You might know that among accounting software, especially for small and mid-size businesses, QuickBooks is a leading solution thousands of business owners and accounting specialists use daily. So, if you’re looking for a career in accounting, obtaining a QuickBooks certification might be a smart move.

Let’s break down QuickBooks certification, its terms, requirements, and cost in this article.

Key takeaways

- QuickBooks Certification opens doors to enhanced job opportunities, credibility, and career advancement in the accounting and finance field.

- Carefully choosing courses and making the most of the study materials and preparation tests might help you go smoothly through the certification exam. Good rest before it and time management practices during the exam might also help.

- You can walk the extra mile and introduce technology and automation tools into your accounting practice to level up your experience, have deeper financial insights, and help clients make sense of their numbers and decide based on that.

What is QuickBooks Certification?

So, What’s QuickBooks certification, and why you might want to complete one?

QuickBooks Certification is a credential awarded by Intuit, the company behind QuickBooks software, to individuals who demonstrate proficiency in using QuickBooks.

Basically, it recognizes your ability to effectively utilize and understand the features and functionalities of QuickBooks for various accounting and bookkeeping tasks.

You got the idea. As mentioned, for a future accounting professional, this certification is a logical step towards advancing their career. So, let’s break down what this certification can give you.

Go beyond certification and level up your accounting practice with smart technology! Book your seat at our Weekly Public Demo to see how you can use Synder to automate a good deal of your practice or explore it yourself with a 15-day all-inclusive free trial.

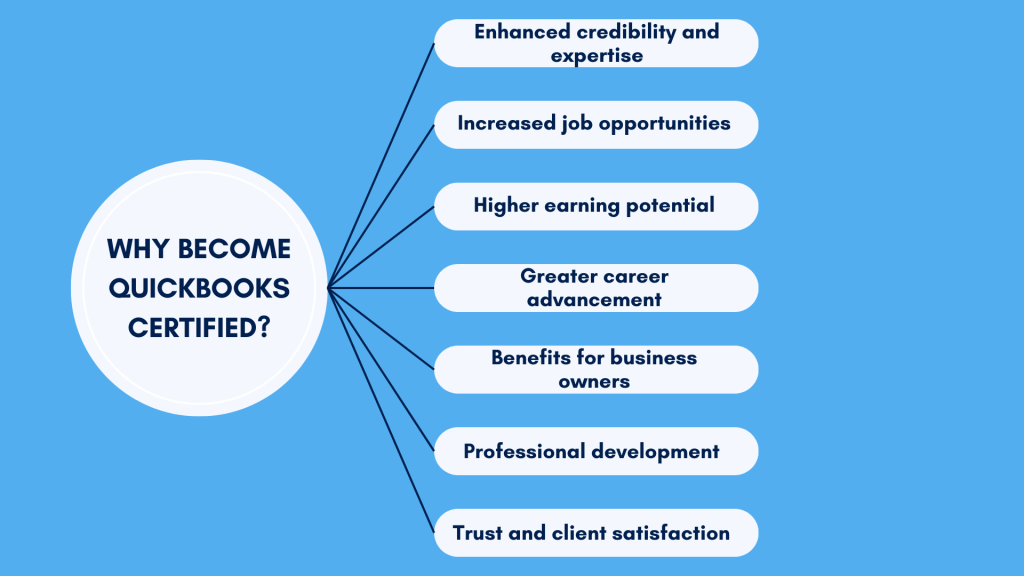

Why become QuickBooks certified?

Earning a QuickBooks certification brings several benefits that will improve your employability and organizational performance. There are numerous benefits to be gained from pursuing certification: improving one’s professional standing and potentially expanding the number of job opportunities available, increasing income, and establishing a path toward career advancement.

Here is more information on what makes getting this certification a big deal.

Enhanced credibility and expertise

Since certification shows one has comprehensive knowledge of the software, it can recommend them to the job market as a competent person. Hiring managers, employers, and clients tend to rely on certified professionals because the process of certification guarantees that they possess the knowledge on how to efficiently employ QuickBooks.

