PayPal’s global reach and reliability make it the go-to payment platform for ecommerce and digital businesses. Yet as transaction volumes rise, keeping PayPal data, like sales, fees, refunds, and payouts, accurate in NetSuite becomes increasingly complex. In 2024, PayPal processed 26.3 billion transactions worth $1.68 trillion USD, up 10 percent from 2023. For most NetSuite users, handling that scale manually leads to errors and wasted hours.

The simplest and most reliable approach is to automate PayPal-to-NetSuite synchronization with an accounting tool like Synder, which automatically syncs every transaction, fee, refund, and payout across all accounts and currencies for clean, real-time reconciliation.

TL;DR

Here’s a quick breakdown before we get into details.

- PayPal makes selling easy, but getting all sales, fees, refunds, and payouts into NetSuite manually quickly becomes a mess once volume grows.

- Integrating PayPal with NetSuite automates all of that without CSV exports or late-night journal entries. Your data lands in the right accounts automatically, whether you sync daily, monthly, or per payout.

- Synder handles this seamlessly by syncing PayPal transactions (including multi-currency and multiple PayPal accounts), posting sales, fees, taxes, refunds, and chargebacks to the right NetSuite accounts, and keeping everything ready for reconciliation.

- You end up with clean books, faster month-end close, and saving up to 40 hours a month without losing accuracy or control.

Now let’s look at how the PayPal–NetSuite integration actually works.

What is a PayPal NetSuite integration?

In simple terms, a PayPal NetSuite integration automatically transfers all your PayPal transaction data, including sales, fees, refunds, and settlements, into NetSuite. Instead of manually exporting CSVs, mapping columns, and entering journal entries, the integration automatically posts summarized data into the right NetSuite accounts through journal entries on a set schedule: daily, monthly, per payout, or custom.

When customers pay through PayPal, Synder generates a summarized entry in NetSuite once the day closes. For example, a daily summary for October 23 would post on October 24, reflecting total PayPal sales, fees (e.g., $3 on every $100 sale), and net revenue, all consolidated into accurate journal entries.

If a refund occurs, it can be reflected in NetSuite through summarized journal entries. In our example, it’ll be a $100 debit to income (reducing revenue) and a $3 credit to expenses (reversing related fees).

When PayPal deposits, let’s say, $10,000 into your bank account, this amount is matched to the summarized journal entries rather than individual transactions, supporting accurate reconciliation.

For multi-brand operations, you can even connect several PayPal accounts (for example, one USD, one EUR) and map each to the correct NetSuite subsidiary, revenue, and bank accounts.

Integration options

Before you begin, it’s worth understanding the main ways to connect PayPal and NetSuite.

Native NetSuite connector

NetSuite’s built-in PayPal integration supports PayPal Express Checkout for web stores, but it’s a tool to accept payments. It doesn’t automatically post processing fees or refunds. Many businesses find themselves exporting PayPal statements monthly to fill these gaps manually – a workable approach for low volume, but unsustainable for growing operations.

Third-party tools

A dedicated integration platform like Synder automates the entire workflow: syncing sales, fees, refunds, and payouts directly into NetSuite via daily, monthly, or custom date range journal entries with proper account mapping. This ensures streamlined reconciliation, offers multi-account support, and historical import capabilities.

Custom builds or middleware

Developers can connect PayPal’s REST API to NetSuite’s SuiteTalk API, or use middleware like MuleSoft. While this allows deep customization, it requires ongoing engineering resources and high upkeep costs. Unless your PayPal process is highly specialized, pre-built automation tools are cheaper and more reliable.

Generally, for 95 percent of businesses, third-party automation software like Synder offers the best balance of control, completeness, and scalability.

Step-by-step setup with Synder

Here’s how to integrate PayPal and NetSuite using Synder in three simple steps.

