Payroll can feel like a complicated puzzle, especially when it comes to all the different forms you need to fill out as an employer. If you’re running a business, it’s essential to get these forms right. Payroll forms are not just paperwork; they’re tools for paying employees correctly, reporting taxes, and staying on the right side of the law.

In this guide, we’re going to break down the different types of payroll forms, why they matter, and how you can manage them without getting overwhelmed.

Ready to streamline your payroll? Sign up with Synder now and enjoy 6 months of Gusto for FREE! Don’t miss this exclusive offer, valid until January 31st, 2024. Make payroll effortless today!

Contents:

1. Are payroll forms only about wages and taxes?

2. Payroll forms vs. payroll taxes: Are payroll forms the same as payroll tax forms?

3. What are the most important payroll forms that every business owner should know about?

4. What are Affordable Care Act (ACA) forms?

5. Are there any other payroll forms that employers should be aware of?

6. What can help employers with payroll forms?

7. What are the consequences of not filing payroll forms or filing them incorrectly

Are payroll forms only about wages and taxes?

Payroll forms are documents used by employers to handle various aspects of paying their employees. They help accomplish several important tasks:

- Summarize wages and deductions: Payroll forms track what employees earn and deduct like taxes and benefits.

- Gather employee info and keep records: They collect employee details to correctly calculate tax withholdings.

- Report taxes: These forms detail taxes withheld from paychecks and what employers owe the government.

- Ensure legal compliance: They help employers stick to tax laws and avoid problems like fines.

- Provide proof of income for employees: Forms like the W-2 give employees the numbers they need for their tax returns.

Payroll forms vs. payroll taxes: Are payroll forms the same as payroll tax forms?

Not quite, but they’re related. While all payroll tax forms are payroll forms, not all payroll forms are specifically for taxes. Payroll forms cover a broader range of employee payment and reporting duties, whereas payroll tax forms are focused solely on the tax side of things. Here’s the difference in simple terms.

Payroll forms

These are all the forms and documents related to paying employees. This includes tracking their hours, calculating their wages, and handling deductions like retirement contributions or health insurance. Payroll forms also include documents that gather employee information for tax purposes, like the Form W-4.

Payroll tax forms

These are a specific subset of payroll forms that deal directly with payroll taxes. They’re used to report and pay the taxes that come out of an employee’s paycheck. These taxes are a significant part of the payroll process and include:

- Social Security and Medicare Taxes (Federal Insurance Contributions Act, FICA Taxes): These are contributions to the Social Security and Medicare programs. Employers withhold a certain percentage of an employee’s wages for these taxes and also pay a matching amount themselves.

- Federal income tax: The amount varies based on the employee’s earnings and information provided on their Form W-4, like marital status and number of dependents.

- State and local taxes: Depending on where your business and employees are located, there might be additional state and local income taxes to withhold and pay.

- Unemployment taxes: These taxes are paid by employers at both federal and state levels to help workers who are out of a job.

Payroll tax forms are also used to report and pay the employer’s share of some taxes. Examples include Form 941 (for reporting federal tax withholdings and employer taxes each quarter but it also includes the employer’s share of Social Security and Medicare taxes) or Form 940 (used annually to report and pay the Federal Unemployment Tax, FUTA).

Operating an online store? Check out our guide on ecommerce tax filing.