Increased job opportunities

Given that so many businesses in the US use QuickBooks as their accounting solutions, including small start-ups, mid-sized companies, and large global corporations, they might consider a certified specialist over someone without such credentials. This way, upon receiving certification, you might secure more job offers. It can also be a requirement for the bookkeeper, accountant, financial analyst, or office manager positions. Moreover, certification could be a unique selling point in your job application, putting you in a better position than your non-certified counterparts.

Higher earning potential

QuickBooks-certified experts are believed to be paid more than those not certified. Employers understand and appreciate the benefits of having certified personnel, which include increased productivity, accurate financial reporting, and identification of tailored QuickBooks solutions. For this reason, getting a certification increases the chances of the professionals commanding higher wages and other privileges.

Greater career advancement

QuickBooks certification is not only about employment. Having a certification can result in a promotion and the amount of responsibility taken in an organization. Employers have more confidence in certified professionals for business-critical tasks and leadership positions. It can also mean that people may advance in their careers faster and have dealings with the superior levels of an organization.

Benefits for business owners

From the perspective of business owners, having QuickBooks Certified personnel in the company is beneficial. Certified employees have the knowledge to handle the company’s financial matters effectively and rightfully, helping to ensure that financial records are kept properly, minimizing errors and the possibility of financial embezzlement. Moreover, certified staff can get more out of QuickBooks features and functions that may not be frequently used. It can result in improved financial control, accounting, and organizational performance in general.

Professional development and networking

The path to becoming QuickBooks certified involves a commitment to continual training and familiarizing with the most current updates and requirements. Maintaining such a commitment can help you stay abreast of the established norms and emerging advancements in your field. Additionally, belonging to the QuickBooks Certified fraternity provides a chance to interface with other professionals. Interacting with other people, groups, and forums and attending meetings and conferences are also beneficial for developing relationships and sharing information and ideas.

Trust and client satisfaction

QuickBooks Certification is more than a professional accomplishment for freelancers and consultants. Certification offers clients confidence in hiring and engaging the services of professionals so that they can handle their financial affairs well and without bias. This is beneficial for establishing long-term relationships with clients, repeat business, and the client referring other clients, thus being very important for the business growth.

A brief overview of QuickBooks

Before we proceed, let’s take a quick look at QuickBooks.

QuickBooks is the most widely used accounting software in the US. It’s designed to help businesses efficiently manage their finances and fulfill bookkeeping and accounting tasks. Its functionality comprises the chart of accounts, invoicing, expense tracking, payroll management, and financial reporting. It can also provide inventory tracking, either native or through integration with third-party solutions, and an impressive number of other integrations that can extend its functionality, depending on a business’s requirements.

QuickBooks comes in various versions, including cloud-based QuickBooks Online and QuickBooks Desktop, installed on a local computer. Each version can address different business needs, making it a versatile tool for accountants and business owners.