1. Connect your accounts

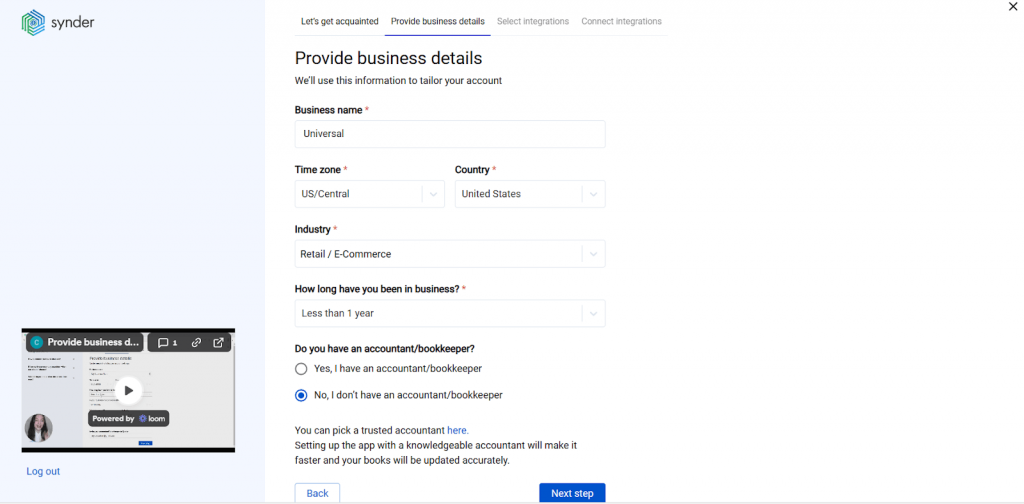

Follow these steps to connect PayPal and Oracle NetSuite in Synder and start syncing your transactions automatically.