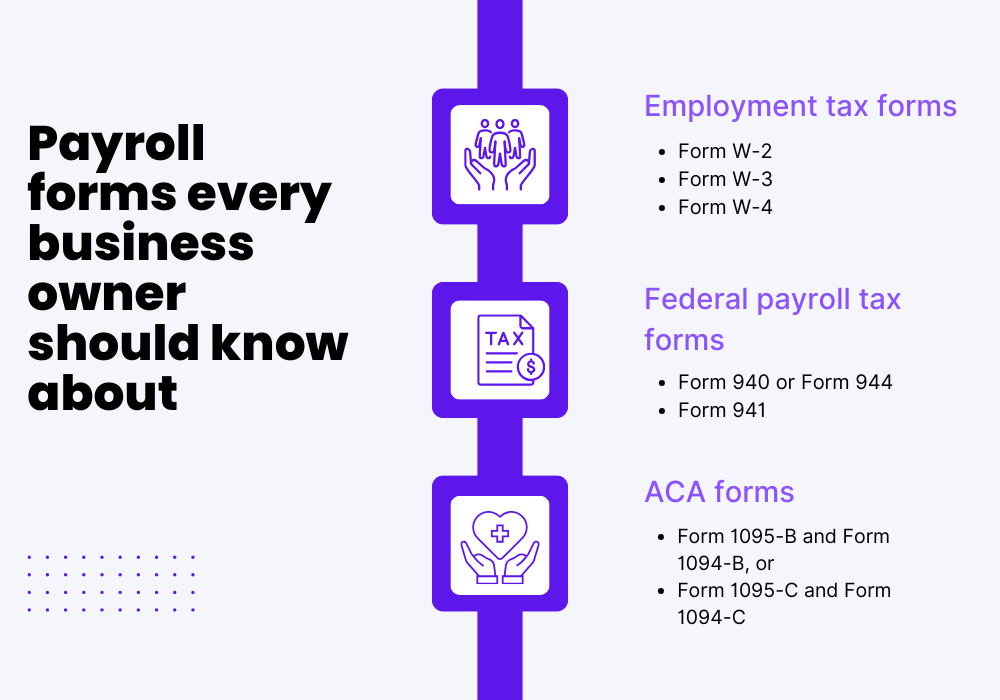

What are the most important payroll forms that every business owner should know about?

Now that we have a general understanding of what payroll forms are, let’s dive into the nitty-gritty of some specific payroll forms you’ll encounter. To help you, we break down each form, what it’s for, why it matters to your business, when to file it, and how to do it correctly.

Form W-2: The yearly lowdown on what an employee earned and paid in taxes

This is the annual wage and tax statement that employers must give to each employee and the IRS. It summarizes the employee’s annual wages and the amount of taxes withheld from their paychecks.

Some more details about Form W-2:

- The employee’s tax info: This form is essential for your employees come tax time. It serves as their financial summary for the year, showing exactly what they earned and the taxes they’ve already paid. They need this info to fill out their tax returns accurately.

- Paper or digital – your call: As an employer, you can send out W-2s either as a paper form or electronically. Employees can choose what they prefer, making it convenient for everyone.

- More than just taxes: The W-2 doesn’t just matter for current taxes; it’s also part of figuring out future benefits like Social Security and Medicare. The earnings reported here count towards what employees will get from these programs later on.

- Oops, made a mistake: If you ever find an error on a W-2, just use a W-2C form to fix it. Getting it right is important, so employees and the IRS have the correct information.

When to file: You need to send Form W-2 to your employees by January 31st each year. It also needs to be filed with the Social Security Administration (SSA) by the same due date.

How to file: You can file electronically or mail paper copies. Filing online is often more convenient, especially if you’re filing for many employees.

Form W-3: The big picture of everyone’s earnings and taxes

This form is a summary report that accompanies Form W-2s. It’s sent to the Social Security Administration (SSA) and shows the total earnings, Social Security wages, Medicare wages, and tax withholdings for all employees in a year.

Here are the key aspects of the W-3 Form:

- The coordinator of W-2 Forms: Form W-3 is basically the team leader for all the W-2 forms you send out. It gathers all the important numbers from each W-2 – like how much you paid your employees and what was taken out for taxes – and puts it all together in one place.

- Official reporting document: This form isn’t just for your records; it’s a report you send off to the Social Security Administration. It’s your way of saying, “Here’s the full story on what we paid our team and the taxes we handled this year.”

- A check on your math: Form W-3 also helps double-check your totals. It ensures that

the sum of all individual W-2s matches up with what you’re reporting overall. Think of it as a way to make sure everything adds up correctly.

- Exclusively for SSA submission: Unlike the W-2s, which go to your employees, Form W-3 is just for the SSA. It plays a key role in validating your payroll records with federal authorities.

When to file: This form accompanies your W-2 forms and must also be submitted to the SSA by January 31st.

How to file: Like the W-2, Form W-3 can be filed either electronically or on paper.

Form W-4: Your employee’s tax blueprint

This form is filled out by employees when they start a new job. It determines how much federal income tax to withhold from their paychecks. It’s essential because it impacts how much employees owe or get refunded during tax season.

Here are the key points about Form W-4:

- The first-day must-do: When someone joins your team, one of their first tasks is to fill out Form W-4. It’s a key step in getting them set up on your payroll.

- Customizing tax withholding: The W-4 is all about personalizing how much federal income tax gets taken out of each paycheck. Employees provide details like whether they’re married, have kids, or have other jobs. This info is used to tailor the tax withholding to their individual situation.

- Avoiding tax surprises: The reason it’s so important for employees to fill out the W-4 accurately is all about balance. Get it right, and they’re less likely to face a big tax bill or a huge refund when tax season rolls around. It’s about making sure they pay the right amount of tax throughout the year.

- Changes in life, changes in tax: Employees should remember to update their W-4 if major life changes happen, like getting married, having a child, or picking up a side gig. These changes can affect their tax situation.