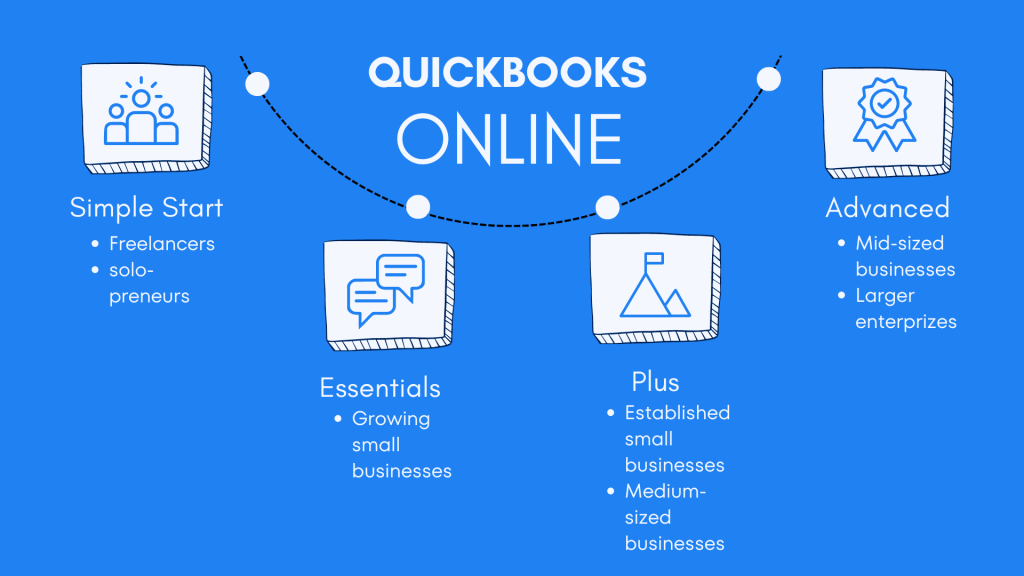

QuickBooks Online

As stated, QuickBooks Online is one of the cloud-based solutions for the software where users can access financial data at any time from anywhere when connected to the internet. This flexibility is most advantageous, especially to companies with several employees working with finances, employees who work from home, or companies that need regular access to their finances from different places.

Divisions of QuickBooks Online

QuickBooks Online can be a choice for many businesses, from solopreneurs to mid-sized enterprises. Based on the kind of business it targets, it has several divisions.

- QuickBooks Online Simple Start targets small businesses and solo entrepreneurs. Its key features include basic income and expense tracking, invoicing, and receipt capture.

- QuickBooks Online Essentials is mostly for growing small businesses and offers bill management, multiple user permissions, and time tracking in addition to the Simple Start feature package.

- QuickBooks Online Plus is a more sophisticated solution for small and mid-sized businesses. Besides the basic features mentioned above, it allows for inventory tracking, project profitability, and detailed reporting.

- QuickBooks Online Advanced addresses the more complex needs of larger businesses. It features more advanced reporting, custom user permissions, dedicated account managers, and the possibility to set up customized workflows in addition to everything offered in the Plus version.

As you can see, QuickBooks Online is a pretty versatile solution that can equally help freelancers, small businesses, and larger companies. The choice of versions allows users to select the software that would address their needs but not overwhelm them with features that might be unnecessary and excessive at the stage of their business development.

QuickBooks Desktop

QuickBooks Desktop, as it derives from the name, is a desktop version of the software, so you need to download it on your computer before you can use it. It offers multiple features and functionalities that can be accessed without an internet connection, in other words, locally. It’s considered to be more secure. This way, it can be ideal for businesses that prefer storing their data on their servers and require advanced capabilities.

Divisions of QuickBooks Desktop

QuickBooks Desktop also comes in several versions, catering to small to medium businesses and larger enterprises.

- QuickBooks Pro addresses the needs of established small businesses with comprehensive accounting tools, including invoicing, expense tracking, and basic inventory management.

- QuickBooks Premier might be a better choice for small to mid-sized businesses with specific industry needs. Besides the features offered in the Pro version, it offers industry-specific reports and tools for sectors like manufacturing, retail, or nonprofits.

- QuickBooks Enterprise, designed for larger businesses, covers even more specific requirements, such as those for advanced inventory management, payroll management, and enhanced reporting capabilities that allow for a better view of a company’s assets and liabilities. It’s the version with the most advanced features, offering scalability and the ability to handle large volumes of data and transactions.

How much does it cost to get QuickBooks certified?

Now, let’s talk about how much it might cost you to get QuickBooks certification. The total cost commonly depends on the certification type one wants to undertake and the resources one would have used. Various institutions can offer certification courses, which also explains the cost differences. You can look for certification courses provided by QuickBooks and those by affiliate partners and organizations.

But let’s break down the potential costs involved.

Exam fees

The cost of the QuickBooks Certification exam itself varies from $150 to $600. The price fluctuation depends on the type of certification you want to achieve.

For instance, the QuickBooks Online Certification may fall under the low-end certification. Still, there are high-end certifications like those on QuickBooks Desktop Enterprise Solutions that come with more investment. The correct price should be confirmed on the official website of Intuit or through an accredited training center since the prices might be reviewed and changed with time.

Additional preparation costs

With the exam being just the final part of the certification, there are several additional costs that candidates should consider to adequately prepare for it. Let’s figure out how much you might need to invest in the preparation.

Study guides

These guides contain the information that would help students pass the exam and cover all the topics you need to know for the exam. They sometimes contain questions the student may be asked on the exam, tricks, and how to solve the problems.