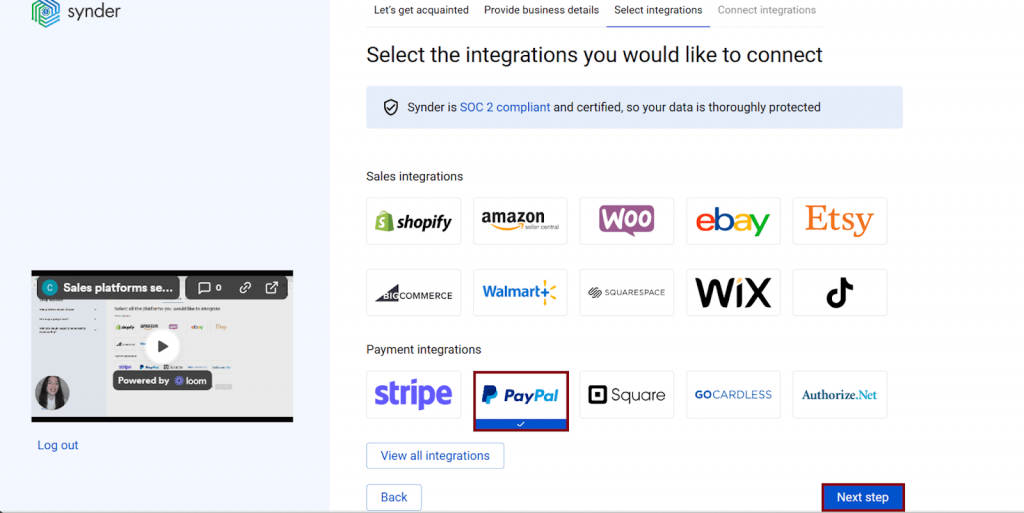

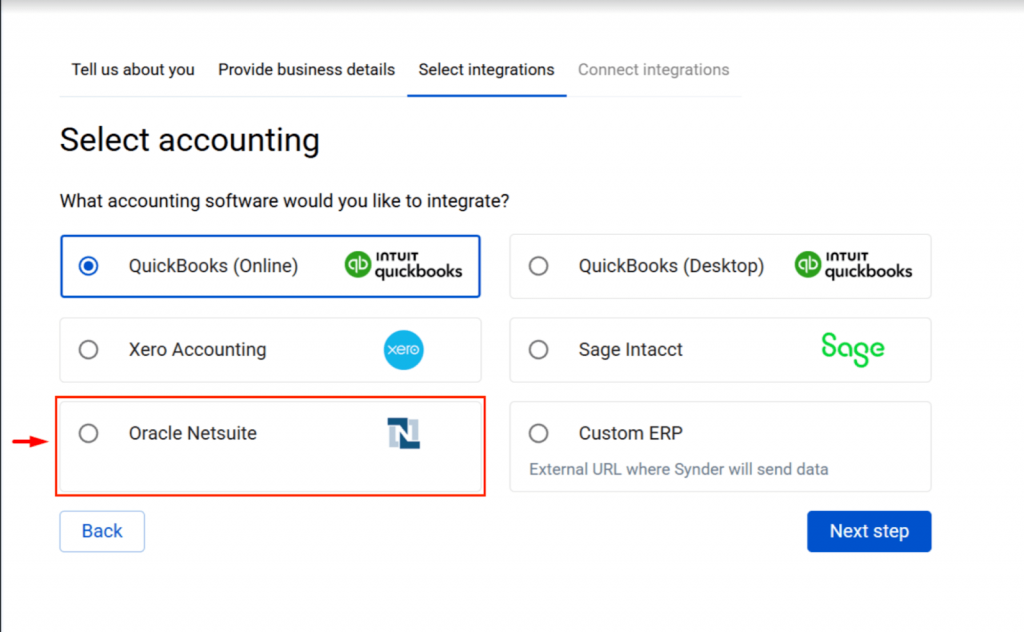

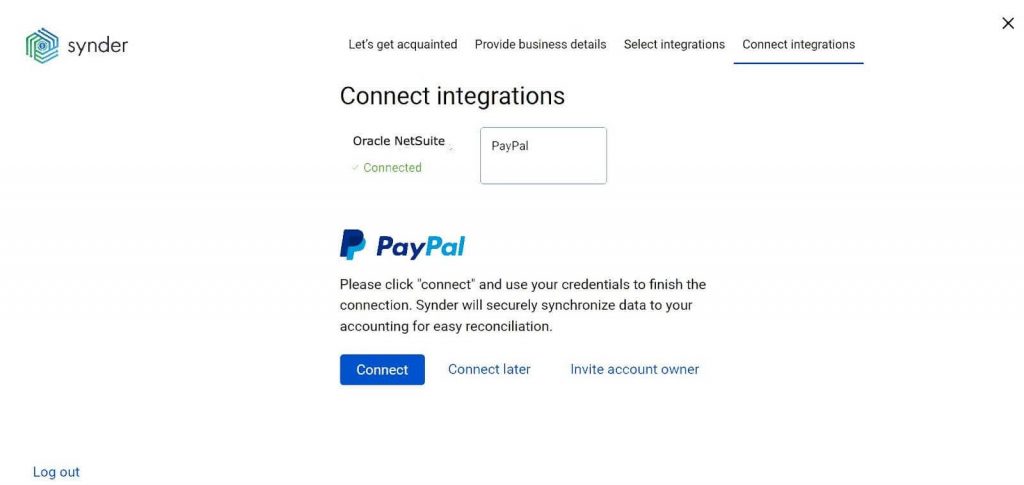

Step 2: Select your platforms

When prompted, select the platforms you’d like to integrate. You can connect multiple platforms at once, but for now, make sure to select PayPal (your payment processor) and Oracle NetSuite (your accounting platform).

You can always return later to add more integrations.

Step 3: Connect Oracle NetSuite

To connect NetSuite, you’ll need to provide your integration credentials:

- Account ID

- Consumer Key

- Consumer Secret

- NetSuite Role (Internal ID)

If you’re unsure where to find these, refer to our detailed setup guide:

👉 How to Create a NetSuite User and Retrieve Integration Credentials

Step 4: Connect your PayPal account

Click Connect next to PayPal and grant Synder permission to access your account. If you don’t have admin access in PayPal, use the Invite account owner option to send the connection link to the appropriate person.

After authorization, PayPal will appear as an active integration.

Step 5: Configure your settings

To finalize your setup, you’ll be prompted to:

- Choose an account in NetSuite to represent PayPal payouts (usually your Checking account).

- Review fee, sales, and refund mappings for accuracy.

- (Optional) Enable automatic synchronization to have Synder post your PayPal transactions to NetSuite automatically.

Once completed, Synder will start importing and syncing your PayPal data to NetSuite.