- A guide for employers, too: For you, as the employer, the W-4 is a guide to each employee’s tax needs. It helps you withhold the right amount from each paycheck, ensuring that you’re meeting your tax responsibilities as an employer.

When to file: There’s no specific filing date for Form W-4, as it’s filled out by each employee when they start working for you or when their personal or financial situation changes.

How to file: The W-4 is kept on file with you, the employer. You don’t submit it to the IRS, but you use the information it contains to calculate how much tax to withhold from the employee’s paycheck.

Form 940: Your yearly check-in on federal unemployment taxes

This form is used to report the annual Federal Unemployment Tax Act (FUTA) tax. FUTA tax, combined with state unemployment systems, funds unemployment compensation for workers who lose their jobs. Employers need to file this form annually, and it’s separate from the state unemployment insurance they might also pay.

When to file: This form is due annually by January 31st, covering the previous calendar year.

How to file: Form 940 can be filed either electronically through the IRS e-file system or by mailing a paper form.

Form 941: The quarterly tax roundup

Form 941 is a critical part of your payroll tax routine. In this form, you’re mainly dealing with three big things: federal income tax, Social Security, and Medicare taxes. You report how much you’ve withheld from your employees’ pay for these taxes and also your share as an employer (for Social Security and Medicare).

When to file: Form 941 is filed quarterly. The due dates are April 30, July 31, October 31, and January 31 for the fourth quarter of the previous year.

How to file: You can file Form 941 online through the IRS e-file system or by mailing a paper form.

Form 944: The small business’s yearly tax checkup

This form is designed for smaller employers (whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less) to report and pay these taxes once a year instead of every quarter. It’s like Form 941 but for smaller businesses.

When to file: This form is for smaller employers and is filed annually with the due date on January 31st.

How to file: Like other forms, Form 944 can be filed electronically or via mail. The IRS will send you a written notice if you’re eligible to file Form 944 instead of Form 941.

What are Affordable Care Act (ACA) forms?

The main idea behind ACA forms is to document and report health insurance coverage as required by the ACA. They help the IRS track who has the necessary coverage and ensure employers are meeting their obligations to offer health insurance. These forms are important for both tax compliance and for individuals to show they have health insurance as required by law.

Form 1095-B: Your annual health coverage status report

This form is provided by insurance companies and smaller employers who provide health coverage. It lists who in the household had health coverage and for how many months of the year. Think of it as proof of insurance for individuals, showing they met the health coverage requirements.

Here is what you need to know about Form 1095-B:

- Your role in providing this form: If you’re a small business owner offering health insurance to your employees (or if you’re an insurer), you’re responsible for providing Form 1095-B. It serves as an annual statement that details the health coverage you’ve provided.

- What you’ll include: On Form 1095-B, you’ll list the names of your employees and their family members who were covered under your health plan. You’ll also specify how long each person was covered throughout the year.

- Its importance for compliance: This form is a crucial piece for proving that you, as an employer or insurer, provided health coverage. While the individual mandate penalty for not having health insurance has been lifted in many places, providing this form is still important for legal compliance and for your employees’ records.

- A tool for your employees at tax time: When tax season rolls around, Form 1095-B becomes a helpful document for your employees. It allows them to easily verify that they and their dependents had health coverage during the year, which can be useful information for their tax filings.

When to file: The deadline for Form 1095-B is typically March 31st if you’re filing electronically, or February 28th for paper filings. This form covers health insurance information for the previous year.

How to file: You can file Form 1095-B electronically or on paper. If you’re filing for a large number of employees, online filing might be more convenient.

Form 1094-B: Your health coverage summary report to the IRS

So, as an employer or insurer, Form 1094-B is your tool for giving the IRS a bird’s-eye view of the health coverage you’ve provided.

Here are some important aspects of Form 1094-B:

- The coordinator of 1095-B Forms: What Form W-3 was to Form W-2s, Form 1094-B is to Form 1095-Bs – in other words, a summary. It’s a document that you, as an employer or insurer, use to summarize and send all those individual Form 1095-Bs to the IRS.

- Not a public document: Unlike the 1095-B forms that go to each person covered under your plan, Form 1094-B is just for the IRS. It’s behind-the-scenes paperwork that your employees don’t need to worry about.

- Organizing your records: Filling out Form 1094-B helps you stay organized. It forces you to gather all the coverage data in one place, making sure you don’t miss reporting anyone’s coverage.

- Compliance is key: By sending Form 1094-B to the IRS, you’re keeping up with healthcare law requirements. It’s an essential step in showing that you’re on top of your game when it comes to providing health insurance.