Study guides cost might vary from$50 to $150.

Online courses

Online classes are more accurate and consist of recorded lectures, often including video tutorials, interactive modules, and quizzes. These courses come with rich course material and accommodate learners with various learning styles. So, they can be a useful tool to get a full grasp of QuickBooks features.

Online courses might cost you from $100 to $300.

Practice exams

Practice exams are exercises that resemble the conditions of the real certification test. Preparing for it allows potential test-takers to assess their level of preparedness, notice their lack of knowledge in certain topics, and get accustomed to the exam structure and types of questions that can be expected.

The practice exam cost ranges from $30 to $100.

Total investment

This way, various expenses for QuickBooks Certification can run anywhere between $230 and $1,000 if all possible costs are accounted for. The totals involve the examination fee and extra materials required throughout preparation. However, if you seek recognition as a QuickBooks expert and the advantages it comes with, then the investment you have to make would be more than deserving of the benefits you are about to reap.

To lighten things up a bit, there are some cost-saving tips you might want to follow.

- Bundle offers

Some providers may group their products together and offer them as a package at a discounted price. The products in the bundle might include the exam fee, manual, and online tutorials. - Free resources

Explore additional sources found on QuickBooks itself or trusted online sources to augment your paid content with free ones. - Employer support

It is also worth mentioning that your employer can sometimes reimburse your expenses incurred while acquiring the certification or offer training resources.

How to prepare for and leverage QuickBooks certifications

Preparing for QuickBooks certification might require a strategic approach from your side, combining the right choice of course and study materials with effective study strategies.

#1 – Choosing the suitable course and study materials

Selecting the appropriate QuickBooks certification course is the first step in your preparation. QuickBooks offers various certifications, such as QuickBooks Online Certification, QuickBooks Desktop Certification, and specialized certifications like QuickBooks Payroll.

You might want to research each certification to determine which aligns best with your career goals and current job requirements. Understanding the differences and requirements of each certification will help you focus your efforts and choose the most relevant path.

To prepare effectively for the QuickBooks certification exam, you might want to use official study guides for comprehensive coverage. Besides, online courses like those on Udemy or Coursera offer structured learning experiences. As mentioned, taking practice exams can help you identify areas that need more study and improve your test-taking skills.

#2 – Strategizing your studies

Having the right study materials is critical, but it’s equally important to use effective study strategies.

You might consider creating a schedule including specific times for studying each day or week to cover topics systematically and avoid last-minute cramming. Identify and prioritize the most significant parts, such as navigation, transactions, reporting, and troubleshooting within QuickBooks, to improve your chances of passing the exam. You might also join study groups or forums to discuss topics, share resources, and ask questions for new insights and motivation.

#3 – Taking the exam

The QuickBooks Certification exam usually includes multiple-choice questions and simulation-based tasks. To pass it you might want some preparation and a wise approach.

- You might fancy a good night’s sleep before the exam to stay alert and focused. Being well-rested can improve concentration and reduce anxiety.

- Ensure you have all the necessary materials, such as a photo ID, exam confirmation documents, and allowed supplies. Preparing those beforehand will prevent last-minute stress and allow you to concentrate on the exam.

- Manage your time wisely during the exam to have enough time to answer all the questions. Proper time management will help you complete the exam without rushing and review your answers. Reviewing can help you catch and correct mistakes, potentially improving your score.

Post-certification: what’s next?

After obtaining QuickBooks Certification, you might want to leverage your new credentials and continue professional development.

Don’t forget to add your QuickBooks Certification to your professional profiles. Keep learning and staying updated with the latest QuickBooks features. Use your certification to explore new job opportunities and consider mentoring others for career growth.

Level up your practice as an accountant with Synder

Obtaining QuickBooks Certification is a significant milestone in your career as an accounting or finance specialist. However, you might want to continually improve your practice by leveraging all available tools and technologies to excel in your field.

How’s that?

Let me explain using Synder as an example of what technology can do to your accounting practice.