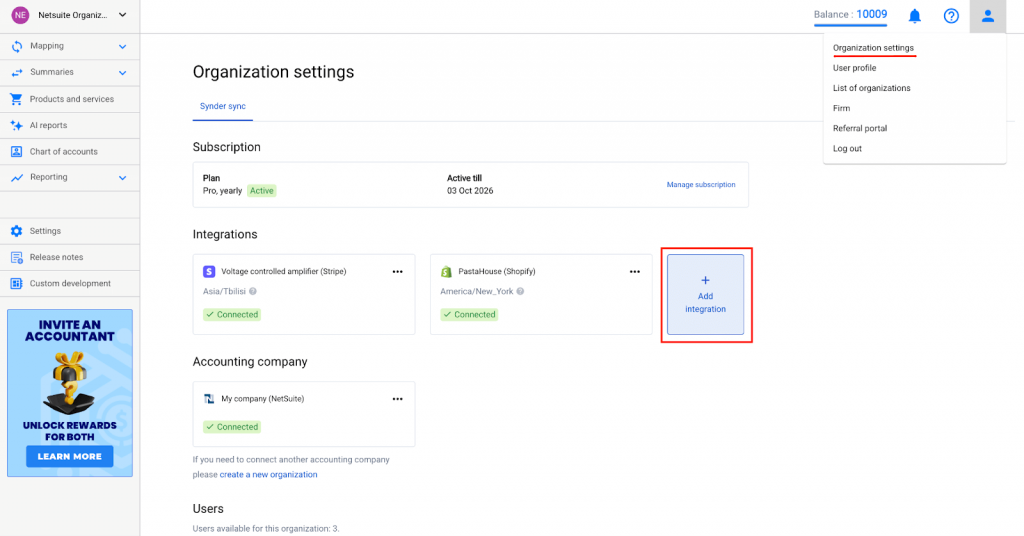

Connecting PayPal to an existing Synder organization

If you already have a Synder organization connected to NetSuite, you can easily add PayPal:

- Go to Organization Settings → Integrations.

- In your Synder account, select your Organization (top-left corner).

