E-commerce accounting differs from traditional accounting, as e-commerce businesses usually have much larger volumes of business transactions to manage. All these transactions should be accurately brought and categorized in the books, which can potentially be a challenge for an accountant or a bookkeeper working with e-commerce clients.

Synder’s Daily Summary feature aims to facilitate recordkeeping for accounting specialists that work with e-commerce businesses. It allows batching the daily scope of transactions into daily totals and automatically importing them into the books, thus dramatically reducing a load of data to manage. At the same time, it ensures accurate categorization of transaction details necessary for correct financial reporting, tax filing, and reconciliation.

Here’s an overview of how it works.

What’s the challenge?

The majority of e-commerce business transactions are sales transactions featuring lots of details unnecessary to accountants that might overload the books. It adds up to the challenges that e-commerce accountants face – categorization of business transaction data, viewing the data by each sales channel, and reconciling accounts.

- Overloading books with unnecessary details

While business owners might want to have some transaction details, such as customer or product data in the books, this data is of no use to accountants who usually deal with purely financial information. Recording large amounts of highly-detailed transaction data into the books can slow down the performance of an accounting solution. Moreover, some accounting tools might have daily limits for the number of transactions allowed.

- Categorizing transaction data

All the records that come into the books should be correctly categorized. The accuracy of categorization highly affects accounting reports and financial statements that an accountant uses to analyze a business’s financial state and prepare tax returns. The larger the amount of data to manage in accounting, the higher the risk of errors and miscategorization is. Moreover, categorizing thousands of transactions might be a spine-breaking and time-consuming task. While automation can help, there’s still a possibility that software might fail to categorize some transaction details correctly.

- Reconciling accounts

A discrepancy can ruin the reconciliation of your books with the bank account. What’s more heartbreaking, it can take days to scrape through thousands of transactions to find the error.

How does Synder beat the challenge?

Synder automatically fetches highly detailed transaction data from multiple channels, including e-commerce platforms, marketplaces, and payment processors. The Daily Summary feature allows accountants to switch from the per transaction data import into the books (if they feel that it overloads their books due to high volume of transactions) to the import of summarized daily totals of transactions.

- How does it work?

When the Daily Summary feature is enabled, Synder batches the day’s scope of transactions into a journal entry of highly relevant financial data and then posts it into your client’s accounting system once a day. What’s more, Synder automatically categorizes transaction data with a high level of accuracy.

- What’s the catch?

While automating the process, Synder makes sure the users have financial reporting and tax filing based on the correct numbers, offering better control over data synchronization and categorization. It helps accountants analyze their clients’ finances more efficiently, giving them access to valuable insights into the performance of their businesses.

Here are some smart features that make it happen.

Intelligent mapping functionality

The Daily Summary feature comes with functionality that allows users to align journal entries with the corresponding accounts in the books. This way, all the necessary details, such as sales, fees, taxes, or expenses, get into the correct categories and are accurately reflected in the accounting statements. Upon setup, the users will either be able to select the needed accounts or make full use of the preset standard mapping.

Data breakup by platforms

To ensure transparency in terms of where the data comes from, Synder creates separate journal entries for each e-commerce platform or any other sales data source instead of a single batch for the day. It can help analyze and compare the performance of various sales channels your e-commerce clients might use, so they know which brings them more profit and where to put more effort.

Control over the level of automation

After the initial setup, Synder can do all the work automatically. However, users can choose the level of automation they’d want to rely on. They can either allow Synder to put the process on autopilot, or have the possibility to review the created journal entries before syncing them to the books.

Smooth one-click reconciliation

Daily Summary features a high level of data accuracy in the books with the minimum possibility of errors. And should they happen, it’ll be much easier and faster to identify and correct discrepancies. The in-built duplicate detection, roll back of any erroneous transactions, and subsequent resync of this data help ensure the accuracy of the books and level up the reconciliation process.