Synder is an accounting automation software designed to streamline and enhance your experience as a financial specialist. It allows you to handle larger volumes of transactions efficiently, reduces the time spent on repetitive tasks, and minimizes the likelihood of human errors. This increases your productivity and the accuracy and reliability of your financial records.

You can integrate Synder with QuickBooks to provide better service to your clients or manage your business finances more effectively. Real-time reports and insights empower you to offer strategic advice and make data-driven decisions.

What does Synder do in combination with QuickBooks?

Now, let’s take a quick look at what the Synder-QuickBooks combination has under the hood.

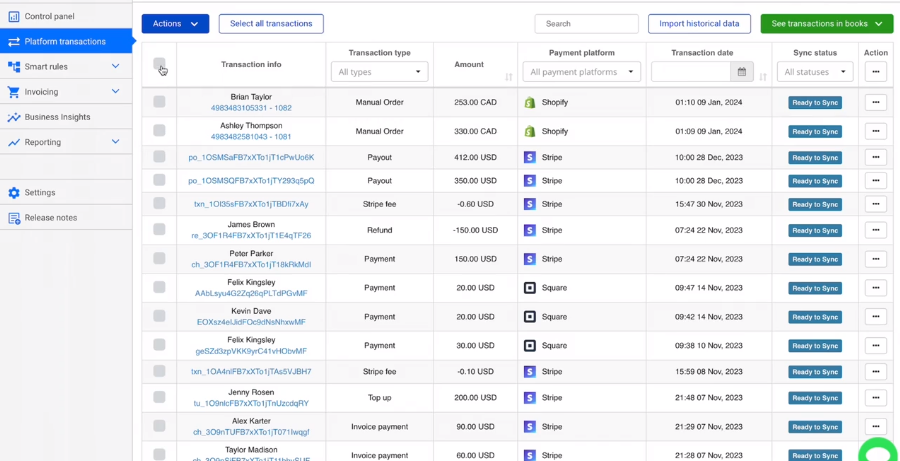

Automated data entry

Synder automates data entry by importing transaction data from various platforms into QuickBooks, saving time and reducing errors.

Real-time synchronization

Synder offers real-time synchronization, ensuring that your QuickBooks records are always up to date. This way, you can have immediate insights into your financial status and accurate financial reporting.

QuickBooks integration with multiple data sources

Synder also offers multi-platform integration, connecting your QuickBooks with numerous platforms such as PayPal, Stripe, Shopify, and Amazon (30+ altogether). This integration ensures that all your business transactions, regardless of the platform, are seamlessly recorded in QuickBooks. As a result, you get a comprehensive view of your financial activities, making it easier to manage your finances across different sales channels.

Fast and simple reconciliation

Accurate reconciliation is another significant advantage of using Synder. The software facilitates easy reconciliation by matching transactions from different sources and identifying discrepancies. This way, your books are always balanced, which is crucial for maintaining financial accuracy and preparing for audits.

Comprehensive reporting

Synder also enhances your reporting capabilities. You can generate detailed reports based on the synchronized data, offering insights into sales, expenses, important accounting ratios, and overall financial performance. Besides, you can track plenty of critical business metrics on your sales, products, and customers in general or by each platform to literally dissect the performance of your business and assess each aspect of it.

Tax management

Tax management is another area where Synder excels. The software accurately calculates and records sales taxes for all transactions, simplifying tax preparation and ensuring compliance with tax regulations. This reduces the risk of errors and potential penalties, making tax season less stressful.

Revenue recognition

No more struggles with subscription-based revenue recognition. Synder’s revenue recognition feature automates revenue scheduling, ensuring compliance with accounting standards such as ASC 606 and IFRS 15. It allows businesses to set rules for recognizing revenue based on specific criteria, integrates seamlessly with QuickBooks, and provides an accurate picture of financial health by matching revenue and expenses.

Long story short

Understanding QuickBooks is essential for accountants and finance professionals. QuickBooks Certification boosts credibility and career prospects.

Leveraging technology and automation enhances productivity and efficiency, reduces errors, and provides excellent services to clients.Understanding QuickBooks is crucial for accountants and finance professionals.

Share your thoughts

Do you think getting QuickBooks Certification is a good idea?Share your thoughts in the comments section below!