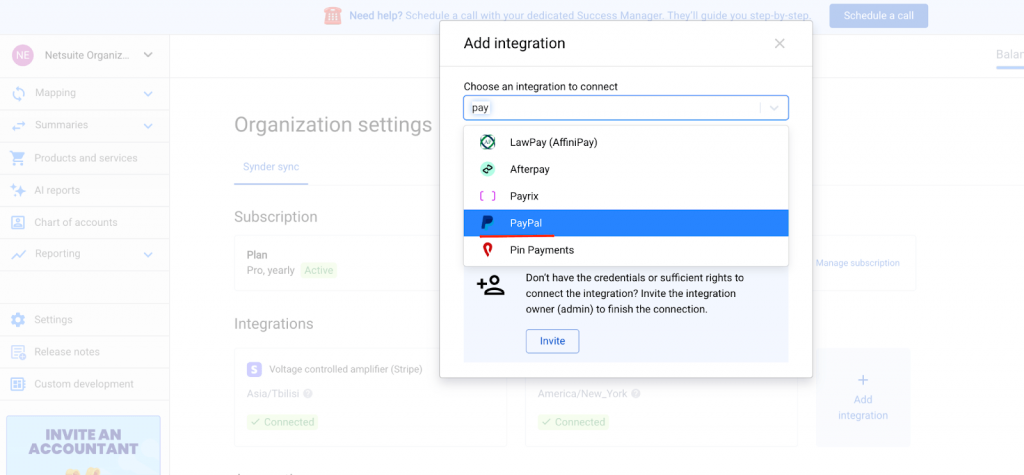

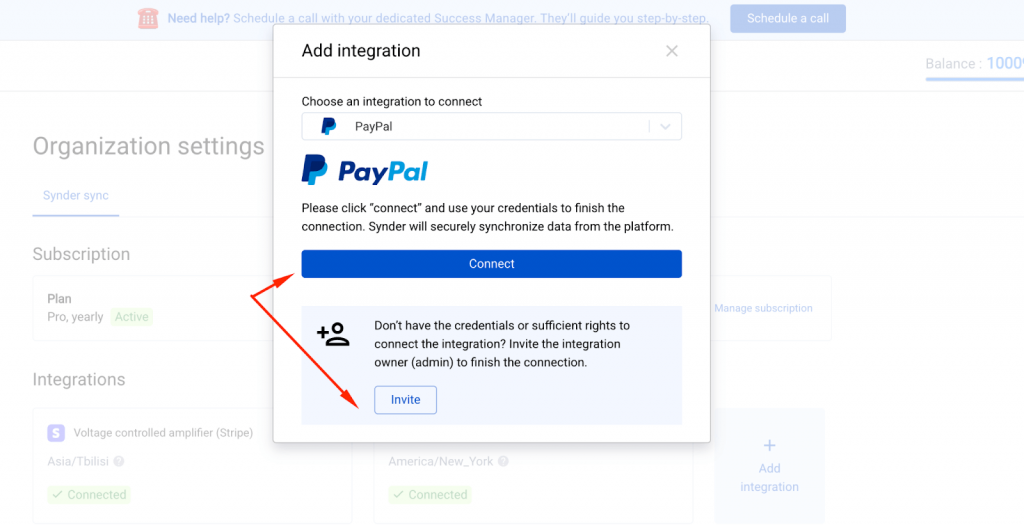

- Click Add integration and select PayPal.

- Authorize the connection through your PayPal account. Alternatively, if you don’t have admin rights, send an invitation to the account owner.

Your PayPal account is now connected and ready to sync with NetSuite. Review your configuration one more time before proceeding.

2. Map general ledger accounts

- Sales → Income account

- Payments → Clearing account (representing PayPal’s balance)

- Processing fees → Expense account

- Refunds → Income account (to offset sales in P&L; can be separated if preferred)

- Payouts → Bank account

This mapping ensures every PayPal event lands in the right spot in your chart of accounts. If you’re running multi-currency PayPal accounts, Synder handles currency conversion automatically using NetSuite’s base currency settings.

3. Test and go live

Run a test transaction through PayPal and confirm that NetSuite shows the corresponding sale, fee, and bank deposit. Once verified, activate automatic sync. From then on, PayPal transactions will flow to NetSuite as journal entries, which aggregate transactions (daily, monthly, custom period) without manual intervention, keeping your books clean and audit-ready.

How to choose the right tool for PayPal–NetSuite integration

When choosing a PayPal–NetSuite integration, focus on how completely the solution handles your data flows. The best tool should not only move data between systems but also ensure every transaction lands correctly in your general ledger, ready for reconciliation. Here’s what to look for and why Synder stands out in each area.

1. Accurate sales transaction sync

Every PayPal sale should appear in NetSuite with the correct date and amount without duplicates or missing data. Tools that only import partial information lead to mismatched records.

Why Synder: It posts summarized sales data into NetSuite, such as daily, monthly, or per payout, creating accurate journal entries that reflect all sales, payments, and fees in real time. For high-volume sellers, like fashion or electronics retailers, this eliminates manual entry and ensures your sales totals always match PayPal reports.

2. Fee import and categorization

Payment processing fees often go unnoticed but can distort margins if not tracked properly. The integration should import all PayPal fees and expenses: both processing fees from sales and expenses from purchases made via PayPal, and post them to the appropriate expense accounts in NetSuite.

Why Synder: Synder automatically records every PayPal fee line item, mapping it to your chosen expense account in NetSuite. This means you always see true net revenue by channel, which is critical for accurate profitability reporting.

3. Refunds and chargebacks handling

Refunds and chargebacks are inevitable. Without proper automation, accountants waste hours searching for missing reversals or disputed transactions. A strong integration must link every refund or chargeback back to its original sale.

Why Synder: Synder records PayPal refunds and chargebacks in NetSuite through summarized journal entries, automatically reducing income and reversing related fees. While individual links between refunds and payments aren’t created in Summary Sync, the journal entries provide a clear and traceable record of all reversals.

4. Multi-account support

If your business operates across multiple brands or regions, you probably manage more than one PayPal account. Your integration should make that easy, not add complexity.