How to enable the Daily Summary feature in Synder

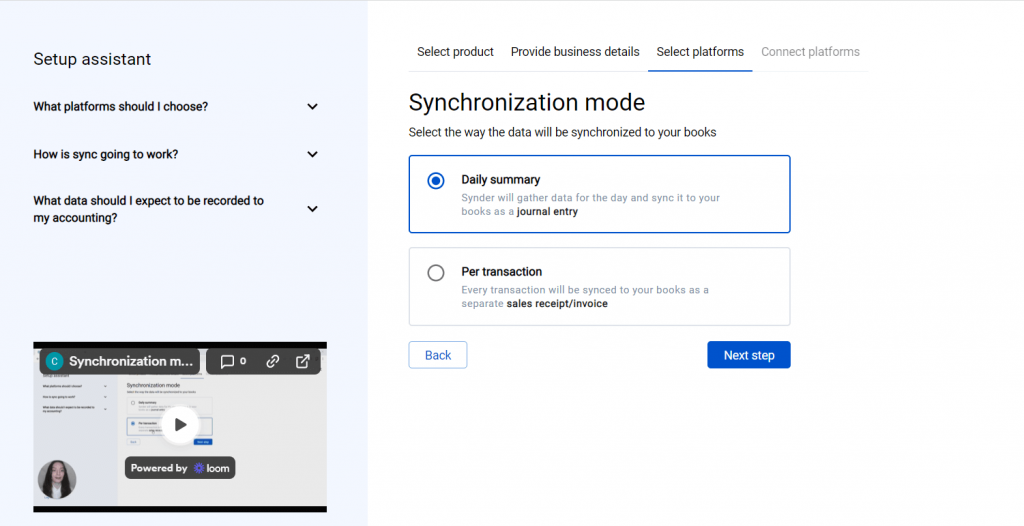

At the initial setup of Synder, when users need to connect the sales channels and accounting platforms they use, they’ll be offered to select the preferred synchronization mode, such as Per transaction or Daily Summary. The process is pretty straightforward and intuitive. Here it is step by step:

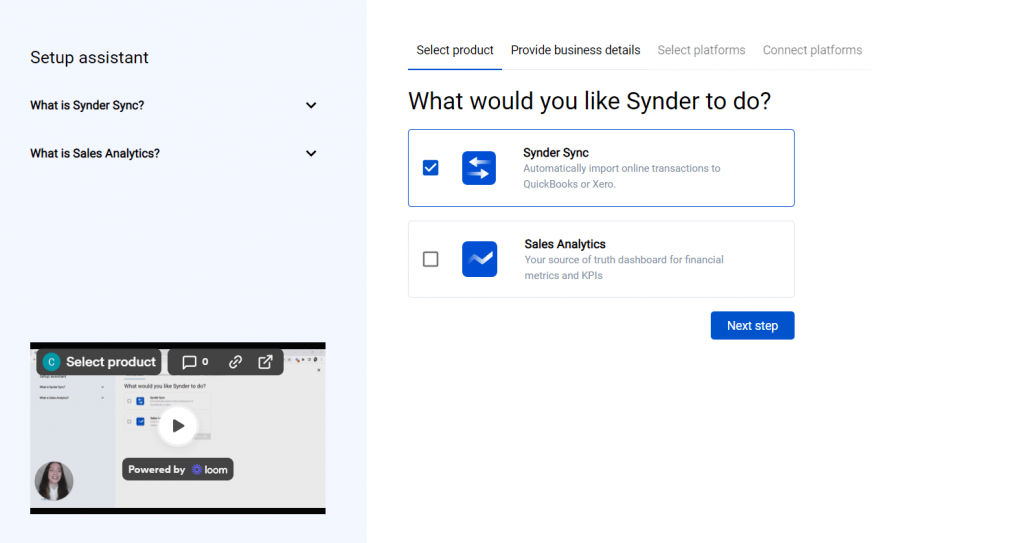

1. Choose the Synder product you’re going to use – in this case, it’s Synder Sync:

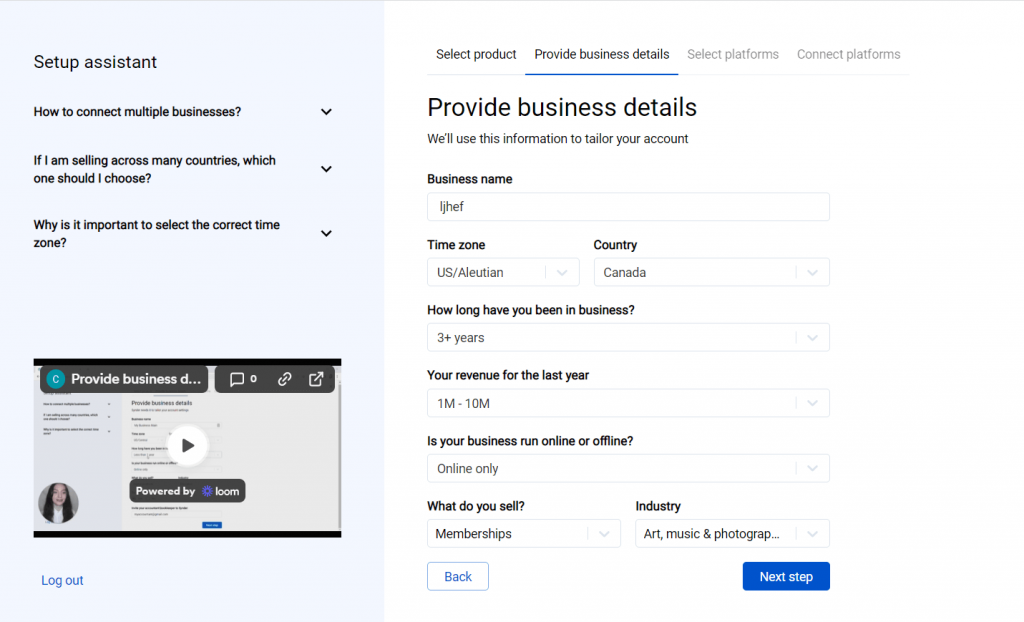

2. Provide your business details:

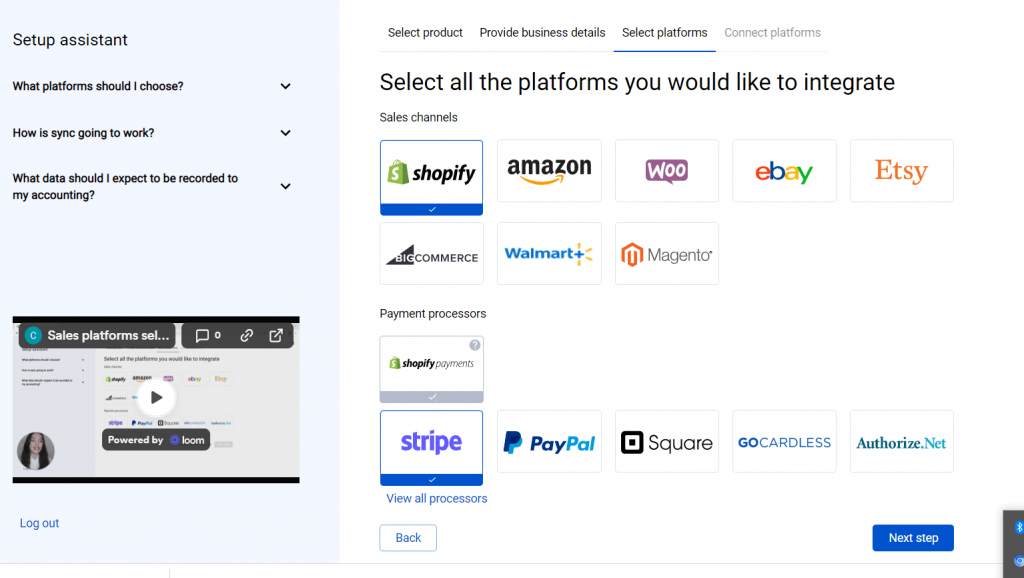

3. Select the sales channel you what to fetch your transactions from:

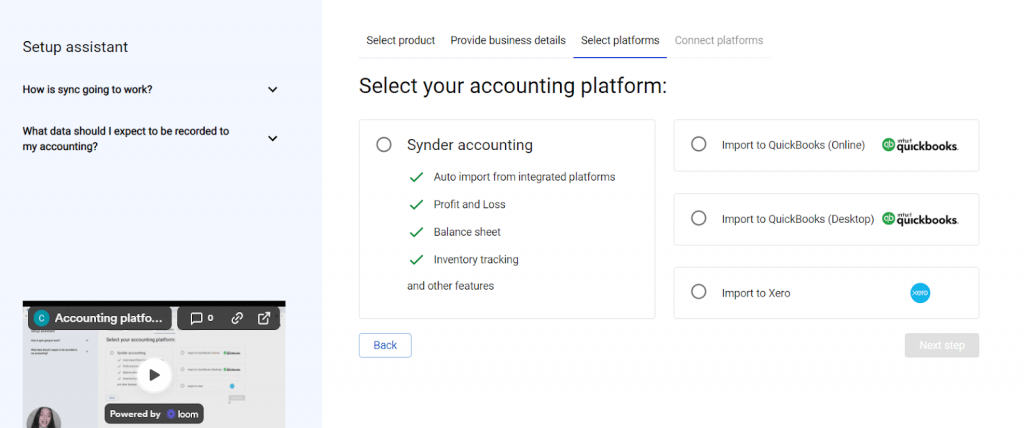

4. Select the accounting solution you’re using:

5. Choose Daily Summary as the preferred data synchronization mode:

That’s it, you’re all set!

Have more questions about Synder Sync or other products by Synder?