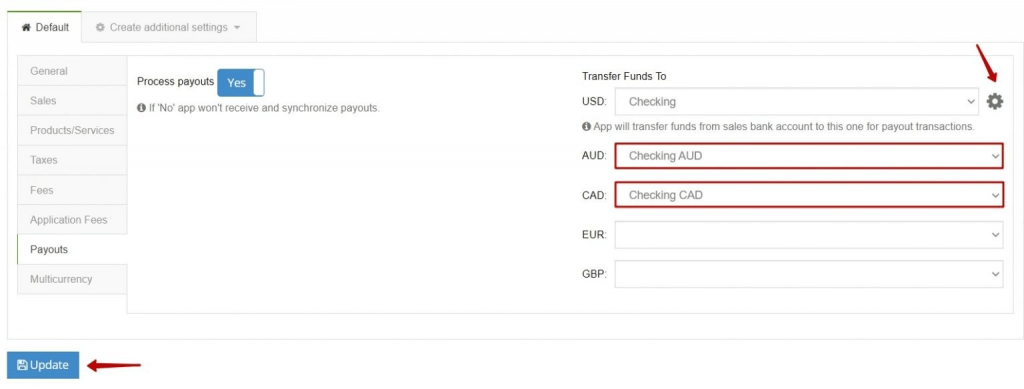

7. Go to the Payouts tab and choose your Checking accounts for each currency correspondingly.

And that’s it.

The bottom line

Handling international payments in accounting can seem pretty intimidating, especially when it comes to accounting for transactions in various foreign currencies. Doing it manually sounds almost impossible if you have large amounts of transactions to deal with. Hopefully, you don’t have to, as you can automate the process and profit from data accuracy. With Synder’s multi-currency feature, processing foreign currency transactions from multiple sources is smooth and frictionless, so you always have accurate financial reporting and don’t have to bother about reconciliation.

Read our step-by-step guides to correctly set up synchronization of multi-currency transactions with QuickBooks or Xero. And if you want to learn more about how Synder can help your business, feel free to try a free trial or book an online demo.