Why Synder: Synder lets you connect unlimited PayPal accounts under one NetSuite environment. Each account can map to a different subsidiary or GL structure, giving you full visibility across all entities without extra setup or manual consolidation.

5. Multi-currency support

Global sales often mean dealing with multiple currencies, and conversions can quickly become a source of errors. A good integration handles this automatically.

Why Synder: Synder handles multicurrency PayPal transactions by sourcing exchange rates from a trusted third-party provider and posting them in the correct base currency within NetSuite, ensuring consistent and reliable reporting. You always get compliant, reliable reports in NetSuite, no matter how many currencies you process.

6. Audit-ready transparency for every transaction

Finance teams and auditors need full transparency. Each synced transaction should carry identifiers linking back to the PayPal source.

Why Synder: Each NetSuite journal entry created through Synder is backed by detailed source data available in the Summary preview. Users can download the Raw Data Report to review the exact composition of every journal entry, ensuring transparency, easy verification, and cleaner financial records.

How businesses benefit from automating PayPal–NetSuite integration

When you automate your PayPal NetSuite integration, you gain measurable efficiency that truly changes how your finance team works. Here’s what that looks like in practice:

Save time and reduce human error

Manual reconciliation is slow and error-prone. With automation, you can cut repetitive tasks dramatically and close books faster. Synder reduces manual accounting work by up to 40 hours each month, as PayPal sales, fees, and refunds are summarized and posted into NetSuite through aggregated journal entries for the selected period: daily, monthly, per payout, or custom.

Gain a single source of truth

When PayPal data syncs automatically, your ERP becomes the single, accurate record of all JEs. Synder’s automation can handle thousands of transactions accurately, which gives businesses unified, audit-ready data across all payment platforms.

Scale effortlessly

As your business expands across new PayPal accounts, currencies, or regions, your integration should scale without reconfiguration. Synder grows with you. For instance, companies that began with one PayPal account now manage multiple global accounts in NetSuite seamlessly, all through one connected dashboard.

Accelerate month-end closing

By the time your accounting team starts the close, PayPal data is already synced, organized, and ready for reconciliation. Synder users report that what once required 5–10 hours of manual work per week is now fully automated, freeing up time for analysis instead of admin.

Reduce reconciliation headaches

PayPal payouts often make reconciliation messy. The right integration automatically matches each bank deposit to the bank statement. Synder’s payout matching ensures every PayPal settlement mirrors your NetSuite bank records, eliminating unexplained differences and saving hours each close.

With PayPal holding 45.39 % of the market share in online payments worldwide as of August 2024, automation isn’t optional for growing businesses. Synder delivers the accuracy, scalability, and audit-ready control needed to keep PayPal and NetSuite perfectly aligned at any scale.

Takeaway

Choosing the right PayPal NetSuite integration requires more than simple data transfer. Accuracy, automation, and scalability are key to maintaining control as your business expands. Synder combines complete transaction sync, payout matching, and multi-account support for advanced automation and SOC 2 Type II–certified security. This allows finance teams to close faster, keep books accurate, and ensure every PayPal transaction is properly reflected in NetSuite.

FAQ

Can I integrate multiple PayPal accounts into NetSuite?

Yes. Synder lets you connect and map multiple PayPal accounts, for example, USD, EUR, and GBP accounts, each with its own subsidiary and GL mapping.

How are refunds and chargebacks handled in NetSuite?

When PayPal issues a refund or chargeback, Synder records PayPal refunds in NetSuite through journal entries: debiting income to reduce revenue and crediting expenses to return associated fees, adjusting the original revenue, and reversing fees as needed, so your financials reflect the net impact accurately.

Can I import historical transactions after setup?

Yes. Synder’s historical import feature lets you backfill up to 3 years of PayPal activity, which is limited by PayPal API restrictions. This way, your books will include past sales, fees, and refunds.

How does the integration simplify month-end closing?

Because PayPal transactions and payouts are already reconciled in NetSuite, the finance team doesn’t spend days manually matching entries or correcting errors. With Synder, your closing time can drop up to 50%.

Can I manage refunds directly from NetSuite?

You’ll still initiate refunds in PayPal, but Synder automatically reflects them in NetSuite, ensuring the accounting side is complete without extra steps.