When to file: The filing deadline for Form 1094-B is typically the same as Form 1095-B – March 31st if you’re e-filing, and February 28th if you’re sending it by mail. This is for the coverage provided in the previous year.

How to file: You’ve got two choices for filing Form 1094-B: either electronically or by paper. If you’re reporting for a large number of employees, e-filing can be more efficient. Plus, if you’re required to file 250 or more 1095-B forms, the IRS mandates that you file electronically.

Form 1095-C: The big employer’s guide to reporting health coverage

Larger employers (with 50 or more full-time employees) use this form to provide information about the health insurance they offered to their employees.

Here are the key points about Form 1095-C:

- Proof of offered insurance: As a larger employer with 50 or more full-time staff, you use Form 1095-C to show what kind of health insurance you offered to your employees. It’s like a detailed record showing that you did your part in providing healthcare options, even if some employees didn’t opt in.

- Month-by-month coverage details: In this form, you’ll break down the insurance coverage month by month. This means listing who had insurance, who was offered insurance but didn’t take it, and who wasn’t eligible. It’s a way of showing the IRS exactly how you handled health insurance throughout the year.

- A necessary compliance step: Filling out and sending Form 1095-C is a big part of meeting your legal obligations under healthcare laws. It’s your way of documenting and proving that you’ve offered health insurance as required.

- Employee and IRS filing: Each of your full-time employees should receive a copy of Form 1095-C. Also, part-time workers get Form 1095-C too, if they sign up for a large employer’s self-insured health plan. This form is important for their personal tax filings, as it shows their health insurance status throughout the year. You also need to file these forms with the IRS as part of your reporting obligations under the Affordable Care Act (ACA).

- Dealing with complex situations: This payroll form can get a bit complex, especially if you have a mix of full-time, part-time, and seasonal employees, or if you offer different types of health plans. It’s about capturing all those nuances in your health insurance offerings.

When to file: The deadline for sending Form 1095-C to your employees is January 31st. For filing with the IRS, the deadline is February 28th for paper filings or March 31st if you’re filing electronically, covering the previous calendar year.

How to file: You have the option to file Form 1095-C either electronically or by mail. If you’re filing 250 or more forms, the IRS requires that you file electronically.

Form 1094-C: The big employer’s IRS roundup for health coverage

Similar to Form 1094-B, this is a transmittal form but for larger employers. They use it when sending their Form 1095-C documents to the IRS. It summarizes the information on the 1095-C forms but isn’t something the employees themselves receive.

Here are the crucial aspects of Form 1094-C:

- Your 1095-C forms’ chaperone: As a large employer, you use this form to bundle up all those Form 1095-Cs you’ve prepared. It’s like a cover letter that you send along with the 1095-Cs to the IRS, summarizing the health insurance details you’ve provided.

- The big picture on health coverage: Form 1094-C is your way of presenting the overall health insurance story to the IRS. It doesn’t just list who got what; it gives a complete view, including how many employees were offered coverage and the type of coverage available.

- Essential for legal compliance: Filling out and sending Form 1094-C is a key part of your legal duties under healthcare laws and shows you’re up to date with the Affordable Care Act requirements.

- Not for employee distribution: Unlike Form 1095-C, which goes to your employees, Form 1094-C is strictly between you and the IRS. Your employees won’t need this form, but it plays a vital role in your tax documentation.

- A snapshot of your company’s health offerings: This form is especially important if you have a diverse range of health plans or a mix of full-time and part-time employees. It captures the essence of your health insurance efforts over the year.

When to file: If you’re filing on paper, the deadline for Form 1094-C is typically February 28th of the year following the calendar year being reported. For electronic filings, the deadline is extended to March 31st of the year following the reported year.

How to file it: You have the choice of filing electronically or by paper. However, if you’re filing 250 or more forms, the IRS mandates that you file electronically.

Are there any other payroll forms that employers should be aware of?

Let’s take a look at these additional payroll forms that employers might need to be aware of. Each of these forms serves a specific purpose, often related to unique employment situations or specific types of employees. Understanding and using them correctly is important for legal and tax compliance in these special circumstances.

Form 8027

This is for employers who operate large food or beverage establishments. They use Form 8027 to report tips received by their employees. It helps the IRS make sure that employees are reporting and paying taxes on their tip income properly.

Schedule H (Form 1040)

This form is used by people who employ household workers, like a nanny, housekeeper, or gardener. It’s a way to report and pay Social Security, Medicare, Withheld Income, and Federal Unemployment (FUTA) taxes for these workers. Schedule H is usually filed with the employer’s personal tax return if they pay their household employee(s) more than a certain amount in a year.

WH-347

This form is used by contractors or subcontractors who work on federally funded or assisted construction projects. It’s a payroll report that shows worker classifications, hours worked, and the wages paid. The purpose is to demonstrate compliance with prevailing wage laws on these projects.

Form 1042

Employers use this form to report wages paid to non-resident aliens (employees who are not U.S. citizens and do not reside in the U.S.). It’s important for ensuring that the correct amount of tax is withheld and reported for these international workers.

Form 943

This is a form for employers who hire farm workers. If the wages paid to these workers reach a certain threshold in a year, the employer needs to file Form 943 to report and pay withheld federal income tax and FICA taxes (Social Security and Medicare) for these employees.

What can help employers with payroll forms?

With such a large number of different forms, filling them all manually can be a difficult task. Using tools and resources can save time, reduce errors, and help you stay compliant with tax laws, making the payroll process much smoother.

Payroll software: Your digital payroll assistant

With payroll software, like Gusto, you can set your payroll on autopilot. It calculates how much to pay each employee, figures out the tax deductions, and even fills out those pesky forms for you. Plus, the software keeps an eye on tax law changes, so you’re never caught off guard.

Why it’s useful: Payroll software takes care of the heavy lifting, making payday a breeze. It can also handle other parts like direct deposits, year-end tax forms, and even track employee vacation and sick days.

Professional accountants or payroll services: Your personal payroll guru

Sometimes, you just need a human touch. Hiring a professional accountant or a payroll service means you’ve got an expert who’s got your back. These pros are knee-deep in payroll day in and day out, so they know exactly what needs to be done and when.

The perks: They can handle everything payroll-related – from ensuring every employee is paid accurately to making sure all your tax filings are spot-on. They can spot issues before they become problems and keep everything running smoothly.

IRS resources: Your official payroll guides and instructions

The IRS website isn’t just for tax season; it’s a goldmine of information, especially when it comes to payroll forms. They’ve got guides, instructions, and all sorts of resources to help you fill out forms correctly. Plus, they keep everything updated, so you’re getting the latest info straight from the source.

How it helps: Whether you’re a payroll newbie or just need a refresher, the IRS has got you covered. Their resources can help you understand tricky forms and even keep you in the loop on new tax laws or changes that could affect your business’s payroll.

What are the consequences of not filing payroll forms or filing them incorrectly

Not filing payroll forms or filing them incorrectly can lead to several problems for a business, all of which can be serious. Here’s a straightforward look at the potential consequences:

Penalties and fines

The IRS can impose penalties for late filing, failing to file, or filing incorrect forms. These fines can add up quickly, and the longer the delay or mistake goes uncorrected, the more it can cost.

Interest charges

If you owe taxes due to incorrect filings and you pay late, the IRS will also charge interest on the amount owed. This means you could end up paying significantly more than the original tax due.

Audit and scrutiny

Filing mistakes or not filing at all can draw unwanted attention from the IRS, potentially leading to an audit. An audit can be a time-consuming and stressful process, where you’ll need to provide additional documentation and explanations.

Damaged reputation

If word gets out that your business has issues with payroll compliance, it can harm your reputation. Employees might lose trust in your ability to manage payroll correctly, and it could also deter potential new hires.

Legal consequences

In severe cases, particularly where non-compliance is willful and repeated, there could be legal consequences, including criminal charges. While this is rare, it’s a serious risk for egregious violations.

Employee relations issues

Employees might face personal tax issues if their W-2 forms are incorrect or if their withholdings are mishandled. This can lead to dissatisfaction, complaints, and even legal actions from employees.

Cash flow problems

Dealing with penalties and having to correct filings can lead to unexpected expenses, causing cash flow issues for your business.

Conclusion

And there you have it! We’ve walked through the maze of payroll forms together, covering the what, when, and how of each essential form. From the employee-focused W-2s and W-4s to the crucial tax forms like 941 and 940, and the healthcare-related 1095s and 1094s, you’re now equipped with the knowledge to tackle payroll paperwork like a pro.

Remember, while these forms might seem daunting at first, they’re just a part of the business rhythm. Keeping on top of them means you’re not just paying your team correctly, but also staying in good standing with tax laws and healthcare requirements. Whether you choose to go high-tech with payroll software, team up with a professional, or dig into the resources provided by the IRS yourself, you’ve got this!

Streamline your payroll effortlessly! Join Synder now and unlock 6 months of Gusto at no cost. Say goodbye to payroll hassles – hurry, the offer valid until January 31st, 2024. Seize this opportunity to simplify your payroll management!